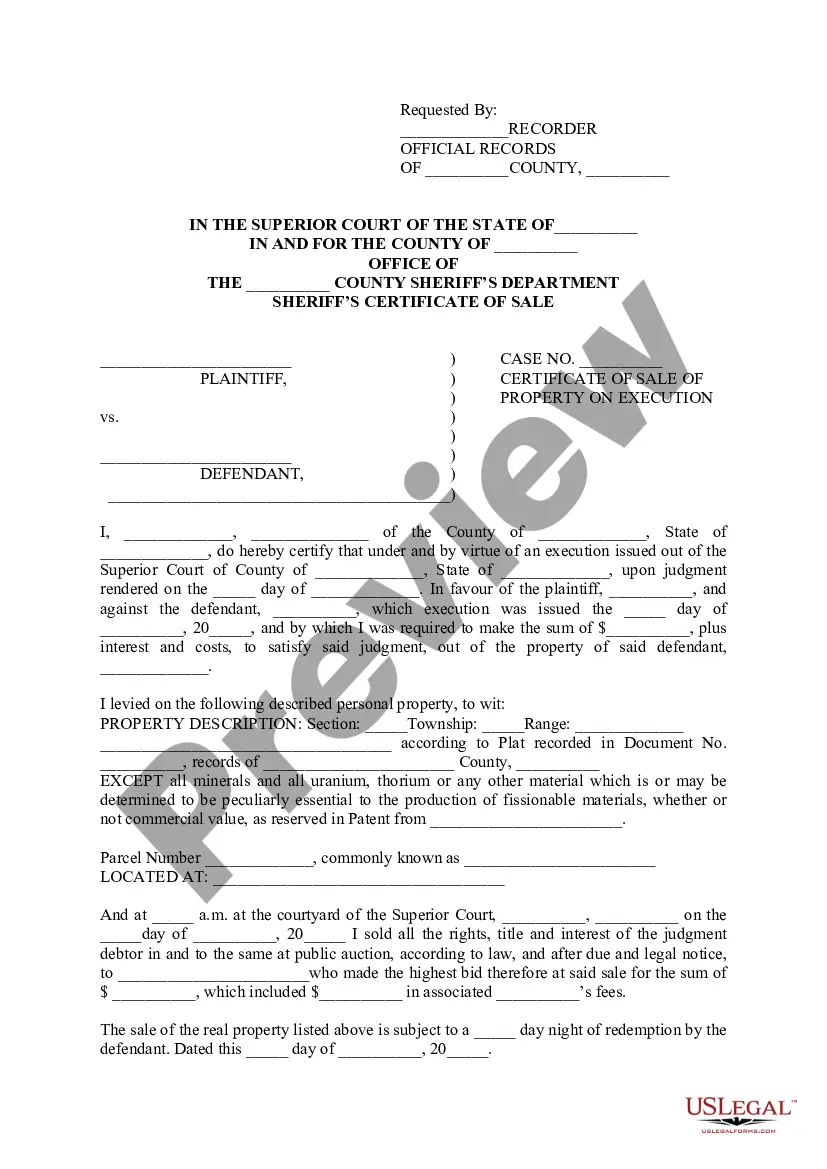

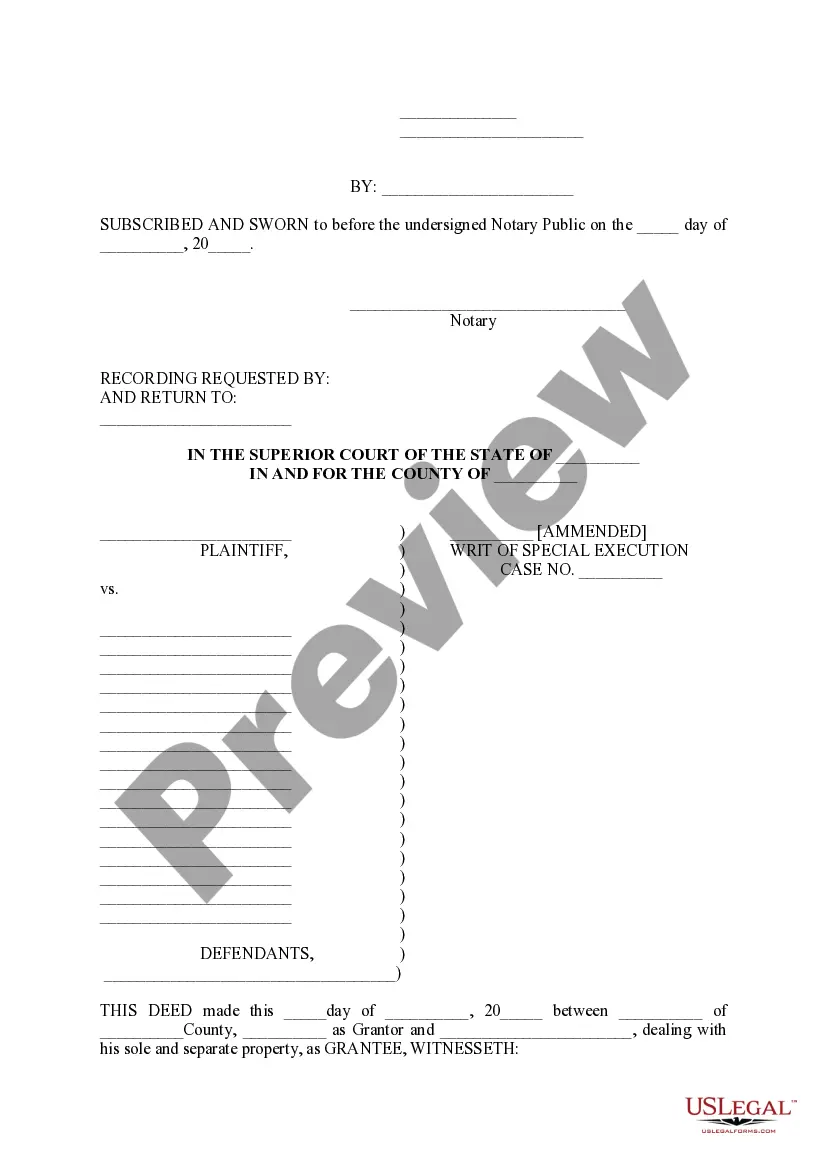

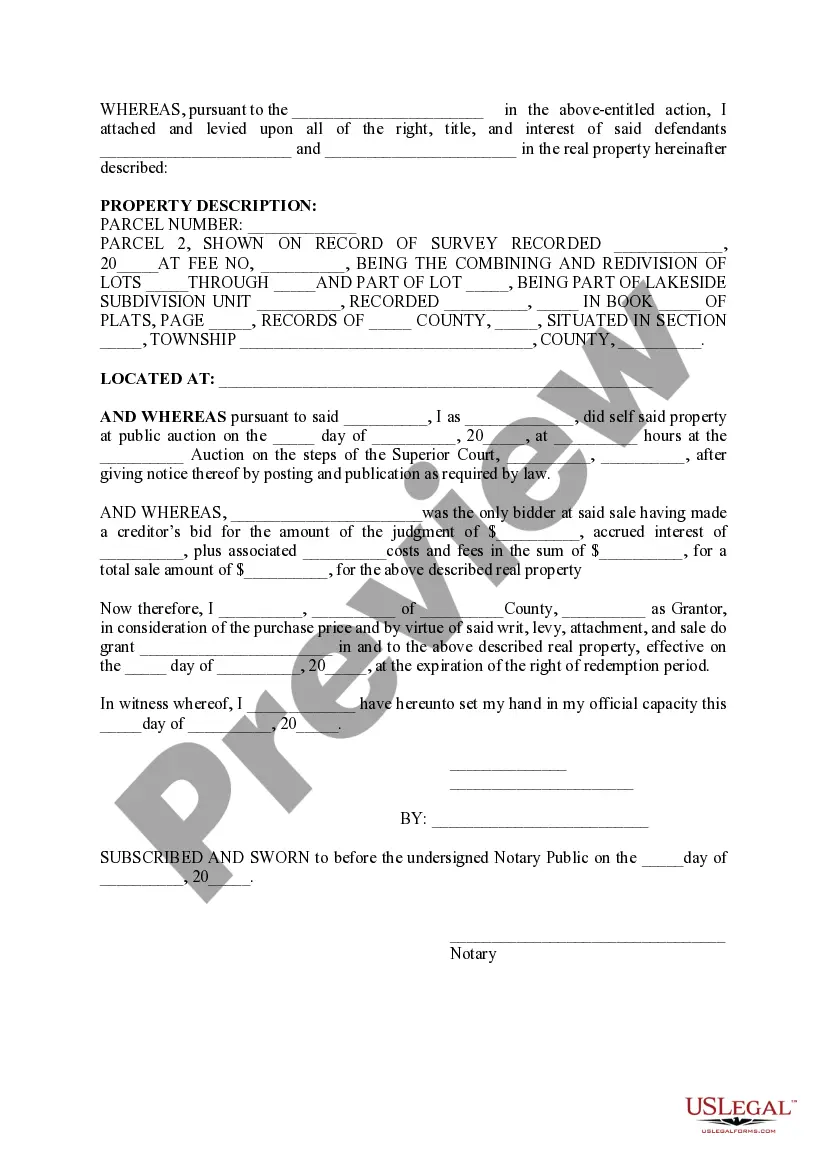

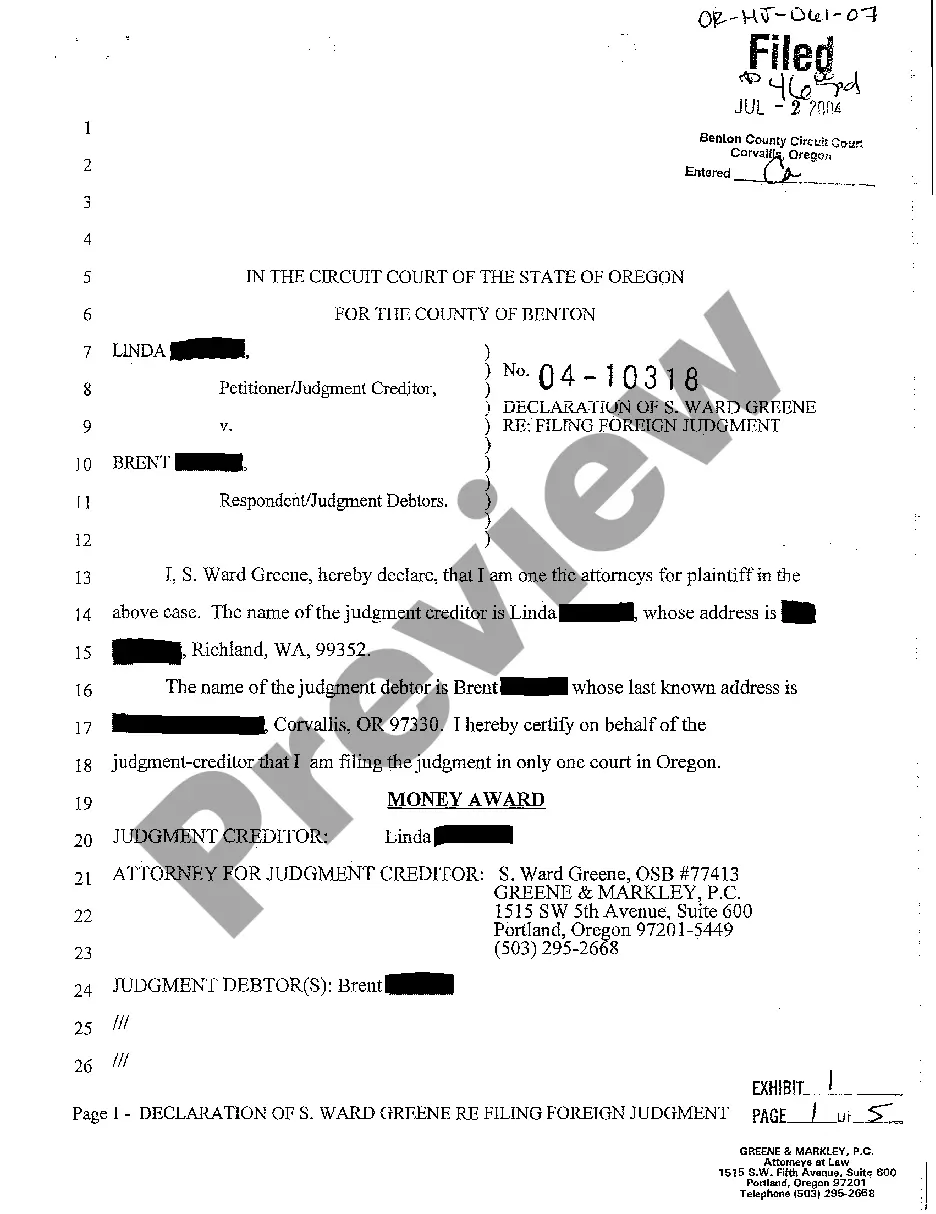

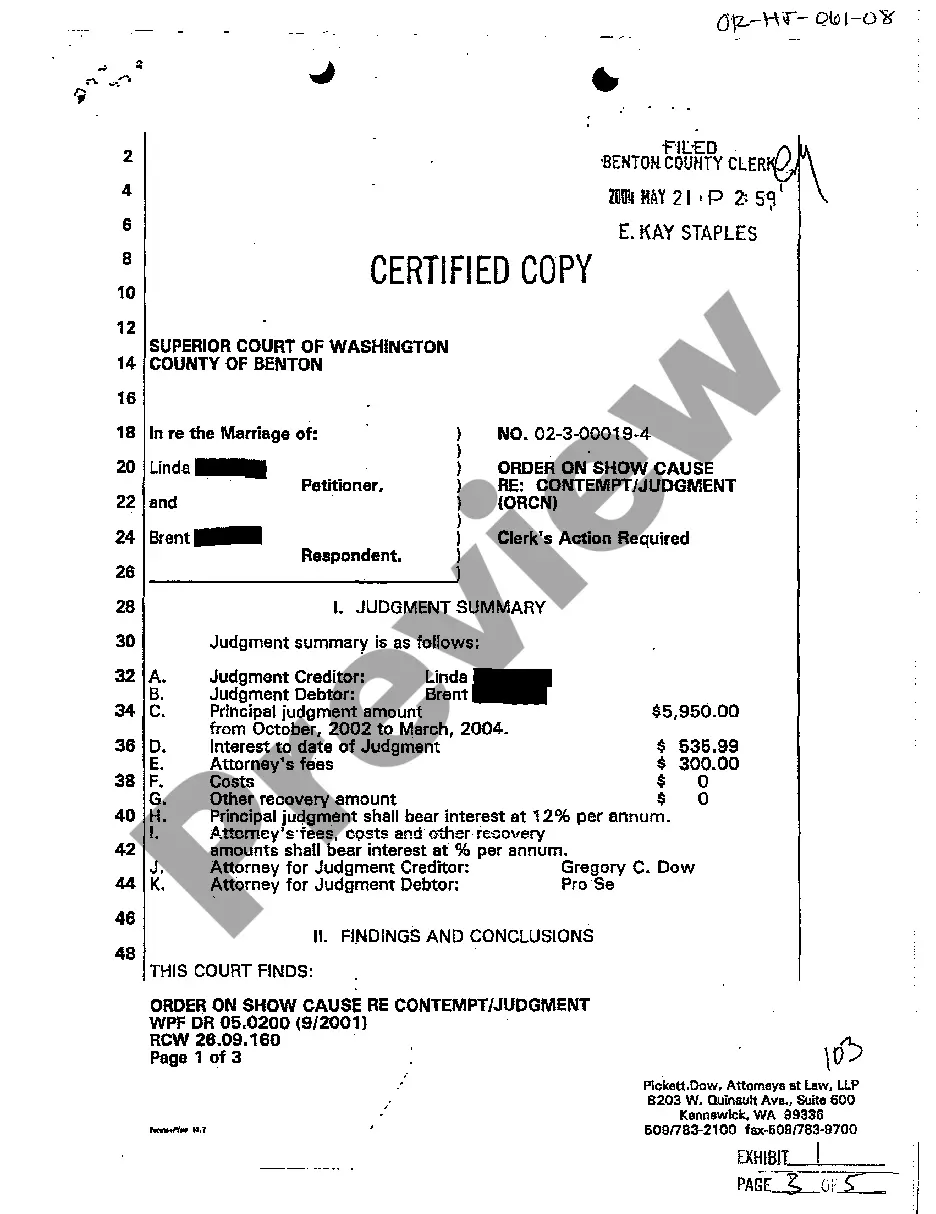

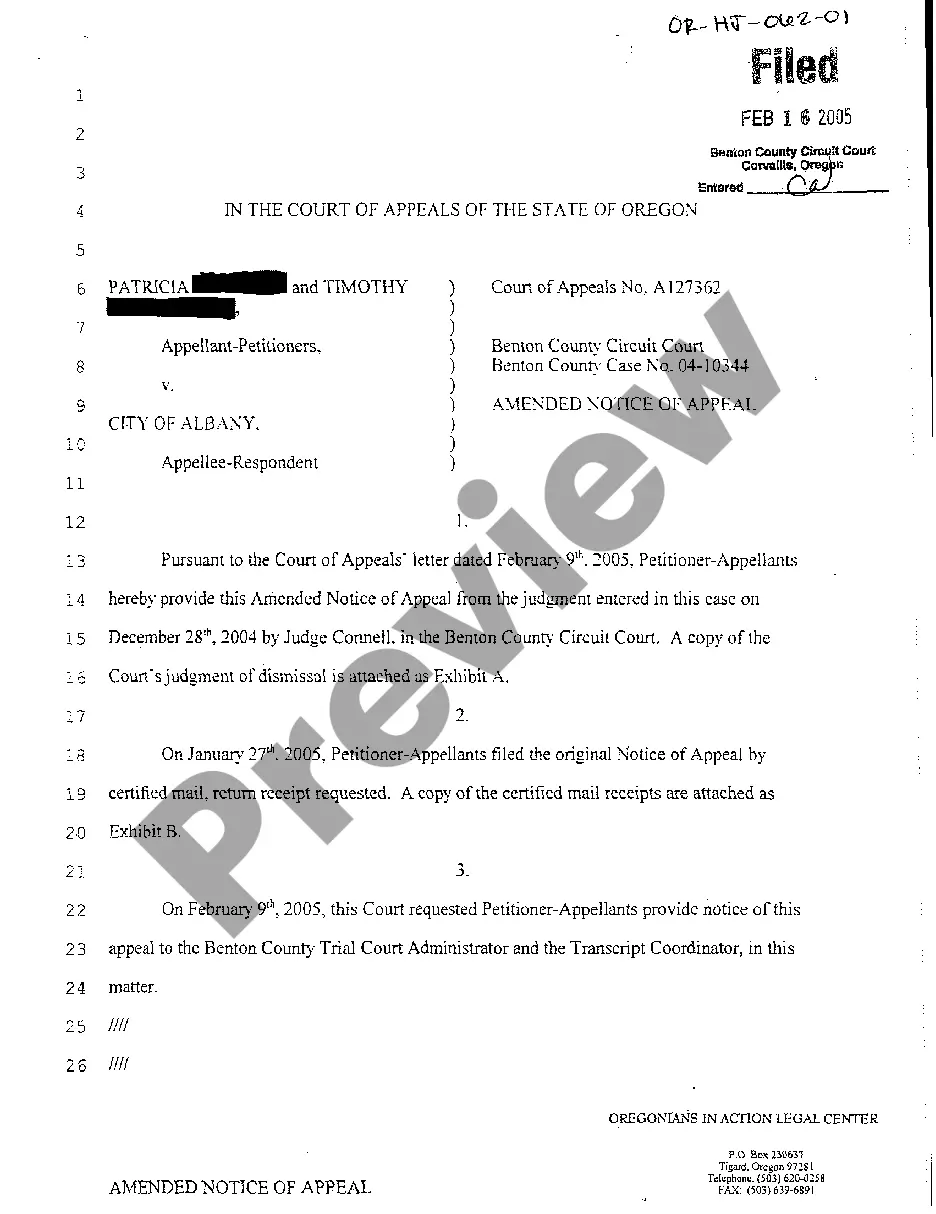

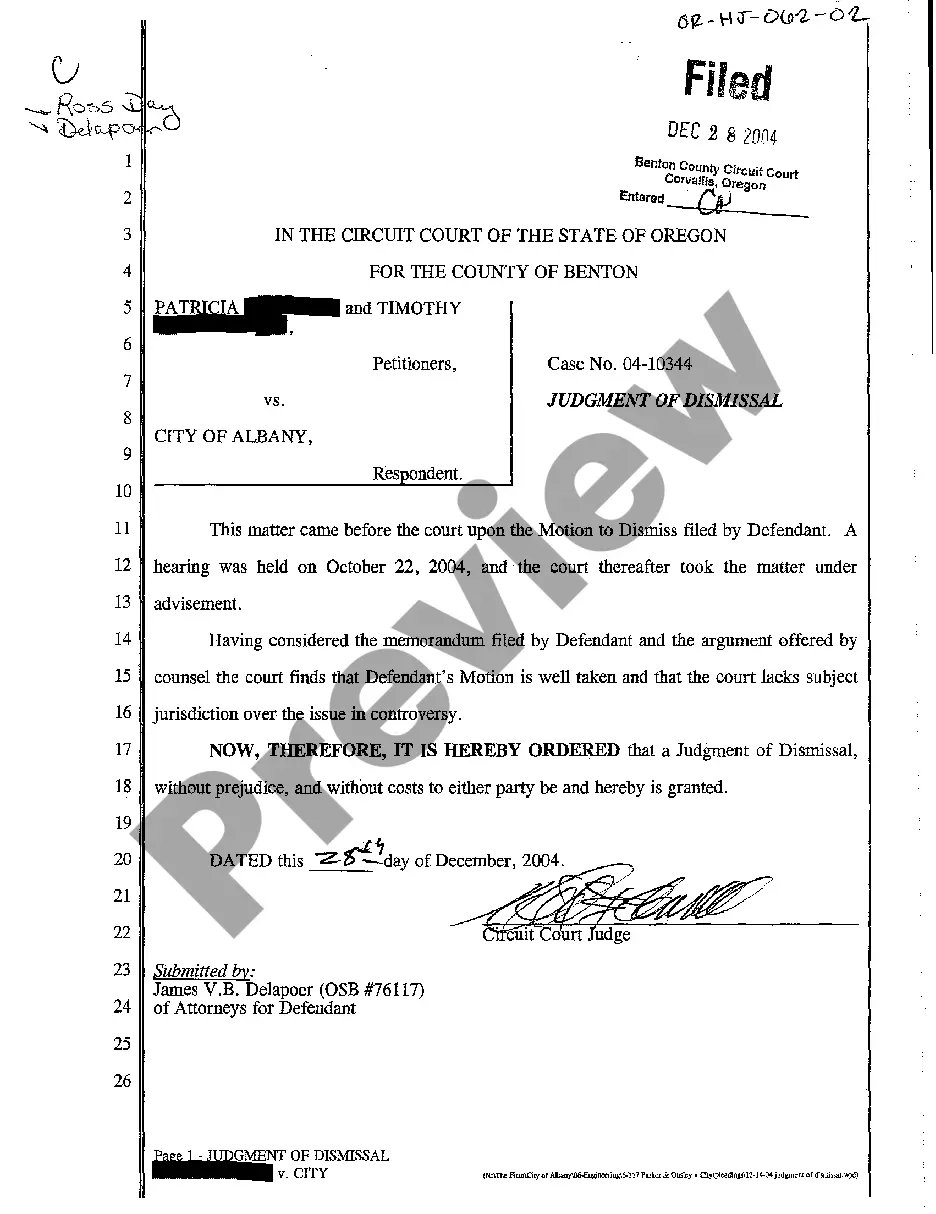

Tucson Arizona Certificate of Sale of Property on Execution is an official legal document that signifies the transfer of ownership rights of a particular property through a court-ordered sale. This certificate is issued following the completion of a judicial process known as execution, which is often initiated to recover outstanding debts or satisfy legal judgments. Keywords: Tucson Arizona, Certificate of Sale of Property on Execution, transfer of ownership, court-ordered sale, judicial process, execution, outstanding debts, legal judgments. The Tucson Arizona Certificate of Sale of Property on Execution is typically categorized into two main types: Tax Lien Certificates and Mortgage Foreclosure Certificates. 1. Tax Lien Certificates: This type of certificate is issued when a property owner fails to pay their property taxes. In such cases, the local government may place a tax lien on the property. After a specified period of unpaid taxes, the government auctions off the tax lien certificate to interested buyers. Upon purchasing this certificate, the buyer gains the right to collect the unpaid taxes, along with any accrued interest, from the property owner. In certain situations, if the owner fails to pay off their outstanding debt within a given timeframe, the buyer may initiate foreclosure proceedings to gain full ownership of the property. 2. Mortgage Foreclosure Certificates: When a property owner defaults on their mortgage payments, the lender may file a lawsuit to recover the unpaid debt. Through the execution process, the court may order a sale of the property to satisfy the outstanding mortgage debt. Once the property is sold at auction, a Certificate of Sale of Property on Execution is issued to the winning bidder. This certificate serves as evidence of the legal transfer of ownership rights from the previous owner to the new buyer. In conclusion, the Tucson Arizona Certificate of Sale of Property on Execution is an important legal document that facilitates the transfer of property ownership through court-ordered sales. It is divided into Tax Lien Certificates and Mortgage Foreclosure Certificates, each with its own specific circumstances and procedures. Whether it involves unpaid taxes or mortgage defaults, the issuance of these certificates aims to resolve outstanding debts and satisfy legal judgments.

Tucson Arizona Certificate of Sale of Property on Execution

Description

How to fill out Tucson Arizona Certificate Of Sale Of Property On Execution?

Do you need a reliable and inexpensive legal forms provider to get the Tucson Arizona Certificate of Sale of Property on Execution? US Legal Forms is your go-to choice.

No matter if you need a simple arrangement to set rules for cohabitating with your partner or a package of forms to advance your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of specific state and area.

To download the document, you need to log in account, locate the needed form, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Tucson Arizona Certificate of Sale of Property on Execution conforms to the regulations of your state and local area.

- Read the form’s description (if provided) to find out who and what the document is good for.

- Start the search over if the form isn’t suitable for your specific scenario.

Now you can create your account. Then choose the subscription option and proceed to payment. Once the payment is done, download the Tucson Arizona Certificate of Sale of Property on Execution in any provided file format. You can get back to the website when you need and redownload the document without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting hours researching legal paperwork online for good.