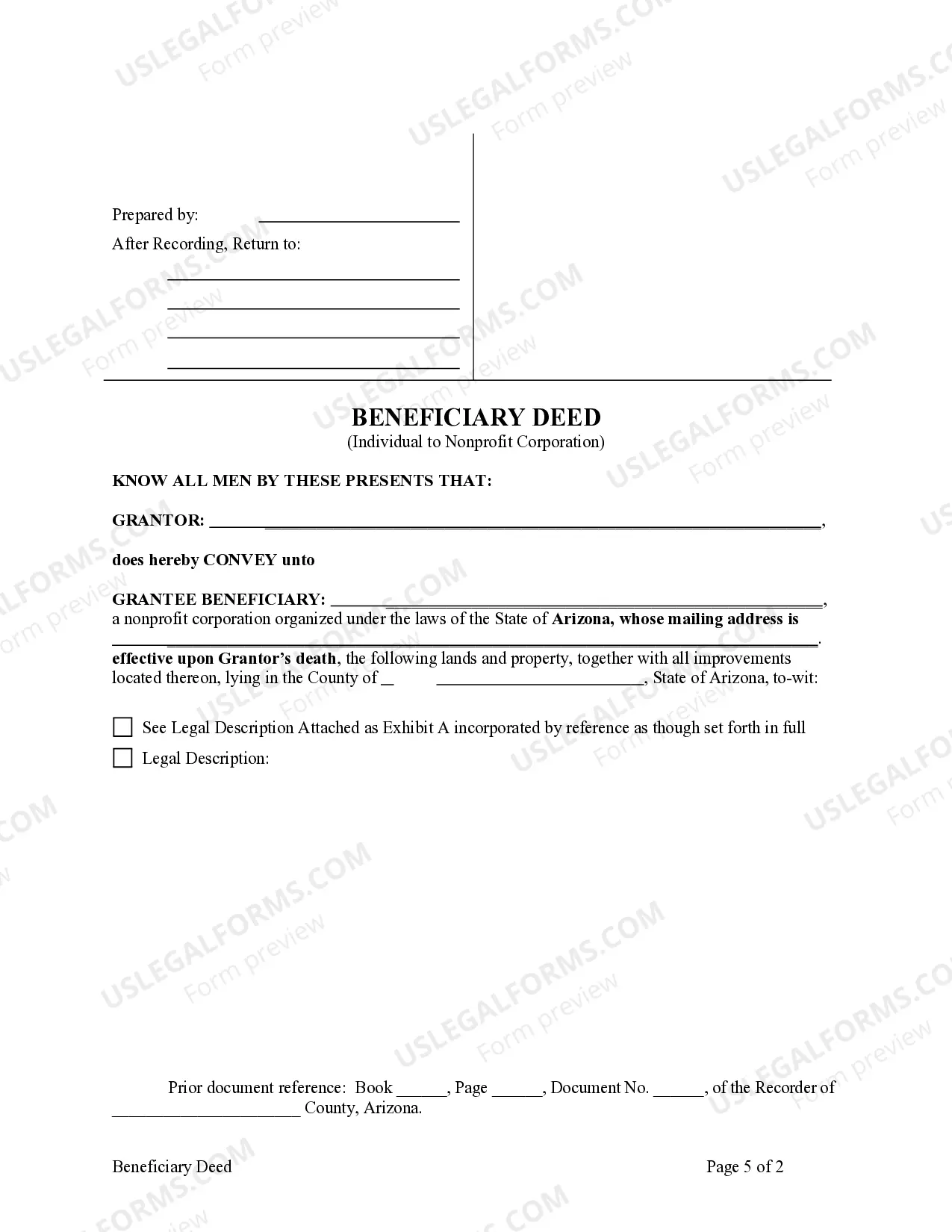

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee \ Beneficiary is a Nonprofit Corporation. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. The deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

Tempe Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary

Description

How to fill out Arizona Beneficiary Or Transfer On Death Deed From An Individual Owner To A Nonprofit Corporation As Beneficiary?

Acquiring verified templates tailored to your regional laws can be difficult unless you utilize the US Legal Forms library.

It’s a web-based repository of over 85,000 legal documents addressing both personal and professional requirements, catering to various real-life scenarios.

All documents are organized according to their area of application and jurisdiction, allowing the retrieval of the Tempe Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary to be incredibly swift and straightforward.

Maintaining documents orderly and in compliance with legal stipulations is crucial. Utilize the US Legal Forms library to have vital document templates readily available for any requirements!

- Ensure to preview the mode and form description.

- Confirm that you’ve selected the correct one that fulfills your requirements and fully aligns with your local jurisdiction standards.

- If necessary, search for another template.

- If you notice any discrepancies, use the Search tab above to locate the appropriate one.

- If it meets your needs, proceed to the next step.

Form popularity

FAQ

Yes, a beneficiary deed does help avoid probate in Arizona. When you create a beneficiary deed for your property, ownership transfers immediately to the nonprofit corporation upon your death without going through the probate process, which can often take time and incur costs. This setup allows for a smoother transition and ensures that your intended beneficiary receives the property as you specified. If you want to ensure its accuracy, using UsLegalForms is a great way to navigate this legal process.

Filing a beneficiary deed in Arizona involves submitting your completed form to the appropriate county recorder's office, such as in Tempe. Ensure that the beneficiary deed is properly signed and notarized before submission. Once filed, the document serves to designate the nonprofit corporation as the beneficiary upon your passing, following Arizona law regarding the transfer of property. For assistance in this process, consider using UsLegalForms to access the right resources.

To obtain a beneficiary deed in Arizona, start by completing a beneficiary deed form, which you can find online or through legal service providers like UsLegalForms. Then, include essential details such as the property description and the intended nonprofit corporation as the beneficiary. Once completed, sign the deed in front of a notary. After this, file the deed with the county recorder's office in Maricopa County to officially document your intention.

The terms beneficiary and transfer on death refer to distinct aspects of estate planning. A beneficiary is an individual or organization designated to receive assets upon the death of the owner. In contrast, a transfer on death deed allows an individual owner to transfer real estate directly to a specified beneficiary without going through probate. Understanding the Tempe Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary can simplify this process, ensuring that your wishes are honored efficiently.

In Arizona, a beneficiary deed generally takes precedence over a will regarding the transfer of the specified property. If you have a beneficiary deed in place, the property will pass directly to the named beneficiary upon your death, bypassing the probate process outlined in your will. This highlights the importance of proper estate planning to ensure your intentions are clear. A Tempe Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary can provide assurance of this process.

Yes, Arizona allows the use of transfer-on-death deeds to facilitate the transfer of real estate upon death. This option helps avoid the lengthy probate process and simplifies property transfer to beneficiaries. It's important to draft the deed correctly and record it with the county to ensure it is valid. If you're considering a Tempe Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary, this method may be a practical solution.

In Arizona, you can transfer title on death through a transfer-on-death deed. This deed allows you to name a beneficiary who will receive the property automatically upon your death without going through probate. To create this deed, you should use a legal form that complies with Arizona laws and ensure it is duly recorded. A Tempe Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary is an excellent option for your estate planning.

To transfer a property deed from a deceased relative in Arizona, you generally need to open probate if the relative owned the property solely. If the property has a beneficiary deed, it may bypass probate. You will need to provide necessary documents, including the death certificate and a copy of the deed. Utilizing a Tempe Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary may simplify this process.

Yes, in Arizona, a beneficiary deed must be recorded to take effect. Recording the deed ensures that the property transfer is legally recognized. Without recording, the beneficiary may face challenges proving ownership after the owner's death. If you're interested in a Tempe Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary, ensure you follow the recording process.

To transfer a property title to a family member in Arizona, you need to complete a deed, such as a warranty deed or a quitclaim deed. After preparing the deed, sign it in front of a notary public and ensure it meets state requirements. Next, you must record the deed with the county recorder's office. This process is essential in executing a Tempe Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary.