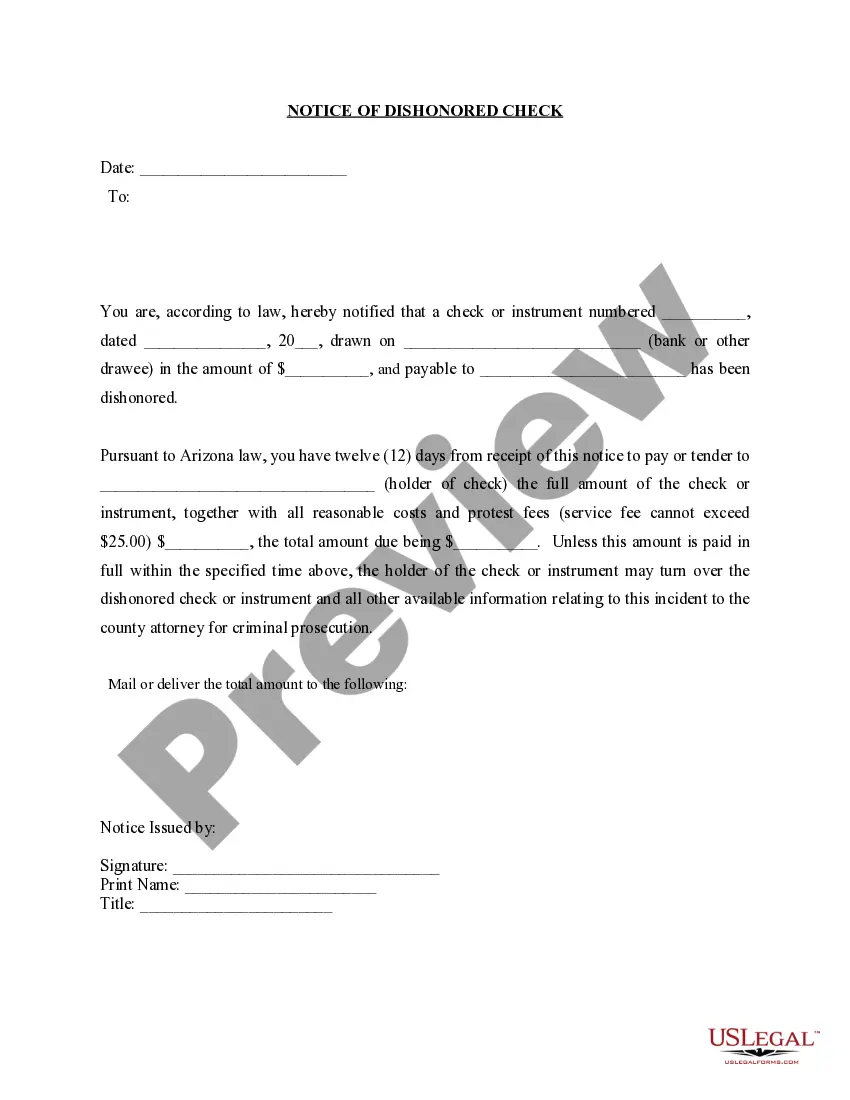

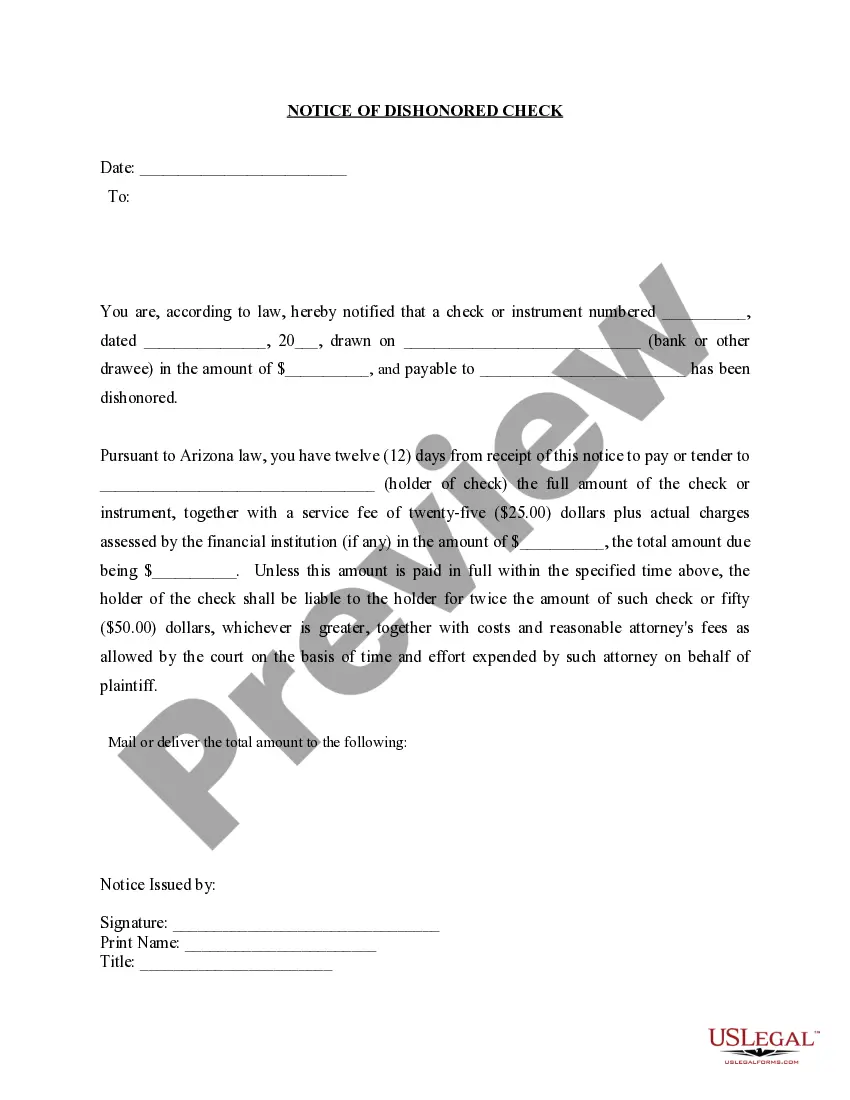

This is a Notice of Dishonored Check - Civil. A "dishonored check" (also known as a "bounced check" or "bad check") is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Title: Understanding the Tempe Arizona Notice of Dishonored Check — Civil Introduction: In Tempe, Arizona, individuals and businesses are protected against financial loss due to bad or bounced checks through a legal process that involves a Notice of Dishonored Check — Civil. By delving into the key aspects and types of this notice, this article aims to educate readers about the implications, consequences, and steps involved when dealing with bad checks in Tempe, Arizona. Types of Tempe Arizona Notice of Dishonored Check — Civil: 1. Formal Notice: When a check is returned unpaid due to insufficient funds, it triggers the issuance of a formal Notice of Dishonored Check — Civil by the recipient (payee). This notice serves to inform the check writer (drawer) about the dishonored check and the potential consequences if the matter remains unresolved. 2. Demand Letter: If the drawer fails to respond or doesn't remedy the situation within a specified timeframe after receiving the formal notice, the payee may escalate the matter by sending a Demand Letter. This letter reiterates the failure to resolve the bad check issue and requests immediate payment, often including additional charges or penalties to cover the costs incurred. 3. Litigation: If both the formal notice and the demand letter fail to elicit a response or resolution, the payee may choose to pursue legal action against the drawer. Filing a lawsuit is typically the last resort to recover the amount owed, and it may result in court proceedings, a judgment against the drawer, and potential financial repercussions. Important Keywords: 1. Bad check: A bad check refers to a check that cannot be processed or honored due to insufficient funds, a closed account, or any other reason preventing payment. 2. Bounced check: A bounced check is another term for a bad check. It describes a situation where a check is returned by the bank unpaid due to the reasons mentioned above. Consequences of a Tempe Arizona Notice of Dishonored Check — Civil: 1. Financial Penalties: The drawer may be required to pay the face value of the dishonored check, plus any associated bank fees, processing charges, or service fees imposed by the payee. 2. Legal Ramifications: Failure to address the matter can lead to a civil lawsuit. If the payee wins the case, the court may order the drawer to pay the outstanding amount, including legal expenses and potentially imposing a judgment against their creditworthiness. 3. Damage to Reputation: A bad check incident, especially if taken to court, can tarnish the drawer's reputation within the business community, potentially affecting future opportunities or business relationships. Conclusion: The Tempe Arizona Notice of Dishonored Check — Civil serves as an essential tool in addressing the issue of bad or bounced checks in Tempe, Arizona. Understanding the process and potential consequences outlined in this article will help individuals and businesses navigate this situation responsibly, aiming to reach a speedy resolution while minimizing any negative impact.Title: Understanding the Tempe Arizona Notice of Dishonored Check — Civil Introduction: In Tempe, Arizona, individuals and businesses are protected against financial loss due to bad or bounced checks through a legal process that involves a Notice of Dishonored Check — Civil. By delving into the key aspects and types of this notice, this article aims to educate readers about the implications, consequences, and steps involved when dealing with bad checks in Tempe, Arizona. Types of Tempe Arizona Notice of Dishonored Check — Civil: 1. Formal Notice: When a check is returned unpaid due to insufficient funds, it triggers the issuance of a formal Notice of Dishonored Check — Civil by the recipient (payee). This notice serves to inform the check writer (drawer) about the dishonored check and the potential consequences if the matter remains unresolved. 2. Demand Letter: If the drawer fails to respond or doesn't remedy the situation within a specified timeframe after receiving the formal notice, the payee may escalate the matter by sending a Demand Letter. This letter reiterates the failure to resolve the bad check issue and requests immediate payment, often including additional charges or penalties to cover the costs incurred. 3. Litigation: If both the formal notice and the demand letter fail to elicit a response or resolution, the payee may choose to pursue legal action against the drawer. Filing a lawsuit is typically the last resort to recover the amount owed, and it may result in court proceedings, a judgment against the drawer, and potential financial repercussions. Important Keywords: 1. Bad check: A bad check refers to a check that cannot be processed or honored due to insufficient funds, a closed account, or any other reason preventing payment. 2. Bounced check: A bounced check is another term for a bad check. It describes a situation where a check is returned by the bank unpaid due to the reasons mentioned above. Consequences of a Tempe Arizona Notice of Dishonored Check — Civil: 1. Financial Penalties: The drawer may be required to pay the face value of the dishonored check, plus any associated bank fees, processing charges, or service fees imposed by the payee. 2. Legal Ramifications: Failure to address the matter can lead to a civil lawsuit. If the payee wins the case, the court may order the drawer to pay the outstanding amount, including legal expenses and potentially imposing a judgment against their creditworthiness. 3. Damage to Reputation: A bad check incident, especially if taken to court, can tarnish the drawer's reputation within the business community, potentially affecting future opportunities or business relationships. Conclusion: The Tempe Arizona Notice of Dishonored Check — Civil serves as an essential tool in addressing the issue of bad or bounced checks in Tempe, Arizona. Understanding the process and potential consequences outlined in this article will help individuals and businesses navigate this situation responsibly, aiming to reach a speedy resolution while minimizing any negative impact.