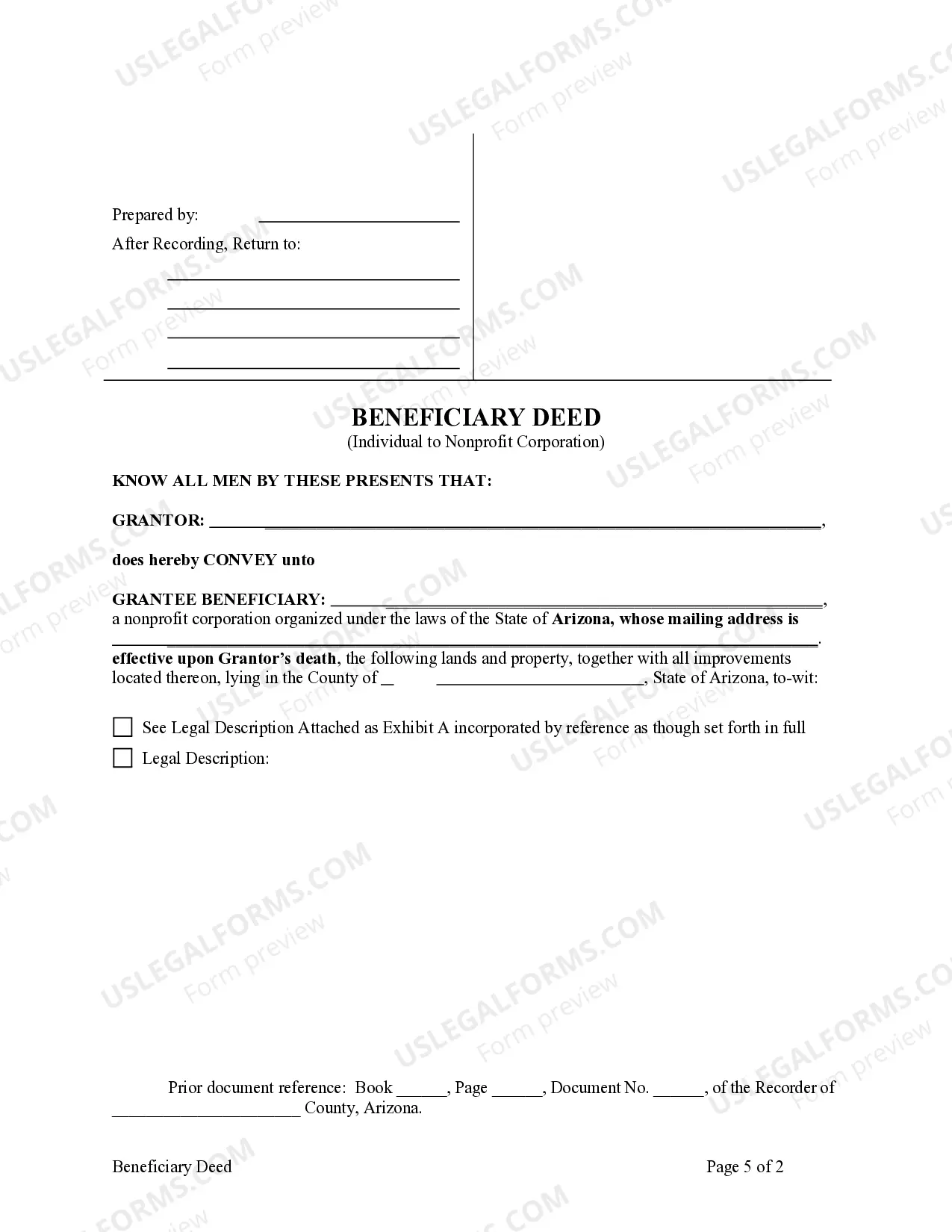

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee \ Beneficiary is a Nonprofit Corporation. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. The deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

Surprise Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary is a legal arrangement that allows a property owner in Surprise, Arizona, to transfer ownership of their property to a designated nonprofit corporation upon their death. This type of deed offers individuals the opportunity to support charitable organizations while ensuring their property is utilized for a worthy cause after their passing. One of the key benefits of a Surprise Arizona Beneficiary or Transfer on Death Deed is that it provides individuals with the ability to make a significant impact on their chosen nonprofit organization without having to part with their property during their lifetime. This arrangement allows property owners to retain full ownership and control of their property until their demise. As a result, they can continue to use, lease, or sell the property as they wish, while simultaneously supporting a charitable cause. This kind of deed is a strategic estate planning tool that can help individuals effectively manage their assets and leave a lasting legacy. By naming a nonprofit corporation as the beneficiary, individuals can ensure that their property is used towards philanthropic efforts that align with their values and passions. Whether it's supporting educational institutions, medical research facilities, environmental conservation organizations, or any other cause close to their heart, this deed allows individuals to make a meaningful contribution. Furthermore, Surprise Arizona Beneficiary or Transfer on Death Deed provides flexibility in terms of the property to be transferred. It can include residential homes, commercial buildings, vacant land, or any other type of property eligible for ownership transfer. It is important to note that although Surprise Arizona Beneficiary or Transfer on Death Deed is predominantly used to transfer ownership to nonprofit corporations, there may be variations in how the deed is structured. For instance, individuals may choose to name specific charitable trusts or foundations as beneficiaries instead of a nonprofit corporation. These variations depend on the personal preferences and objectives of the property owner. Overall, Surprise Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary provides property owners with a unique opportunity to make a lasting impact on the community. By utilizing this legal tool, individuals can support charitable causes they believe in while retaining control over their property during their lifetime. It is advised to consult an experienced estate planning attorney to fully understand the legal implications and ensure all necessary procedures are followed when establishing this type of deed.Surprise Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary is a legal arrangement that allows a property owner in Surprise, Arizona, to transfer ownership of their property to a designated nonprofit corporation upon their death. This type of deed offers individuals the opportunity to support charitable organizations while ensuring their property is utilized for a worthy cause after their passing. One of the key benefits of a Surprise Arizona Beneficiary or Transfer on Death Deed is that it provides individuals with the ability to make a significant impact on their chosen nonprofit organization without having to part with their property during their lifetime. This arrangement allows property owners to retain full ownership and control of their property until their demise. As a result, they can continue to use, lease, or sell the property as they wish, while simultaneously supporting a charitable cause. This kind of deed is a strategic estate planning tool that can help individuals effectively manage their assets and leave a lasting legacy. By naming a nonprofit corporation as the beneficiary, individuals can ensure that their property is used towards philanthropic efforts that align with their values and passions. Whether it's supporting educational institutions, medical research facilities, environmental conservation organizations, or any other cause close to their heart, this deed allows individuals to make a meaningful contribution. Furthermore, Surprise Arizona Beneficiary or Transfer on Death Deed provides flexibility in terms of the property to be transferred. It can include residential homes, commercial buildings, vacant land, or any other type of property eligible for ownership transfer. It is important to note that although Surprise Arizona Beneficiary or Transfer on Death Deed is predominantly used to transfer ownership to nonprofit corporations, there may be variations in how the deed is structured. For instance, individuals may choose to name specific charitable trusts or foundations as beneficiaries instead of a nonprofit corporation. These variations depend on the personal preferences and objectives of the property owner. Overall, Surprise Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary provides property owners with a unique opportunity to make a lasting impact on the community. By utilizing this legal tool, individuals can support charitable causes they believe in while retaining control over their property during their lifetime. It is advised to consult an experienced estate planning attorney to fully understand the legal implications and ensure all necessary procedures are followed when establishing this type of deed.