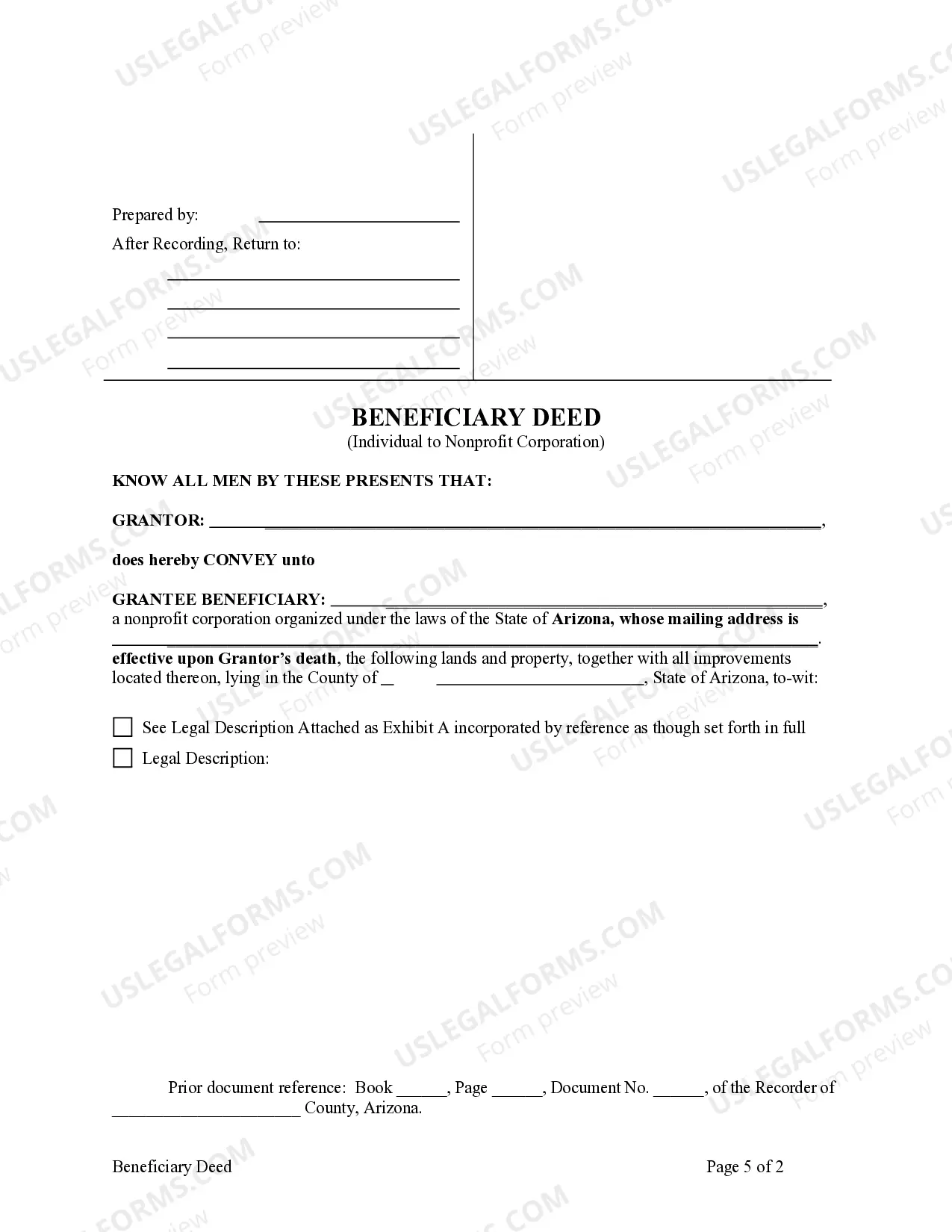

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantee \ Beneficiary is a Nonprofit Corporation. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. The deed must be recorded prior to Grantor's death. This deed complies with all state statutory laws.

A Tucson Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary is a legal document that allows a property owner to transfer ownership of their property to a non-profit corporation upon their death, bypassing the probate process. This type of deed ensures that the individual's charitable wishes are fulfilled while also providing potential tax benefits for the donor's estate. There are different variations of Tucson Arizona Beneficiary or Transfer on Death Deeds, each offering specific advantages depending on the individual's circumstances and goals. Some types include: 1. Traditional Beneficiary Deed: This type of deed allows the property owner to retain full control and ownership rights over their property until their death. Only after their passing does the property automatically transfer to the designated nonprofit corporation as the beneficiary. 2. Enhanced Beneficiary Deed: With an enhanced Beneficiary Deed, the property owner has the flexibility to modify or revoke the deed during their lifetime. This type offers greater control and can be useful if the owner's plans or circumstances change. 3. Joint Beneficiary Deed: A Joint Beneficiary Deed enables the property owner to name multiple beneficiaries, including a nonprofit corporation, to inherit the property jointly. This type can be useful if the owner wishes to distribute their assets among multiple charitable organizations. 4. Charitable Remainder Beneficiary Deed: This deed allows the property owner to transfer their property to a nonprofit corporation while retaining the right to live in or use the property during their lifetime. Once the owner passes away or chooses to release the rights, the nonprofit becomes the sole owner. By utilizing a Tucson Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary, property owners can ensure their support for charitable causes continues even after their demise. It is crucial to consult with an experienced estate planning attorney to determine the most appropriate type of deed based on individual circumstances and desired outcomes.A Tucson Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary is a legal document that allows a property owner to transfer ownership of their property to a non-profit corporation upon their death, bypassing the probate process. This type of deed ensures that the individual's charitable wishes are fulfilled while also providing potential tax benefits for the donor's estate. There are different variations of Tucson Arizona Beneficiary or Transfer on Death Deeds, each offering specific advantages depending on the individual's circumstances and goals. Some types include: 1. Traditional Beneficiary Deed: This type of deed allows the property owner to retain full control and ownership rights over their property until their death. Only after their passing does the property automatically transfer to the designated nonprofit corporation as the beneficiary. 2. Enhanced Beneficiary Deed: With an enhanced Beneficiary Deed, the property owner has the flexibility to modify or revoke the deed during their lifetime. This type offers greater control and can be useful if the owner's plans or circumstances change. 3. Joint Beneficiary Deed: A Joint Beneficiary Deed enables the property owner to name multiple beneficiaries, including a nonprofit corporation, to inherit the property jointly. This type can be useful if the owner wishes to distribute their assets among multiple charitable organizations. 4. Charitable Remainder Beneficiary Deed: This deed allows the property owner to transfer their property to a nonprofit corporation while retaining the right to live in or use the property during their lifetime. Once the owner passes away or chooses to release the rights, the nonprofit becomes the sole owner. By utilizing a Tucson Arizona Beneficiary or Transfer on Death Deed from an Individual Owner to a Nonprofit Corporation as Beneficiary, property owners can ensure their support for charitable causes continues even after their demise. It is crucial to consult with an experienced estate planning attorney to determine the most appropriate type of deed based on individual circumstances and desired outcomes.