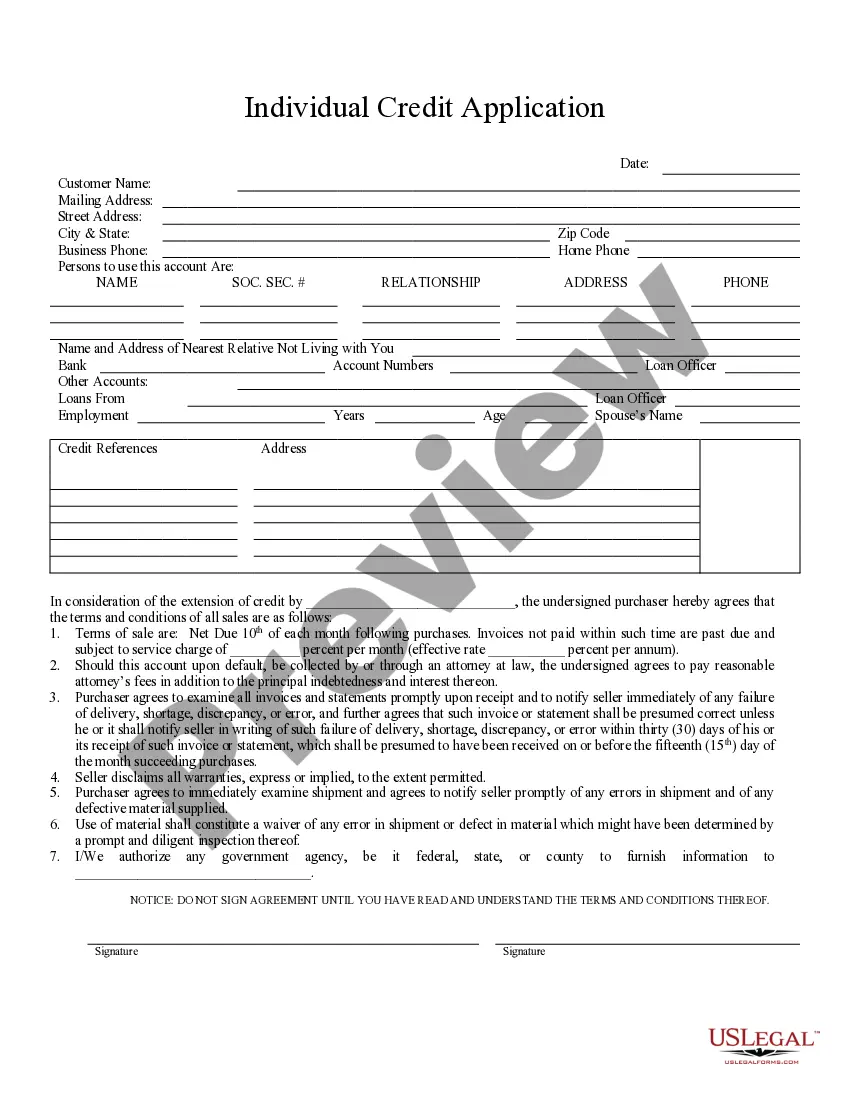

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

The Phoenix Arizona Individual Credit Application is a standardized document that individuals in the city of Phoenix, Arizona fill out when applying for credit. This application serves as a comprehensive form where individuals provide relevant personal, financial, and employment information to potential lenders or creditors. Keywords: Phoenix, Arizona, individual, credit application, standardized document, personal information, financial information, employment information, lenders, creditors. The purpose of the Phoenix Arizona Individual Credit Application is to gather essential information about an individual's financial status and creditworthiness, enabling lenders or creditors to evaluate their eligibility for credit. By having a standardized application, it ensures uniformity and consistency in the information required from applicants, making it easier for lenders to compare and assess credit applications. While there might not be distinct types of Phoenix Arizona Individual Credit Applications, different financial institutions or creditors in Phoenix, Arizona might include additional sections or questions specific to their policies or requirements. However, regardless of any variations, the basic structure of the credit application remains the same. The Phoenix Arizona Individual Credit Application typically includes sections where applicants provide their full name, contact details (address, phone number, email), social security number, date of birth, and employment information (employer's name, address, job title, duration of employment). These details help establish the applicant's identity and enable the lender to contact and verify their information. Additionally, the credit application requires individuals to disclose their financial information, such as their annual income, sources of income, monthly housing expenses, existing loans or debts, and any other financial obligations. This allows lenders to gauge the applicant's financial capacity and determine if they can handle additional credit responsibly. Furthermore, the application may include a section for applicants to list their assets, including property, vehicles, investments, or savings accounts to provide the lenders with a comprehensive overview of the financial standing of the applicant. Overall, the Phoenix Arizona Individual Credit Application is designed to gather detailed information about an individual's personal, financial, and employment background and helps to evaluate their creditworthiness. It serves as a crucial tool for lenders to assess the risk associated with extending credit to an individual in the Phoenix area. Important keywords: creditworthiness, eligibility, financial status, credit application, essential information, lenders, financial institutions, creditors, policies, requirements, uniformity, consistency, risk assessment, verification.The Phoenix Arizona Individual Credit Application is a standardized document that individuals in the city of Phoenix, Arizona fill out when applying for credit. This application serves as a comprehensive form where individuals provide relevant personal, financial, and employment information to potential lenders or creditors. Keywords: Phoenix, Arizona, individual, credit application, standardized document, personal information, financial information, employment information, lenders, creditors. The purpose of the Phoenix Arizona Individual Credit Application is to gather essential information about an individual's financial status and creditworthiness, enabling lenders or creditors to evaluate their eligibility for credit. By having a standardized application, it ensures uniformity and consistency in the information required from applicants, making it easier for lenders to compare and assess credit applications. While there might not be distinct types of Phoenix Arizona Individual Credit Applications, different financial institutions or creditors in Phoenix, Arizona might include additional sections or questions specific to their policies or requirements. However, regardless of any variations, the basic structure of the credit application remains the same. The Phoenix Arizona Individual Credit Application typically includes sections where applicants provide their full name, contact details (address, phone number, email), social security number, date of birth, and employment information (employer's name, address, job title, duration of employment). These details help establish the applicant's identity and enable the lender to contact and verify their information. Additionally, the credit application requires individuals to disclose their financial information, such as their annual income, sources of income, monthly housing expenses, existing loans or debts, and any other financial obligations. This allows lenders to gauge the applicant's financial capacity and determine if they can handle additional credit responsibly. Furthermore, the application may include a section for applicants to list their assets, including property, vehicles, investments, or savings accounts to provide the lenders with a comprehensive overview of the financial standing of the applicant. Overall, the Phoenix Arizona Individual Credit Application is designed to gather detailed information about an individual's personal, financial, and employment background and helps to evaluate their creditworthiness. It serves as a crucial tool for lenders to assess the risk associated with extending credit to an individual in the Phoenix area. Important keywords: creditworthiness, eligibility, financial status, credit application, essential information, lenders, financial institutions, creditors, policies, requirements, uniformity, consistency, risk assessment, verification.