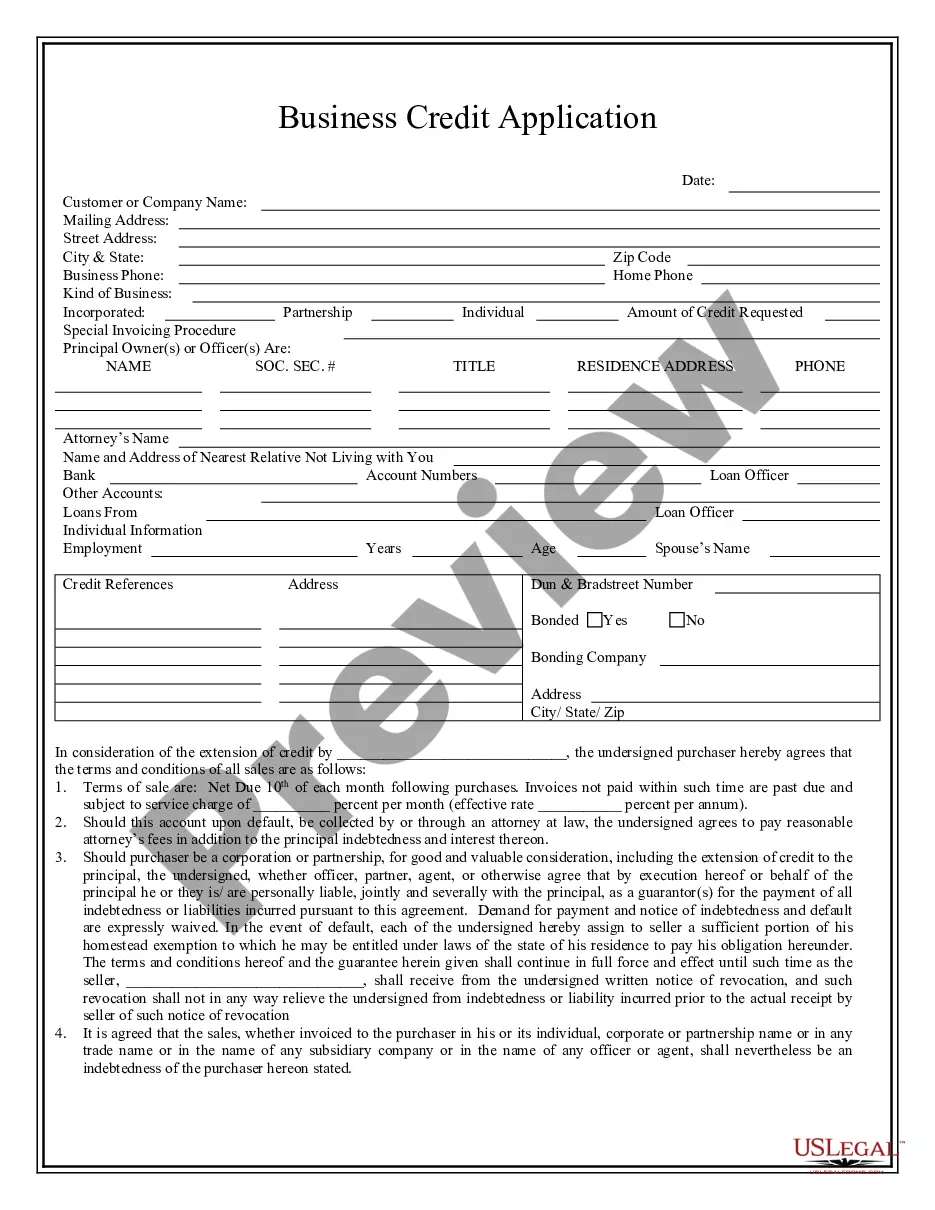

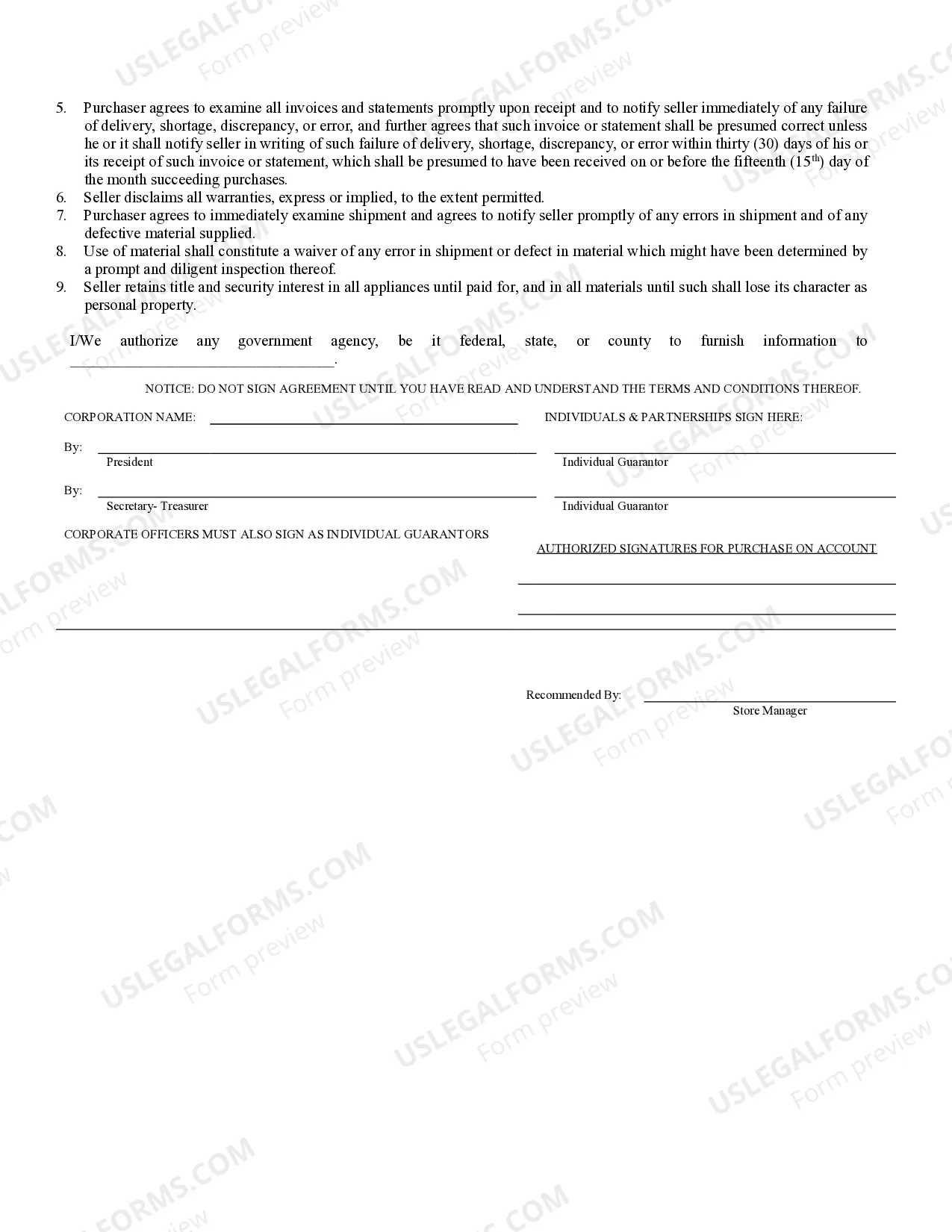

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Tucson, Arizona is a thriving city with a dynamic business community, and if you are looking to establish or expand your business in this region, you may need to apply for Tucson Arizona Business Credit Application. This application is designed to help businesses access credit from financial institutions, enabling them to manage cash flow, fund operations, and fuel growth. Tucson Arizona Business Credit Application is a comprehensive form that requires businesses to provide detailed information about their financial standing, including revenue, assets, liabilities, and credit history. This application assists in assessing the creditworthiness of a business and determining its eligibility for various credit products, such as loans, lines of credit, or credit cards. There are different types of Tucson Arizona Business Credit Applications available to cater to the diverse needs of businesses. Some common types include: 1. Small Business Credit Application: This type of application is specifically designed for small businesses, including startups and micro-enterprises, seeking credit to support their day-to-day operations or expand their operations. It typically requires basic financial information and may have a simplified approval process. 2. Commercial Credit Application: Commercial businesses, such as corporations or large enterprises, often require significant credit facilities to handle their extensive operations. A commercial credit application is more detailed, seeking comprehensive financial and operational data to evaluate the creditworthiness of the business. 3. Construction Credit Application: This application is tailored to construction companies and subcontractors who often need credit to finance projects, purchase materials, and cover labor costs. It may include specific sections related to project history, bonding capacity, and construction industry references. Regardless of the type, Tucson Arizona Business Credit Applications typically require the following information: — Business information, including legal name, address, and contact details. — Ownership information, including the names and contact details of the owners and key shareholders. — Financial statements, such as balance sheets, income statements, and tax returns. — Bank statements and credit references. — Business licenses and registrations— - Industry-specific information, if applicable (e.g., contractor's license for construction credit application). Completing a Tucson Arizona Business Credit Application accurately and providing all required supporting documents is crucial to increasing the chances of approval. It's essential to consult with financial advisors or professionals to ensure the application is thorough and well-prepared. In conclusion, the Tucson Arizona Business Credit Application is a comprehensive form required by financial institutions to evaluate a business's creditworthiness. The different types of applications cater to specific business needs, such as small businesses, commercial enterprises, or construction companies.Tucson, Arizona is a thriving city with a dynamic business community, and if you are looking to establish or expand your business in this region, you may need to apply for Tucson Arizona Business Credit Application. This application is designed to help businesses access credit from financial institutions, enabling them to manage cash flow, fund operations, and fuel growth. Tucson Arizona Business Credit Application is a comprehensive form that requires businesses to provide detailed information about their financial standing, including revenue, assets, liabilities, and credit history. This application assists in assessing the creditworthiness of a business and determining its eligibility for various credit products, such as loans, lines of credit, or credit cards. There are different types of Tucson Arizona Business Credit Applications available to cater to the diverse needs of businesses. Some common types include: 1. Small Business Credit Application: This type of application is specifically designed for small businesses, including startups and micro-enterprises, seeking credit to support their day-to-day operations or expand their operations. It typically requires basic financial information and may have a simplified approval process. 2. Commercial Credit Application: Commercial businesses, such as corporations or large enterprises, often require significant credit facilities to handle their extensive operations. A commercial credit application is more detailed, seeking comprehensive financial and operational data to evaluate the creditworthiness of the business. 3. Construction Credit Application: This application is tailored to construction companies and subcontractors who often need credit to finance projects, purchase materials, and cover labor costs. It may include specific sections related to project history, bonding capacity, and construction industry references. Regardless of the type, Tucson Arizona Business Credit Applications typically require the following information: — Business information, including legal name, address, and contact details. — Ownership information, including the names and contact details of the owners and key shareholders. — Financial statements, such as balance sheets, income statements, and tax returns. — Bank statements and credit references. — Business licenses and registrations— - Industry-specific information, if applicable (e.g., contractor's license for construction credit application). Completing a Tucson Arizona Business Credit Application accurately and providing all required supporting documents is crucial to increasing the chances of approval. It's essential to consult with financial advisors or professionals to ensure the application is thorough and well-prepared. In conclusion, the Tucson Arizona Business Credit Application is a comprehensive form required by financial institutions to evaluate a business's creditworthiness. The different types of applications cater to specific business needs, such as small businesses, commercial enterprises, or construction companies.