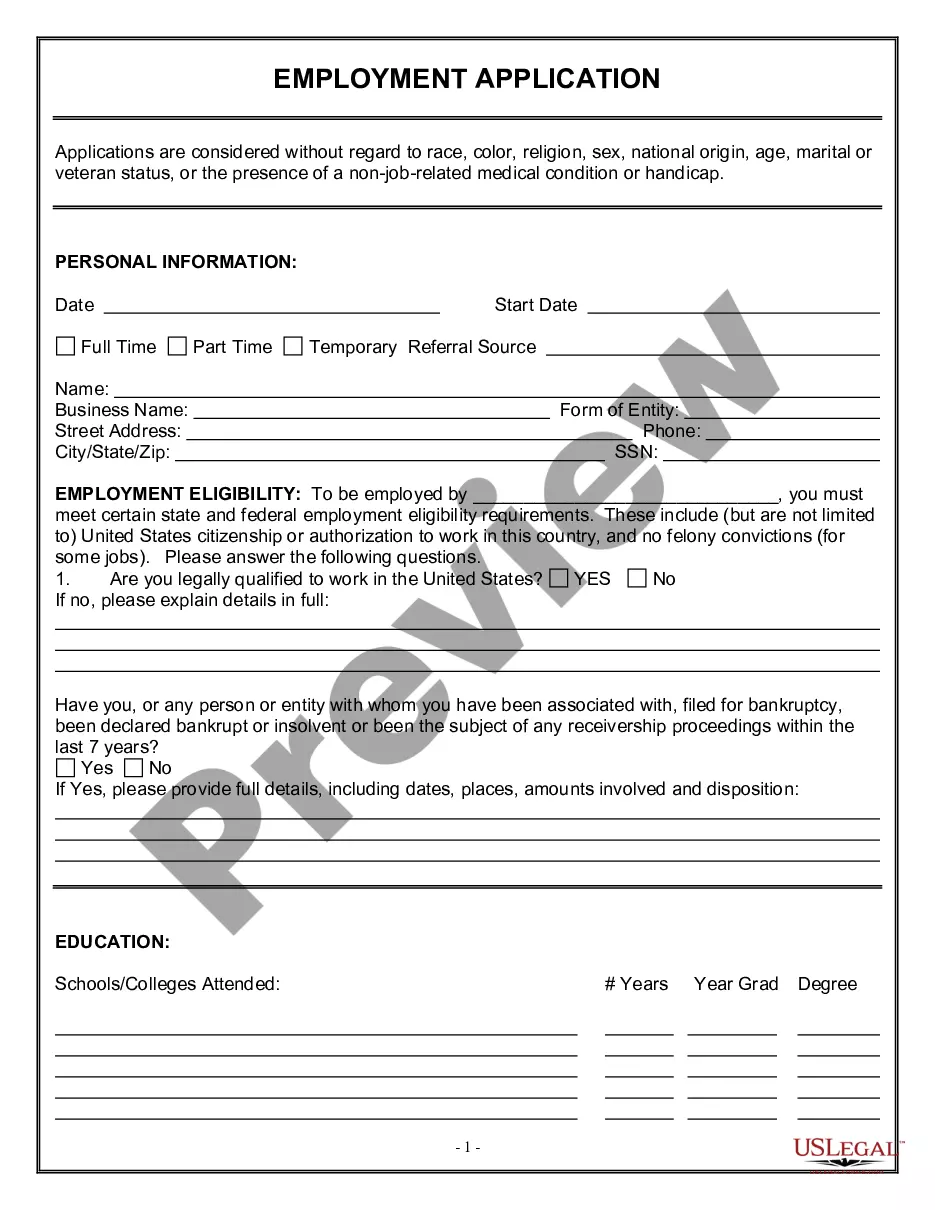

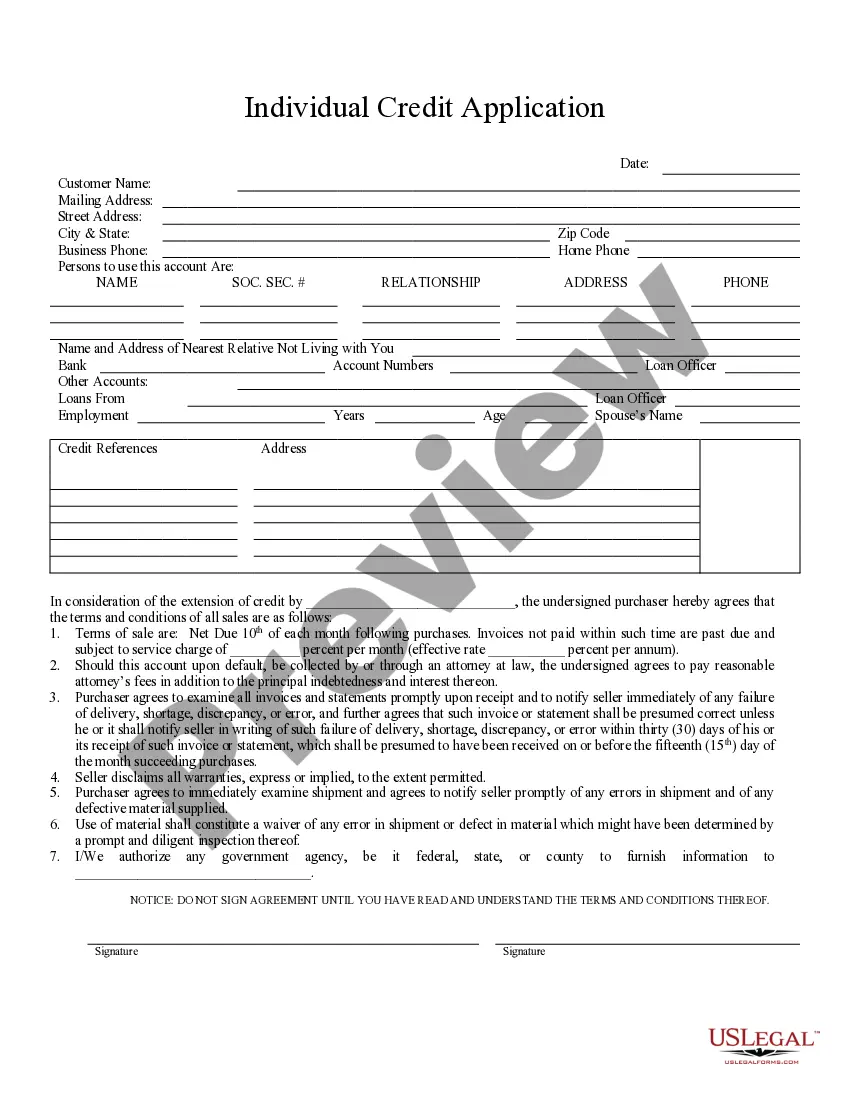

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Tucson Arizona Individual Credit Application is a comprehensive document that individuals residing in Tucson, Arizona can utilize to apply for credit in various financial institutions and lenders within the region. This application form serves as a means for prospective borrowers to provide necessary personal and financial details to lenders for evaluation and processing of their creditworthiness. The Tucson Arizona Individual Credit Application requests essential information such as the applicant's full name, contact details, residential address, social security number, and date of birth to establish identity and ensure accurate record keeping. Additionally, the form requires details about the applicant's employment, including current and previous employers, job title, duration of employment, and income details. Having accurate employment information allows lenders to assess the borrower's financial stability and ability to repay the credit. Financial specifics are also a crucial component of the Tucson Arizona Individual Credit Application. Applicants are expected to provide accurate information about their current financial status, including bank account details, assets, liabilities, outstanding debts, and monthly expenses. These details help lenders evaluate the borrower's existing financial commitments and determine if they have the capacity to take on additional credit responsibly. Furthermore, the Tucson Arizona Individual Credit Application may differ based on the type of credit being sought. Some commonly encountered credit applications in Tucson, Arizona include: 1. Mortgage Credit Application: Specifically for individuals seeking loans to finance the purchase or refinancing of real estate properties, including homes, condos, or land. 2. Auto Loan Credit Application: Geared towards those applying for credit to purchase a vehicle, whether new or used, requiring information such as the make, model, and estimated value of the car being purchased. 3. Personal Loan Credit Application: Used when individuals require a loan for personal purposes, such as debt consolidation, medical expenses, or unexpected financial needs. 4. Credit Card Application: Designed for obtaining a credit card, providing detailed information about the applicant's income, employment, and existing financial obligations. 5. Business Loan Credit Application: For entrepreneurs and business owners who seek credit for their business-related needs, such as starting a new venture or expanding an existing one. Overall, the Tucson Arizona Individual Credit Application ensures that applicants provide essential information to financial institutions and lenders for accurate evaluation of their creditworthiness. Potential borrowers must fill out the appropriate credit application form based on their specific credit requirements, ensuring all relevant information is provided accurately and truthfully to maximize the chances of obtaining credit approval.