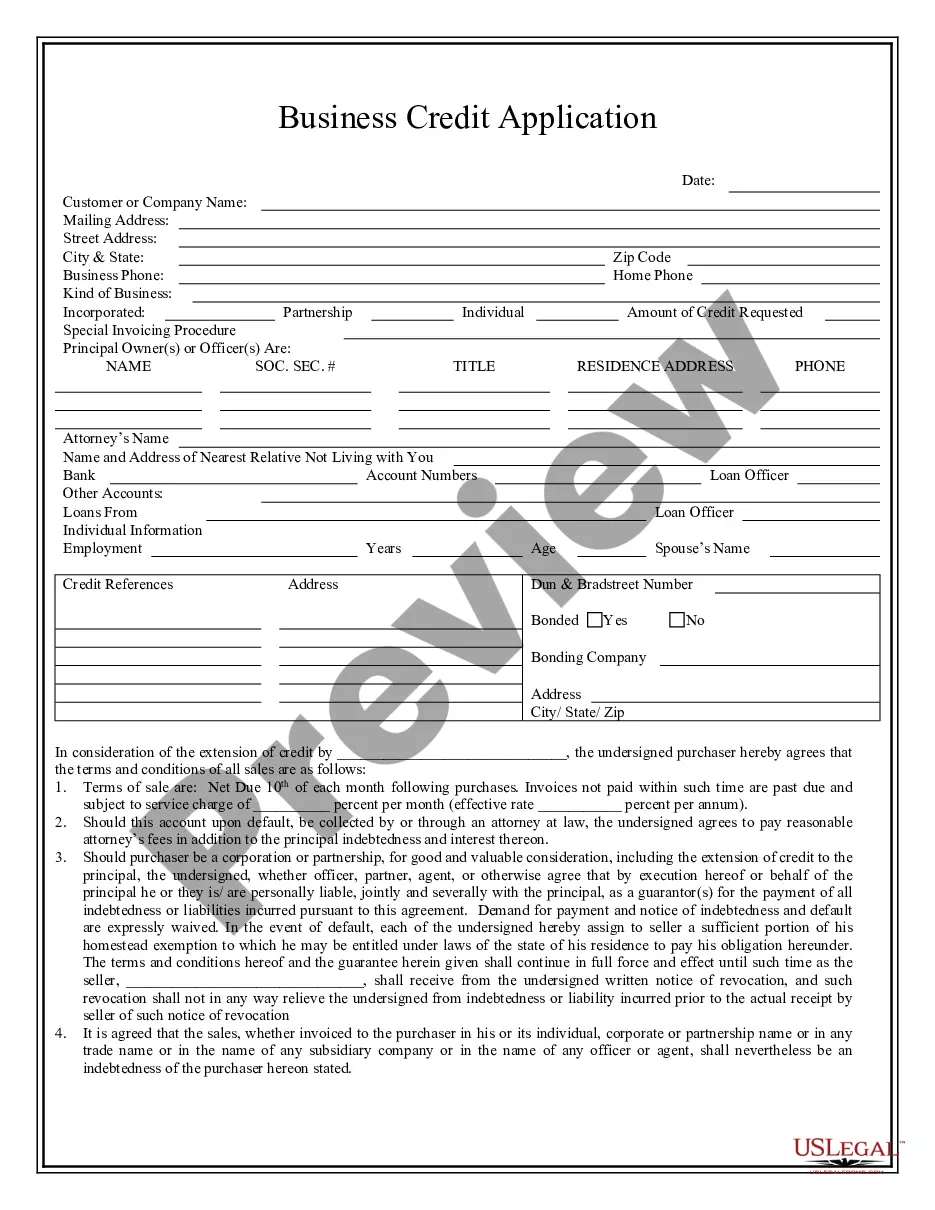

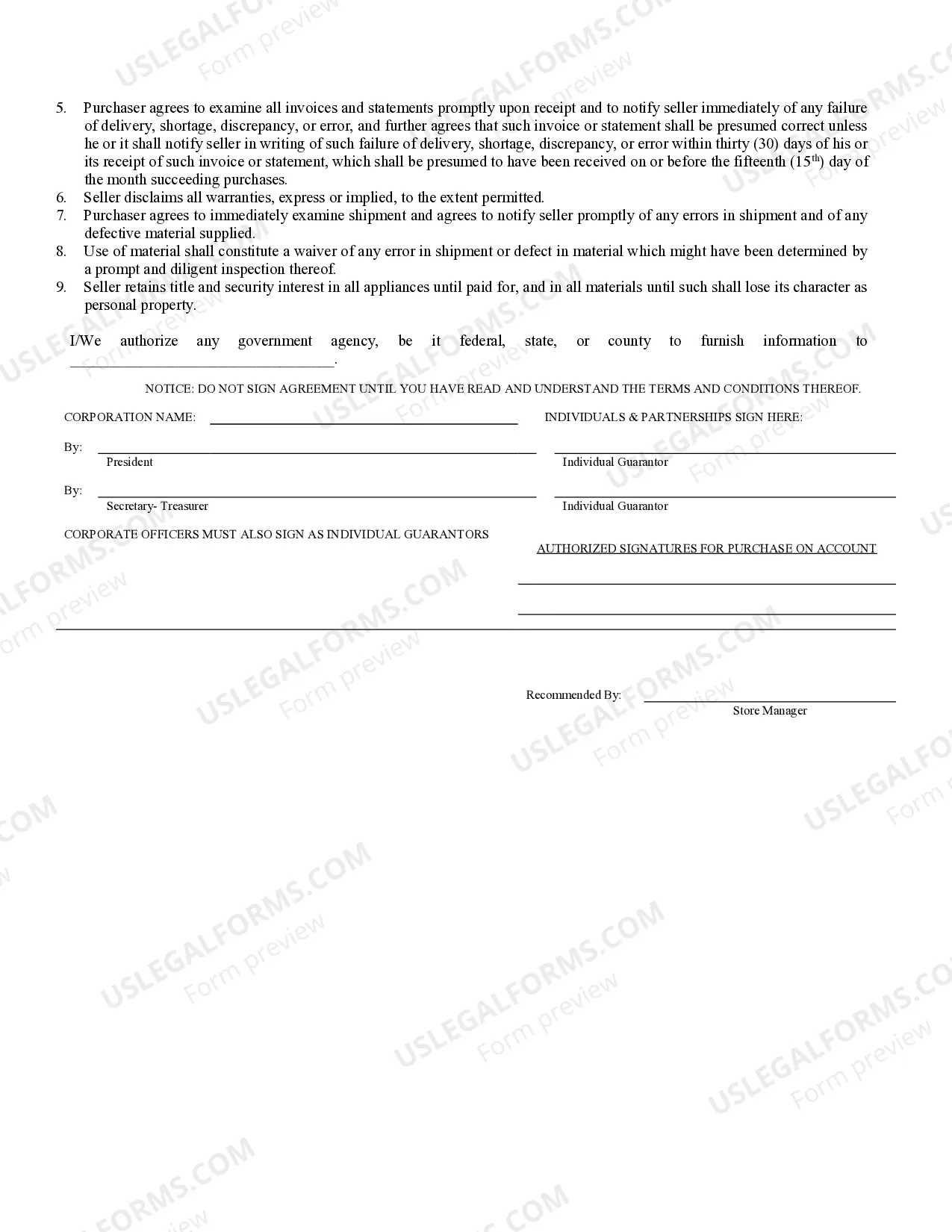

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Scottsdale, Arizona Business Credit Application: A Comprehensive Guide If you're a business owner in Scottsdale, Arizona, looking to secure funding and access credit for your enterprise, a business credit application is an essential document to familiarize yourself with. It serves as a crucial tool for banks, lenders, and financial institutions to assess the creditworthiness and capabilities of your business. In this article, we will provide a detailed description of what Scottsdale Arizona Business Credit Application entails, along with relevant keywords to enhance your understanding of the topic. Keywords: Scottsdale, Arizona, business credit application, funding, creditworthiness, financial institutions, lenders, banks. 1. Scottsdale Arizona Business Credit Application: Overview When applying for business credit in Scottsdale, Arizona, understanding the key components and requirements of the credit application is vital. This form enables you to present essential information about your business, financial history, and future plans, giving lenders the necessary insights to evaluate your creditworthiness and determine the level of risk involved. Keywords: credit application, business credit, Scottsdale, Arizona, lenders, financial history, risk assessment. 2. Basic Information Scottsdale Arizona Business Credit Application generally begins with capturing basic information about your business. This includes your company's legal name, address, contact details, and relevant business identification numbers (such as Employer Identification Number or Tax Identification Number). Keywords: business information, legal name, address, contact details, identification numbers. 3. Business Profile Provide an in-depth overview of your business, highlighting its nature, structure, and industry sector. Describe your products or services, target market, and discuss your competitive advantage or unique selling propositions (USP's). This section helps lenders gain insights into your business operations and market positioning. Keywords: business profile, industry sector, products, services, target market, competitive advantage, USP's. 4. Financial Statements Scottsdale Arizona Business Credit Application requires you to present financial statements demonstrating your business's financial stability and performance. These typically include balance sheets, income statements, cash flow statements, and tax returns. Providing accurate and up-to-date financial statements helps lenders assess the liquidity, profitability, and financial health of your business. Keywords: financial statements, balance sheets, income statements, cash flow statements, tax returns, liquidity, profitability, financial health. 5. Business Credit History Outline your business's credit history by mentioning any existing loans, credit lines, or outstanding debts. Include details about repayment schedules, interest rates, and whether payments have been made on time. A positive credit history boosts your credibility and increases the likelihood of securing additional credit. Keywords: credit history, loans, credit lines, outstanding debts, repayment schedules, interest rates, credibility. 6. Purpose of Credit Clearly state why you are seeking business credit in Scottsdale, Arizona. Explain how the funds will be utilized and how it aligns with your company's objectives. Whether it's to expand operations, purchase equipment, or manage cash flow, providing a compelling case for the loan strengthens your application. Keywords: purpose of credit, fund utilization, business objectives, expansion, equipment purchase, cash flow management. 7. Collateral and Guarantees When applying for substantial credit amounts, lenders may require collateral to secure the loan. Outline any assets, such as property, equipment, or accounts receivable, that you are willing to pledge as collateral. Additionally, mention any personal guarantees provided by business owners or partners to assure repayment. Keywords: collateral, guarantees, assets, property, equipment, accounts receivable, personal guarantees. Types of Scottsdale Arizona Business Credit Applications: 1. Small Business Line of Credit Application Targeted at small businesses, this type of credit application allows for a pre-approved credit limit, giving businesses access to funds whenever needed. It provides flexibility in managing cash flow, covering short-term expenses, and addressing unforeseen emergencies. Keywords: small business, line of credit, pre-approved, cash flow, short-term expenses, emergencies. 2. Business Loan Application This credit application is typically used when businesses require a lump sum amount for specific purposes such as purchasing real estate, expanding operations, or investing in new equipment. It is subject to detailed evaluation and approval, involving a more thorough credit assessment process. Keywords: business loan, lump sum, real estate purchase, expansion, equipment investment, credit assessment. In conclusion, the Scottsdale Arizona Business Credit Application is a comprehensive document that outlines crucial details about your business, financial history, and credit needs. By presenting accurate and compelling information, you enhance your chances of securing the necessary funding and credit to support your business growth in Scottsdale, Arizona.Scottsdale, Arizona Business Credit Application: A Comprehensive Guide If you're a business owner in Scottsdale, Arizona, looking to secure funding and access credit for your enterprise, a business credit application is an essential document to familiarize yourself with. It serves as a crucial tool for banks, lenders, and financial institutions to assess the creditworthiness and capabilities of your business. In this article, we will provide a detailed description of what Scottsdale Arizona Business Credit Application entails, along with relevant keywords to enhance your understanding of the topic. Keywords: Scottsdale, Arizona, business credit application, funding, creditworthiness, financial institutions, lenders, banks. 1. Scottsdale Arizona Business Credit Application: Overview When applying for business credit in Scottsdale, Arizona, understanding the key components and requirements of the credit application is vital. This form enables you to present essential information about your business, financial history, and future plans, giving lenders the necessary insights to evaluate your creditworthiness and determine the level of risk involved. Keywords: credit application, business credit, Scottsdale, Arizona, lenders, financial history, risk assessment. 2. Basic Information Scottsdale Arizona Business Credit Application generally begins with capturing basic information about your business. This includes your company's legal name, address, contact details, and relevant business identification numbers (such as Employer Identification Number or Tax Identification Number). Keywords: business information, legal name, address, contact details, identification numbers. 3. Business Profile Provide an in-depth overview of your business, highlighting its nature, structure, and industry sector. Describe your products or services, target market, and discuss your competitive advantage or unique selling propositions (USP's). This section helps lenders gain insights into your business operations and market positioning. Keywords: business profile, industry sector, products, services, target market, competitive advantage, USP's. 4. Financial Statements Scottsdale Arizona Business Credit Application requires you to present financial statements demonstrating your business's financial stability and performance. These typically include balance sheets, income statements, cash flow statements, and tax returns. Providing accurate and up-to-date financial statements helps lenders assess the liquidity, profitability, and financial health of your business. Keywords: financial statements, balance sheets, income statements, cash flow statements, tax returns, liquidity, profitability, financial health. 5. Business Credit History Outline your business's credit history by mentioning any existing loans, credit lines, or outstanding debts. Include details about repayment schedules, interest rates, and whether payments have been made on time. A positive credit history boosts your credibility and increases the likelihood of securing additional credit. Keywords: credit history, loans, credit lines, outstanding debts, repayment schedules, interest rates, credibility. 6. Purpose of Credit Clearly state why you are seeking business credit in Scottsdale, Arizona. Explain how the funds will be utilized and how it aligns with your company's objectives. Whether it's to expand operations, purchase equipment, or manage cash flow, providing a compelling case for the loan strengthens your application. Keywords: purpose of credit, fund utilization, business objectives, expansion, equipment purchase, cash flow management. 7. Collateral and Guarantees When applying for substantial credit amounts, lenders may require collateral to secure the loan. Outline any assets, such as property, equipment, or accounts receivable, that you are willing to pledge as collateral. Additionally, mention any personal guarantees provided by business owners or partners to assure repayment. Keywords: collateral, guarantees, assets, property, equipment, accounts receivable, personal guarantees. Types of Scottsdale Arizona Business Credit Applications: 1. Small Business Line of Credit Application Targeted at small businesses, this type of credit application allows for a pre-approved credit limit, giving businesses access to funds whenever needed. It provides flexibility in managing cash flow, covering short-term expenses, and addressing unforeseen emergencies. Keywords: small business, line of credit, pre-approved, cash flow, short-term expenses, emergencies. 2. Business Loan Application This credit application is typically used when businesses require a lump sum amount for specific purposes such as purchasing real estate, expanding operations, or investing in new equipment. It is subject to detailed evaluation and approval, involving a more thorough credit assessment process. Keywords: business loan, lump sum, real estate purchase, expansion, equipment investment, credit assessment. In conclusion, the Scottsdale Arizona Business Credit Application is a comprehensive document that outlines crucial details about your business, financial history, and credit needs. By presenting accurate and compelling information, you enhance your chances of securing the necessary funding and credit to support your business growth in Scottsdale, Arizona.