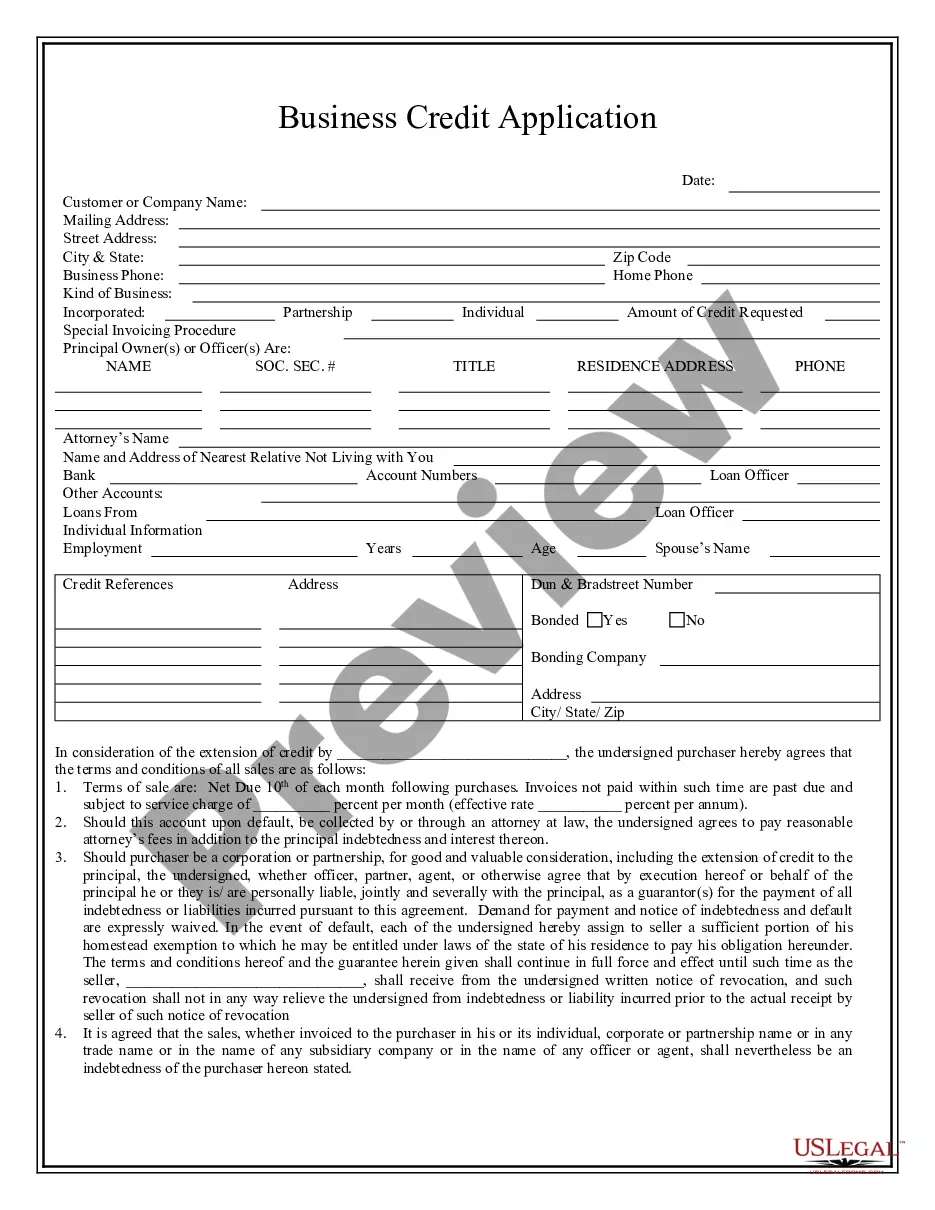

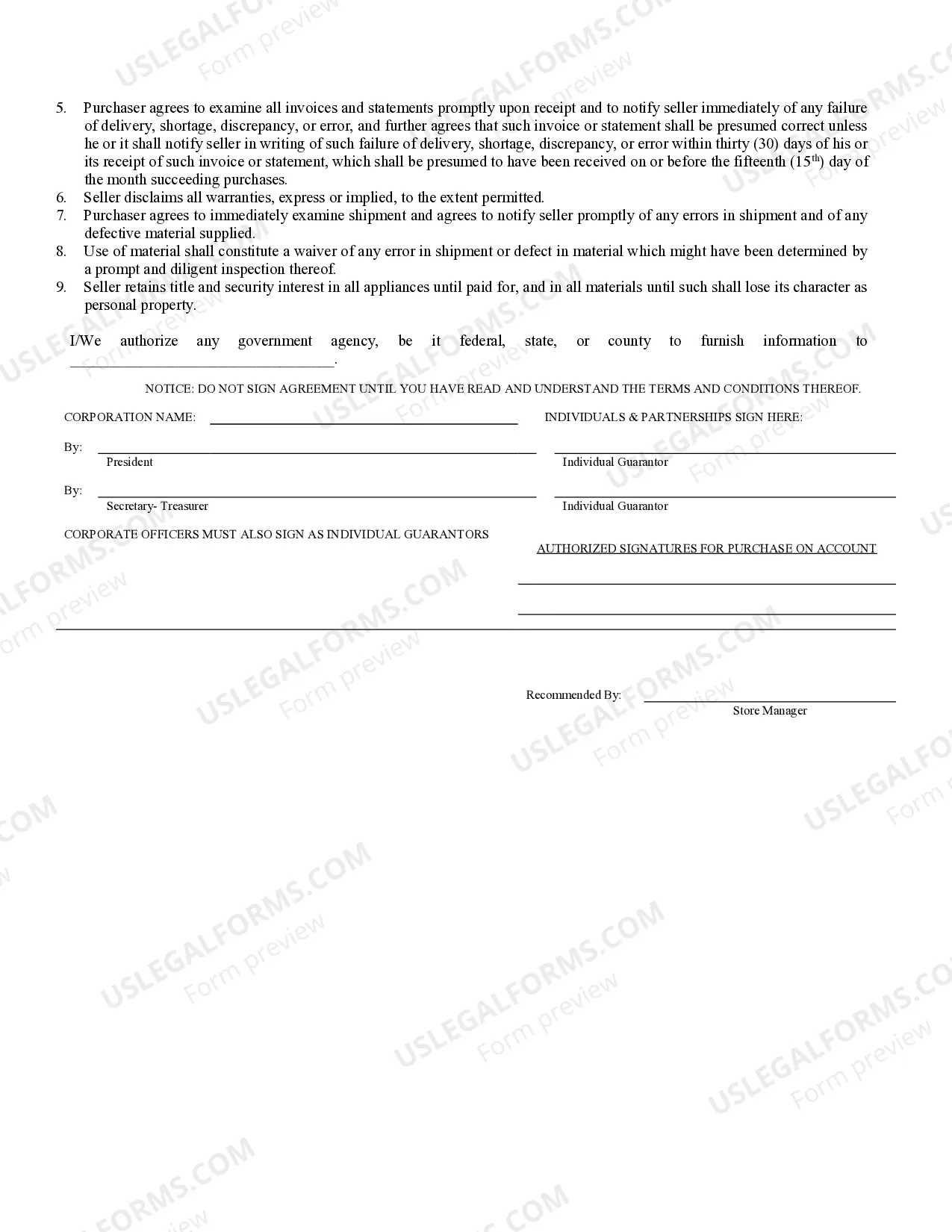

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Lima Arizona Business Credit Application is a comprehensive form used by businesses in Lima, Arizona, to apply for credit facilities or financing options. It serves as a crucial document for businesses seeking the acquisition of funds, credit lines, or loans from financial institutions or lenders. The Lima Arizona Business Credit Application gathers vital information about the business applying for credit, including their legal name, contact details, business type, industry, years in operation, and ownership structure. Additionally, it collects information about the business's financial standing, such as annual revenue, current assets and liabilities, outstanding loans or debts, and credit history. By submitting a completed Lima Arizona Business Credit Application, businesses provide potential lenders with a detailed overview of their financial position and creditworthiness. This enables lenders to assess the risk associated with extending credit to the applicant. Moreover, certain types of Lima Arizona Business Credit Applications may exist, catering to specific financing needs or institutions. Some of these might include: 1. Lima Arizona Small Business Administration (SBA) Loan Credit Application: Specifically designed for small businesses seeking financial assistance through SBA loan programs. This application may require additional information related to SBA eligibility criteria, such as business size, industry type, and intended use of funds. 2. Lima Arizona Bank Line of Credit Application: Individuals or businesses looking for a flexible financing option can use this application to request a line of credit from a bank. The application may focus on the business's financial stability, creditworthiness, and potential collateral. 3. Lima Arizona Vendor Credit Application: Tailored for businesses aiming to establish credit terms with suppliers or vendors, this application can help streamline the purchasing process. It typically includes details regarding the business's purchasing history, references, payment terms, and credit limit requests. 4. Lima Arizona Business Credit Card Application: Suitable for businesses seeking a revolving credit line, this application focuses on the business's financials, credit history, and desired credit limit for a business credit card. Completing a Lima Arizona Business Credit Application accurately and thoroughly is essential for businesses to increase their chances of obtaining the desired credit or financing. It is crucial to provide all necessary information, supporting documents, and ensure clarity in responses to enhance the application's overall credibility.Lima Arizona Business Credit Application is a comprehensive form used by businesses in Lima, Arizona, to apply for credit facilities or financing options. It serves as a crucial document for businesses seeking the acquisition of funds, credit lines, or loans from financial institutions or lenders. The Lima Arizona Business Credit Application gathers vital information about the business applying for credit, including their legal name, contact details, business type, industry, years in operation, and ownership structure. Additionally, it collects information about the business's financial standing, such as annual revenue, current assets and liabilities, outstanding loans or debts, and credit history. By submitting a completed Lima Arizona Business Credit Application, businesses provide potential lenders with a detailed overview of their financial position and creditworthiness. This enables lenders to assess the risk associated with extending credit to the applicant. Moreover, certain types of Lima Arizona Business Credit Applications may exist, catering to specific financing needs or institutions. Some of these might include: 1. Lima Arizona Small Business Administration (SBA) Loan Credit Application: Specifically designed for small businesses seeking financial assistance through SBA loan programs. This application may require additional information related to SBA eligibility criteria, such as business size, industry type, and intended use of funds. 2. Lima Arizona Bank Line of Credit Application: Individuals or businesses looking for a flexible financing option can use this application to request a line of credit from a bank. The application may focus on the business's financial stability, creditworthiness, and potential collateral. 3. Lima Arizona Vendor Credit Application: Tailored for businesses aiming to establish credit terms with suppliers or vendors, this application can help streamline the purchasing process. It typically includes details regarding the business's purchasing history, references, payment terms, and credit limit requests. 4. Lima Arizona Business Credit Card Application: Suitable for businesses seeking a revolving credit line, this application focuses on the business's financials, credit history, and desired credit limit for a business credit card. Completing a Lima Arizona Business Credit Application accurately and thoroughly is essential for businesses to increase their chances of obtaining the desired credit or financing. It is crucial to provide all necessary information, supporting documents, and ensure clarity in responses to enhance the application's overall credibility.