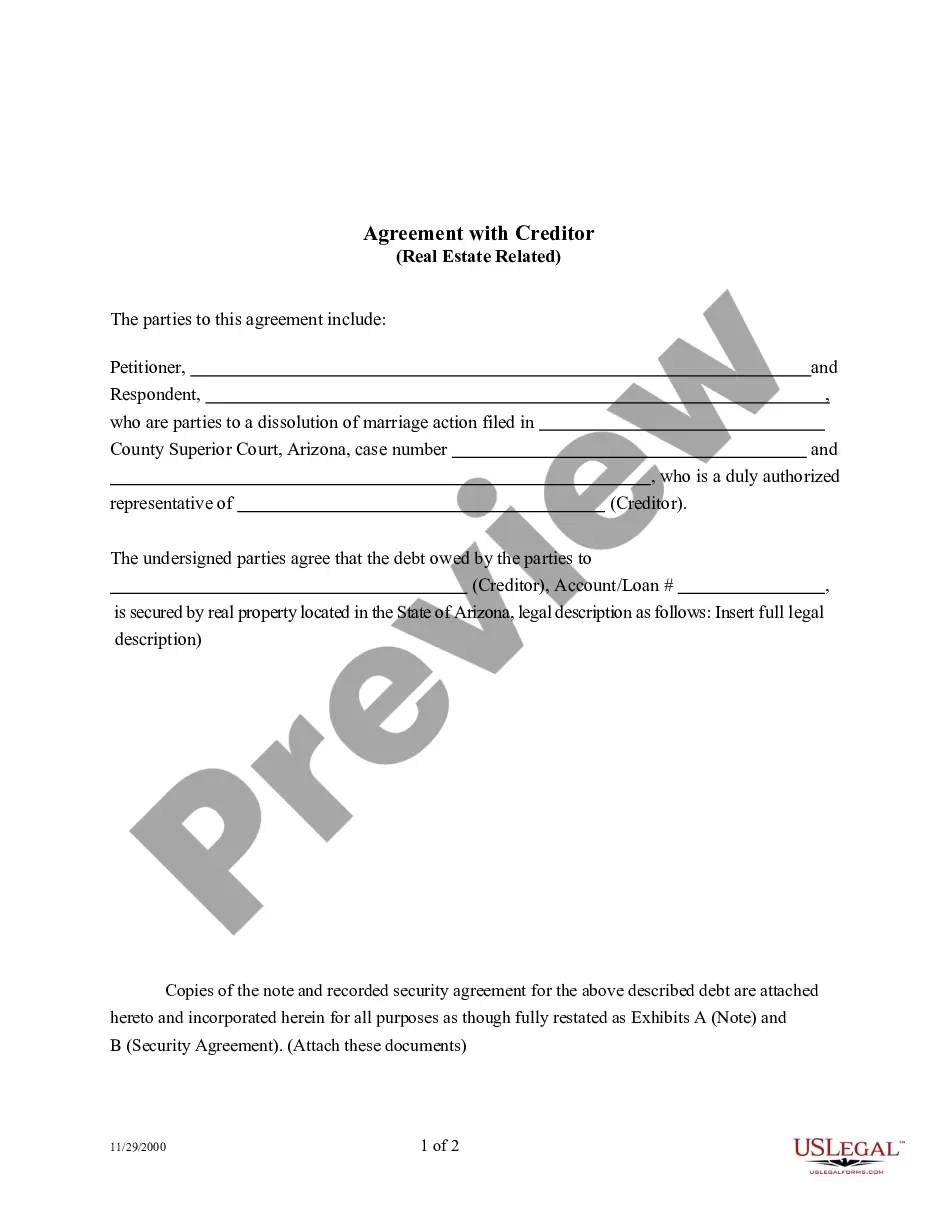

An Agreement with Creditor for Real Estate is a form used by parties to a dissolution of marriage action. It seeks to modify or reaffirm all real estate related to any of the couple's debts attained during the marriage.

Title: Understanding Tucson Arizona Agreements with Creditors in Real Estate Transactions Introduction: Tucson, Arizona, is a vibrant city known for its booming real estate industry. When it comes to agreements with creditors in real estate, potential buyers and sellers need to be familiar with the different types of agreements available to protect their interests. In this article, we will explore the various Tucson Arizona agreements with creditors specifically related to real estate transactions. 1. Tucson Arizona Agreement with Creditor — Purchase & Sale Agreement: This type of agreement establishes the terms and conditions when buying or selling a property in Tucson. It outlines the purchase price, financing details, earnest money, closing date, and contingencies. By signing this agreement, both parties are legally bound to fulfill their obligations in the transaction. 2. Tucson Arizona Agreement with Creditor — Mortgage Agreement: A mortgage agreement is a legal contract between a borrower and a lender, specifically addressing financial terms and collateral requirements for property purchase. In Tucson, this agreement plays a crucial role in securing the financing necessary to acquire the real estate. It states the loan amount, interest rate, payment schedule, and potential penalties. 3. Tucson Arizona Agreement with Creditor — Lease Agreement: In situations where individuals or businesses rent or lease properties from a creditor, a lease agreement becomes essential. This legally binding document outlines the obligations and rights of both parties regarding rent, utilities, property maintenance, and lease duration. Understanding the Tucson-specific lease agreement terms helps ensure a smooth rental process. 4. Tucson Arizona Agreement with Creditor — Option to Purchase Agreement: This agreement grants the potential buyer the exclusive right to purchase the property at a predetermined price within a specified timeframe. Useful for tenants looking to exercise their option to buy, this agreement sets out the terms, including the option fee, strike price, and the period within which the option can be exercised. 5. Tucson Arizona Agreement with Creditor — Land Contract Agreement: Also referred to as a contract for deed or installment land contract, this agreement is a financing option allowing the buyer to pay the purchase price directly to the seller over a specific period. In Tucson, this arrangement can be beneficial when obtaining traditional financing is challenging, as it provides an alternative option for both the buyer and the creditor. Conclusion: Understanding the various Tucson Arizona agreements with creditors related to real estate is crucial for individuals involved in property transactions in the city. From purchase and sale agreements to lease agreements or mortgage agreements, each serves a unique purpose in safeguarding the interests of both parties. By familiarizing oneself with these agreements, individuals can make informed decisions, protect their investments, and ensure a successful real estate experience in Tucson, Arizona.Title: Understanding Tucson Arizona Agreements with Creditors in Real Estate Transactions Introduction: Tucson, Arizona, is a vibrant city known for its booming real estate industry. When it comes to agreements with creditors in real estate, potential buyers and sellers need to be familiar with the different types of agreements available to protect their interests. In this article, we will explore the various Tucson Arizona agreements with creditors specifically related to real estate transactions. 1. Tucson Arizona Agreement with Creditor — Purchase & Sale Agreement: This type of agreement establishes the terms and conditions when buying or selling a property in Tucson. It outlines the purchase price, financing details, earnest money, closing date, and contingencies. By signing this agreement, both parties are legally bound to fulfill their obligations in the transaction. 2. Tucson Arizona Agreement with Creditor — Mortgage Agreement: A mortgage agreement is a legal contract between a borrower and a lender, specifically addressing financial terms and collateral requirements for property purchase. In Tucson, this agreement plays a crucial role in securing the financing necessary to acquire the real estate. It states the loan amount, interest rate, payment schedule, and potential penalties. 3. Tucson Arizona Agreement with Creditor — Lease Agreement: In situations where individuals or businesses rent or lease properties from a creditor, a lease agreement becomes essential. This legally binding document outlines the obligations and rights of both parties regarding rent, utilities, property maintenance, and lease duration. Understanding the Tucson-specific lease agreement terms helps ensure a smooth rental process. 4. Tucson Arizona Agreement with Creditor — Option to Purchase Agreement: This agreement grants the potential buyer the exclusive right to purchase the property at a predetermined price within a specified timeframe. Useful for tenants looking to exercise their option to buy, this agreement sets out the terms, including the option fee, strike price, and the period within which the option can be exercised. 5. Tucson Arizona Agreement with Creditor — Land Contract Agreement: Also referred to as a contract for deed or installment land contract, this agreement is a financing option allowing the buyer to pay the purchase price directly to the seller over a specific period. In Tucson, this arrangement can be beneficial when obtaining traditional financing is challenging, as it provides an alternative option for both the buyer and the creditor. Conclusion: Understanding the various Tucson Arizona agreements with creditors related to real estate is crucial for individuals involved in property transactions in the city. From purchase and sale agreements to lease agreements or mortgage agreements, each serves a unique purpose in safeguarding the interests of both parties. By familiarizing oneself with these agreements, individuals can make informed decisions, protect their investments, and ensure a successful real estate experience in Tucson, Arizona.