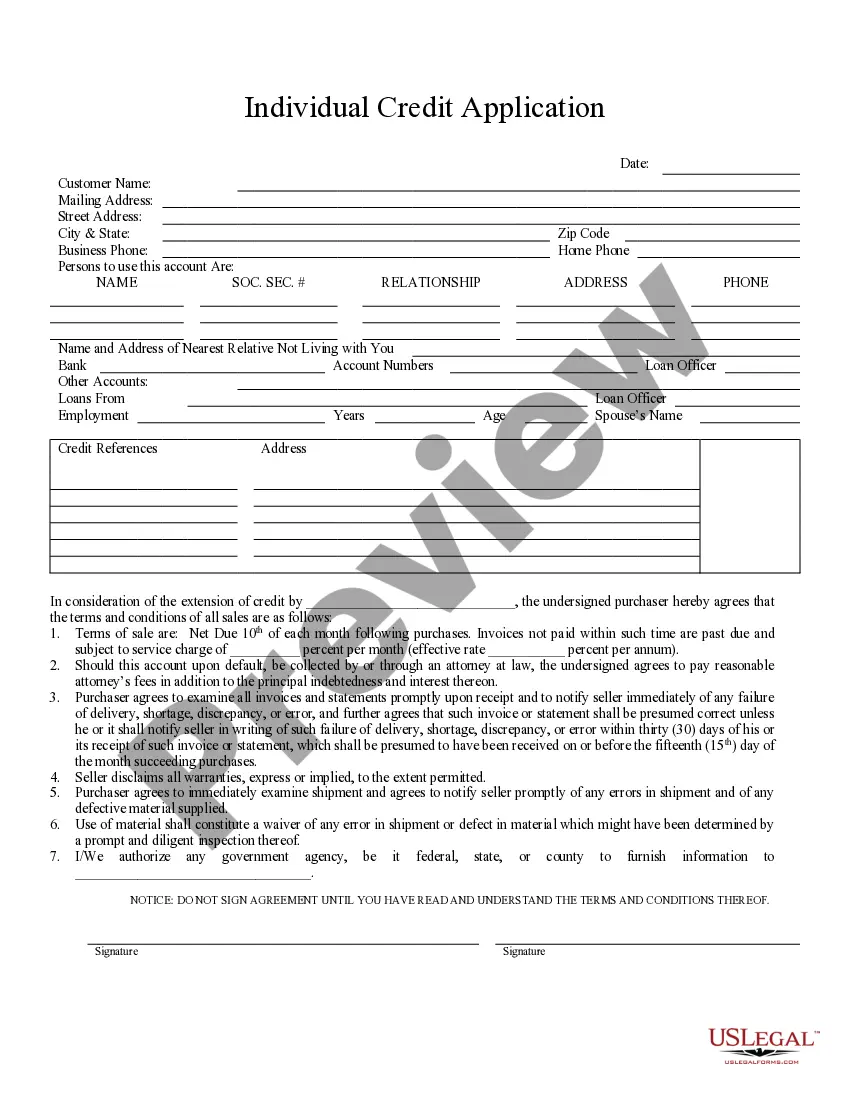

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Lima Arizona Individual Credit Application is a standardized form designed for individuals who reside in Lima, Arizona, and are seeking credit services from financial institutions or other lending entities. This comprehensive application plays a vital role in assessing an individual's creditworthiness and determining their eligibility for various types of loans, credit cards, mortgages, or other credit-based services. The Lima Arizona Individual Credit Application gathers essential personal and financial information from the applicant, ensuring a comprehensive evaluation of their credit profile. The application typically includes the following key components: 1. Personal Information: This section requires the applicant to provide their full name, current address, contact details, social security number, date of birth, marital status, and number of dependents. Providing accurate personal details is crucial for establishing identity and assessing creditworthiness. 2. Employment Details: Here, the applicant is required to disclose their current employer's information, including the company name, address, position, length of employment, and monthly income. This section helps evaluate the stability of the applicant's income source. 3. Financial Information: This section delves into the applicant's financial standing. It includes details on their existing bank accounts, investments, assets (such as properties or vehicles), and liabilities (such as loans, credit card debts, or outstanding obligations). Providing an accurate overview of their financial situation assists in analyzing the applicant's ability to meet future credit obligations. 4. Credit History: This section requires the applicant to provide details of their previous credit experiences. They must disclose information about their current and previous creditors, loan types, outstanding balances, payment history, and any delinquencies or bankruptcies. This data enables lenders to gauge the applicant's creditworthiness and repayment behavior. 5. Loan Purpose and Amount: Applicants should specify the purpose of their credit request, whether it is for purchasing a home, car, education, or other significant expenses. Additionally, they must state the desired loan amount, tenure, and any collateral they can offer, if applicable. Different types of Lima Arizona Individual Credit Applications may be available to cater to specific credit requirements. Some examples may include: 1. Lima Arizona Mortgage Loan Application: Specifically tailored for individuals seeking loans to finance the purchase or refinancing of a home or property in Lima, Arizona. 2. Lima Arizona Auto Loan Application: Geared towards individuals looking to finance the purchase of a vehicle, whether new or used, within the Lima area. 3. Lima Arizona Personal Loan Application: Designed for individuals seeking credit for personal expenses, such as debt consolidation, home renovations, education costs, or unexpected emergencies. 4. Lima Arizona Credit Card Application: Focused on individuals interested in obtaining a credit card that can be used for various transactions while maintaining a revolving credit facility. In conclusion, the Lima Arizona Individual Credit Application is a vital tool for individuals in Lima, Arizona, who seek credit services. By collecting detailed personal, financial, and credit history information, lenders can evaluate an applicant's creditworthiness and make informed decisions regarding loan approvals. Whether it's for mortgages, auto loans, personal loans, or credit cards, these applications aim to streamline the credit assessment process and ensure efficiency in credit application processing.Lima Arizona Individual Credit Application is a standardized form designed for individuals who reside in Lima, Arizona, and are seeking credit services from financial institutions or other lending entities. This comprehensive application plays a vital role in assessing an individual's creditworthiness and determining their eligibility for various types of loans, credit cards, mortgages, or other credit-based services. The Lima Arizona Individual Credit Application gathers essential personal and financial information from the applicant, ensuring a comprehensive evaluation of their credit profile. The application typically includes the following key components: 1. Personal Information: This section requires the applicant to provide their full name, current address, contact details, social security number, date of birth, marital status, and number of dependents. Providing accurate personal details is crucial for establishing identity and assessing creditworthiness. 2. Employment Details: Here, the applicant is required to disclose their current employer's information, including the company name, address, position, length of employment, and monthly income. This section helps evaluate the stability of the applicant's income source. 3. Financial Information: This section delves into the applicant's financial standing. It includes details on their existing bank accounts, investments, assets (such as properties or vehicles), and liabilities (such as loans, credit card debts, or outstanding obligations). Providing an accurate overview of their financial situation assists in analyzing the applicant's ability to meet future credit obligations. 4. Credit History: This section requires the applicant to provide details of their previous credit experiences. They must disclose information about their current and previous creditors, loan types, outstanding balances, payment history, and any delinquencies or bankruptcies. This data enables lenders to gauge the applicant's creditworthiness and repayment behavior. 5. Loan Purpose and Amount: Applicants should specify the purpose of their credit request, whether it is for purchasing a home, car, education, or other significant expenses. Additionally, they must state the desired loan amount, tenure, and any collateral they can offer, if applicable. Different types of Lima Arizona Individual Credit Applications may be available to cater to specific credit requirements. Some examples may include: 1. Lima Arizona Mortgage Loan Application: Specifically tailored for individuals seeking loans to finance the purchase or refinancing of a home or property in Lima, Arizona. 2. Lima Arizona Auto Loan Application: Geared towards individuals looking to finance the purchase of a vehicle, whether new or used, within the Lima area. 3. Lima Arizona Personal Loan Application: Designed for individuals seeking credit for personal expenses, such as debt consolidation, home renovations, education costs, or unexpected emergencies. 4. Lima Arizona Credit Card Application: Focused on individuals interested in obtaining a credit card that can be used for various transactions while maintaining a revolving credit facility. In conclusion, the Lima Arizona Individual Credit Application is a vital tool for individuals in Lima, Arizona, who seek credit services. By collecting detailed personal, financial, and credit history information, lenders can evaluate an applicant's creditworthiness and make informed decisions regarding loan approvals. Whether it's for mortgages, auto loans, personal loans, or credit cards, these applications aim to streamline the credit assessment process and ensure efficiency in credit application processing.