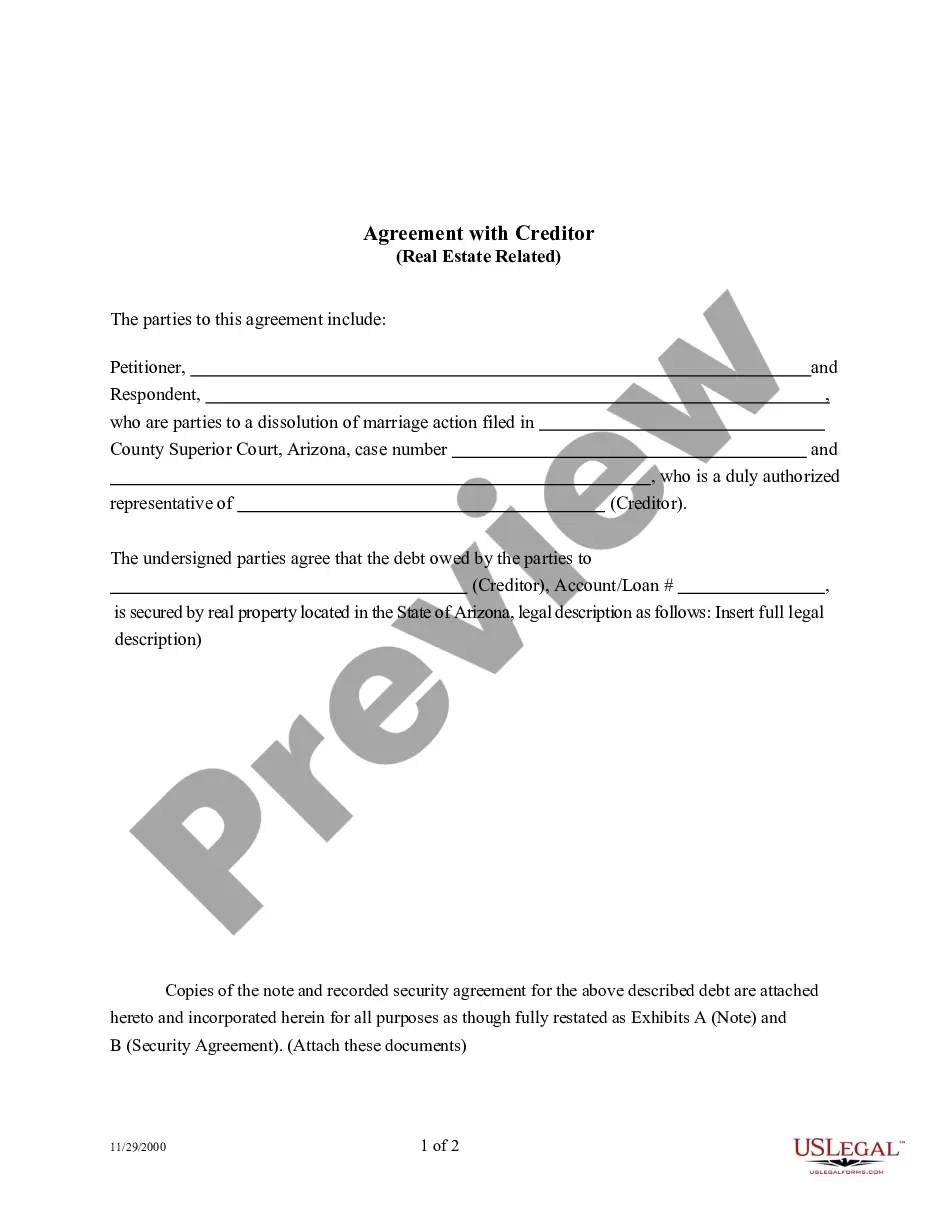

An Agreement with Creditor for Real Estate is a form used by parties to a dissolution of marriage action. It seeks to modify or reaffirm all real estate related to any of the couple's debts attained during the marriage.

A Chandler Arizona Agreement with Creditor is a legal contract that outlines the terms and conditions agreed upon between a debtor and a creditor in relation to real estate matters. This agreement serves as a binding contract between the parties involved and ensures clarity and protection for both sides. There are several types of Chandler Arizona Agreements with Creditor — Real Estate Related, including: 1. Chandler Arizona Loan Modification Agreement: This type of agreement is commonly entered into when a debtor is struggling to meet their mortgage obligations. It allows the debtor to negotiate more favorable terms with the creditor, such as lower interest rates, reduced monthly payments, or extended loan terms. A loan modification agreement can help prevent foreclosure and provide financial relief for the debtor. 2. Chandler Arizona Short Sale Agreement: In situations where a debtor is unable to pay off their mortgage and the value of the property is less than the outstanding loan balance, a short sale agreement may be arranged. This agreement allows the debtor to sell the property for less than what is owed on the mortgage, with the creditor agreeing to accept the sale proceeds as full satisfaction of the debt. Short sales can be a viable alternative to foreclosure for debtors in financial distress. 3. Chandler Arizona Deed in Lieu of Foreclosure Agreement: This type of agreement is an option for debtors who are unable to sell their property through a short sale or qualify for a loan modification. Instead of going through the foreclosure process, the debtor voluntarily transfers the property title to the creditor to satisfy the debt. A deed in lieu of foreclosure agreement can help debtors avoid the negative consequences of foreclosure and minimize damage to their credit. 4. Chandler Arizona Mortgage Forbearance Agreement: When a debtor experiences a temporary financial hardship, a mortgage forbearance agreement may be considered. This agreement allows the debtor to temporarily suspend or reduce mortgage payments for a specified period. Once the forbearance period ends, the debtor must resume making regular payments or work out a modified repayment plan with the creditor. Regardless of the specific type of Chandler Arizona Agreement with Creditor — Real Estate Related, it is crucial for both the debtor and creditor to thoroughly review and understand the terms and obligations set forth in the agreement. Consulting with a qualified attorney or real estate professional is highly recommended ensuring compliance with state laws and protection of rights for all parties involved.A Chandler Arizona Agreement with Creditor is a legal contract that outlines the terms and conditions agreed upon between a debtor and a creditor in relation to real estate matters. This agreement serves as a binding contract between the parties involved and ensures clarity and protection for both sides. There are several types of Chandler Arizona Agreements with Creditor — Real Estate Related, including: 1. Chandler Arizona Loan Modification Agreement: This type of agreement is commonly entered into when a debtor is struggling to meet their mortgage obligations. It allows the debtor to negotiate more favorable terms with the creditor, such as lower interest rates, reduced monthly payments, or extended loan terms. A loan modification agreement can help prevent foreclosure and provide financial relief for the debtor. 2. Chandler Arizona Short Sale Agreement: In situations where a debtor is unable to pay off their mortgage and the value of the property is less than the outstanding loan balance, a short sale agreement may be arranged. This agreement allows the debtor to sell the property for less than what is owed on the mortgage, with the creditor agreeing to accept the sale proceeds as full satisfaction of the debt. Short sales can be a viable alternative to foreclosure for debtors in financial distress. 3. Chandler Arizona Deed in Lieu of Foreclosure Agreement: This type of agreement is an option for debtors who are unable to sell their property through a short sale or qualify for a loan modification. Instead of going through the foreclosure process, the debtor voluntarily transfers the property title to the creditor to satisfy the debt. A deed in lieu of foreclosure agreement can help debtors avoid the negative consequences of foreclosure and minimize damage to their credit. 4. Chandler Arizona Mortgage Forbearance Agreement: When a debtor experiences a temporary financial hardship, a mortgage forbearance agreement may be considered. This agreement allows the debtor to temporarily suspend or reduce mortgage payments for a specified period. Once the forbearance period ends, the debtor must resume making regular payments or work out a modified repayment plan with the creditor. Regardless of the specific type of Chandler Arizona Agreement with Creditor — Real Estate Related, it is crucial for both the debtor and creditor to thoroughly review and understand the terms and obligations set forth in the agreement. Consulting with a qualified attorney or real estate professional is highly recommended ensuring compliance with state laws and protection of rights for all parties involved.