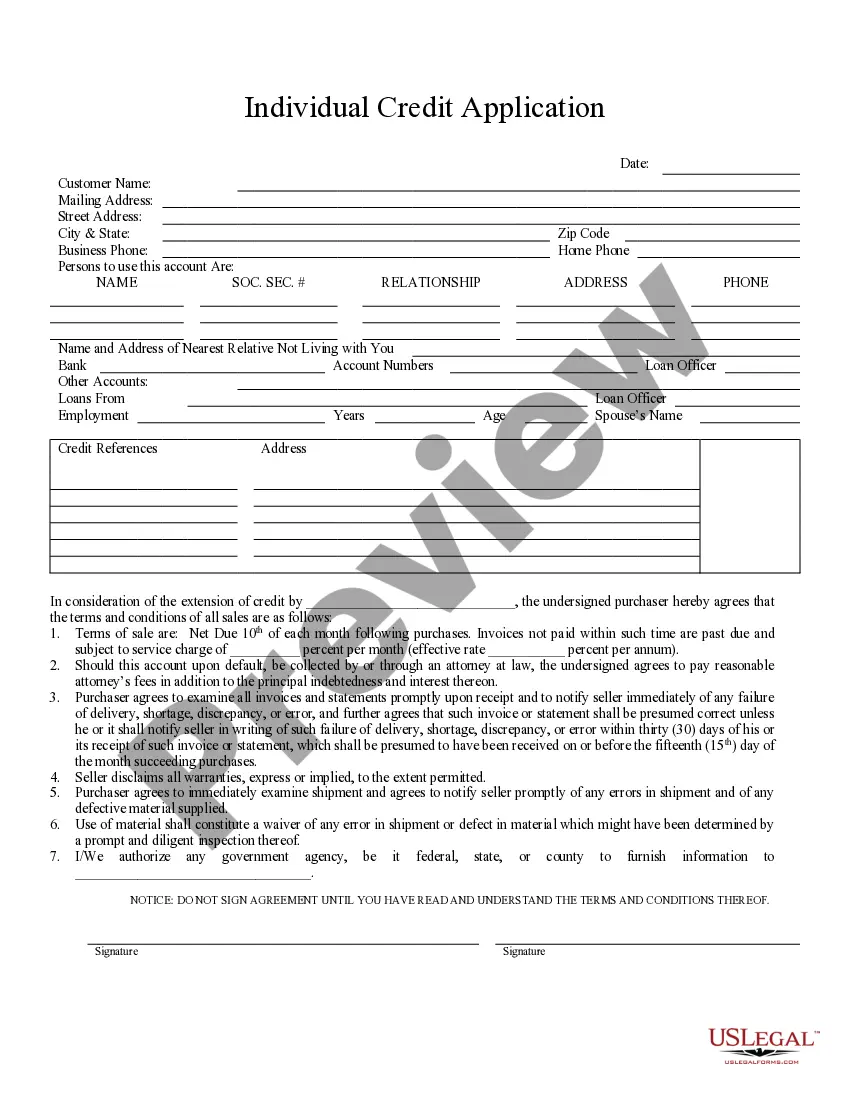

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Scottsdale, Arizona Individual Credit Application The Scottsdale, Arizona Individual Credit Application is a comprehensive document that individuals residing in Scottsdale can use to apply for credit in various financial institutions, including banks, credit unions, and lenders. This application is designed to collect essential information about the individual's personal and financial background, ensuring the lender has all the necessary details to make an informed decision about extending credit to the applicant. Keywords: Scottsdale, Arizona, individual credit, application, personal, financial, background, information, lender, decision, extending, credit, applicant. The Scottsdale, Arizona Individual Credit Application typically encompasses the following sections: 1. Personal Information: This section focuses on gathering key details about the applicant, including their full name, address, contact information (phone number and email), social security number, date of birth, and employment information. 2. Financial Information: Here, applicants are required to provide comprehensive details about their financial situation. This may include their current income, employment status, employer's details, monthly expenses, existing debt obligations (such as loans, mortgages, or credit card balances), and any additional sources of income. 3. Credit History: This section aims to capture the applicant's credit history, including details of any previous credit accounts (such as loans, credit cards), repayment history, bankruptcy filings, or any other credit-related incidents. 4. References: Certain financial institutions may request references as part of the credit application. Applicants are required to provide personal or professional references who can vouch for their character and reliability, typically including their contact information. 5. Purpose of Credit: In this section, applicants can outline the intended purpose for which they need credit. This information assists lenders in understanding how the funds will be utilized and whether it aligns with their lending policies. 6. Terms and Conditions: This segment outlines the legal terms and conditions associated with the credit application, such as interest rates, repayment terms, penalties for late payments, and other contractual obligations. Types of Scottsdale, Arizona Individual Credit Applications: 1. Personal Loan Application: Specifically designed for individuals seeking personal loans to finance various purposes, such as home renovations, debt consolidation, or funding a major purchase. 2. Mortgage Loan Application: Geared towards individuals looking to purchase or refinance a home in Scottsdale, Arizona. This application requires additional details about the property, its value, and potential collateral. 3. Credit Card Application: Individuals interested in obtaining a credit card from a financial institution in Scottsdale can use this type of credit application. It typically focuses on the applicant's credit history and financial background. 4. Auto Loan Application: Intended for individuals looking to purchase a vehicle, this application requires information about the make, model, price, and potential collateral (such as the vehicle itself). In conclusion, the Scottsdale, Arizona Individual Credit Application is a crucial tool for residents seeking credit from financial institutions in the region. By providing accurate and comprehensive information, applicants increase their chances of securing the credit they need to achieve their financial goals.Scottsdale, Arizona Individual Credit Application The Scottsdale, Arizona Individual Credit Application is a comprehensive document that individuals residing in Scottsdale can use to apply for credit in various financial institutions, including banks, credit unions, and lenders. This application is designed to collect essential information about the individual's personal and financial background, ensuring the lender has all the necessary details to make an informed decision about extending credit to the applicant. Keywords: Scottsdale, Arizona, individual credit, application, personal, financial, background, information, lender, decision, extending, credit, applicant. The Scottsdale, Arizona Individual Credit Application typically encompasses the following sections: 1. Personal Information: This section focuses on gathering key details about the applicant, including their full name, address, contact information (phone number and email), social security number, date of birth, and employment information. 2. Financial Information: Here, applicants are required to provide comprehensive details about their financial situation. This may include their current income, employment status, employer's details, monthly expenses, existing debt obligations (such as loans, mortgages, or credit card balances), and any additional sources of income. 3. Credit History: This section aims to capture the applicant's credit history, including details of any previous credit accounts (such as loans, credit cards), repayment history, bankruptcy filings, or any other credit-related incidents. 4. References: Certain financial institutions may request references as part of the credit application. Applicants are required to provide personal or professional references who can vouch for their character and reliability, typically including their contact information. 5. Purpose of Credit: In this section, applicants can outline the intended purpose for which they need credit. This information assists lenders in understanding how the funds will be utilized and whether it aligns with their lending policies. 6. Terms and Conditions: This segment outlines the legal terms and conditions associated with the credit application, such as interest rates, repayment terms, penalties for late payments, and other contractual obligations. Types of Scottsdale, Arizona Individual Credit Applications: 1. Personal Loan Application: Specifically designed for individuals seeking personal loans to finance various purposes, such as home renovations, debt consolidation, or funding a major purchase. 2. Mortgage Loan Application: Geared towards individuals looking to purchase or refinance a home in Scottsdale, Arizona. This application requires additional details about the property, its value, and potential collateral. 3. Credit Card Application: Individuals interested in obtaining a credit card from a financial institution in Scottsdale can use this type of credit application. It typically focuses on the applicant's credit history and financial background. 4. Auto Loan Application: Intended for individuals looking to purchase a vehicle, this application requires information about the make, model, price, and potential collateral (such as the vehicle itself). In conclusion, the Scottsdale, Arizona Individual Credit Application is a crucial tool for residents seeking credit from financial institutions in the region. By providing accurate and comprehensive information, applicants increase their chances of securing the credit they need to achieve their financial goals.