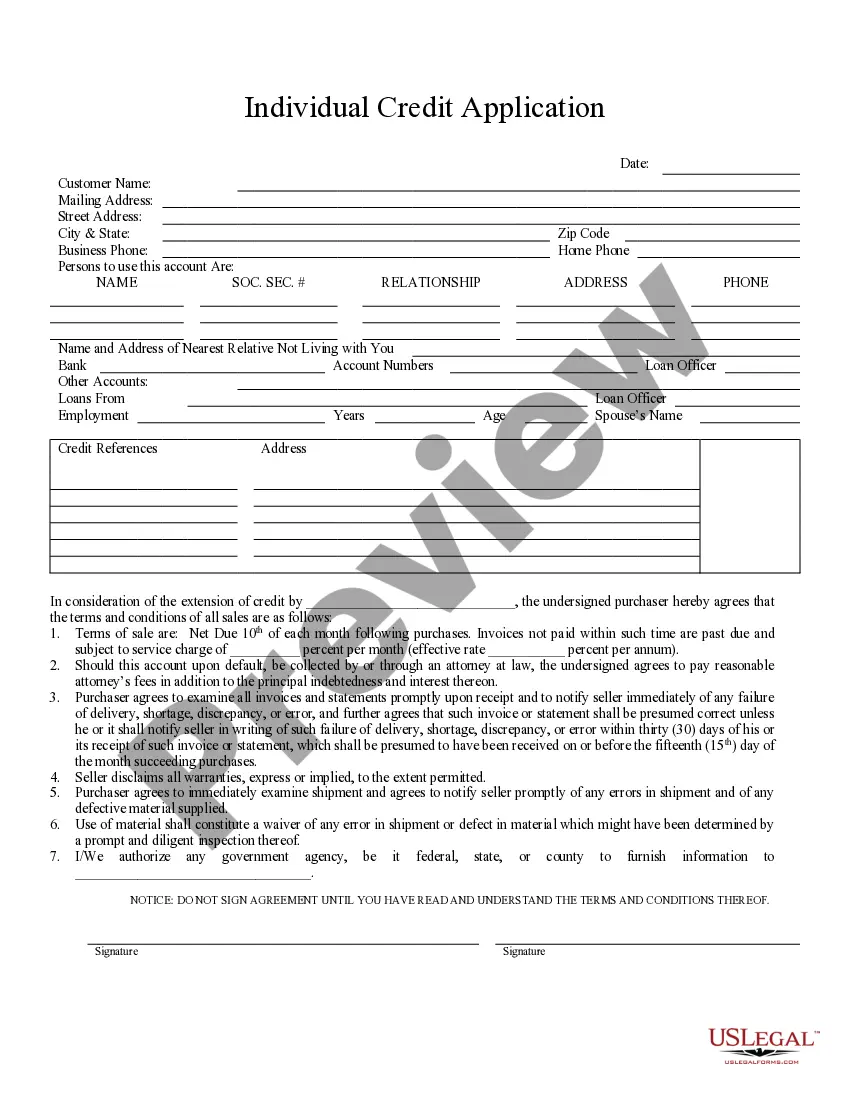

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Surprise Arizona Individual Credit Application is a comprehensive form that individuals residing in Surprise, Arizona needs to fill out when applying for credit or loans from financial institutions, such as banks or credit unions. This application allows lenders to assess the applicant's creditworthiness and determine whether they qualify for credit. The Surprise Arizona Individual Credit Application typically requires applicants to provide personal information, such as their full name, date of birth, social security number, contact details, and residential address. Additionally, applicants must provide information about their employment status, including current employer, job title, and length of employment. Moreover, the application requires applicants to disclose their income sources, such as salary, bonuses, investments, or other sources of regular income. It may also ask for details about outstanding debts, monthly expenses, and financial assets, such as savings, real estate, or vehicles owned. Applicants may also be required to provide details of their co-applicants or any additional individuals who will be financially responsible for the credit, if applicable. This could include a spouse or any other joint account holders. The Surprise Arizona Individual Credit Application serves as a crucial tool for lenders to evaluate an individual's creditworthiness and make informed decisions regarding lending. By reviewing the application, lenders can assess an applicant's financial stability, employment history, and ability to manage debt. Different types of Surprise Arizona Individual Credit Applications may exist, depending on the lending institution or specific loan/credit type. For instance, there might be separate applications for auto loans, mortgage loans, personal loans, or credit cards. Each application will contain relevant questions and fields tailored to the specific credit product being applied for. Overall, the Surprise Arizona Individual Credit Application is an important step in the credit application process, allowing lenders in Surprise, Arizona, to evaluate an individual's financial situation and determine their eligibility for credit.Surprise Arizona Individual Credit Application is a comprehensive form that individuals residing in Surprise, Arizona needs to fill out when applying for credit or loans from financial institutions, such as banks or credit unions. This application allows lenders to assess the applicant's creditworthiness and determine whether they qualify for credit. The Surprise Arizona Individual Credit Application typically requires applicants to provide personal information, such as their full name, date of birth, social security number, contact details, and residential address. Additionally, applicants must provide information about their employment status, including current employer, job title, and length of employment. Moreover, the application requires applicants to disclose their income sources, such as salary, bonuses, investments, or other sources of regular income. It may also ask for details about outstanding debts, monthly expenses, and financial assets, such as savings, real estate, or vehicles owned. Applicants may also be required to provide details of their co-applicants or any additional individuals who will be financially responsible for the credit, if applicable. This could include a spouse or any other joint account holders. The Surprise Arizona Individual Credit Application serves as a crucial tool for lenders to evaluate an individual's creditworthiness and make informed decisions regarding lending. By reviewing the application, lenders can assess an applicant's financial stability, employment history, and ability to manage debt. Different types of Surprise Arizona Individual Credit Applications may exist, depending on the lending institution or specific loan/credit type. For instance, there might be separate applications for auto loans, mortgage loans, personal loans, or credit cards. Each application will contain relevant questions and fields tailored to the specific credit product being applied for. Overall, the Surprise Arizona Individual Credit Application is an important step in the credit application process, allowing lenders in Surprise, Arizona, to evaluate an individual's financial situation and determine their eligibility for credit.