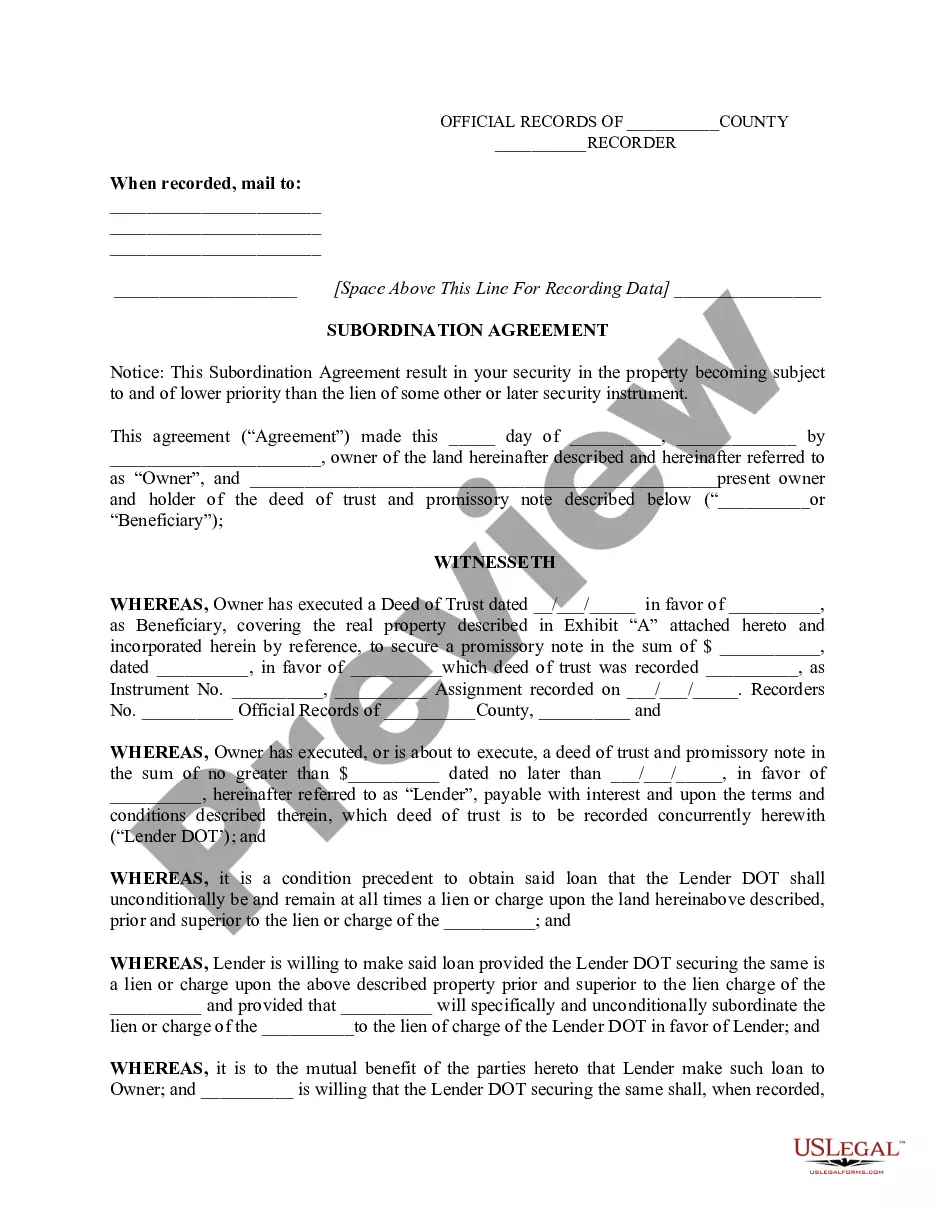

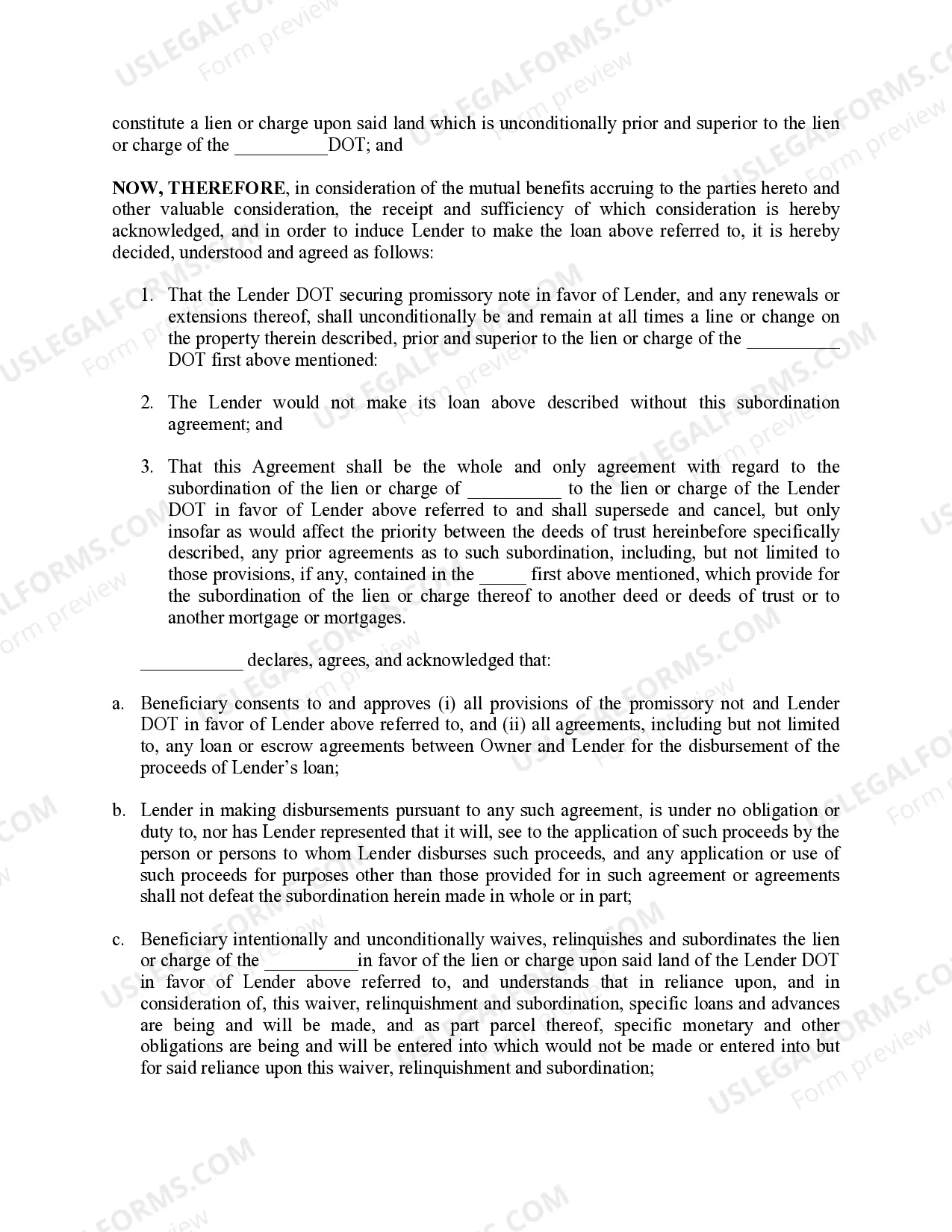

A Maricopa Arizona Subordination Agreement is a legal document that outlines the order of priority among different creditors when it comes to the distribution of funds or assets in case of a borrower's default. This agreement is commonly used in real estate transactions where there are multiple loans or liens involved. Keyword: Maricopa Arizona Subordination Agreement In Maricopa, Arizona, a Subordination Agreement plays a crucial role in determining the hierarchy of lien holders' rights to collect debts and ensures a fair distribution of funds in the event of foreclosure or bankruptcy. This agreement is typically entered into when a property owner intends to take out a new loan or refinance an existing one while there are already outstanding obligations secured by the property. The purpose of a Maricopa Arizona Subordination Agreement is to establish the priority of liens should the borrower default on his or her loan payments. By agreeing to subordinate their lien, a creditor willingly gives up their higher position in the lien hierarchy, allowing another creditor to take a superior position. This allows the borrower to obtain new financing while maintaining the established interests of previous lien holders. Different Types of Maricopa Arizona Subordination Agreements: 1. First lien subordination: This type of agreement is used when a lien holder with a first lien position subordinates their rights to a new lender or creditor who is providing additional financing. This is the most common type of subordination agreement in real estate transactions. 2. Second lien subordination: In this scenario, a lien holder with a second mortgage or lower priority lien agrees to give up their superior position to a new creditor. This agreement is typically used when a property owner wants to refinance their first mortgage and secure additional funds from a new lender. 3. Inter-creditor agreement: This agreement is utilized when there are multiple creditors with competing interests on the same property. It establishes the order in which they will be repaid if the borrower defaults. This type of subordination agreement is often used in commercial real estate or large-scale development projects where multiple parties are involved. In summary, a Maricopa Arizona Subordination Agreement is a legal contract that determines the priority of creditors' rights in the event of a borrower's default. This agreement protects the interests of all parties involved by establishing a clear order of repayment. Whether it is a first lien subordination, second lien subordination, or an inter-creditor agreement, these agreements are essential tools in managing the distribution of funds and maintaining the integrity of real estate transactions in Maricopa, Arizona.

Maricopa Arizona Subordination Agreement

Description

How to fill out Maricopa Arizona Subordination Agreement?

If you’ve already used our service before, log in to your account and download the Maricopa Arizona Subordination Agreement on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to get your document:

- Make certain you’ve located a suitable document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Maricopa Arizona Subordination Agreement. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!

Form popularity

FAQ

Arizona real estate is transferred using a legal document called a deed....The process involves four general steps: Locate the Prior Deed to the Property.Get a New Deed to the Property.Sign and Notarize the New Deed.Record the New Deed in the Land Records.

Checklist: Preparing and Recording Your Quitclaim Deed Fill in the deed form. Print it out. Sign and get the signature(s) notarized. Prepare and sign an Affidavit of Property Value, if required. Check the recording fees in your county. Record the document at the county recorder's office.

In Maricopa County, Arizona, you can do this at either the main office in Phoenix, at 111 S. Third Avenue, or in Mesa at 222 E. Javelina Avenue. The recorder will need your original deed or a legible copy with original signatures.

Hours & Locations Recorder's Office. Phone: 602-506-1511. Elections MCTEC Office. 510 S. Third Ave. Phoenix AZ 85003. By appointment only. Call for services. Hours: A.M. - P.M. Monday - Friday. Phone: 602-506-1511. T.D.D. 602-506-2348.

? Beneficiary deeds are filed in the Maricopa County Recorder's Office.

Hours & Locations Recorder's Office. Phone: 602-506-1511. Elections MCTEC Office. 510 S. Third Ave. Phoenix AZ 85003. By appointment only. Call for services. Hours: A.M. - P.M. Monday - Friday. Phone: 602-506-1511. T.D.D. 602-506-2348.

You can file the deed with either branch of the Maricopa County Recorder's Office. Once you pay the recording fee, the staff will take the document, microfilm it, then index where to find it in the files. The office will mail the original document back to you within six to eight weeks.

Document recording feesAll documents (except plats and surveys)$30.00Plats and surveys first page$24.00Plats and surveys additional per page$20.00Military Discharge (per ARS 11-465)Free3 more rows

Maricopa County Recorder's Office has two full service offices to record your quitclaim deed. The main office is located in downtown Phoenix. The Southeast office is in Mesa, Arizona. Maricopa County Recorder's Offices are responsible for recording and maintaining permanent public records.

Interesting Questions

More info

No need to carry copies of the documents when attending court and all legal documents are delivered to you in PDF, TXT or TXT XLS formats. Get the latest information you need on an assignment and save time filling out the required documents and paperwork. Include your full name and Social Security number in the title (if you choose) along with the state and area your case is filed for. Send to your client along with a copy of their name, address, date of birth, signature, and the number of copies ordered. Not many states keep a record of those orders. If the case is heard at the Superior Court of your state, your form will be delivered to an office that handles these types of matters. Your form is to be filled out and forwarded to your client on a paper envelope with a return address. They are required to fill out a Paperwork Affidavit and return it along with their requested fees to your office. We also provide an alternative service to fill out a legal document on your own.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.