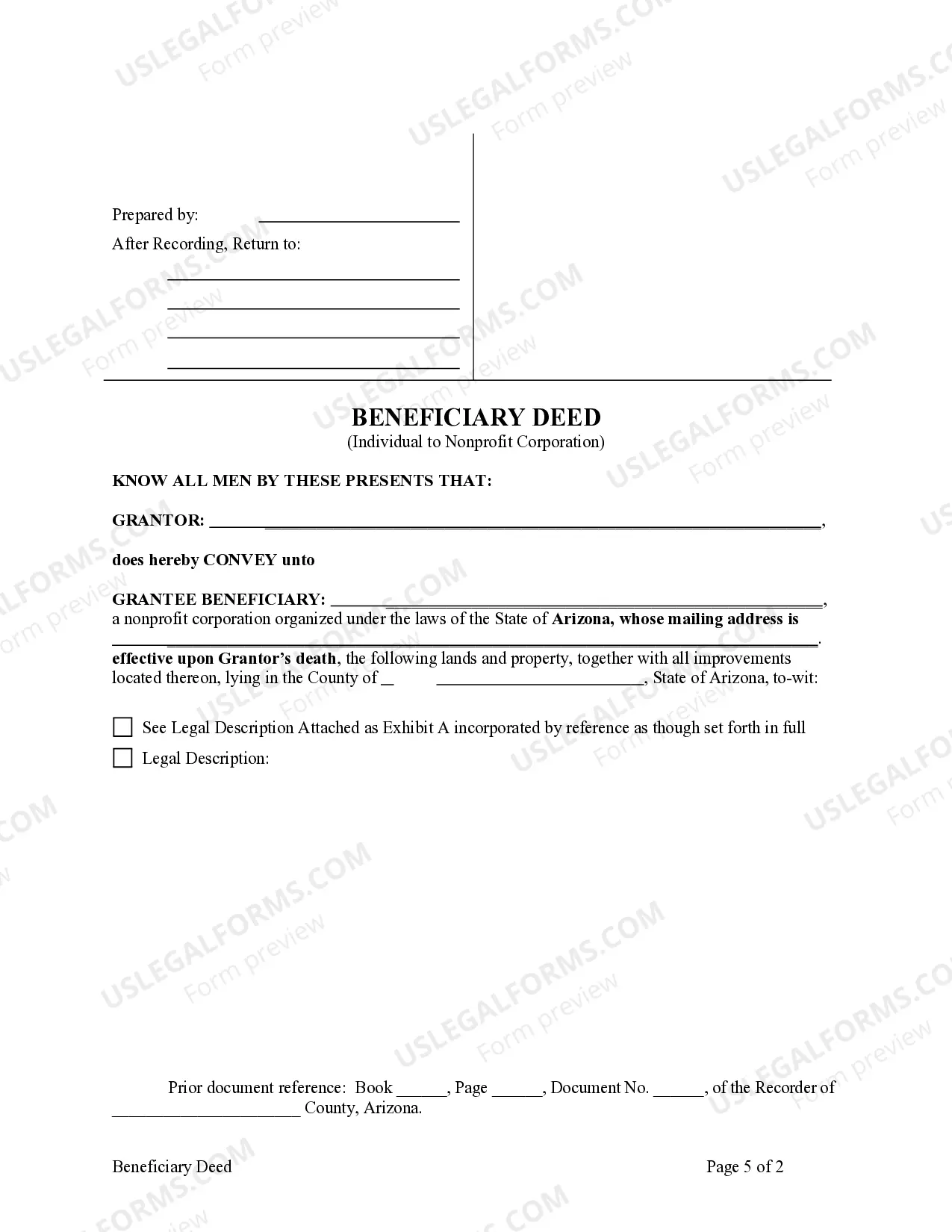

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee \ Beneficiary is a Nonprofit Corporation. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. The deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

A Mesa, Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary is a legal document that allows an individual property owner in Mesa, Arizona to designate a nonprofit corporation as the recipient or beneficiary of their property upon their death. This type of deed serves as an effective tool for individuals who wish to ensure their property is passed on to a nonprofit organization of their choosing. The Mesa, Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary is governed by specific legal requirements and must comply with the laws of the state. It is important to consult with an experienced attorney familiar with Arizona real estate and probate laws to ensure the proper execution and validity of the deed. There are different types of Beneficiary or Transfer on Death Deeds available in Mesa, Arizona, including but not limited to: 1. Beneficiary Deed: This type of deed allows an individual property owner to name a nonprofit corporation as the beneficiary of their property upon their death, without the need for probate. The property owner retains full ownership and control of the property during their lifetime. 2. Transfer on Death Deed: Similar to a Beneficiary Deed, a Transfer on Death Deed also allows an individual property owner to transfer ownership of their property to a nonprofit corporation upon their death. This deed also bypasses the probate process. 3. Enhanced Life Estate Deed: This type of deed, commonly known as a "Lady Bird Deed," grants ownership and control of the property to the individual property owner during their lifetime, with the property seamlessly passing to the nonprofit corporation upon their death. 4. Charitable Remainder Trust: While not a deed, a Charitable Remainder Trust is another option available to property owners in Mesa, Arizona who wish to leave their property to a nonprofit corporation. It involves the transfer of property to a trust, with the nonprofit corporation named as the ultimate beneficiary. The property owner or designated beneficiaries may receive income from the trust during their lifetime, with the remaining assets passing to the nonprofit corporation after their death. When considering a Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary in Mesa, Arizona, it is vital to consult with a knowledgeable attorney who can guide you through the legal requirements and help you determine the most suitable option for your specific circumstances. They can ensure that the deed is properly drafted, executed, and recorded to ensure a smooth transfer of property to the designated nonprofit corporation.A Mesa, Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary is a legal document that allows an individual property owner in Mesa, Arizona to designate a nonprofit corporation as the recipient or beneficiary of their property upon their death. This type of deed serves as an effective tool for individuals who wish to ensure their property is passed on to a nonprofit organization of their choosing. The Mesa, Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary is governed by specific legal requirements and must comply with the laws of the state. It is important to consult with an experienced attorney familiar with Arizona real estate and probate laws to ensure the proper execution and validity of the deed. There are different types of Beneficiary or Transfer on Death Deeds available in Mesa, Arizona, including but not limited to: 1. Beneficiary Deed: This type of deed allows an individual property owner to name a nonprofit corporation as the beneficiary of their property upon their death, without the need for probate. The property owner retains full ownership and control of the property during their lifetime. 2. Transfer on Death Deed: Similar to a Beneficiary Deed, a Transfer on Death Deed also allows an individual property owner to transfer ownership of their property to a nonprofit corporation upon their death. This deed also bypasses the probate process. 3. Enhanced Life Estate Deed: This type of deed, commonly known as a "Lady Bird Deed," grants ownership and control of the property to the individual property owner during their lifetime, with the property seamlessly passing to the nonprofit corporation upon their death. 4. Charitable Remainder Trust: While not a deed, a Charitable Remainder Trust is another option available to property owners in Mesa, Arizona who wish to leave their property to a nonprofit corporation. It involves the transfer of property to a trust, with the nonprofit corporation named as the ultimate beneficiary. The property owner or designated beneficiaries may receive income from the trust during their lifetime, with the remaining assets passing to the nonprofit corporation after their death. When considering a Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary in Mesa, Arizona, it is vital to consult with a knowledgeable attorney who can guide you through the legal requirements and help you determine the most suitable option for your specific circumstances. They can ensure that the deed is properly drafted, executed, and recorded to ensure a smooth transfer of property to the designated nonprofit corporation.