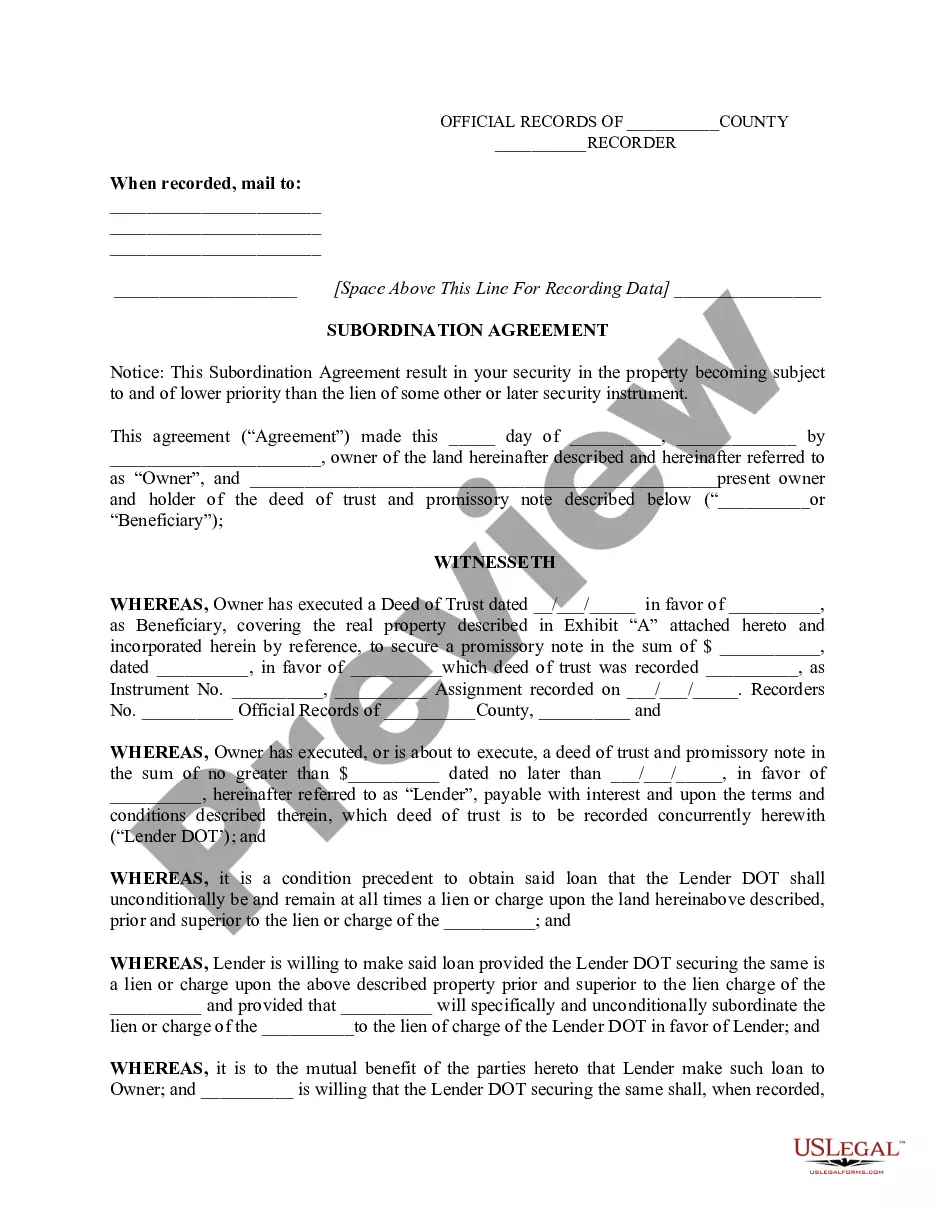

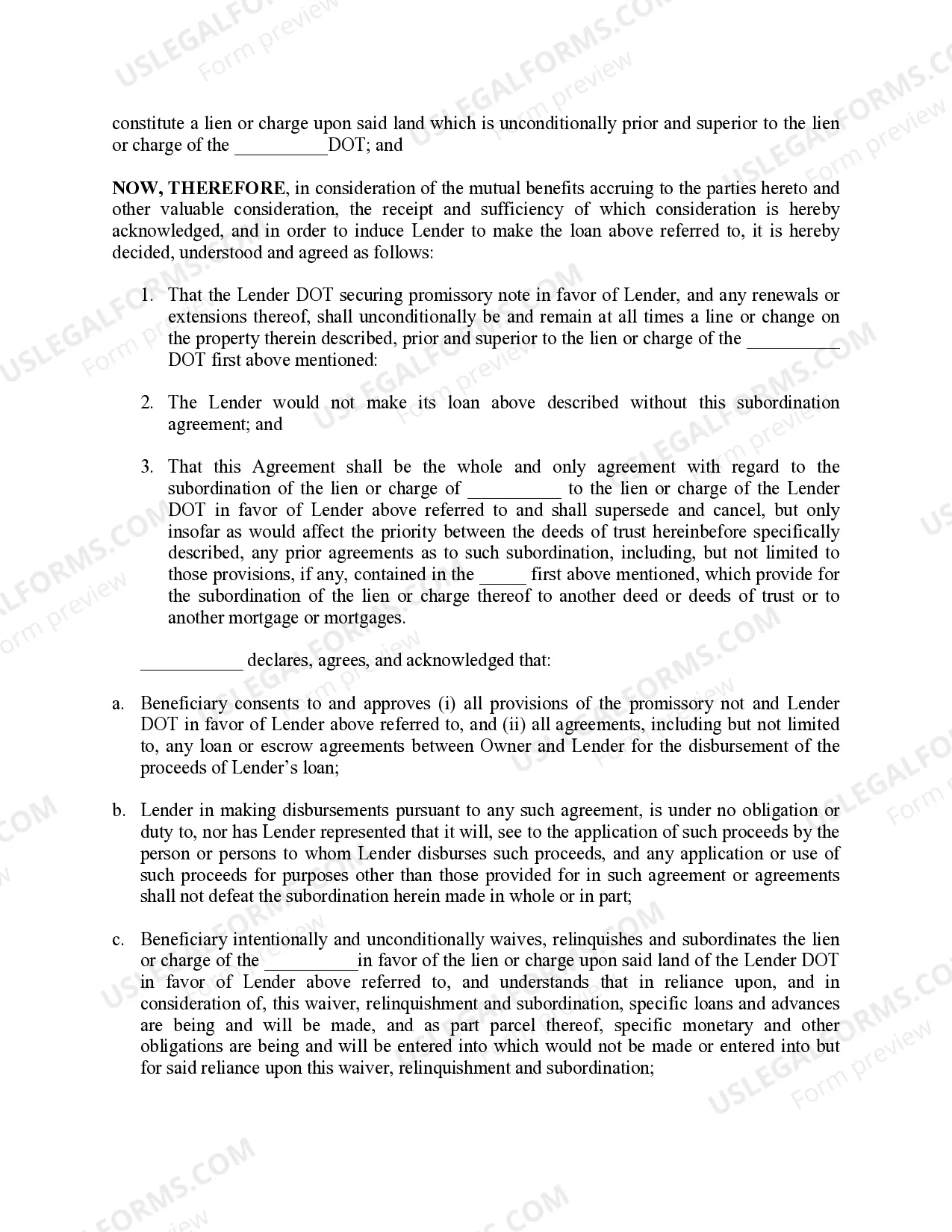

A Gilbert Arizona Subordination Agreement is a legal document that establishes the priority of different liens or mortgages on a property located in Gilbert, Arizona. This agreement is commonly used in real estate transactions to address the order in which creditors are entitled to repayment from the proceeds of a sale or foreclosure. In simple terms, a subordination agreement determines the ranking of debts secured by the property. It allows a creditor with a higher-priority lien to give consent to another creditor to take a subordinate position. By doing so, the higher-priority creditor agrees to have their claim paid after the claims of the newly-subordinated party. There are typically two main types of Gilbert Arizona Subordination Agreements: 1. Mortgage Subordination Agreement: This type of agreement applies to situations where a homeowner refinances their mortgage or obtains a second mortgage while still having an existing first mortgage on the property. The mortgage subordination agreement ensures that the newly acquired mortgage takes a lower priority than the original mortgage. This agreement is essential for the new lender to have confidence in their security interest, knowing that they will be repaid after the initial mortgage holder in case of default. 2. Intercreditor Subordination Agreement: This type of agreement is more commonly used in commercial real estate financing. It occurs when there are multiple lenders involved in a project, each with different priorities and security interests. The intercreditor subordination agreement establishes the order of repayment, ensuring that one lender's position is subordinated to the other lender's position. Different lenders may have different security interests, such as mezzanine loans or construction loans, and this agreement helps clarify their rights and obligations. In Gilbert, Arizona, subordination agreements are crucial in resolving conflicts between competing creditors and protecting the interests of all parties involved. These agreements provide clarity and ensure that all lenders are treated fairly when it comes to the distribution of funds in case of default or sale of the property.

Gilbert Arizona Subordination Agreement

Description

How to fill out Gilbert Arizona Subordination Agreement?

Do you require a reliable and cost-effective provider of legal forms to purchase the Gilbert Arizona Subordination Agreement? US Legal Forms is your best choice.

Whether you need a simple agreement to establish guidelines for living with your partner or a collection of forms to facilitate your divorce through the legal system, we've got you covered. Our platform offers over 85,000 current legal document templates for individual and business purposes.

All templates we provide are not generic and are tailored based on the needs of different states and regions.

To obtain the document, you must Log In to your account, locate the desired form, and click the Download button adjacent to it. Please remember that you can retrieve your previously purchased document templates at any time from the My documents section.

Now you can register for your account. After that, select the subscription plan and go through the payment process. Once the payment is finalized, you can download the Gilbert Arizona Subordination Agreement in any available file format.

You can return to the website anytime and re-download the document at no additional costs. Acquiring current legal forms has never been simpler. Try US Legal Forms today, and say goodbye to wasting your precious time searching for legal documents online.

- Is this your first time visiting our site? No problem.

- You can create an account with ease, but first, ensure to do the following.

- Check if the Gilbert Arizona Subordination Agreement complies with the laws of your state and locality.

- Review the form's details (if available) to understand who and what the document is suitable for.

- If the form does not fit your needs, restart your search.

Form popularity

FAQ

An intercreditor agreement primarily provides a framework for defining the priorities and rights between multiple creditors. In contrast, an agreement among lenders may cover broader terms, including collaborative efforts and responsibilities among creditors. While both types of agreements aim to clarify roles, they focus on different aspects of the lending relationship. Recognizing these differences can help streamline situations involving secured debts in Gilbert, Arizona.

An intercreditor deed and a subordination deed serve different purposes in lending agreements. While both deal with the hierarchy of debts, an intercreditor deed is focused on defining relationships between lenders, and a subordination deed specifically alters the priority of one lender's claim over another's. Understanding these distinctions is crucial for anyone navigating loans in Gilbert, Arizona. Each document plays a unique role in establishing lender relationships.

An intercreditor agreement is a contract between multiple creditors outlining their rights and responsibilities concerning borrower debt. This agreement establishes the priority of debts and can help manage disputes between lenders in Gilbert, Arizona. By defining the terms, it aims to create a smoother process for repayments. Utilizing this agreement can lead to better collaboration and understanding among creditors.

A subordination request form is a document used to change the priority of debts owed on a property. This form allows one creditor's claim to take precedence over another's, often benefiting borrowers in Gilbert, Arizona. By completing this form, property owners can enhance their financing options. It is essential to follow proper legal guidelines to ensure acceptance.

An intercreditor and subordination agreement combines elements from both legal frameworks to clarify the relationship between multiple lenders and establish priority debt rights. This type of agreement becomes essential when creditors have overlapping interests in a debtor's assets. When considering a Gilbert Arizona Subordination Agreement, understanding the nuances between these two agreements can lead to better financial outcomes for all parties involved.

The requirements for a valid subordination agreement typically include the identification of the involved parties, clear terms outlining the prioritization of debts, and proper signatures from all parties. Additionally, it should comply with state and local laws related to lending practices. Seeking professional assistance when preparing a Gilbert Arizona Subordination Agreement ensures all necessary legalities are met.

A subordination agreement is a legal document that determines which creditors have priority in payment should the borrower default. This agreement is crucial in lending arrangements, as it affects the risk and return for each lender. Understanding the implications of a Gilbert Arizona Subordination Agreement helps all parties navigate complexities in financing.

An assignment and subordination agreement allows a lender to transfer their rights to receive payment from a borrower while agreeing to subordinate their rights to another lender. This type of agreement is essential in ensuring that all lenders understand their payment priorities. When drafting a Gilbert Arizona Subordination Agreement, incorporating these elements can provide clarity and protect borrower relationships.

An inter-creditor agreement serves to define the rights and priorities of different lenders involved in a borrowing arrangement. It establishes the framework for how debts will be handled if the borrower defaults, safeguarding the interests of each lender. This legal tool is vital when navigating a Gilbert Arizona Subordination Agreement.

An AAL, or an Asset Allocation Letter, focuses on how assets are divided among creditors. In contrast, an intercreditor agreement outlines the terms and considerations between lenders, particularly regarding subordinated or senior debt. Understanding these distinctions is crucial when drafting a Gilbert Arizona Subordination Agreement for clarity and operational efficiency.