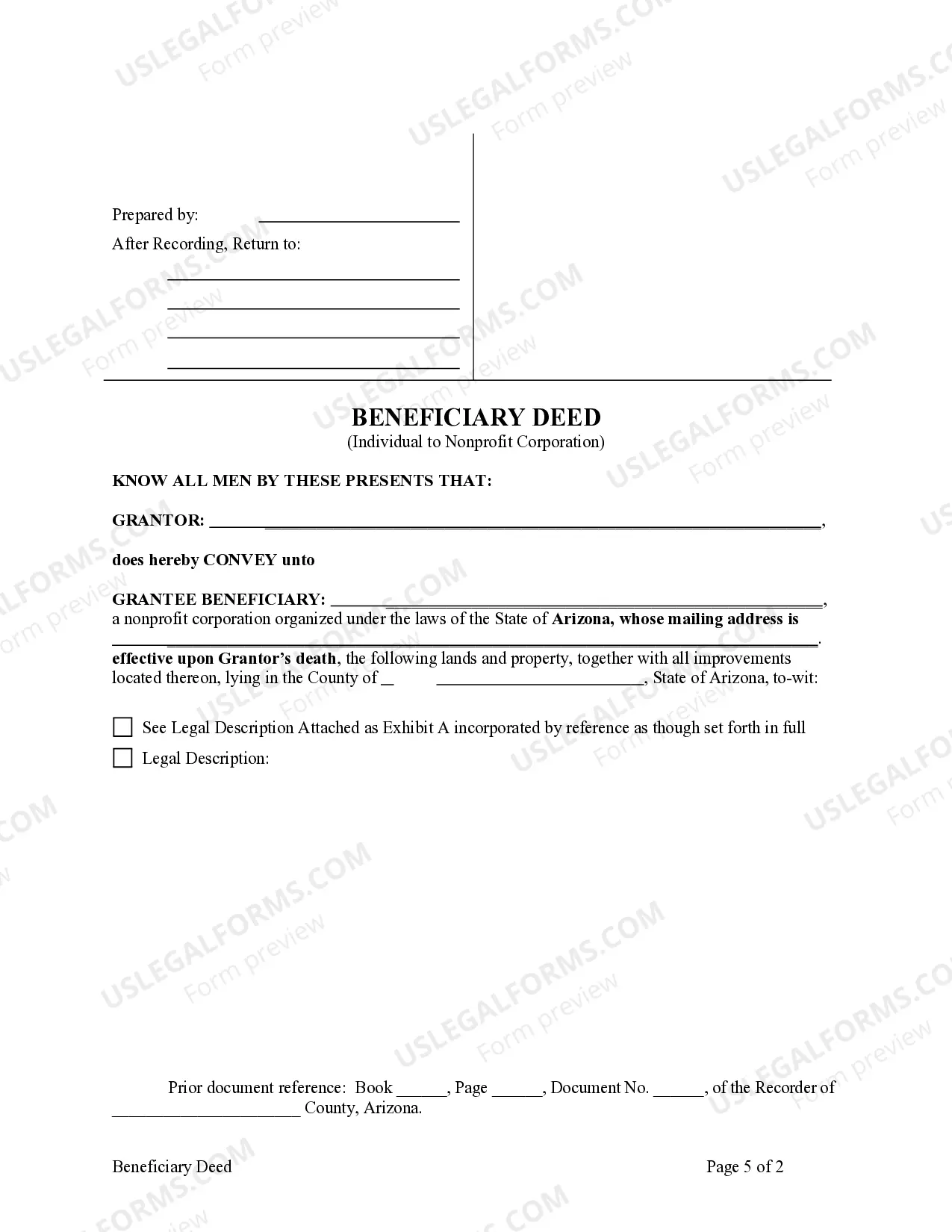

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee \ Beneficiary is a Nonprofit Corporation. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. The deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

Chandler Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary

Description

How to fill out Arizona Beneficiary Or Transfer On Death Deed From An Individual Owner To A Nonprofit Corporation As Beneficiary?

No matter one’s social or occupational standing, finishing law-related paperwork is a regrettable requirement in the current professional landscape.

It is frequently nearly unfeasible for an individual without legal experience to create such documents from scratch, primarily due to the complex terminology and legal subtleties involved.

This is where US Legal Forms becomes invaluable.

Verify that the template you have found is tailored to your area since the laws of one state or county do not apply to another.

Review the document and, if available, read a brief summary of scenarios where the document can be utilized. If the form you selected does not fulfill your requirements, you can begin again and search for the appropriate form. Click Buy now and select the subscription plan that suits you best. Use your credentials or create a new account. Choose the payment method and proceed to download the Chandler Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary once the payment is confirmed. You’re prepared! Now, you can print the document or complete it online. If you encounter any difficulties finding your purchased documents, you can conveniently access them in the My documents section. Whatever issue you are attempting to resolve, US Legal Forms is here to assist you. Try it today and experience the difference.

- Our platform offers an extensive collection of over 85,000 ready-to-use state-specific documents suitable for nearly any legal circumstance.

- US Legal Forms additionally acts as a significant resource for associates or legal advisors eager to enhance their time management by utilizing our DIY forms.

- Whether you need the Chandler Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary, or any other valid document in your jurisdiction, US Legal Forms makes it readily accessible.

- Here’s how to quickly obtain the Chandler Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary in minutes through our dependable platform.

- If you are an existing subscriber, you can proceed to Log In to your account to download the required form.

- However, if you are new to our platform, ensure you complete these steps before downloading the Chandler Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary.

Form popularity

FAQ

To transfer property title to a family member in Arizona, you typically prepare a new deed and ensure it is signed and notarized. After that, you must record the deed with the county recorder's office. If you are looking to create a Chandler Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary to simplify future transfers, you can also utilize tools available on platforms like uslegalforms.

To transfer a title upon death in Arizona, the process largely depends on whether you have a beneficiary deed in place. If a Chandler Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary was executed, the property automatically passes to the designated beneficiary upon death, without the need for probate. Otherwise, you may need to follow the probate process, which can be time-consuming.

Filling out a beneficiary deed in Arizona requires you to provide the current owner's information, a legal description of the property, and the name of the beneficiary. Typically, you can find templates or forms online to assist you in this process. For those considering the Chandler Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary, using a reliable platform like uslegalforms can simplify your task.

To change the deed on a house after the death of a spouse in Arizona, you need to deliver a certified copy of the death certificate along with the existing deed to the county recorder. This process helps to legally transfer the property to the surviving owner or heirs. If your spouse had a Chandler Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary in place, the property would transfer automatically as outlined in the deed.

Yes, in Arizona, a beneficiary deed must be recorded with the county recorder's office to be effective. This recording ensures that the document is part of the public record. If you are considering a Chandler Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary, recording the deed is a vital step to confirm the transfer of ownership upon death.

To file a transfer on death deed in Arizona, you need to complete the deed form that specifies the property and designates the beneficiary, which can be a nonprofit corporation. Once you have signed the deed in front of a notary, it must be recorded at the county recorder's office. This ensures that upon your passing, the property automatically transfers to the designated beneficiary without probate.

Filing a quitclaim deed in Arizona involves preparing the deed with the necessary information about the property and the parties involved. After completing the form, you should sign it in front of a notary. The final step is to submit the deed to the county recorder's office in the county where the property is located to officially document the transfer.

To obtain a beneficiary deed in Arizona, you can either draft one yourself or use a service like uslegalforms. They provide templates tailored to Arizona laws, ensuring you include all necessary information. Once you have prepared the deed, be sure to sign and file it with the local county recorder to establish its legal standing.

Creating a beneficiary deed in Arizona involves completing a specific legal form that names your chosen beneficiary, such as a nonprofit corporation. You must then sign the deed in the presence of a notary public. After signing, file the deed with the county recorder to ensure it is valid and enforceable, allowing the beneficiary to receive the property directly upon your death.

To transfer a deed after death in Arizona, you must first establish the validity of the deceased's beneficiary deed. If the deed names a nonprofit corporation as the beneficiary, you will need to record the death certificate at the county recorder’s office. Once recorded, the property transfers automatically to the designated beneficiary without the need for probate.