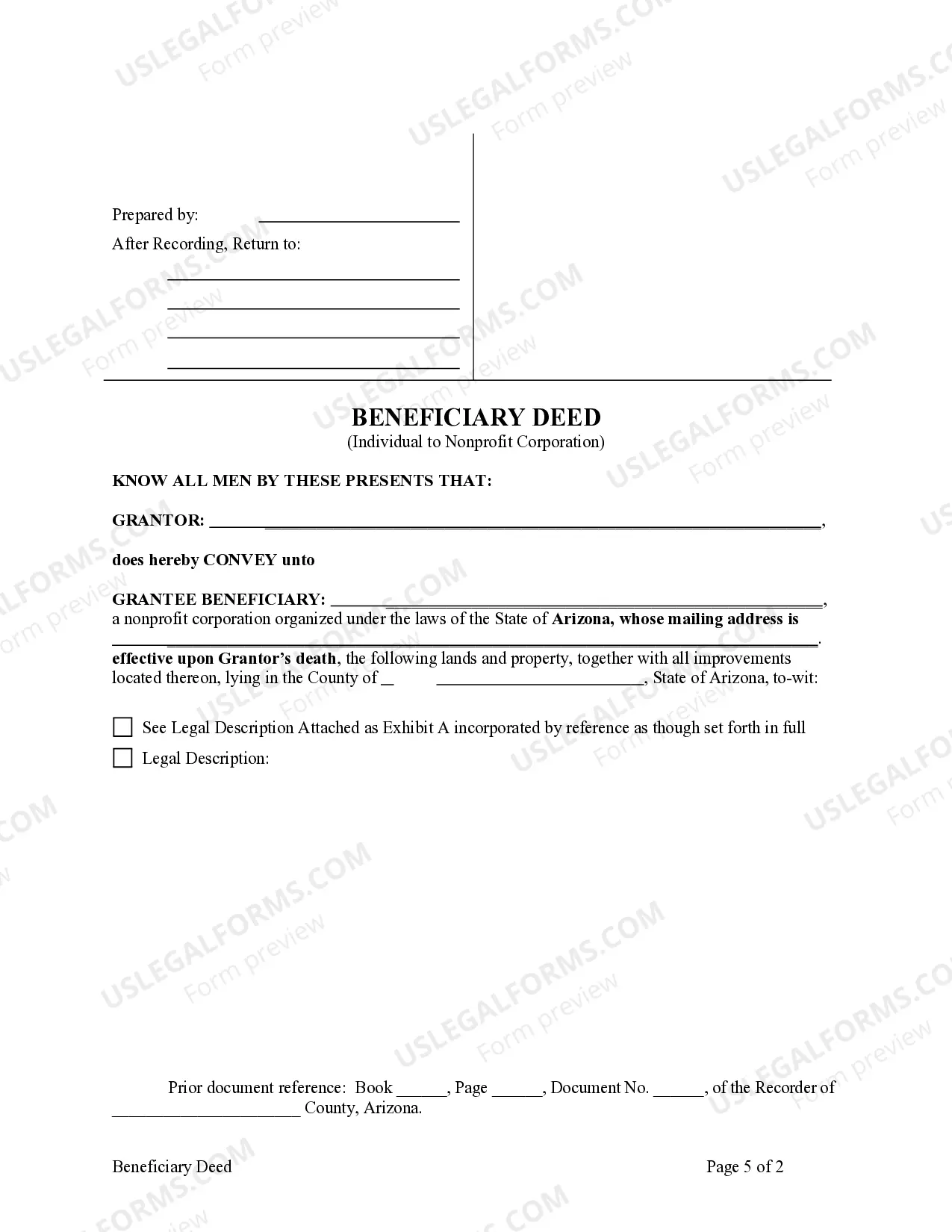

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee \ Beneficiary is a Nonprofit Corporation. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. The deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

Glendale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary

Description

How to fill out Arizona Beneficiary Or Transfer On Death Deed From An Individual Owner To A Nonprofit Corporation As Beneficiary?

If you have previously utilized our service, Log In to your account and retrieve the Glendale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary on your device by selecting the Download button. Ensure your subscription is active. If not, renew it in accordance with your payment plan.

If this is your first time using our service, follow these straightforward steps to obtain your file.

You have unlimited access to every document you have purchased: you can find it in your profile under the My documents menu whenever you need to reference it again. Utilize the US Legal Forms service to effortlessly discover and save any template for your personal or professional requirements!

- Verify that you have selected the appropriate document. Review the description and utilize the Preview feature, if available, to confirm it meets your needs. If it is not suitable, use the Search tab above to find the right one.

- Acquire the template. Click the Buy Now button and select either a monthly or annual subscription option.

- Establish an account and process your payment. Use your credit card information or the PayPal option to finalize the transaction.

- Obtain your Glendale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary. Choose the file format for your document and download it to your device.

- Complete your document. Print it or utilize professional online editing tools to fill it out and sign it electronically.

Form popularity

FAQ

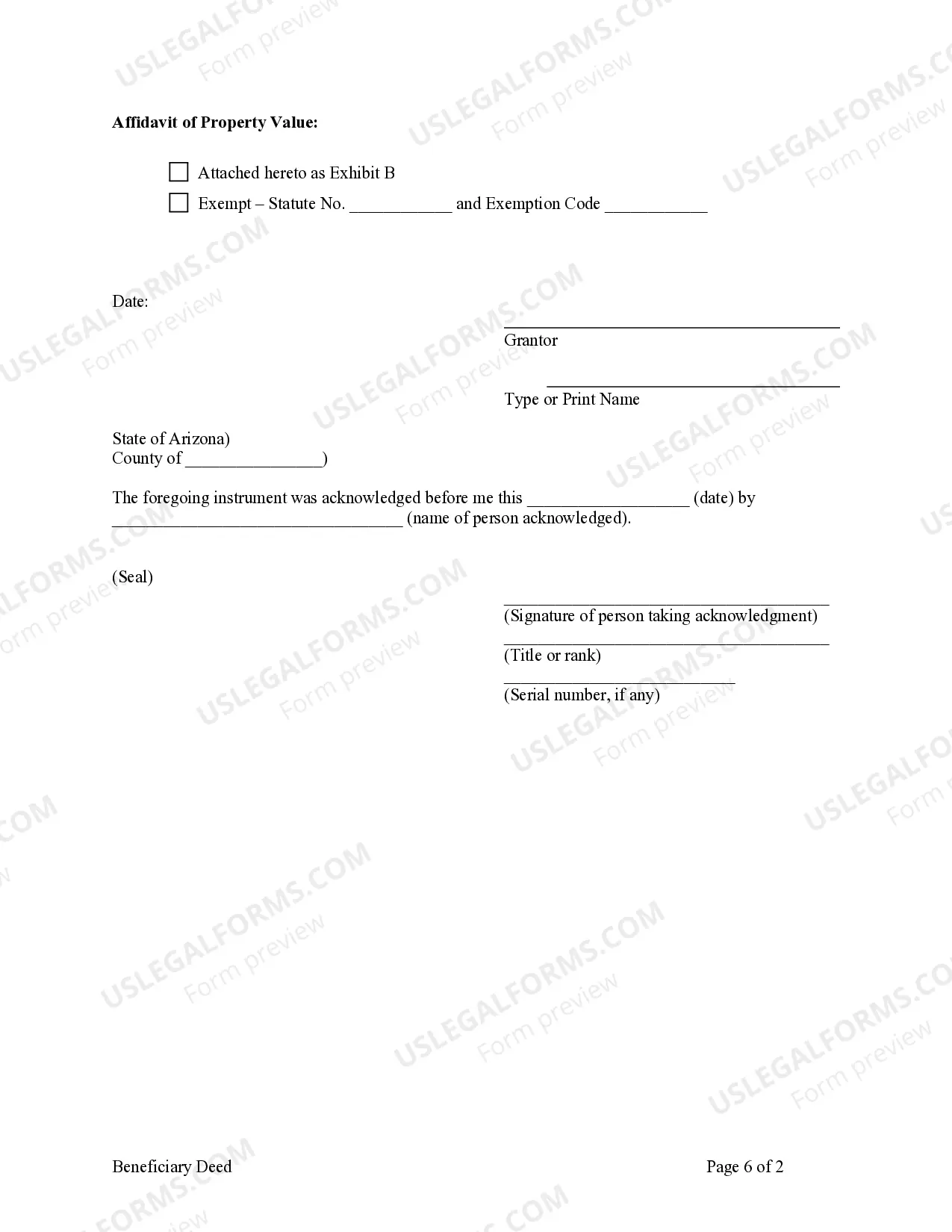

To fill out a beneficiary deed in Arizona, start by obtaining a proper template that complies with state laws. Fill in your name, the beneficiary's name, and a detailed description of the property. Ensure the document is signed and notarized, and then file it with the county recording office to finalize the Glendale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary. Utilizing resources from USLegalForms can provide you with the right guidance and templates.

Filling out a beneficiary form requires you to enter the necessary details about the property and the beneficiary. Make sure to include the full legal name of the nonprofit corporation that will inherit the property. Additionally, it is essential to accurately provide property details and your signature. You can find tailored beneficiary forms through platforms like USLegalForms, which simplify the process of creating a Glendale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary.

To create a beneficiary deed in Arizona, you need to prepare a legal document that names the beneficiary, which may include a nonprofit corporation. This deed must include a description of the property as well as the name of the individual owner. Once completed, you should sign the deed in front of a notary public and file it with the county recorder's office. This process ensures that your Glendale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary becomes effective upon your passing.

To create a beneficiary deed in Arizona, you must draft the document that states your intention to transfer property to a named beneficiary upon your death. The deed must contain specific language indicating it is a beneficiary deed and must include a proper legal description of the property. Sign the deed before a notary public, and then record it with the county recorder in Glendale, Arizona, to ensure your Glendale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary is legally enforceable.

Transferring a deed after death in Arizona typically involves providing a death certificate and the original transfer on death deed to the county recorder. If you hold a Glendale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary, the transfer should be straightforward. Just ensure that the deed was properly recorded before the owner's passing. You may also want to consult an attorney to assist with any legal nuances.

Filing a transfer on death deed in Arizona involves creating a deed that specifies the property will transfer to a designated beneficiary upon your death. You need to sign the deed before a notary public and ensure it includes the correct legal description of the property. Afterward, record the deed with the county recorder in Glendale, Arizona, to ensure your wishes for the Glendale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary are clear.

To file a quitclaim deed in Arizona, you should first obtain the appropriate form. Ensure that you fill out the deed accurately, including the legal description of the property. Next, sign the deed in the presence of a notary public. Finally, you will need to record the deed with the county recorder in Glendale, Arizona, to complete the process and make it effective.

To change the deed on a house after the death of a spouse in Arizona, you’ll first need to gather the death certificate and any relevant estate documents. Depending on how the property was originally titled, you may need to execute a new deed to add or remove a name. If you’re facing complexities, consider using platforms like uslegalforms to guide you through creating a Glendale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary.

Yes, Arizona allows the use of Transfer on Death deeds. This flexible option enables property owners to pass their assets directly to a designated beneficiary upon death, avoiding the probate process. It’s an efficient way to handle estate planning and provides peace of mind. You can establish a Glendale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary for smooth transitions.

To transfer a property title to a family member in Arizona, you typically use a grant deed or warranty deed. Include the name of the family member in the deed, and ensure that both you and the recipient sign it. Afterward, record the new deed with the county recorder's office to make it official. This process can also serve Glendale Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary.