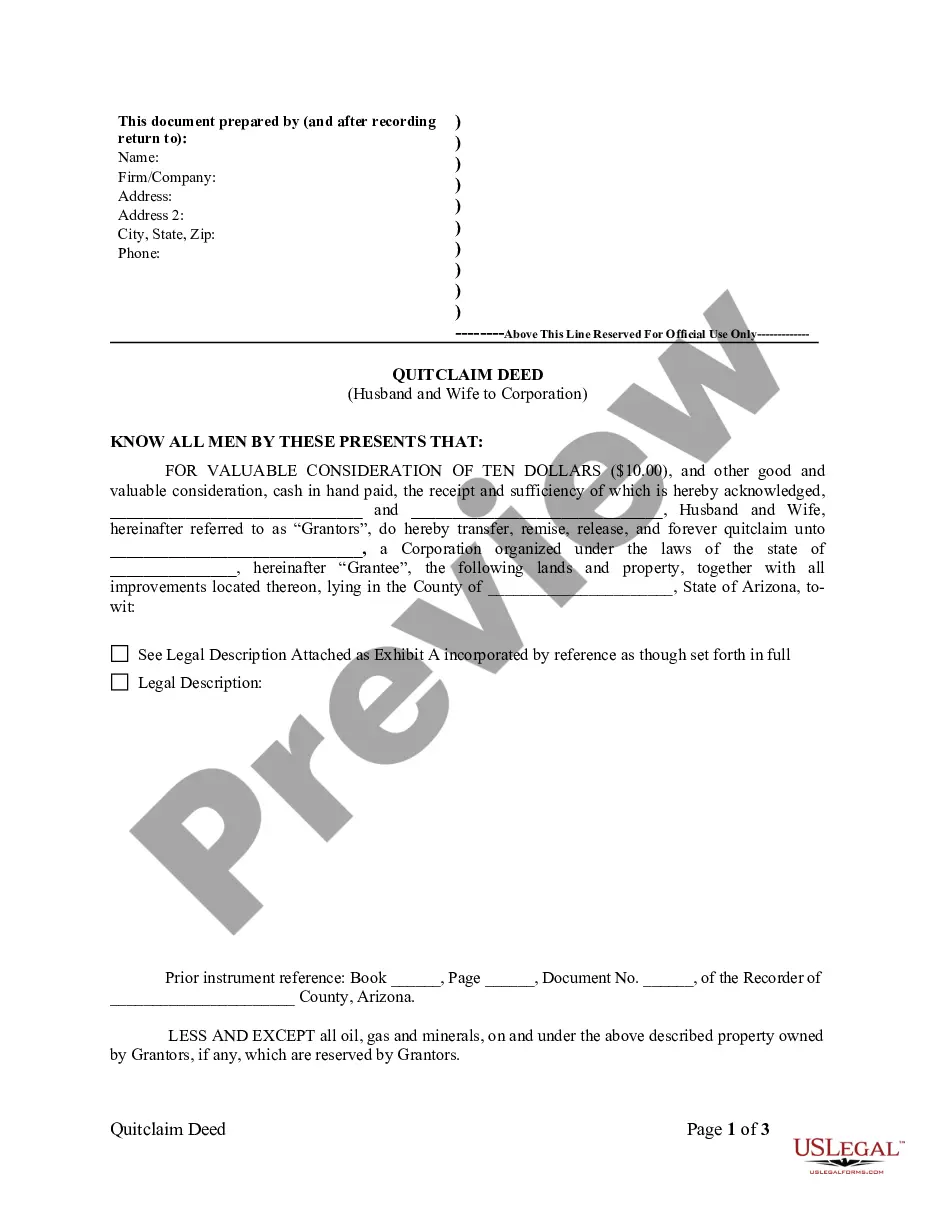

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Surprise Arizona Quitclaim Deed from Husband and Wife to Corporation is a legal document that facilitates the transfer of real estate ownership from a married couple to a corporation in Surprise, Arizona. This type of deed is commonly used when the couple wishes to transfer the property to a corporate entity for various reasons, such as asset protection or tax planning. A Surprise Arizona Quitclaim Deed from Husband and Wife to Corporation is a straightforward process, and it is essential to understand the different types that may exist. Although there aren't specific variations of this deed, it is vital to recognize the various scenarios in which such a transfer can occur. 1. Basic Surprise Arizona Quitclaim Deed from Husband and Wife to Corporation: — This is the most common type where a married couple transfers their property to a corporation using a quitclaim deed method. It involves the completion of necessary legal documents, including the quitclaim deed form and any additional documents required by Arizona state law. 2. Surprise Arizona Quitclaim Deed from Husband and Wife to Corporation for Asset Protection: — In some cases, a couple may choose to transfer their property to a corporation as a means of ensuring asset protection. By transferring ownership to a corporation, the property becomes a corporate asset that is shielded from personal liabilities, providing an added layer of protection. 3. Surprise Arizona Quitclaim Deed from Husband and Wife to Corporation for Estate Planning: — Estate planning is another common reason for transferring property from a married couple to a corporation. By doing so, they can ensure ease of management and potential tax benefits for their heirs or beneficiaries in the future. 4. Surprise Arizona Quitclaim Deed from Husband and Wife to Corporation for Business Purposes: — Sometimes, a married couple may transfer their property to a corporation as part of a larger business strategy. This can occur when the couple wishes to merge their personal property holdings with a corporation they own or intend to establish for specific business goals. 5. Surprise Arizona Quitclaim Deed from Husband and Wife to Corporation for Tax Planning: — Transferring property to a corporation can also have tax benefits depending on the specific circumstances and the couple's financial situation. By consulting with tax professionals and legal advisors, couples can explore the potential advantages of using this type of deed for strategic tax planning purposes. In conclusion, a Surprise Arizona Quitclaim Deed from Husband and Wife to Corporation is a legal instrument that enables the transfer of real estate ownership from a married couple to a corporation. Whether for asset protection, estate planning, business purposes, or tax planning, this deed serves as an effective means of transferring property ownership while protecting the interests of the involved parties.A Surprise Arizona Quitclaim Deed from Husband and Wife to Corporation is a legal document that facilitates the transfer of real estate ownership from a married couple to a corporation in Surprise, Arizona. This type of deed is commonly used when the couple wishes to transfer the property to a corporate entity for various reasons, such as asset protection or tax planning. A Surprise Arizona Quitclaim Deed from Husband and Wife to Corporation is a straightforward process, and it is essential to understand the different types that may exist. Although there aren't specific variations of this deed, it is vital to recognize the various scenarios in which such a transfer can occur. 1. Basic Surprise Arizona Quitclaim Deed from Husband and Wife to Corporation: — This is the most common type where a married couple transfers their property to a corporation using a quitclaim deed method. It involves the completion of necessary legal documents, including the quitclaim deed form and any additional documents required by Arizona state law. 2. Surprise Arizona Quitclaim Deed from Husband and Wife to Corporation for Asset Protection: — In some cases, a couple may choose to transfer their property to a corporation as a means of ensuring asset protection. By transferring ownership to a corporation, the property becomes a corporate asset that is shielded from personal liabilities, providing an added layer of protection. 3. Surprise Arizona Quitclaim Deed from Husband and Wife to Corporation for Estate Planning: — Estate planning is another common reason for transferring property from a married couple to a corporation. By doing so, they can ensure ease of management and potential tax benefits for their heirs or beneficiaries in the future. 4. Surprise Arizona Quitclaim Deed from Husband and Wife to Corporation for Business Purposes: — Sometimes, a married couple may transfer their property to a corporation as part of a larger business strategy. This can occur when the couple wishes to merge their personal property holdings with a corporation they own or intend to establish for specific business goals. 5. Surprise Arizona Quitclaim Deed from Husband and Wife to Corporation for Tax Planning: — Transferring property to a corporation can also have tax benefits depending on the specific circumstances and the couple's financial situation. By consulting with tax professionals and legal advisors, couples can explore the potential advantages of using this type of deed for strategic tax planning purposes. In conclusion, a Surprise Arizona Quitclaim Deed from Husband and Wife to Corporation is a legal instrument that enables the transfer of real estate ownership from a married couple to a corporation. Whether for asset protection, estate planning, business purposes, or tax planning, this deed serves as an effective means of transferring property ownership while protecting the interests of the involved parties.