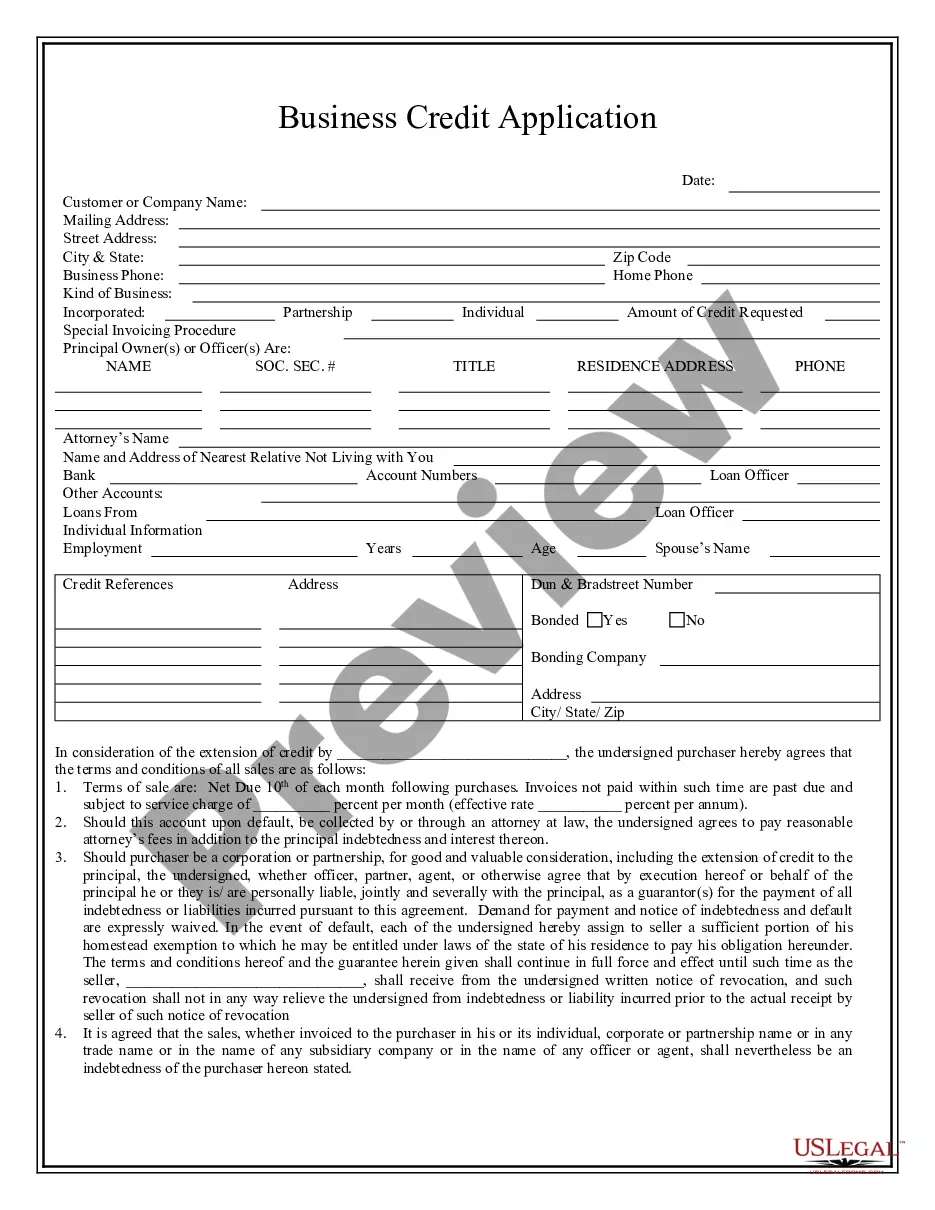

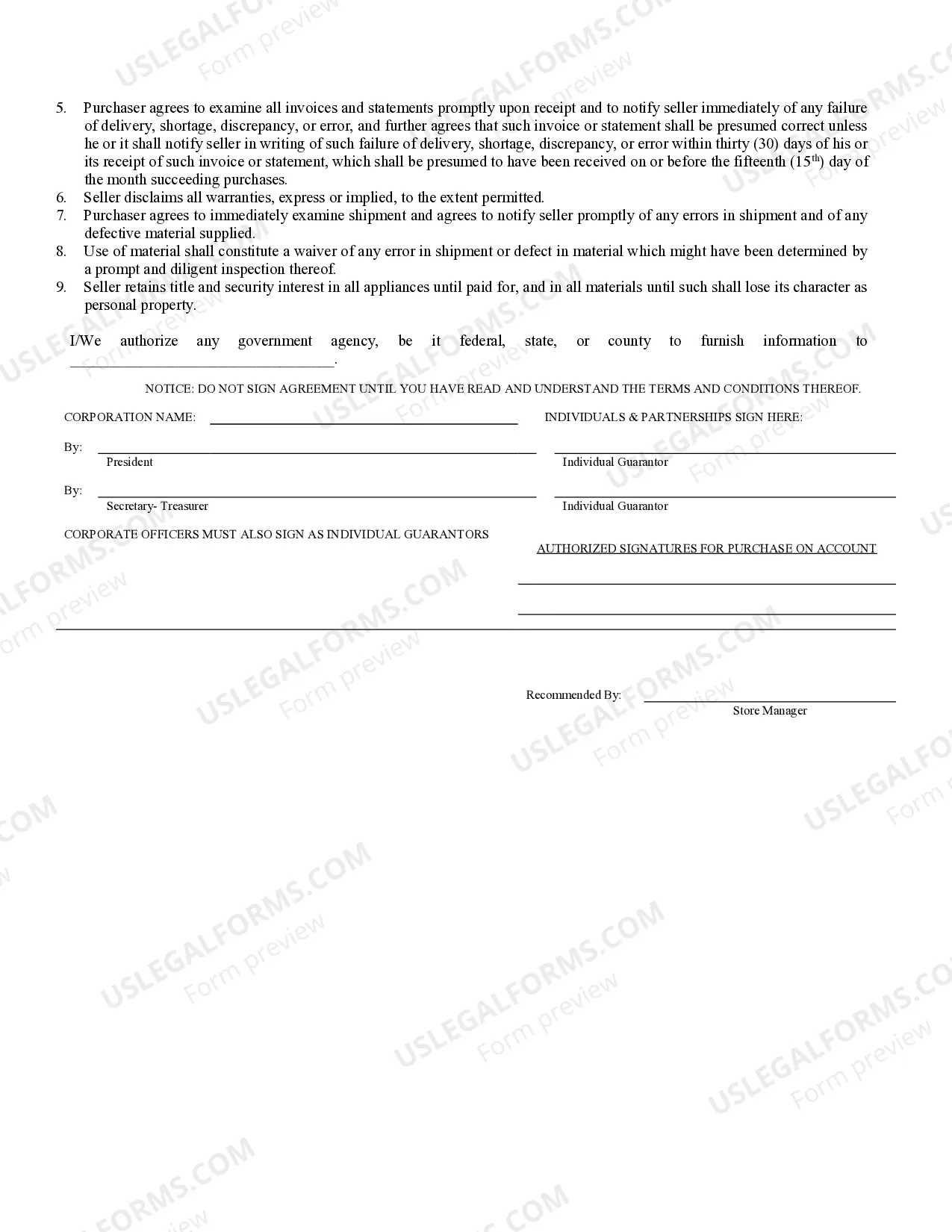

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Gilbert Arizona Business Credit Application is a crucial document used by businesses in Gilbert, Arizona to apply for credit from financial institutions or suppliers. This application allows businesses to establish credit accounts, which can help them manage cash flow, purchase inventory or equipment, and expand their operations. The Gilbert Arizona Business Credit Application typically requires the following information: 1. Business details: This includes the legal name, address, and contact information of the business. It may also require the business's structure (sole proprietorship, partnership, corporation), industry type, and number of years in operation. 2. Owner/Principal information: The application asks for the personal details of the owner or principal, such as name, address, Social Security number, and contact information. This helps determine the individual's creditworthiness and responsibility. 3. Financial information: Businesses need to provide their financial status, including annual revenue, profit/loss statements, and bank references. This information gives lenders an understanding of the business's financial health and repayment capability. 4. Trade references: Businesses often need to provide references from other suppliers or vendors they have worked with in the past. These references help lenders evaluate the business's payment history, reliability, and creditworthiness. 5. Additional documentation: Depending on the type of credit being applied for, additional documents may be required. For instance, applying for a business loan may need detailed financial statements, business plans, or collateral documentation. There aren't specific types of Gilbert Arizona Business Credit Applications, as the core elements remain the same. However, businesses may encounter variations when dealing with different lenders or suppliers who may have customized application forms. It is crucial for businesses to carefully read and complete each section accurately to increase their chances of credit approval. In conclusion, the Gilbert Arizona Business Credit Application is an essential tool for businesses looking to establish credit accounts with financial institutions or suppliers. By providing comprehensive information about the business, its owners, financials, and trade references, this application serves as a gateway to accessing credit to support business growth and day-to-day operations.Gilbert Arizona Business Credit Application is a crucial document used by businesses in Gilbert, Arizona to apply for credit from financial institutions or suppliers. This application allows businesses to establish credit accounts, which can help them manage cash flow, purchase inventory or equipment, and expand their operations. The Gilbert Arizona Business Credit Application typically requires the following information: 1. Business details: This includes the legal name, address, and contact information of the business. It may also require the business's structure (sole proprietorship, partnership, corporation), industry type, and number of years in operation. 2. Owner/Principal information: The application asks for the personal details of the owner or principal, such as name, address, Social Security number, and contact information. This helps determine the individual's creditworthiness and responsibility. 3. Financial information: Businesses need to provide their financial status, including annual revenue, profit/loss statements, and bank references. This information gives lenders an understanding of the business's financial health and repayment capability. 4. Trade references: Businesses often need to provide references from other suppliers or vendors they have worked with in the past. These references help lenders evaluate the business's payment history, reliability, and creditworthiness. 5. Additional documentation: Depending on the type of credit being applied for, additional documents may be required. For instance, applying for a business loan may need detailed financial statements, business plans, or collateral documentation. There aren't specific types of Gilbert Arizona Business Credit Applications, as the core elements remain the same. However, businesses may encounter variations when dealing with different lenders or suppliers who may have customized application forms. It is crucial for businesses to carefully read and complete each section accurately to increase their chances of credit approval. In conclusion, the Gilbert Arizona Business Credit Application is an essential tool for businesses looking to establish credit accounts with financial institutions or suppliers. By providing comprehensive information about the business, its owners, financials, and trade references, this application serves as a gateway to accessing credit to support business growth and day-to-day operations.