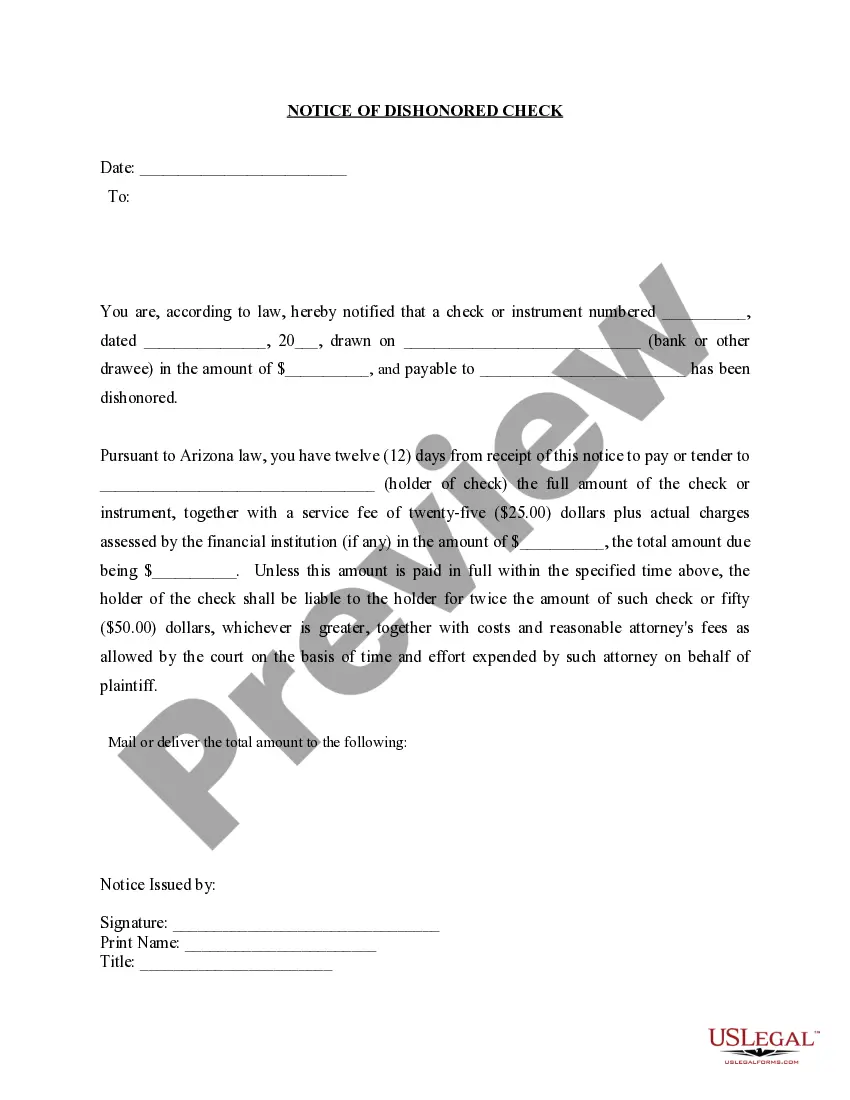

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

The Phoenix Arizona Notice of Dishonored Check — Civil is a legal document that deals with the issue of a bad check or a bounced check in the state of Arizona. This notice is sent by the party who received the check, known as the payee, to the party who issued the check, known as the drawer or maker. A bad check refers to a check that cannot be honored due to various reasons such as insufficient funds in the account, account closure, or a stop payment order. Similarly, a bounced check is a term used to describe a check that has been returned unpaid by the bank. The purpose of this notice is to inform the drawer that their check has been dishonored and to demand payment for the amount specified on the check, including any associated fees or charges. It serves as a formal communication to notify the drawer that legal action may be taken if payment is not made promptly. This document contains essential information to identify the check and the parties involved, such as the payee's name, address, and contact details, as well as the drawer's name and address. Additionally, the notice includes details about the dishonored check, such as the check number, the issuing bank, and the date of dishonor. There can be different types of Phoenix Arizona Notice of Dishonored Check — Civil notices depending on the specific circumstances and intent of the payee. Some of these variations may include: 1. Demand for Payment Notice: This is a straightforward notice that informs the drawer about the dishonored check and immediately demands payment for the amount specified on the check. It typically includes information about the consequences of non-payment, such as legal action or reporting the incident to law enforcement. 2. Cure or Pay Notice: This type of notice gives the drawer an opportunity to cure the dishonor by making payment within a specified period of time, usually within a few days. It informs the drawer about the dishonored check and provides instructions on how to rectify the situation to avoid further legal consequences. 3. Final Demand Notice: If previous attempts to obtain payment have been unsuccessful, a final demand notice may be sent. This notice explicitly states that legal action will be pursued if payment is not made promptly, emphasizing the seriousness of the situation and the consequences that may follow. In conclusion, the Phoenix Arizona Notice of Dishonored Check — Civil is a legal document used to address the issue of a bad check or bounced check. It aims to inform the drawer about the dishonored check and demand prompt payment, while also outlining the potential legal actions that may be taken if payment is not made. Different variations of this notice can be used depending on the circumstances and the desired course of action by the payee.The Phoenix Arizona Notice of Dishonored Check — Civil is a legal document that deals with the issue of a bad check or a bounced check in the state of Arizona. This notice is sent by the party who received the check, known as the payee, to the party who issued the check, known as the drawer or maker. A bad check refers to a check that cannot be honored due to various reasons such as insufficient funds in the account, account closure, or a stop payment order. Similarly, a bounced check is a term used to describe a check that has been returned unpaid by the bank. The purpose of this notice is to inform the drawer that their check has been dishonored and to demand payment for the amount specified on the check, including any associated fees or charges. It serves as a formal communication to notify the drawer that legal action may be taken if payment is not made promptly. This document contains essential information to identify the check and the parties involved, such as the payee's name, address, and contact details, as well as the drawer's name and address. Additionally, the notice includes details about the dishonored check, such as the check number, the issuing bank, and the date of dishonor. There can be different types of Phoenix Arizona Notice of Dishonored Check — Civil notices depending on the specific circumstances and intent of the payee. Some of these variations may include: 1. Demand for Payment Notice: This is a straightforward notice that informs the drawer about the dishonored check and immediately demands payment for the amount specified on the check. It typically includes information about the consequences of non-payment, such as legal action or reporting the incident to law enforcement. 2. Cure or Pay Notice: This type of notice gives the drawer an opportunity to cure the dishonor by making payment within a specified period of time, usually within a few days. It informs the drawer about the dishonored check and provides instructions on how to rectify the situation to avoid further legal consequences. 3. Final Demand Notice: If previous attempts to obtain payment have been unsuccessful, a final demand notice may be sent. This notice explicitly states that legal action will be pursued if payment is not made promptly, emphasizing the seriousness of the situation and the consequences that may follow. In conclusion, the Phoenix Arizona Notice of Dishonored Check — Civil is a legal document used to address the issue of a bad check or bounced check. It aims to inform the drawer about the dishonored check and demand prompt payment, while also outlining the potential legal actions that may be taken if payment is not made. Different variations of this notice can be used depending on the circumstances and the desired course of action by the payee.