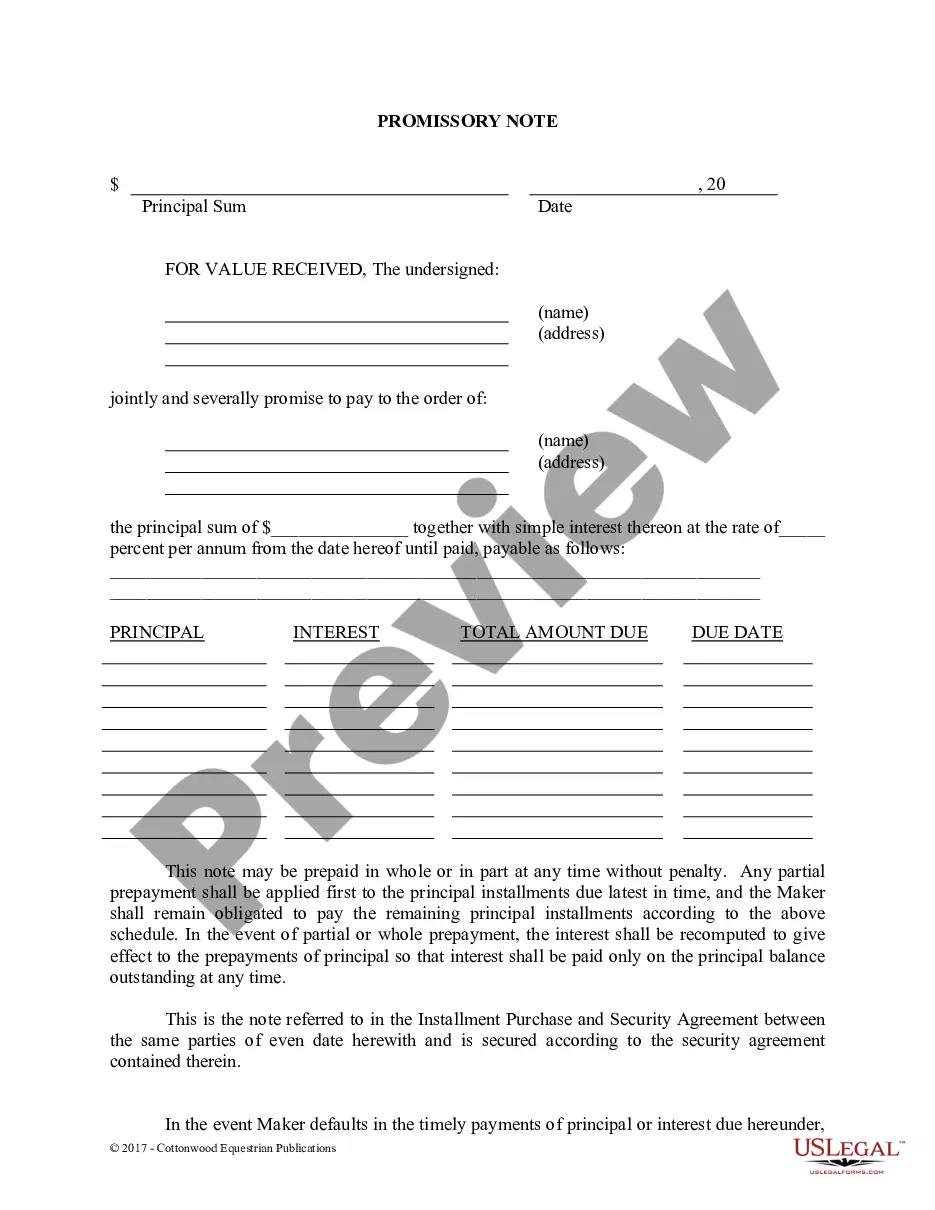

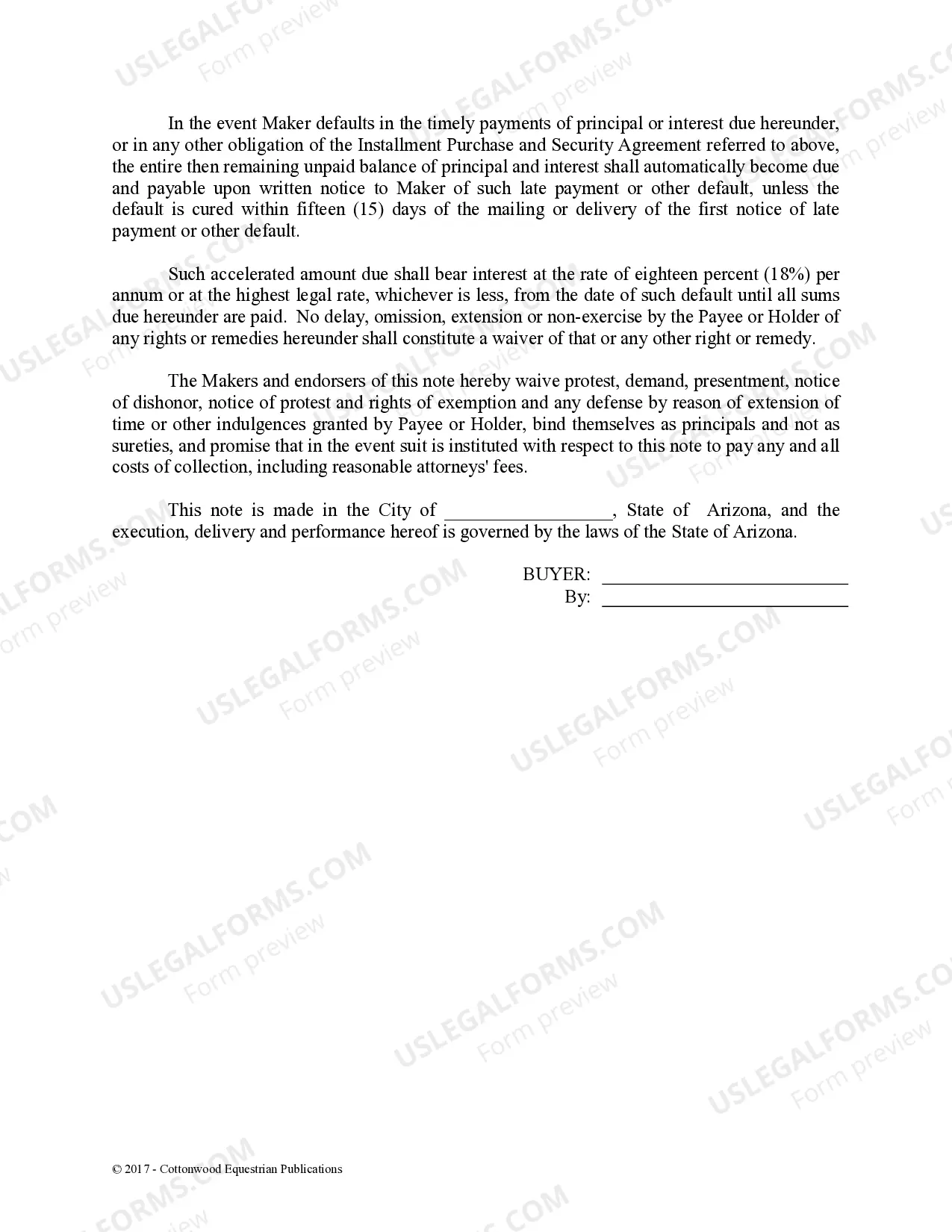

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

Scottsdale Arizona Promissory Note — Horse Equine Forms: A Comprehensive Overview In Scottsdale, Arizona, a Promissory Note — Horse Equine Form is essentially a legally binding document that outlines the terms and conditions of a loan transaction specific to the horse and equine industry. This detailed description will shed light on the various aspects and types of Promissory Note forms commonly used in Scottsdale. 1. Basic Structure and Purpose: A Promissory Note — Horse Equine Form is an agreement between a lender (often a horse owner, equine business, or organization) and a borrower (usually an individual or entity seeking financial assistance within the horse industry) to formalize the terms of a loan. The note includes specific information such as the loan amount, repayment terms, interest rates (if any), duration, collateral details (e.g., the horse/ horses), and any additional obligations or rights related to the loan. 2. Types of Scottsdale Arizona Promissory Note — Horse Equine Forms: a) Standard Promissory Note: This is the most commonly used form for horse equine transactions in Scottsdale, covering various loan types, including purchase financing, stud fees, training expenses, and boarding costs. It features provisions that protect both parties' interests and serves as evidence of the loan agreement. b) Installment Promissory Note: This type of form divides the total loan amount into installment payments, specifying the due dates and amounts for each. It offers flexibility for borrowers to manage their financial obligations while ensuring timely repayment. c) Balloon Promissory Note: Unlike a traditional loan with regular payments, this form allows borrowers to make smaller payments initially and a larger final payment (the "balloon payment") towards the end of the loan term. This can be suitable for horse-related activities involving high-value horses, such as horse racing or show jumping. d) Cross-Collateralized Promissory Note: In cases where multiple horses or equine assets are used as collateral, this form ensures that all assets serve as security for the loan. This type of note provides added security for the lender and may come with more stringent terms for the borrower. 3. Key Considerations: While each Promissory Note form may vary slightly, it is crucial for both lenders and borrowers in Scottsdale, Arizona, to consider the following aspects when drafting or reviewing these documents: — Loan Amount and Interest Rates: Clearly state the specific principal amount borrowed and any applicable interest rates agreed upon. — Repayment Terms: Define the frequency (e.g., monthly, quarterly) and duration of repayment, taking into account the horse industry's seasonal nature. — Default and Remedies: Clearly outline the consequences of defaulting on the loan and the actions the lender may take to recover the debts, such as repossession or legal action. — Signatures and Notary: Ensure that all parties involved sign the Promissory Note and consider notarizing the document to add additional legal validity. In conclusion, a Scottsdale Arizona Promissory Note — Horse Equine Form is an essential tool for formalizing loan agreements within the horse industry. Familiarizing oneself with the various types of Promissory Note forms available can help both lenders and borrowers navigate the unique aspects of horse-related financial transactions.Scottsdale Arizona Promissory Note — Horse Equine Forms: A Comprehensive Overview In Scottsdale, Arizona, a Promissory Note — Horse Equine Form is essentially a legally binding document that outlines the terms and conditions of a loan transaction specific to the horse and equine industry. This detailed description will shed light on the various aspects and types of Promissory Note forms commonly used in Scottsdale. 1. Basic Structure and Purpose: A Promissory Note — Horse Equine Form is an agreement between a lender (often a horse owner, equine business, or organization) and a borrower (usually an individual or entity seeking financial assistance within the horse industry) to formalize the terms of a loan. The note includes specific information such as the loan amount, repayment terms, interest rates (if any), duration, collateral details (e.g., the horse/ horses), and any additional obligations or rights related to the loan. 2. Types of Scottsdale Arizona Promissory Note — Horse Equine Forms: a) Standard Promissory Note: This is the most commonly used form for horse equine transactions in Scottsdale, covering various loan types, including purchase financing, stud fees, training expenses, and boarding costs. It features provisions that protect both parties' interests and serves as evidence of the loan agreement. b) Installment Promissory Note: This type of form divides the total loan amount into installment payments, specifying the due dates and amounts for each. It offers flexibility for borrowers to manage their financial obligations while ensuring timely repayment. c) Balloon Promissory Note: Unlike a traditional loan with regular payments, this form allows borrowers to make smaller payments initially and a larger final payment (the "balloon payment") towards the end of the loan term. This can be suitable for horse-related activities involving high-value horses, such as horse racing or show jumping. d) Cross-Collateralized Promissory Note: In cases where multiple horses or equine assets are used as collateral, this form ensures that all assets serve as security for the loan. This type of note provides added security for the lender and may come with more stringent terms for the borrower. 3. Key Considerations: While each Promissory Note form may vary slightly, it is crucial for both lenders and borrowers in Scottsdale, Arizona, to consider the following aspects when drafting or reviewing these documents: — Loan Amount and Interest Rates: Clearly state the specific principal amount borrowed and any applicable interest rates agreed upon. — Repayment Terms: Define the frequency (e.g., monthly, quarterly) and duration of repayment, taking into account the horse industry's seasonal nature. — Default and Remedies: Clearly outline the consequences of defaulting on the loan and the actions the lender may take to recover the debts, such as repossession or legal action. — Signatures and Notary: Ensure that all parties involved sign the Promissory Note and consider notarizing the document to add additional legal validity. In conclusion, a Scottsdale Arizona Promissory Note — Horse Equine Form is an essential tool for formalizing loan agreements within the horse industry. Familiarizing oneself with the various types of Promissory Note forms available can help both lenders and borrowers navigate the unique aspects of horse-related financial transactions.