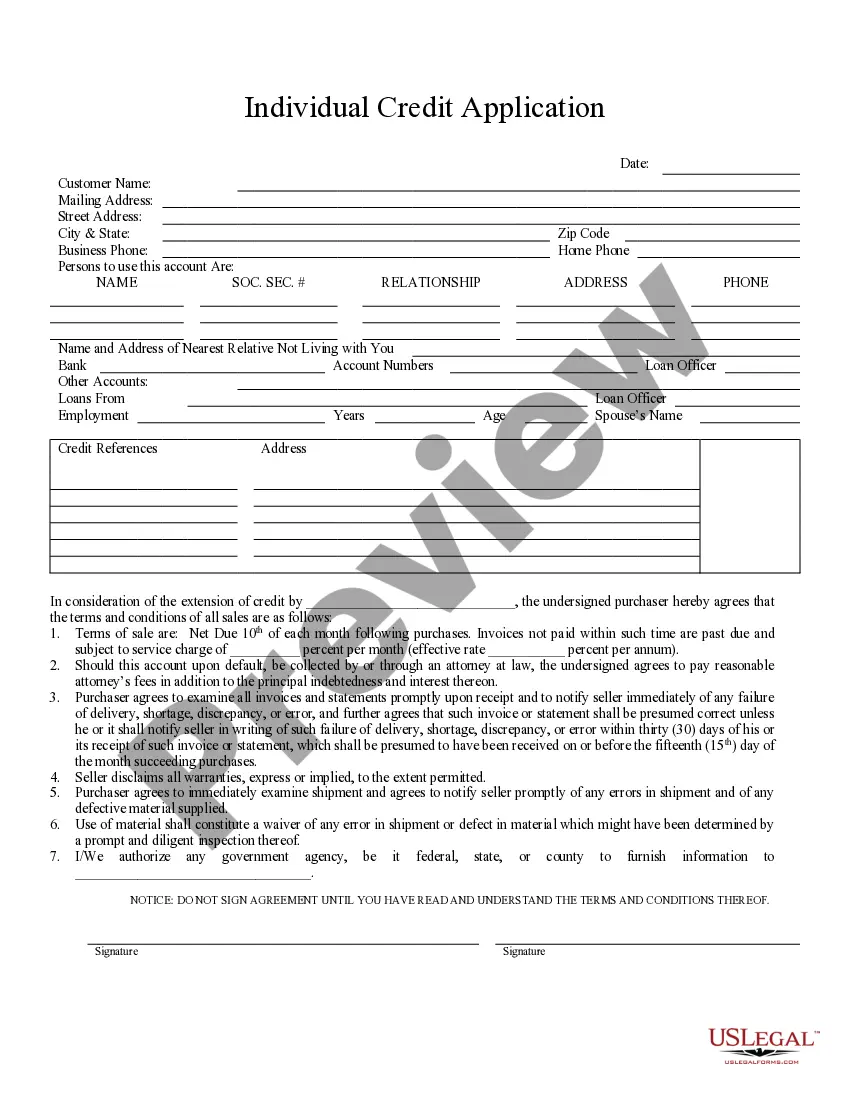

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Maricopa Arizona Individual Credit Application is a document necessary when applying for credit individually in Maricopa, Arizona. This application serves as a comprehensive record of an individual's personal and financial information, which is used by financial institutions and lenders to assess creditworthiness and determine the eligibility for various types of credit. The Maricopa Arizona Individual Credit Application typically consists of several sections and requires the applicant to provide detailed information. These sections often include personal information such as full name, address, contact details, social security number, and employment status. Additionally, applicants are required to disclose their income sources, including employment, investments, and any other sources contributing to their financial stability. Moreover, the credit application may ask for details on current debts and liabilities, such as outstanding loans, credit card balances, mortgages, and other monthly obligations. This information helps lenders evaluate the borrower's existing financial responsibilities and their ability to handle additional credit. The Maricopa Arizona Individual Credit Application may also inquire about the applicant's credit history, requesting details about previously held credit accounts, payment history, and any instances of delinquency or bankruptcy. Providing accurate and up-to-date credit history information is crucial, as lenders heavily rely on this data to determine the applicant's creditworthiness. Within Maricopa, Arizona, there might be different types of Individual Credit Applications available, each tailored for specific purposes. Some common examples include: 1. Auto Loan Credit Application: This type of credit application is specifically designed for individuals looking to secure financing for purchasing a vehicle within Maricopa, Arizona. It may have additional sections related to the make, model, and purchase price of the desired vehicle. 2. Mortgage Credit Application: When applying for a mortgage loan in Maricopa, Arizona, individuals can expect to fill out a specialized credit application that focuses on evaluating their financial situation, employment stability, and ability to repay a substantial home loan. 3. Personal Loan Credit Application: Individuals seeking personal loans for various purposes, such as debt consolidation, home improvements, or medical expenses, can complete a specific credit application that caters to their specific borrowing needs. It is worth noting that while the mentioned types may exist, the specific credit applications available and their requirements may vary depending on the lender or financial institution within Maricopa, Arizona.