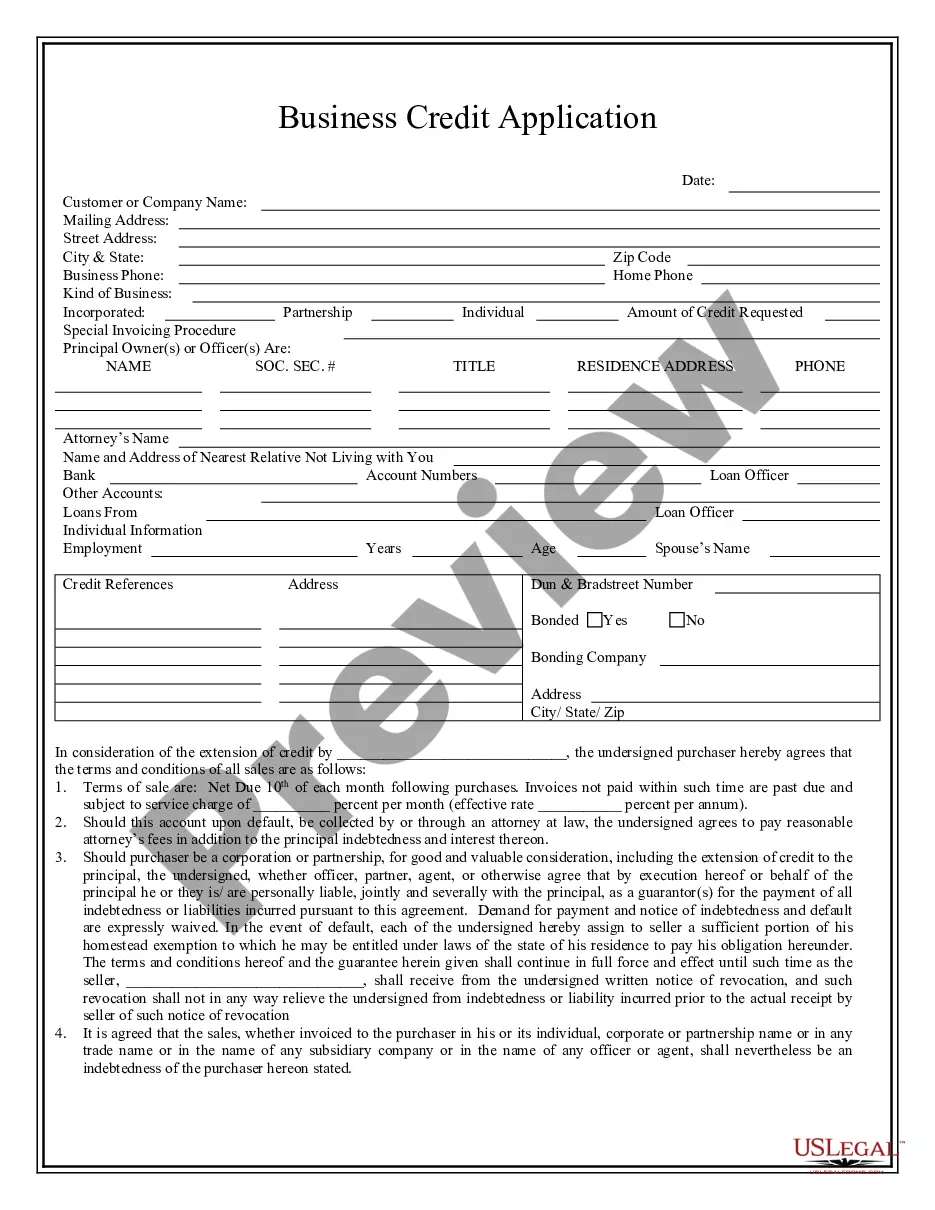

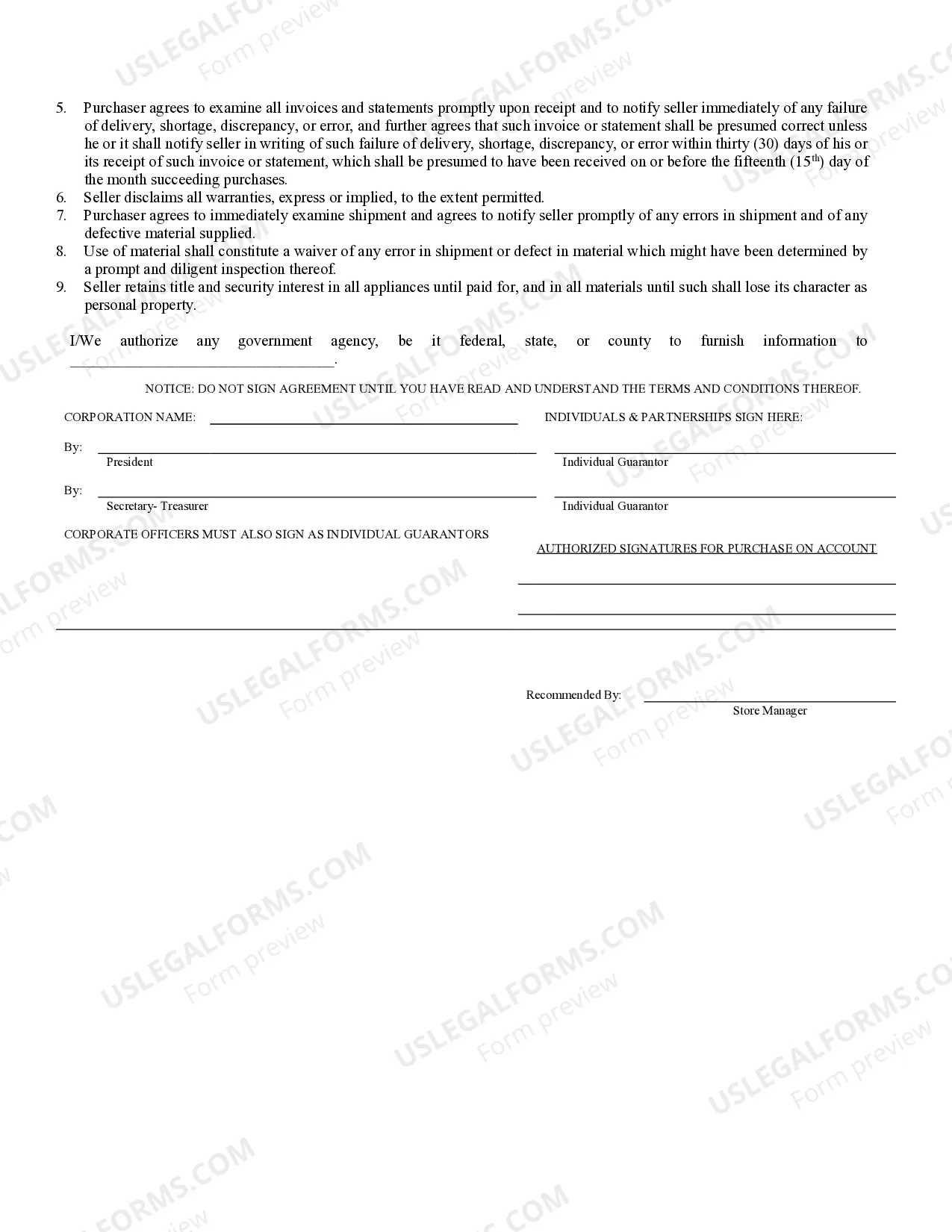

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

The Phoenix Arizona Business Credit Application is a formal document that businesses in the Phoenix, Arizona area use to apply for credit. This application provides essential information about a business, its financial standing, and its creditworthiness to potential lenders or creditors. The Phoenix Arizona Business Credit Application includes various sections that require detailed information. Firstly, it will ask for the basic details of the business, such as its legal name, contact information, and tax identification number. It may also request information about the business structure and any relevant licenses or permits held. The application will typically inquire about the history of the business, including its founding date, previous legal or financial complications, and any bankruptcy or litigation history. This area aims to provide an overview of the business's track record and its ability to responsibly handle credit or debt. Furthermore, the application delves into the business's financial information. This section may require details such as annual revenue, current debts or outstanding loans, and the financial statements of the business, including balance sheets and income statements. Providing comprehensive financial information allows lenders to assess the business's financial health and evaluate its ability to repay any credit given. Additionally, the application often includes a section dedicated to the personal financial information of the business owners or key executives. This section might ask for details such as personal assets, liabilities, and credit history. Lenders often examine personal financial information to gauge the creditworthiness of the individuals associated with the business. In terms of different types, there can be variations of the Phoenix Arizona Business Credit Application based on the specific lender or creditor's requirements. Different financial institutions or credit providers might have custom credit applications tailored to their own policies and needs. However, the general structure and information requested in most Phoenix Arizona Business Credit Applications remain consistent. Overall, the Phoenix Arizona Business Credit Application is a crucial tool for businesses in the Phoenix area looking to secure credit. By providing comprehensive and accurate information about the business's financial stability and creditworthiness, this application allows lenders to make informed decisions about extending credit or issuing loans.The Phoenix Arizona Business Credit Application is a formal document that businesses in the Phoenix, Arizona area use to apply for credit. This application provides essential information about a business, its financial standing, and its creditworthiness to potential lenders or creditors. The Phoenix Arizona Business Credit Application includes various sections that require detailed information. Firstly, it will ask for the basic details of the business, such as its legal name, contact information, and tax identification number. It may also request information about the business structure and any relevant licenses or permits held. The application will typically inquire about the history of the business, including its founding date, previous legal or financial complications, and any bankruptcy or litigation history. This area aims to provide an overview of the business's track record and its ability to responsibly handle credit or debt. Furthermore, the application delves into the business's financial information. This section may require details such as annual revenue, current debts or outstanding loans, and the financial statements of the business, including balance sheets and income statements. Providing comprehensive financial information allows lenders to assess the business's financial health and evaluate its ability to repay any credit given. Additionally, the application often includes a section dedicated to the personal financial information of the business owners or key executives. This section might ask for details such as personal assets, liabilities, and credit history. Lenders often examine personal financial information to gauge the creditworthiness of the individuals associated with the business. In terms of different types, there can be variations of the Phoenix Arizona Business Credit Application based on the specific lender or creditor's requirements. Different financial institutions or credit providers might have custom credit applications tailored to their own policies and needs. However, the general structure and information requested in most Phoenix Arizona Business Credit Applications remain consistent. Overall, the Phoenix Arizona Business Credit Application is a crucial tool for businesses in the Phoenix area looking to secure credit. By providing comprehensive and accurate information about the business's financial stability and creditworthiness, this application allows lenders to make informed decisions about extending credit or issuing loans.