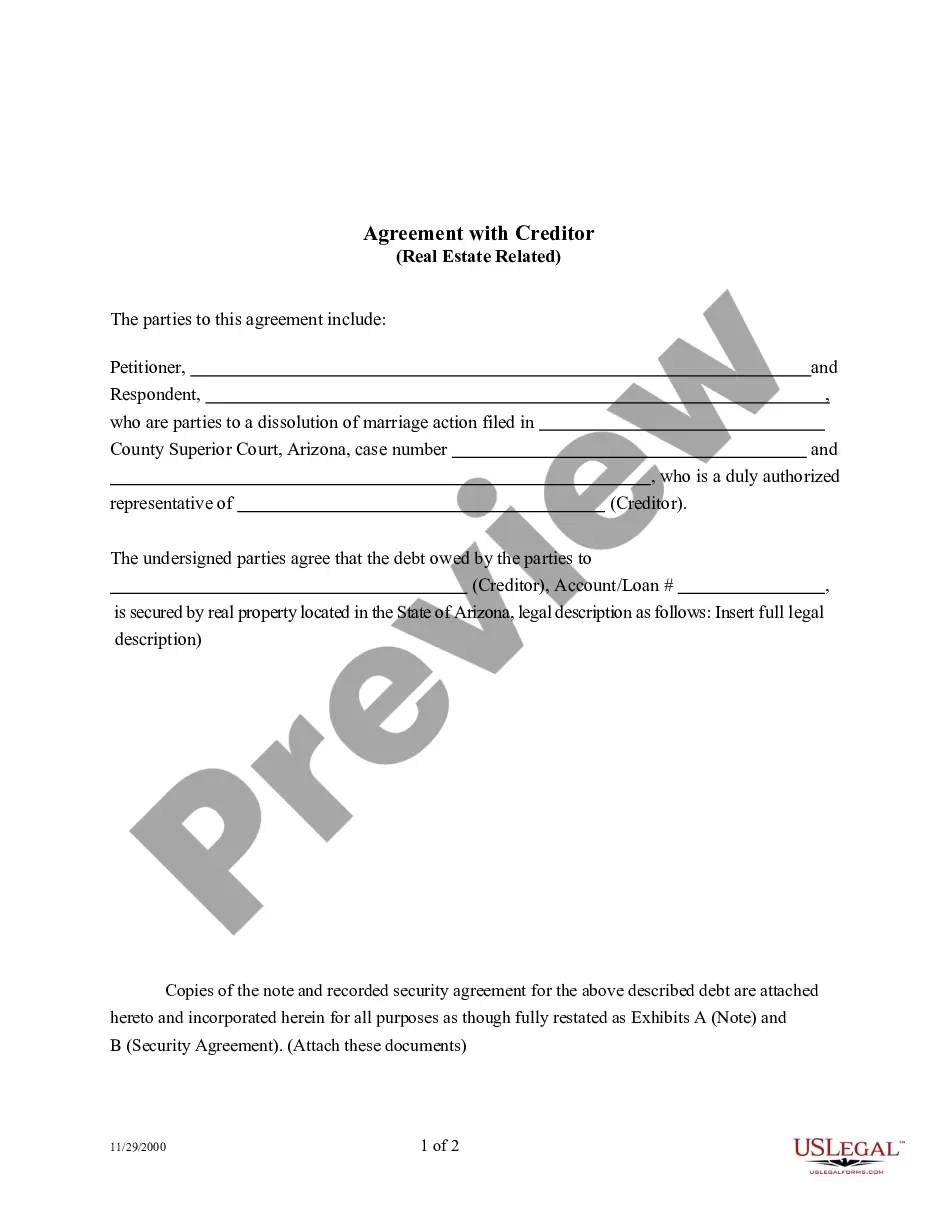

An Agreement with Creditor for Real Estate is a form used by parties to a dissolution of marriage action. It seeks to modify or reaffirm all real estate related to any of the couple's debts attained during the marriage.

The Phoenix Arizona Agreement with Creditor — Real Estate Related is a legal agreement specific to the state of Arizona that pertains to resolving debt and financial obligations related to real estate transactions. This agreement serves as a legally binding contract between a debtor, who is the individual or entity in debt, and a creditor, who is the individual or entity to whom the debt is owed. There are several types of Phoenix Arizona Agreements with Creditor — Real Estate Related, each pertaining to different aspects of real estate transactions. Key types of agreements include: 1. Mortgage Agreement: This agreement outlines the terms and conditions of a mortgage loan, typically used for purchases or refinancing of real property. It specifies the loan amount, interest rate, repayment schedule, and any applicable fees or penalties. 2. Promissory Note Agreement: This agreement serves as evidence of a debt owed by the borrower to the lender. It details the terms of repayment, including the principal amount, interest rate, and repayment schedule. The promissory note agreement is often used in seller-financed transactions or private lending. 3. Loan Modification Agreement: This agreement is entered into when a borrower is facing financial difficulties and seeks a modification of the existing loan terms. It may include changes in interest rates, loan duration, or monthly payment amounts, providing the borrower with more manageable repayment options. 4. Short Sale Agreement: This agreement is specific to situations where a homeowner wants to sell the property for an amount less than the outstanding mortgage balance owed to the lender. It outlines the terms of the sale, including the sale price, potential deficiency judgments, and the lender's acceptance of the reduced payoff. 5. Deed in Lieu of Foreclosure Agreement: This agreement occurs when a borrower voluntarily transfers the title of their property to the lender in exchange for forgiveness of the remaining debt. It specifies the terms under which the deed is transferred and may include provisions regarding the release of liability for the borrower. 6. Foreclosure Agreement: This agreement addresses the process of foreclosure, where the lender initiates legal action to repossess the property due to unpaid debt. It typically includes the terms and conditions of the foreclosure sale, redemption rights, and any potential deficiency judgments. Overall, the Phoenix Arizona Agreement with Creditor — Real Estate Related encompasses various legal documents and contracts, each designed to address specific scenarios related to real estate debt and financial obligations. These agreements play a crucial role in resolving financial disputes and protecting the rights of both parties involved in real estate transactions within the state of Arizona.