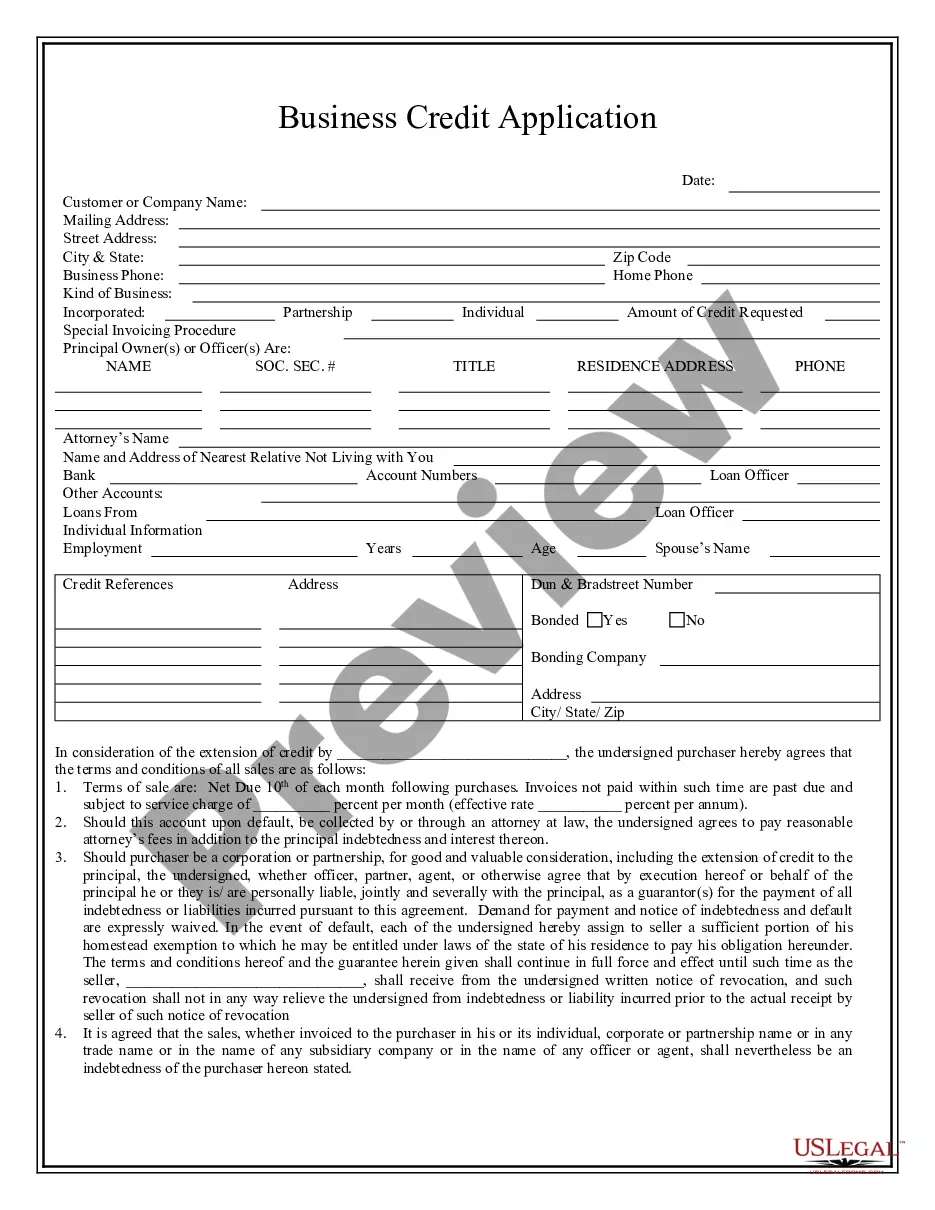

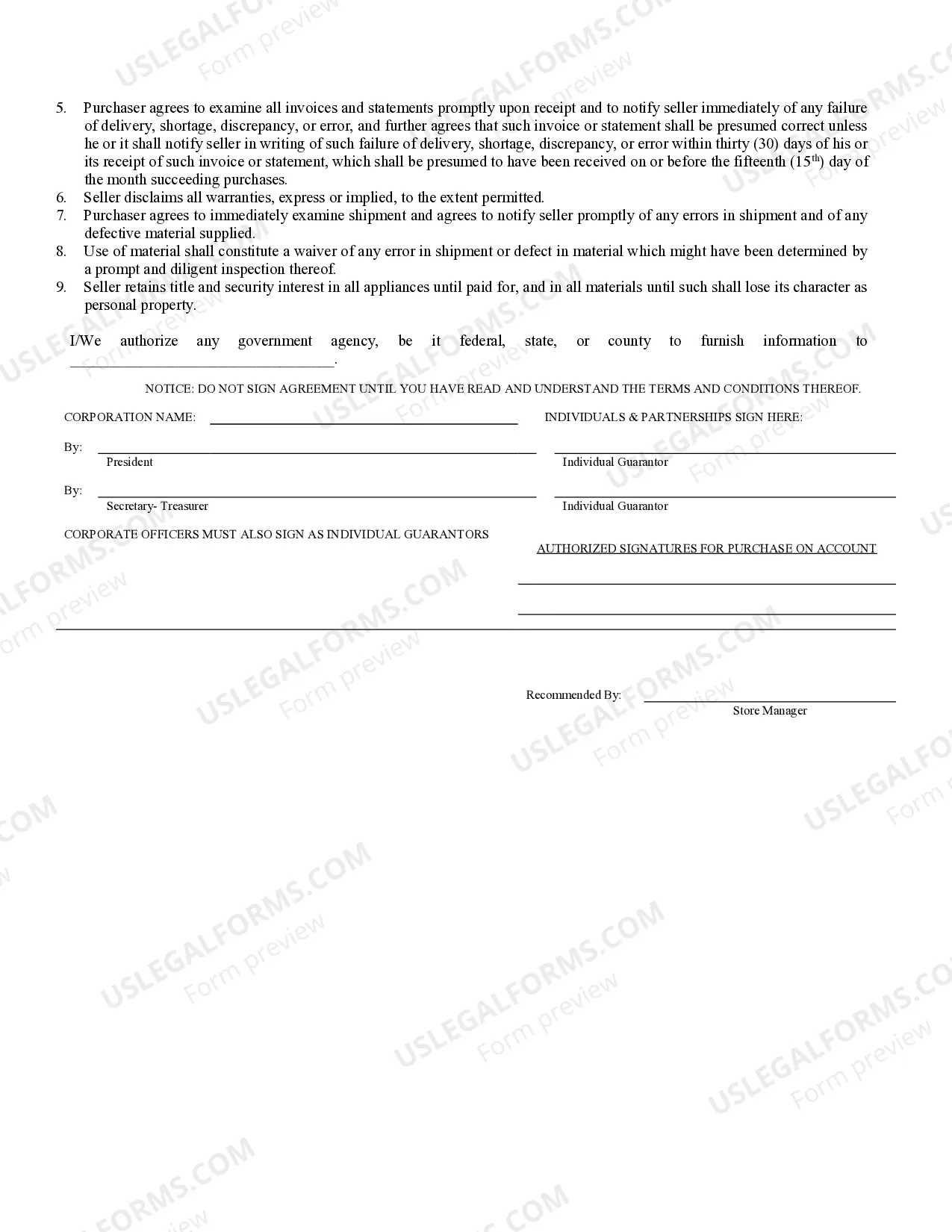

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Surprise Arizona Business Credit Application is a document that enables businesses operating in Surprise, Arizona, to apply for credit from various financial institutions and lenders. This application acts as a formal request for credit and includes all the necessary details about the business, its owners, financial status, and other relevant information. By submitting this application, businesses can seek financial assistance and establish credit lines for their operations and growth. Keywords: Surprise Arizona, business, credit application, financial institutions, lenders, formal request, credit lines, financial assistance, growth. Different types of Surprise Arizona Business Credit Applications may include: 1. Small Business Credit Application: Specifically designed for small businesses in Surprise, Arizona, this type of application caters to the unique needs and requirements of small-scale enterprises. It enables them to apply for credit tailored to their business size and scope. 2. Startup Business Credit Application: Startups often face challenges in securing credit due to their limited operational history. This type of application is targeted towards newly established businesses in Surprise, Arizona, and focuses on evaluating their business plan, market potential, and financial projections to determine their creditworthiness. 3. Commercial Real Estate Credit Application: Businesses involved in the commercial real estate sector, such as real estate developers, property management companies, and construction firms, can utilize this application to apply for credit specific to their industry. It may require additional information like property details, rental income, and property development plans. 4. Professional Services Business Credit Application: Professional service providers like lawyers, doctors, architects, and consultants may require credit to finance their practice's expansion, equipment purchase, or hiring staff. This type of application caters to their unique needs and may consider factors like professional qualifications, client portfolio, and revenue projections. 5. Manufacturing Business Credit Application: Companies engaged in manufacturing and production activities often require credit to finance equipment purchase, inventory management, and working capital. This application is designed to evaluate their production capacity, sales forecasts, and industry trends to establish credit lines suitable for their manufacturing needs. 6. Retail Business Credit Application: Retailers operating in Surprise, Arizona, can use this application to apply for credit to meet their inventory needs, expansion plans, or marketing initiatives. It may require information about their customer base, projected sales, and marketing strategies to assess their creditworthiness. In conclusion, Surprise Arizona Business Credit Applications serve as essential tools for businesses seeking financial support in Surprise, Arizona. By tailoring the application to specific industries or business types, lenders can better understand the needs and creditworthiness of the applicants, ultimately facilitating the growth and success of local businesses in Surprise, Arizona.Surprise Arizona Business Credit Application is a document that enables businesses operating in Surprise, Arizona, to apply for credit from various financial institutions and lenders. This application acts as a formal request for credit and includes all the necessary details about the business, its owners, financial status, and other relevant information. By submitting this application, businesses can seek financial assistance and establish credit lines for their operations and growth. Keywords: Surprise Arizona, business, credit application, financial institutions, lenders, formal request, credit lines, financial assistance, growth. Different types of Surprise Arizona Business Credit Applications may include: 1. Small Business Credit Application: Specifically designed for small businesses in Surprise, Arizona, this type of application caters to the unique needs and requirements of small-scale enterprises. It enables them to apply for credit tailored to their business size and scope. 2. Startup Business Credit Application: Startups often face challenges in securing credit due to their limited operational history. This type of application is targeted towards newly established businesses in Surprise, Arizona, and focuses on evaluating their business plan, market potential, and financial projections to determine their creditworthiness. 3. Commercial Real Estate Credit Application: Businesses involved in the commercial real estate sector, such as real estate developers, property management companies, and construction firms, can utilize this application to apply for credit specific to their industry. It may require additional information like property details, rental income, and property development plans. 4. Professional Services Business Credit Application: Professional service providers like lawyers, doctors, architects, and consultants may require credit to finance their practice's expansion, equipment purchase, or hiring staff. This type of application caters to their unique needs and may consider factors like professional qualifications, client portfolio, and revenue projections. 5. Manufacturing Business Credit Application: Companies engaged in manufacturing and production activities often require credit to finance equipment purchase, inventory management, and working capital. This application is designed to evaluate their production capacity, sales forecasts, and industry trends to establish credit lines suitable for their manufacturing needs. 6. Retail Business Credit Application: Retailers operating in Surprise, Arizona, can use this application to apply for credit to meet their inventory needs, expansion plans, or marketing initiatives. It may require information about their customer base, projected sales, and marketing strategies to assess their creditworthiness. In conclusion, Surprise Arizona Business Credit Applications serve as essential tools for businesses seeking financial support in Surprise, Arizona. By tailoring the application to specific industries or business types, lenders can better understand the needs and creditworthiness of the applicants, ultimately facilitating the growth and success of local businesses in Surprise, Arizona.