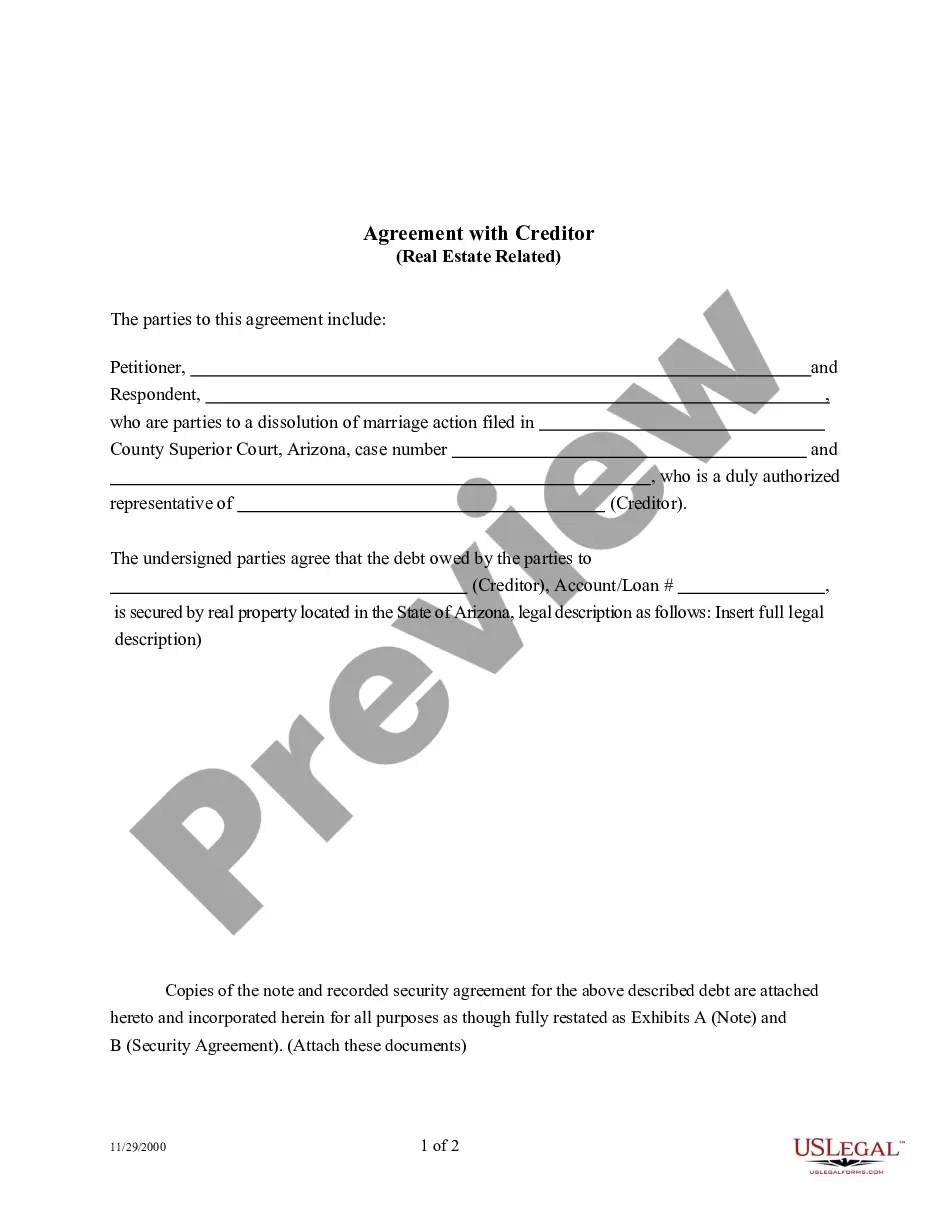

An Agreement with Creditor for Real Estate is a form used by parties to a dissolution of marriage action. It seeks to modify or reaffirm all real estate related to any of the couple's debts attained during the marriage.

The Lima Arizona Agreement with Creditor — Real Estate Related is a legally binding document that outlines the terms and conditions for resolving a debt-related issue between a debtor and creditor in the realm of real estate. This agreement is crucial for individuals or businesses in Lima, Arizona, who are seeking a structured and organized way to address their financial obligations in the real estate sector. The Lima Arizona Agreement with Creditor — Real Estate Related can be classified into several types based on different scenarios, such as: 1. Loan Modification Agreement: This type of agreement is used when the debtor and creditor want to modify the existing loan terms to ensure a smoother repayment process. It may involve changes in interest rates, repayment schedules, or even principal loan amounts. 2. Deed in Lieu of Foreclosure Agreement: In situations where the debtor is unable to meet their financial obligations, this agreement allows them to transfer the property's ownership to the creditor instead of going through the process of foreclosure. It offers potential benefits to both parties and avoids the time-consuming and costly foreclosure process. 3. Short Sale Agreement: When the debtor owes more on their property than its current market value, a short sale agreement allows them to sell the property for less than the outstanding debt amount. This agreement offers an alternative to foreclosure and allows the debtor to settle their debt while minimizing the financial impact. 4. Forbearance Agreement: In cases where the debtor faces temporary financial hardship due to factors like job loss or medical emergencies, a forbearance agreement can provide relief. It allows the debtor to temporarily suspend or reduce their mortgage payments, giving them time to recover financially before resuming regular repayments. 5. Release of Lien Agreement: This type of agreement is used when the debtor has fulfilled their debt obligations, and the creditor releases any liens or encumbrances on the property. It offers assurance to the debtor that the property is free from any claims by the creditor. In conclusion, the Lima Arizona Agreement with Creditor — Real Estate Related is a vital tool for individuals and businesses looking to resolve debt-related issues in the real estate sector. Different types of agreements, such as loan modification, deed in lieu of foreclosure, short sale, forbearance, and release of lien, cater to specific circumstances to ensure a fair and mutually beneficial resolution between the debtor and the creditor.The Lima Arizona Agreement with Creditor — Real Estate Related is a legally binding document that outlines the terms and conditions for resolving a debt-related issue between a debtor and creditor in the realm of real estate. This agreement is crucial for individuals or businesses in Lima, Arizona, who are seeking a structured and organized way to address their financial obligations in the real estate sector. The Lima Arizona Agreement with Creditor — Real Estate Related can be classified into several types based on different scenarios, such as: 1. Loan Modification Agreement: This type of agreement is used when the debtor and creditor want to modify the existing loan terms to ensure a smoother repayment process. It may involve changes in interest rates, repayment schedules, or even principal loan amounts. 2. Deed in Lieu of Foreclosure Agreement: In situations where the debtor is unable to meet their financial obligations, this agreement allows them to transfer the property's ownership to the creditor instead of going through the process of foreclosure. It offers potential benefits to both parties and avoids the time-consuming and costly foreclosure process. 3. Short Sale Agreement: When the debtor owes more on their property than its current market value, a short sale agreement allows them to sell the property for less than the outstanding debt amount. This agreement offers an alternative to foreclosure and allows the debtor to settle their debt while minimizing the financial impact. 4. Forbearance Agreement: In cases where the debtor faces temporary financial hardship due to factors like job loss or medical emergencies, a forbearance agreement can provide relief. It allows the debtor to temporarily suspend or reduce their mortgage payments, giving them time to recover financially before resuming regular repayments. 5. Release of Lien Agreement: This type of agreement is used when the debtor has fulfilled their debt obligations, and the creditor releases any liens or encumbrances on the property. It offers assurance to the debtor that the property is free from any claims by the creditor. In conclusion, the Lima Arizona Agreement with Creditor — Real Estate Related is a vital tool for individuals and businesses looking to resolve debt-related issues in the real estate sector. Different types of agreements, such as loan modification, deed in lieu of foreclosure, short sale, forbearance, and release of lien, cater to specific circumstances to ensure a fair and mutually beneficial resolution between the debtor and the creditor.