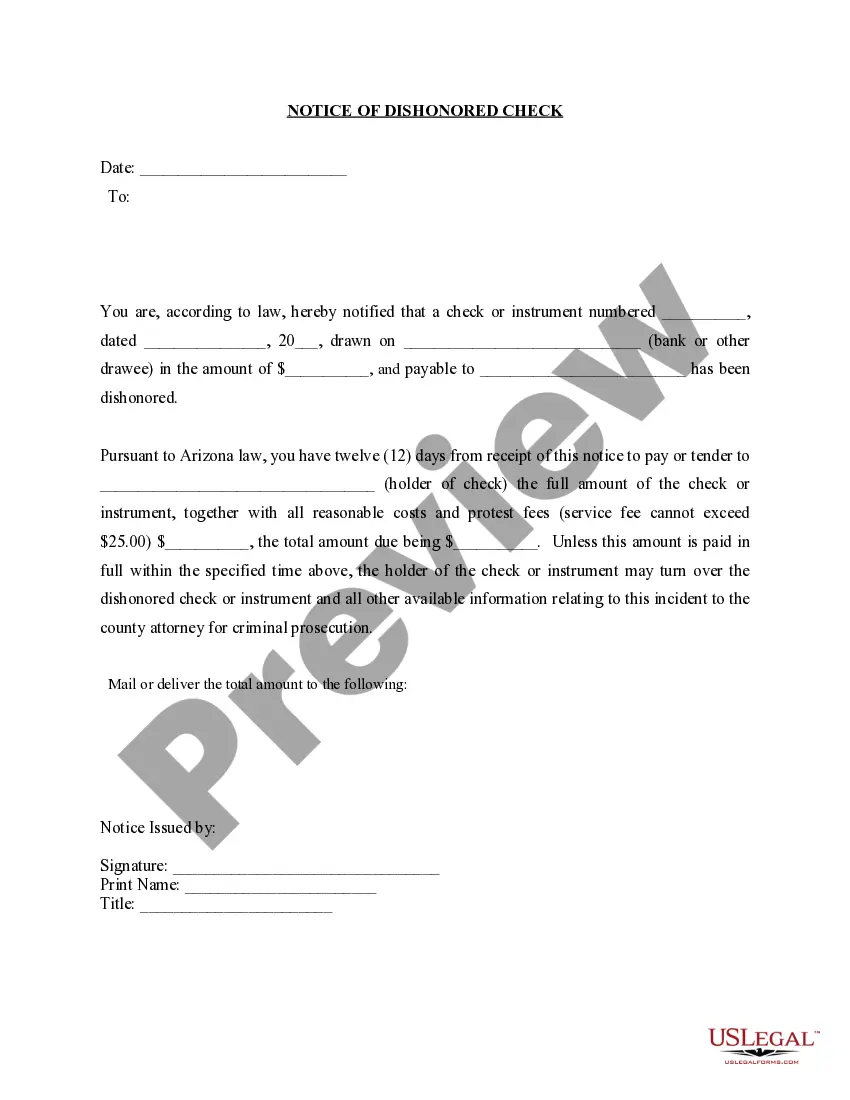

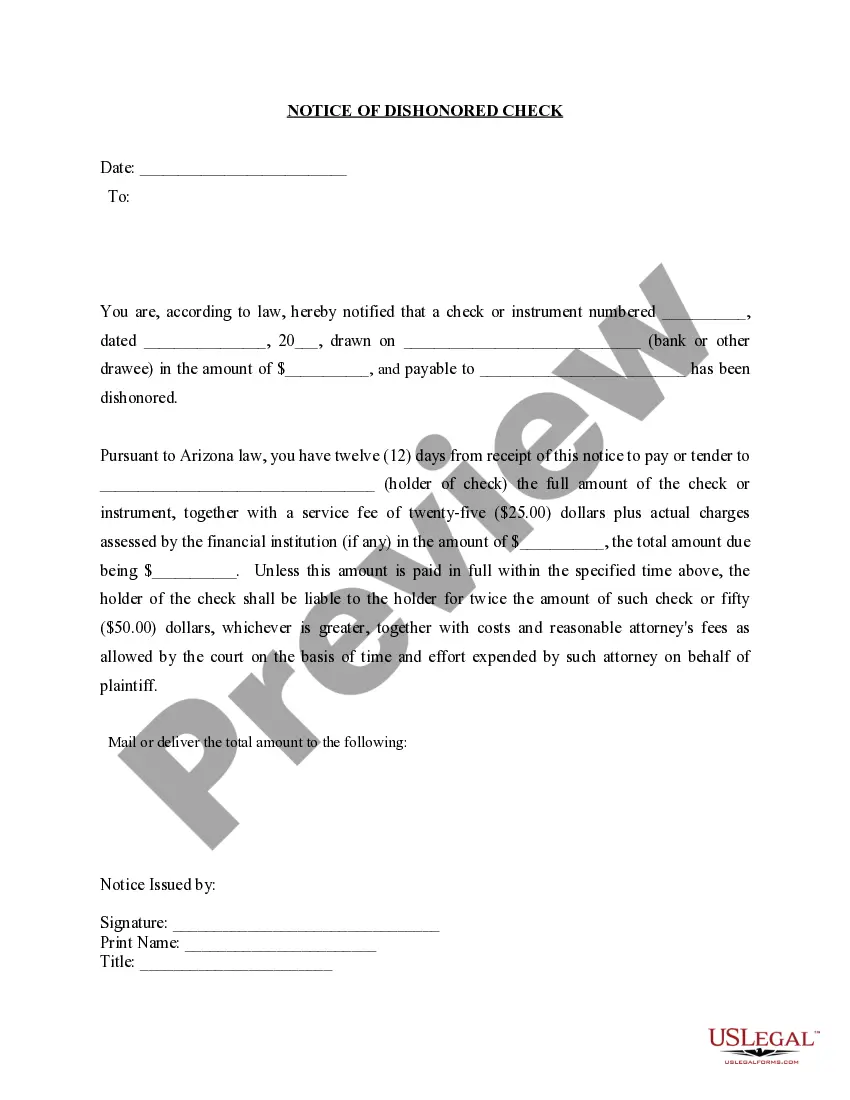

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Glendale Arizona Notice of Dishonored Check Civilvi— - Keywords: bad check, bounced check A Glendale Arizona Notice of Dishonored Check is a legal document issued by a business or individual when a check they received has been returned unpaid by the bank. Also known as a bad check or a bounced check, it indicates that the check writer did not have sufficient funds to cover the payment at the time the check was presented. When a business or individual receives a bounced check, they experience financial inconvenience and potential losses. To address this issue, they can utilize the Glendale Arizona Notice of Dishonored Check — Civil to initiate a legal process to seek compensation and rectify the matter. The notice typically contains essential information such as: 1. Parties Involved: It identifies both the check recipient, referred to as the payee, and the check writer, known as the maker or drawer. 2. Contact Details: The notice includes the contact information of both parties involved, such as their names, addresses, phone numbers, and email addresses. 3. Check Details: It outlines the details of the dishonored check, including the check number, date issued, and the amount of the check. 4. Bank Information: The notice includes the bank name, branch, and account number where the check was deposited. 5. Dishonored Reason: It specifies the reason for dishonor, which could be insufficient funds, a closed account, a stop payment order, or any other reason provided by the bank. 6. Payment Demand: The notice states the total amount due, which includes the original check amount, any bank charges or fees incurred, and any additional penalties or interest as allowed by law. Once the Glendale Arizona Notice of Dishonored Check — Civil is issued, the check writer is given a specific period, usually 10 to 15 days, to rectify the situation by paying the amount owed. Failure to comply within the given time frame can lead to further legal actions, including filing a civil lawsuit to recover the original amount plus any applicable damages. It is important to note that Glendale Arizona may have specific regulations and processes outlined under state laws for issuing and handling dishonored checks. These laws are designed to protect both parties involved while ensuring fair treatment and resolution. Overall, the Glendale Arizona Notice of Dishonored Check — Civil is a crucial document used to address the issue of bounced checks, protect the rights of the payee, and facilitate the prompt resolution of such matters through legal means.Glendale Arizona Notice of Dishonored Check Civilvi— - Keywords: bad check, bounced check A Glendale Arizona Notice of Dishonored Check is a legal document issued by a business or individual when a check they received has been returned unpaid by the bank. Also known as a bad check or a bounced check, it indicates that the check writer did not have sufficient funds to cover the payment at the time the check was presented. When a business or individual receives a bounced check, they experience financial inconvenience and potential losses. To address this issue, they can utilize the Glendale Arizona Notice of Dishonored Check — Civil to initiate a legal process to seek compensation and rectify the matter. The notice typically contains essential information such as: 1. Parties Involved: It identifies both the check recipient, referred to as the payee, and the check writer, known as the maker or drawer. 2. Contact Details: The notice includes the contact information of both parties involved, such as their names, addresses, phone numbers, and email addresses. 3. Check Details: It outlines the details of the dishonored check, including the check number, date issued, and the amount of the check. 4. Bank Information: The notice includes the bank name, branch, and account number where the check was deposited. 5. Dishonored Reason: It specifies the reason for dishonor, which could be insufficient funds, a closed account, a stop payment order, or any other reason provided by the bank. 6. Payment Demand: The notice states the total amount due, which includes the original check amount, any bank charges or fees incurred, and any additional penalties or interest as allowed by law. Once the Glendale Arizona Notice of Dishonored Check — Civil is issued, the check writer is given a specific period, usually 10 to 15 days, to rectify the situation by paying the amount owed. Failure to comply within the given time frame can lead to further legal actions, including filing a civil lawsuit to recover the original amount plus any applicable damages. It is important to note that Glendale Arizona may have specific regulations and processes outlined under state laws for issuing and handling dishonored checks. These laws are designed to protect both parties involved while ensuring fair treatment and resolution. Overall, the Glendale Arizona Notice of Dishonored Check — Civil is a crucial document used to address the issue of bounced checks, protect the rights of the payee, and facilitate the prompt resolution of such matters through legal means.