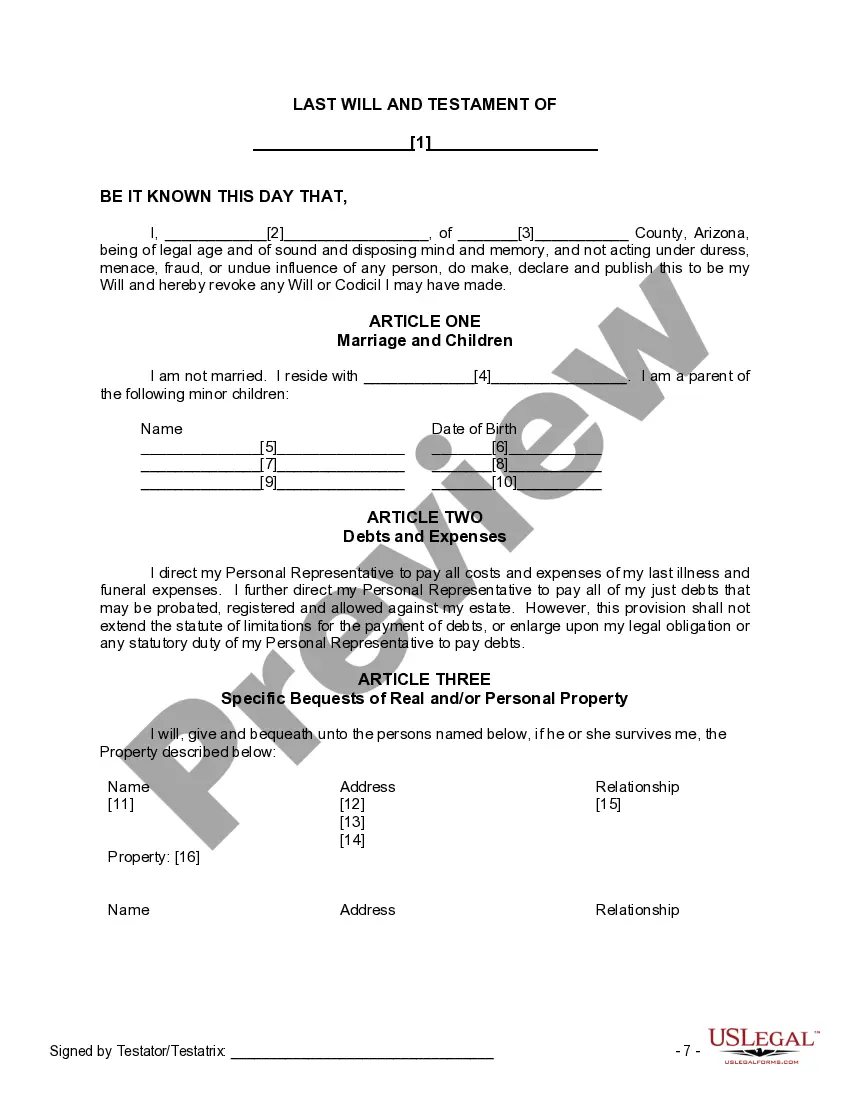

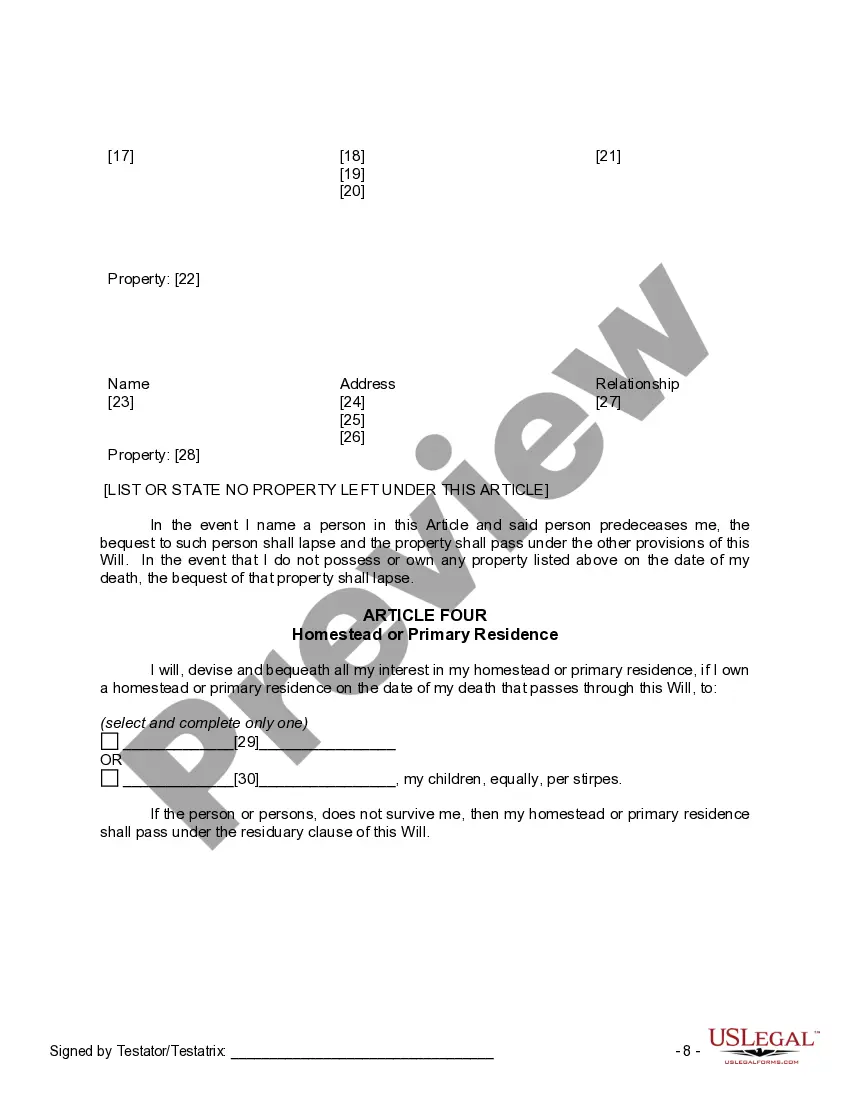

This package contains two wills for a man and woman living together with minor children. It is designed for persons that, although not married, desire to execute mutual wills leaving some of their property to the other and that have minor children. Instructions are also included.

The wills must be signed in the presence of two witnesses, not related to you or named in the wills. If your state has adopted a self-proving affidavit statute, a state specific self-proving affidavit is also included and requires the presence of a notary public to sign the wills. Surprise Arizona Mutual Wills or Last Will and Testaments for Unmarried Persons living together, not Married with Minor Children, are legal documents that allow unmarried couples to state their final wishes concerning the distribution of their assets, belongings, and properties after their deaths. These wills are specifically designed for couples who are not legally married and do not have children. Creating a mutual will is crucial for unmarried couples, as it ensures that their belongings and assets are passed on to their chosen beneficiaries upon their death. Without a will in place, the state's laws of intestacy will determine the distribution of their assets, which may not align with their preferences. Keywords: Surprise Arizona, Mutual Wills, Last Will and Testaments, Unmarried Persons, living together, not Married, Minor Children Different types of Surprise Arizona Mutual Wills or Last Will and Testaments for Unmarried Persons living together, not Married with Minor Children, include: 1. Simple Mutual Wills: These wills outline the distribution of assets in a straightforward manner, ensuring that each partner's assets go to their chosen beneficiaries upon their death. Simple Mutual Wills are suitable for couples with uncomplicated financial situations. 2. Complex Mutual Wills: These wills are more detailed and intricate, catering to unmarried couples with complex financial arrangements or shared businesses. Complex Mutual Wills may involve provisions for the division of jointly owned properties, savings accounts, investments, or even intellectual property rights. 3. Living Will and Testament: In addition to the distribution of assets, a living will and testament allows unmarried couples to express their healthcare wishes. This document specifies the type of medical treatment or life-sustaining measures desired or refused in the case of incapacitation or terminal illness. 4. Powers of Attorney: While not a will per se, Powers of Attorney are often included in estate planning for unmarried couples. These legal documents grant one partner the authority to make important financial and healthcare decisions on behalf of the other partner, should they become incapacitated or unable to advocate for themselves. 5. Revocable Living Trust: In some cases, unmarried couples may choose to establish a revocable living trust as part of their estate planning. This legal arrangement allows assets to be transferred into the trust, ensuring smooth transition and management of assets in case of death or incapacitation. By crafting Surprise Arizona Mutual Wills or Last Will and Testaments, unmarried couples can have peace of mind knowing that their wishes regarding asset distribution and healthcare decisions will be upheld after their passing. Seeking professional legal advice is highly recommended ensuring the will accurately reflects their intentions and adheres to local laws.

Surprise Arizona Mutual Wills or Last Will and Testaments for Unmarried Persons living together, not Married with Minor Children, are legal documents that allow unmarried couples to state their final wishes concerning the distribution of their assets, belongings, and properties after their deaths. These wills are specifically designed for couples who are not legally married and do not have children. Creating a mutual will is crucial for unmarried couples, as it ensures that their belongings and assets are passed on to their chosen beneficiaries upon their death. Without a will in place, the state's laws of intestacy will determine the distribution of their assets, which may not align with their preferences. Keywords: Surprise Arizona, Mutual Wills, Last Will and Testaments, Unmarried Persons, living together, not Married, Minor Children Different types of Surprise Arizona Mutual Wills or Last Will and Testaments for Unmarried Persons living together, not Married with Minor Children, include: 1. Simple Mutual Wills: These wills outline the distribution of assets in a straightforward manner, ensuring that each partner's assets go to their chosen beneficiaries upon their death. Simple Mutual Wills are suitable for couples with uncomplicated financial situations. 2. Complex Mutual Wills: These wills are more detailed and intricate, catering to unmarried couples with complex financial arrangements or shared businesses. Complex Mutual Wills may involve provisions for the division of jointly owned properties, savings accounts, investments, or even intellectual property rights. 3. Living Will and Testament: In addition to the distribution of assets, a living will and testament allows unmarried couples to express their healthcare wishes. This document specifies the type of medical treatment or life-sustaining measures desired or refused in the case of incapacitation or terminal illness. 4. Powers of Attorney: While not a will per se, Powers of Attorney are often included in estate planning for unmarried couples. These legal documents grant one partner the authority to make important financial and healthcare decisions on behalf of the other partner, should they become incapacitated or unable to advocate for themselves. 5. Revocable Living Trust: In some cases, unmarried couples may choose to establish a revocable living trust as part of their estate planning. This legal arrangement allows assets to be transferred into the trust, ensuring smooth transition and management of assets in case of death or incapacitation. By crafting Surprise Arizona Mutual Wills or Last Will and Testaments, unmarried couples can have peace of mind knowing that their wishes regarding asset distribution and healthcare decisions will be upheld after their passing. Seeking professional legal advice is highly recommended ensuring the will accurately reflects their intentions and adheres to local laws.