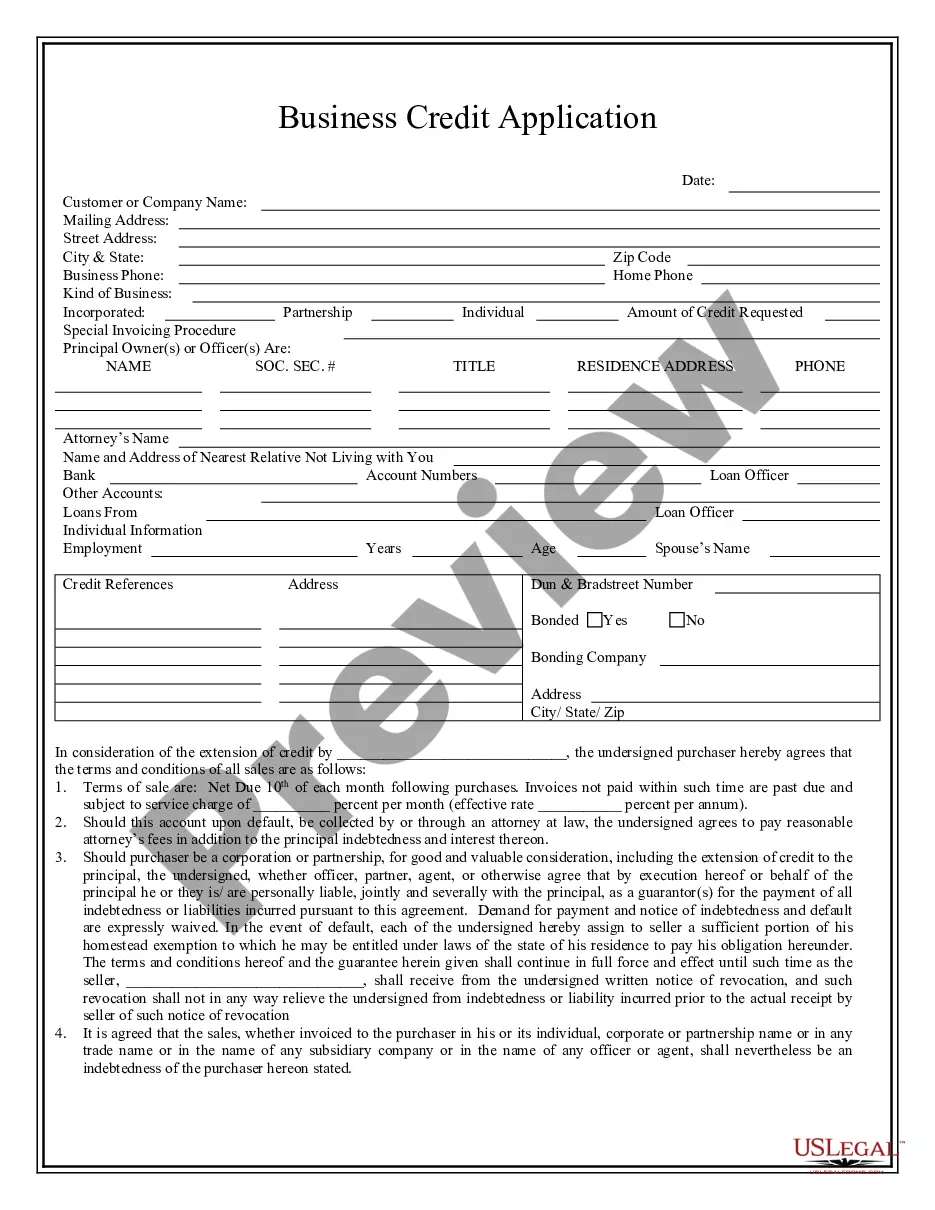

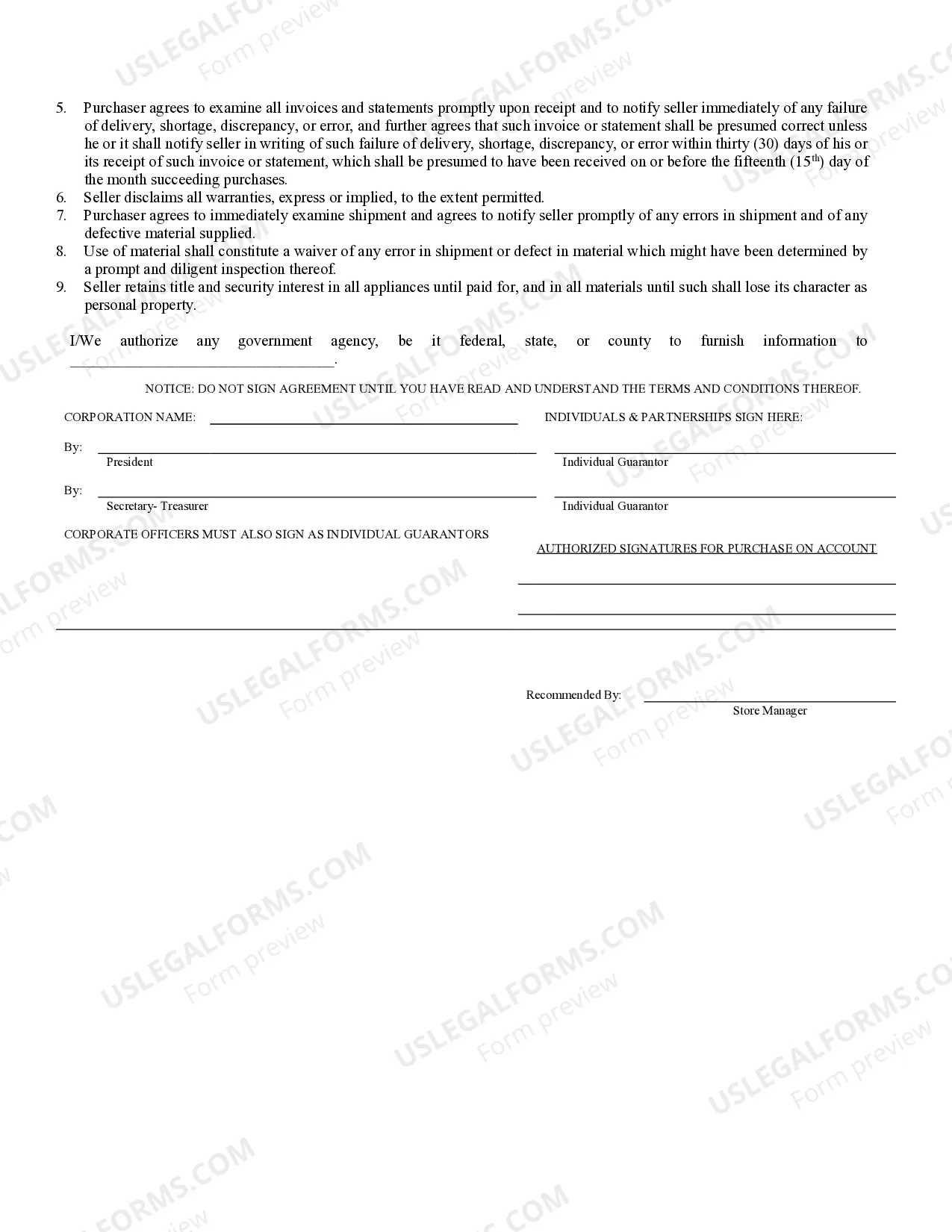

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Maricopa Arizona Business Credit Application is a comprehensive financial tool designed for businesses based in Maricopa, Arizona. This application serves as the initial step for businesses to apply for credit or loans to support their financial needs and growth. By accurately filling out and submitting this application, businesses can provide lenders with essential information required to evaluate their creditworthiness and determine their eligibility for various financial products. The Maricopa Arizona Business Credit Application collects vital information about the business, such as the legal name, physical address, contact details, and industry classification. It also requires the applicant to provide a detailed description of their business operations, including the date of establishment, ownership structure, and number of employees. Financial details are equally important in the application, as businesses need to provide their revenue figures, profit/loss statements, balance sheets, and cash flow projections. Furthermore, businesses applying for credit need to disclose any existing debt obligations, including outstanding loans or lines of credit. In addition to these general details, the Maricopa Arizona Business Credit Application may also request specific information depending on the type of credit sought or the specific lender's requirements. For instance, if a business is seeking a loan to finance equipment purchase, the application may ask for details about the equipment being financed, its cost, and expected usage. Alternatively, for businesses applying for a revolving line of credit, the application may seek monthly sales figures, accounts receivable/payable information, and monthly operational expenses. It is essential for businesses to accurately and honestly complete the Maricopa Arizona Business Credit Application and provide all requested documentation to maximize their chances of securing the desired credit or loan. By doing so, businesses demonstrate their commitment to responsible financial management, enable lenders to assess their creditworthiness accurately, and ultimately improve the chances of a successful credit application. Different types or variations of Maricopa Arizona Business Credit Applications may exist based on the specific lender or financial institution offering the credit. These variations could include applications for short-term loans, long-term loans, lines of credit, business credit cards, or specialized financing options tailored to specific industries or business needs. Therefore, businesses should carefully review and choose the appropriate credit application type that aligns with their particular financial requirements.Maricopa Arizona Business Credit Application is a comprehensive financial tool designed for businesses based in Maricopa, Arizona. This application serves as the initial step for businesses to apply for credit or loans to support their financial needs and growth. By accurately filling out and submitting this application, businesses can provide lenders with essential information required to evaluate their creditworthiness and determine their eligibility for various financial products. The Maricopa Arizona Business Credit Application collects vital information about the business, such as the legal name, physical address, contact details, and industry classification. It also requires the applicant to provide a detailed description of their business operations, including the date of establishment, ownership structure, and number of employees. Financial details are equally important in the application, as businesses need to provide their revenue figures, profit/loss statements, balance sheets, and cash flow projections. Furthermore, businesses applying for credit need to disclose any existing debt obligations, including outstanding loans or lines of credit. In addition to these general details, the Maricopa Arizona Business Credit Application may also request specific information depending on the type of credit sought or the specific lender's requirements. For instance, if a business is seeking a loan to finance equipment purchase, the application may ask for details about the equipment being financed, its cost, and expected usage. Alternatively, for businesses applying for a revolving line of credit, the application may seek monthly sales figures, accounts receivable/payable information, and monthly operational expenses. It is essential for businesses to accurately and honestly complete the Maricopa Arizona Business Credit Application and provide all requested documentation to maximize their chances of securing the desired credit or loan. By doing so, businesses demonstrate their commitment to responsible financial management, enable lenders to assess their creditworthiness accurately, and ultimately improve the chances of a successful credit application. Different types or variations of Maricopa Arizona Business Credit Applications may exist based on the specific lender or financial institution offering the credit. These variations could include applications for short-term loans, long-term loans, lines of credit, business credit cards, or specialized financing options tailored to specific industries or business needs. Therefore, businesses should carefully review and choose the appropriate credit application type that aligns with their particular financial requirements.