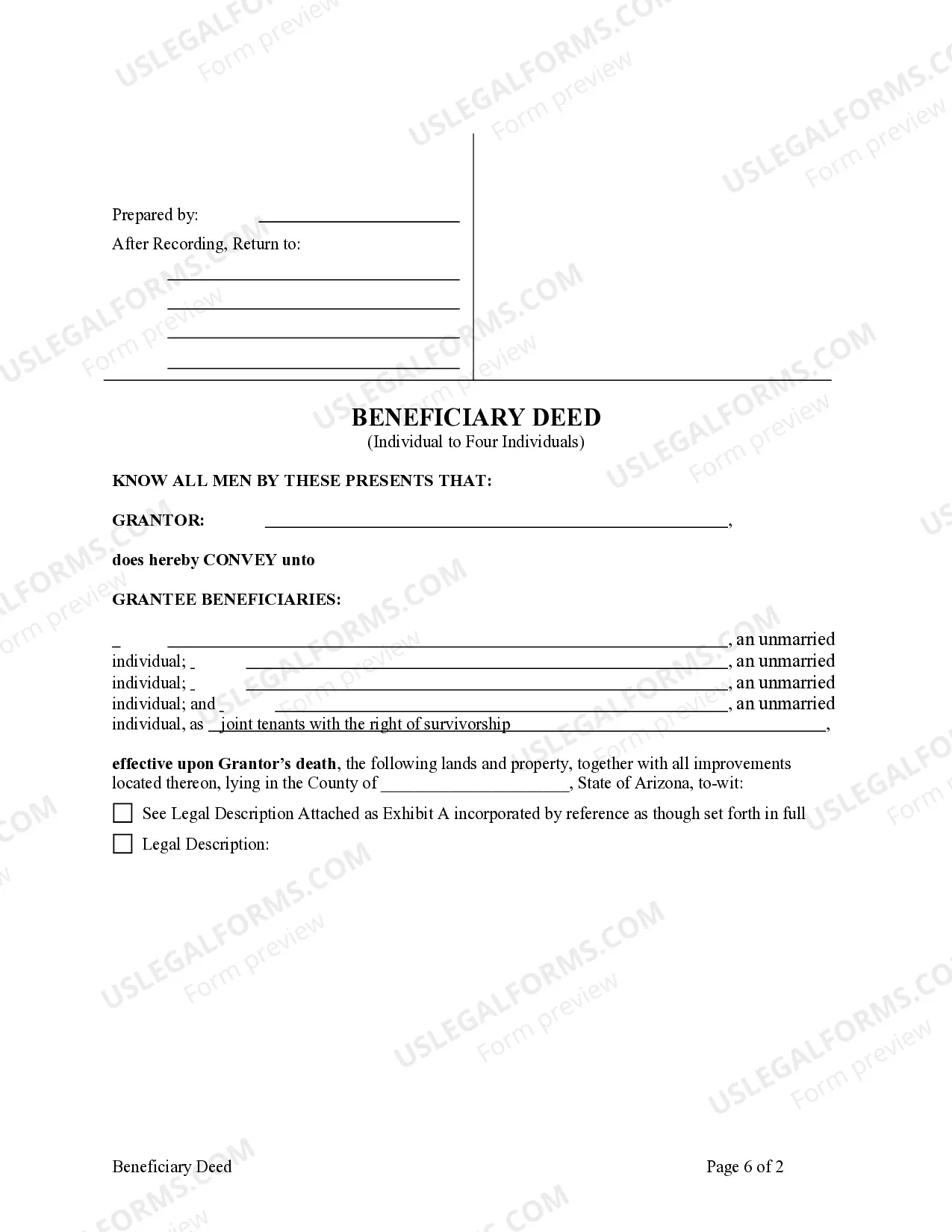

This form is a Transfer on Death Deed where the Grantor Owner is an individual and the Grantee Beneficiaries are four individuals. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. The Grantees take the property as tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

Glendale Arizona Transfer on Death or TOD — Beneficiary Dee— - Individual Grantor to Four Individuals is a legal document that allows an individual to transfer their real property to four specific beneficiaries upon their death, without the need for probate. This type of deed is commonly used in estate planning to ensure a smooth and efficient transfer of property to the intended beneficiaries. The Glendale Arizona Transfer on Death or TOD — Beneficiary Dee— - Individual Grantor to Four Individuals is one of several variations of the transfer on death deed that exist in the state. Other types may include different numbers of beneficiaries or alternative arrangements for the transfer of property. It is important to consult with an experienced estate planning attorney to determine the most suitable option for your specific circumstances. The Glendale Arizona Transfer on Death or TOD — Beneficiary Dee— - Individual Grantor to Four Individuals offers several benefits. Firstly, it allows for the transfer of real property to be completed outside the probate process, which can be time-consuming and costly. This means that the beneficiaries can avoid the lengthy court proceedings and receive the property more quickly. Additionally, using a transfer on death deed can help to minimize the tax implications associated with transferring property, as it does not count as a gift during the individual's lifetime. This can result in potential tax savings for both the granter and the beneficiaries. To create a Glendale Arizona Transfer on Death or TOD — Beneficiary Dee— - Individual Grantor to Four Individuals, certain requirements must be met. The granter must be of sound mind and legal age, and the deed must be signed and notarized. It is advisable to consult with an attorney during the drafting and execution of the deed to ensure all legal requirements are met. In summary, the Glendale Arizona Transfer on Death or TOD — Beneficiary Dee— - Individual Grantor to Four Individuals is a useful tool in estate planning, allowing individuals to transfer their real property to four specific beneficiaries upon their death, avoiding probate and potential tax implications. It is important to consult with a legal professional to ensure compliance with all relevant laws and to choose the most appropriate type of transfer on death deed for your individual circumstances.Glendale Arizona Transfer on Death or TOD — Beneficiary Dee— - Individual Grantor to Four Individuals is a legal document that allows an individual to transfer their real property to four specific beneficiaries upon their death, without the need for probate. This type of deed is commonly used in estate planning to ensure a smooth and efficient transfer of property to the intended beneficiaries. The Glendale Arizona Transfer on Death or TOD — Beneficiary Dee— - Individual Grantor to Four Individuals is one of several variations of the transfer on death deed that exist in the state. Other types may include different numbers of beneficiaries or alternative arrangements for the transfer of property. It is important to consult with an experienced estate planning attorney to determine the most suitable option for your specific circumstances. The Glendale Arizona Transfer on Death or TOD — Beneficiary Dee— - Individual Grantor to Four Individuals offers several benefits. Firstly, it allows for the transfer of real property to be completed outside the probate process, which can be time-consuming and costly. This means that the beneficiaries can avoid the lengthy court proceedings and receive the property more quickly. Additionally, using a transfer on death deed can help to minimize the tax implications associated with transferring property, as it does not count as a gift during the individual's lifetime. This can result in potential tax savings for both the granter and the beneficiaries. To create a Glendale Arizona Transfer on Death or TOD — Beneficiary Dee— - Individual Grantor to Four Individuals, certain requirements must be met. The granter must be of sound mind and legal age, and the deed must be signed and notarized. It is advisable to consult with an attorney during the drafting and execution of the deed to ensure all legal requirements are met. In summary, the Glendale Arizona Transfer on Death or TOD — Beneficiary Dee— - Individual Grantor to Four Individuals is a useful tool in estate planning, allowing individuals to transfer their real property to four specific beneficiaries upon their death, avoiding probate and potential tax implications. It is important to consult with a legal professional to ensure compliance with all relevant laws and to choose the most appropriate type of transfer on death deed for your individual circumstances.