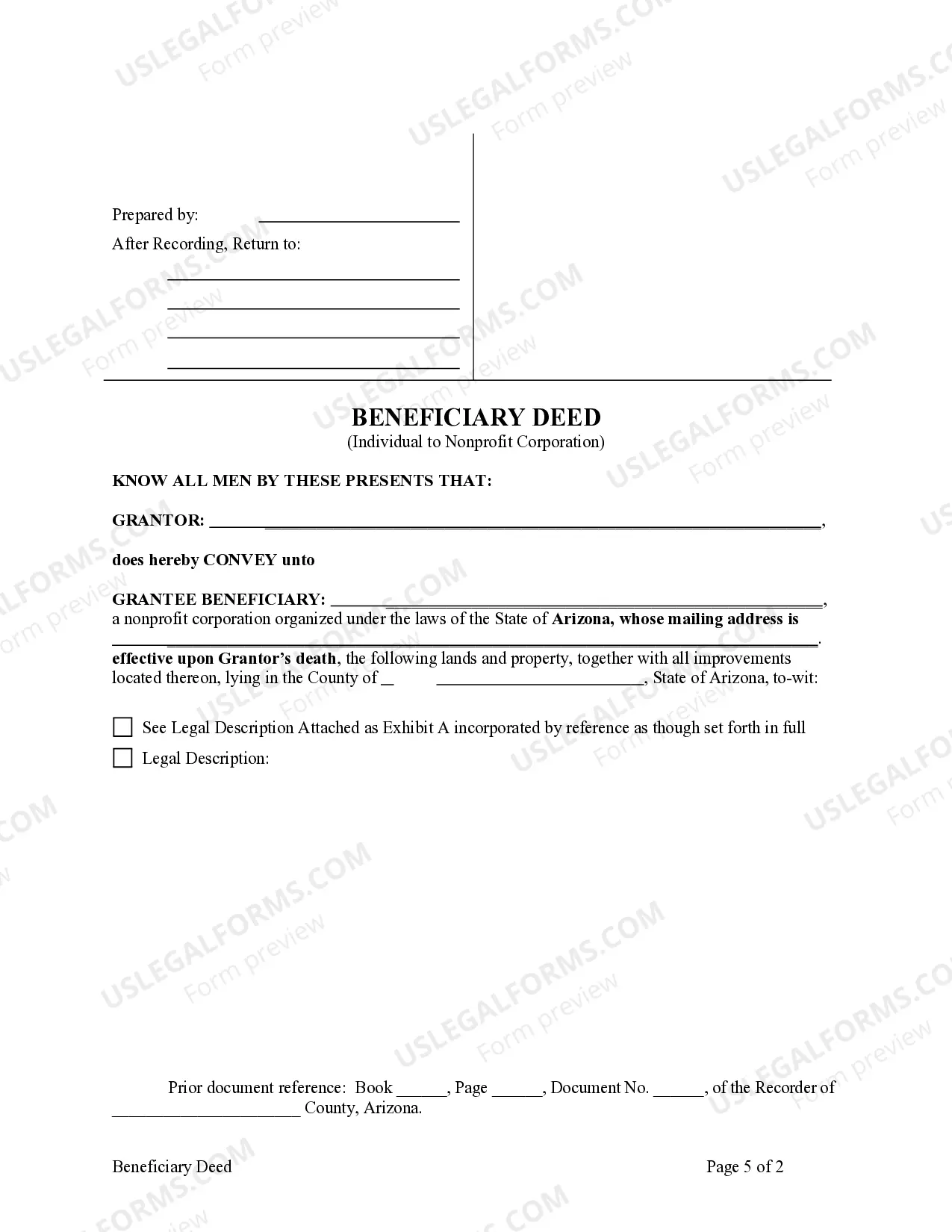

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee \ Beneficiary is a Nonprofit Corporation. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. The deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

Lima Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary is a legal instrument used for estate planning purposes. This particular deed allows an individual property owner to designate a nonprofit corporation as the beneficiary of their real estate assets upon their death. By utilizing this deed, the property owner ensures that their property will be transferred directly to the designated nonprofit organization without having to go through the probate process. This not only provides a seamless transfer of ownership but also avoids potential delays and expenses associated with probate proceedings. There are various types of Lima Arizona Beneficiary or Transfer on Death Deeds that can be employed depending on the specific circumstances and objectives of the property owner. These may include: 1. Traditional Beneficiary Deed: This type of deed allows an individual property owner to designate a nonprofit corporation as the beneficiary of their real estate property. The transfer of ownership takes effect upon the death of the property owner, and it can be revoked or modified at any time before that event. 2. Enhanced Beneficiary Deed: This type of deed provides additional flexibility to the property owner by allowing them to retain full control and ownership rights over the property during their lifetime. The owner maintains the right to sell, mortgage, or lease the property without the need for consent from the designated nonprofit corporation beneficiary. 3. Contingent Beneficiary Deed: In situations where the designated nonprofit corporation beneficiary is unable or unwilling to accept the property, this type of deed allows for the appointment of an alternate or contingent beneficiary. This ensures that the property will still be transferred smoothly according to the property owner's wishes. The use of a Lima Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary can offer numerous advantages. Besides avoiding probate, it allows individuals to support their favorite charitable causes by ensuring that their property assets ultimately benefit nonprofit organizations. Consulting with an experienced estate planning attorney can help determine the best type of deed to meet specific objectives while adhering to legal requirements.Lima Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary is a legal instrument used for estate planning purposes. This particular deed allows an individual property owner to designate a nonprofit corporation as the beneficiary of their real estate assets upon their death. By utilizing this deed, the property owner ensures that their property will be transferred directly to the designated nonprofit organization without having to go through the probate process. This not only provides a seamless transfer of ownership but also avoids potential delays and expenses associated with probate proceedings. There are various types of Lima Arizona Beneficiary or Transfer on Death Deeds that can be employed depending on the specific circumstances and objectives of the property owner. These may include: 1. Traditional Beneficiary Deed: This type of deed allows an individual property owner to designate a nonprofit corporation as the beneficiary of their real estate property. The transfer of ownership takes effect upon the death of the property owner, and it can be revoked or modified at any time before that event. 2. Enhanced Beneficiary Deed: This type of deed provides additional flexibility to the property owner by allowing them to retain full control and ownership rights over the property during their lifetime. The owner maintains the right to sell, mortgage, or lease the property without the need for consent from the designated nonprofit corporation beneficiary. 3. Contingent Beneficiary Deed: In situations where the designated nonprofit corporation beneficiary is unable or unwilling to accept the property, this type of deed allows for the appointment of an alternate or contingent beneficiary. This ensures that the property will still be transferred smoothly according to the property owner's wishes. The use of a Lima Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary can offer numerous advantages. Besides avoiding probate, it allows individuals to support their favorite charitable causes by ensuring that their property assets ultimately benefit nonprofit organizations. Consulting with an experienced estate planning attorney can help determine the best type of deed to meet specific objectives while adhering to legal requirements.