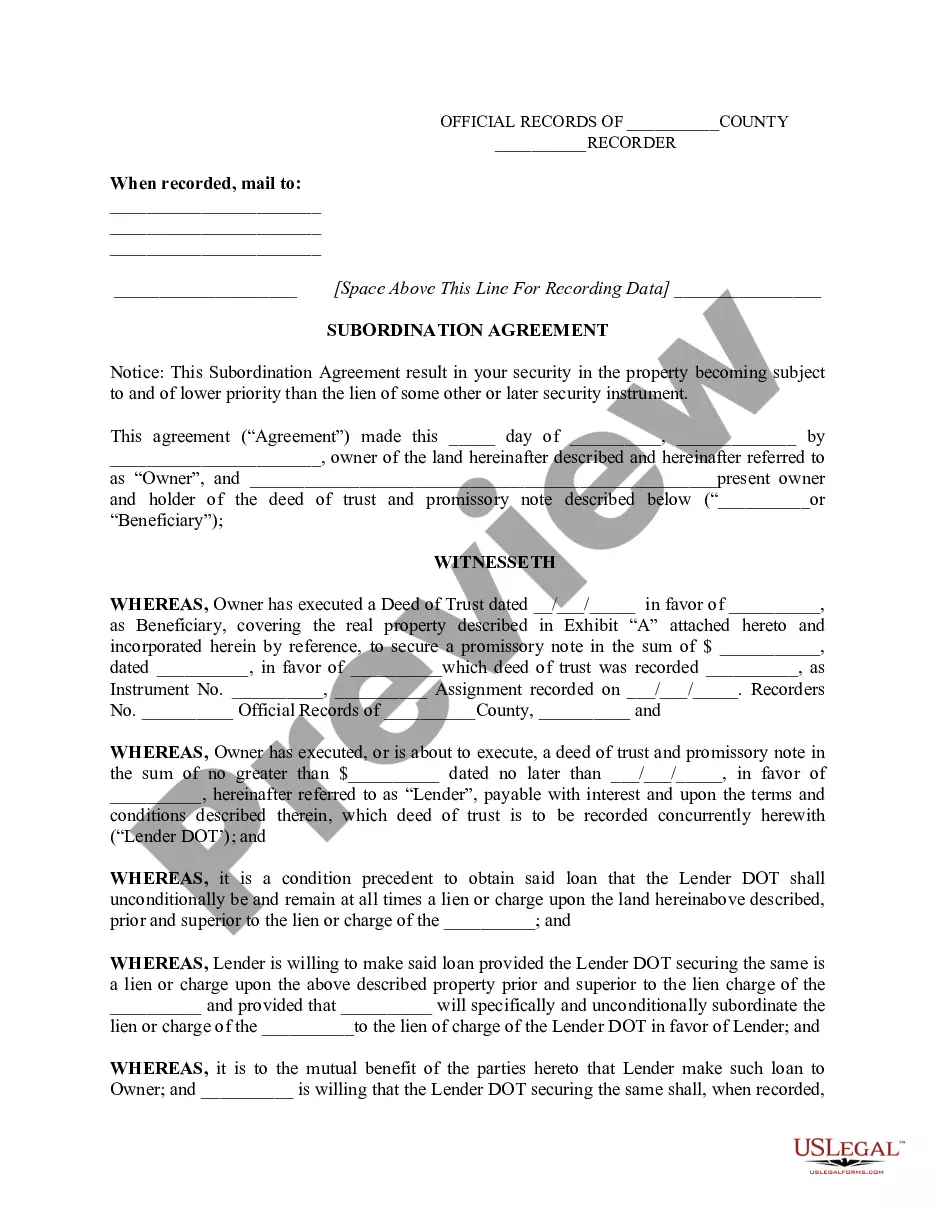

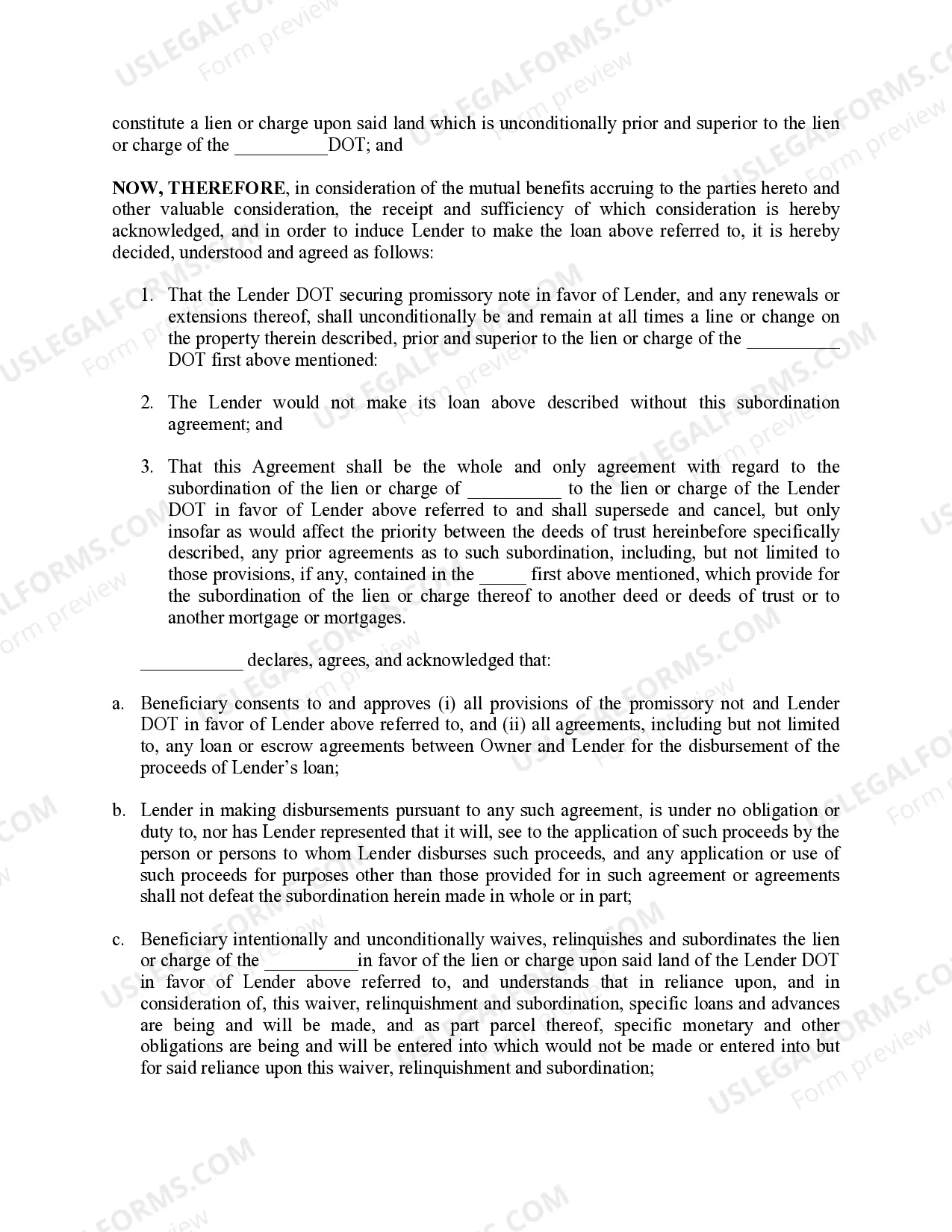

A Tucson Arizona Subordination Agreement is a legally binding document that outlines the priority of different liens or claims on a property located in Tucson, Arizona. This agreement ensures that the interests of different parties, such as lenders and borrowers, are properly protected in case of default or foreclosure. By signing this agreement, parties agree to alter the order of priority of their claims against the property, which can have significant implications in terms of repayment and recovery. There are different types of Tucson Arizona Subordination Agreements, each serving specific purposes and catering to varying situations. Some common types of these agreements include: 1. Mortgage Subordination Agreement: This type of agreement occurs when a homeowner decides to refinance their mortgage loan. Since refinancing generally involves securing a new loan, the existing mortgage lien needs to be subordinated to the new loan. The mortgage subordination agreement ensures that the new lender has the first lien position, surpassing the previous lender's interest on the property. 2. Construction Loan Subordination Agreement: In cases where a property owner seeks additional financing to fund construction or renovations, a construction loan subordination agreement is required. This agreement allows the construction lender to obtain a higher priority on the property ahead of any existing liens. 3. Subordinate Financing Agreement: This agreement is relevant when a property owner needs to obtain additional financing while an initial mortgage is already in place. By signing this agreement, the existing lender agrees to subordinate their lien position to the newly acquired loan. 4. Leasehold Subordination Agreement: In the context of leasehold interests, this agreement is used to address situations where a tenant wants to execute a lease agreement for an extended period but requires a lender to finance the property. The leasehold subordination agreement ensures that the lender's interest takes precedence over the tenant's leasehold interest. In summary, a Tucson Arizona Subordination Agreement is a crucial legal document that establishes the priority of claims on a property. It plays a significant role in situations involving mortgages, construction loans, subordinate financing, and leasehold interests. Having a clear understanding of the different types of subordination agreements can help parties navigate real estate transactions and protect their respective interests effectively.

Tucson Arizona Subordination Agreement

Description

How to fill out Tucson Arizona Subordination Agreement?

Regardless of social or professional status, filling out legal documents is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone with no law education to draft such paperwork from scratch, mostly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our platform provides a massive library with more than 85,000 ready-to-use state-specific documents that work for practically any legal scenario. US Legal Forms also is an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you require the Tucson Arizona Subordination Agreement or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Tucson Arizona Subordination Agreement in minutes using our trusted platform. If you are presently a subscriber, you can proceed to log in to your account to get the appropriate form.

Nevertheless, in case you are new to our library, make sure to follow these steps before downloading the Tucson Arizona Subordination Agreement:

- Ensure the form you have chosen is suitable for your location since the rules of one state or county do not work for another state or county.

- Preview the form and read a brief outline (if provided) of cases the paper can be used for.

- If the form you chosen doesn’t suit your needs, you can start again and look for the necessary document.

- Click Buy now and choose the subscription option that suits you the best.

- Access an account {using your credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Tucson Arizona Subordination Agreement as soon as the payment is through.

You’re all set! Now you can proceed to print the form or fill it out online. In case you have any issues locating your purchased documents, you can easily find them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.