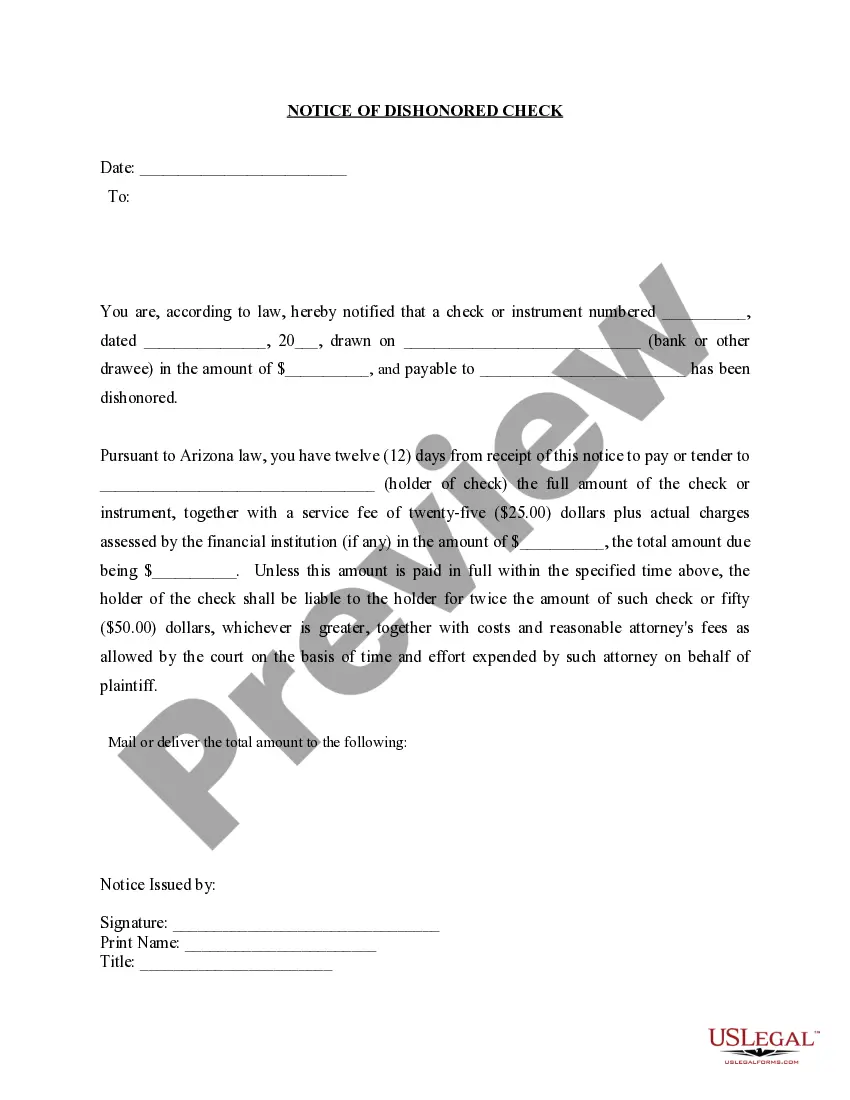

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Surprise Arizona Notice of Dishonored Check — Civil: Understanding Bad Checks and Bounced Checks Introduction: Surprise Arizona Notice of Dishonored Check — Civil refers to the legal notification sent to individuals or businesses who have provided or received a bad check that has been returned or failed to clear due to insufficient funds in the account. In such cases, a formal notification is issued to the check issuer, outlining their obligations and consequences of their actions. This article will provide a detailed description of what a bad check and a bounced check mean, their implications, and the different types of notices associated with them. 1. What is a Bad Check? A bad check, also known as a non-sufficient funds (NSF) check or a dishonored check, refers to a check that has been issued by an individual or business without enough funds in the account to cover the amount written on the check. It is considered an illegal act as it intentionally deceives the recipient into believing they will receive the funds when deposited or cashed. 2. Consequences of Writing a Bad Check: When a bad check is issued, it can lead to various negative consequences for both parties involved. These may include: — Financial penalties and fees: The check issuer may be liable to pay penalties, fees, or other charges imposed by the bank, the recipient, or the legal system. — Legal actions: The recipient of the bad check can take legal actions against the check issuer, which may result in civil lawsuits or criminal charges, depending on the severity of the offense. — Damage to reputation: Issuing bad checks can tarnish the reputation of the individual or business responsible, potentially affecting future financial transactions and relationships. 3. What is a Bounced Check? A bounced check is a term often used interchangeably with a bad check. It refers to a check that has been returned unpaid by the bank due to insufficient funds, closed accounts, or other reasons stated by the financial institution. 4. Types of Surprise Arizona Notice of Dishonored Check — Civil: Within the Surprise Arizona legal system, different types of notices may be issued to inform the check issuer of the consequences of issuing a bad or bounced check. These may include: — Initial Notice: The initial notice serves as an official warning to the check issuer, informing them about the dishonored check and requesting immediate payment to avoid further legal actions. — Final Notice: If the check issuer fails to respond or pay the owed amount within a specified period mentioned in the initial notice, a final notice is sent. This notice highlights the potential legal implications if the payment is not made promptly. — Legal Action Notice: If the check issuer persists in neglecting the payment or resolving the issue, a notice informing the initiation of legal actions can be sent. This notice emphasizes the consequences, such as civil lawsuits or criminal charges. Conclusion: The Surprise Arizona Notice of Dishonored Check — Civil alerts check issuers about the implications and legal consequences associated with writing bad checks or bouncing checks. Understanding the significance of honoring financial commitments, avoiding bad check incidents, and responding promptly to notifications is crucial to maintaining a good reputation and avoiding legal troubles.Surprise Arizona Notice of Dishonored Check — Civil: Understanding Bad Checks and Bounced Checks Introduction: Surprise Arizona Notice of Dishonored Check — Civil refers to the legal notification sent to individuals or businesses who have provided or received a bad check that has been returned or failed to clear due to insufficient funds in the account. In such cases, a formal notification is issued to the check issuer, outlining their obligations and consequences of their actions. This article will provide a detailed description of what a bad check and a bounced check mean, their implications, and the different types of notices associated with them. 1. What is a Bad Check? A bad check, also known as a non-sufficient funds (NSF) check or a dishonored check, refers to a check that has been issued by an individual or business without enough funds in the account to cover the amount written on the check. It is considered an illegal act as it intentionally deceives the recipient into believing they will receive the funds when deposited or cashed. 2. Consequences of Writing a Bad Check: When a bad check is issued, it can lead to various negative consequences for both parties involved. These may include: — Financial penalties and fees: The check issuer may be liable to pay penalties, fees, or other charges imposed by the bank, the recipient, or the legal system. — Legal actions: The recipient of the bad check can take legal actions against the check issuer, which may result in civil lawsuits or criminal charges, depending on the severity of the offense. — Damage to reputation: Issuing bad checks can tarnish the reputation of the individual or business responsible, potentially affecting future financial transactions and relationships. 3. What is a Bounced Check? A bounced check is a term often used interchangeably with a bad check. It refers to a check that has been returned unpaid by the bank due to insufficient funds, closed accounts, or other reasons stated by the financial institution. 4. Types of Surprise Arizona Notice of Dishonored Check — Civil: Within the Surprise Arizona legal system, different types of notices may be issued to inform the check issuer of the consequences of issuing a bad or bounced check. These may include: — Initial Notice: The initial notice serves as an official warning to the check issuer, informing them about the dishonored check and requesting immediate payment to avoid further legal actions. — Final Notice: If the check issuer fails to respond or pay the owed amount within a specified period mentioned in the initial notice, a final notice is sent. This notice highlights the potential legal implications if the payment is not made promptly. — Legal Action Notice: If the check issuer persists in neglecting the payment or resolving the issue, a notice informing the initiation of legal actions can be sent. This notice emphasizes the consequences, such as civil lawsuits or criminal charges. Conclusion: The Surprise Arizona Notice of Dishonored Check — Civil alerts check issuers about the implications and legal consequences associated with writing bad checks or bouncing checks. Understanding the significance of honoring financial commitments, avoiding bad check incidents, and responding promptly to notifications is crucial to maintaining a good reputation and avoiding legal troubles.