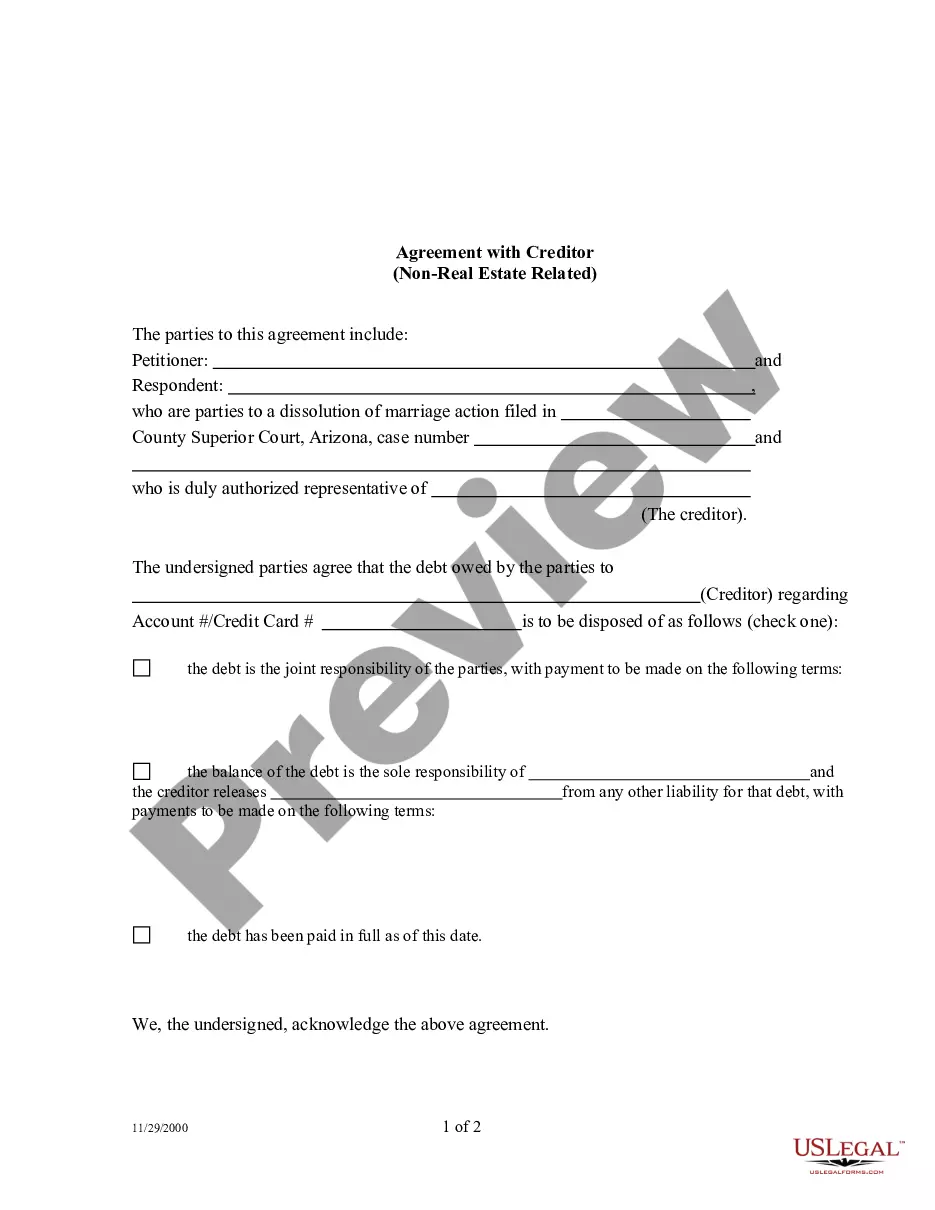

An Agreement with Creditor on Real Estate matters is a form used by both parties to a dissolution of marriage cause of action. It seeks to modify and/or reaffirm all non-real estate related debts.

Gilbert Arizona Agreement with Creditor — Debt Not Related to Real Estate In Gilbert, Arizona, when individuals or businesses find themselves in a financial struggle with their creditors, they may consider entering into an agreement to address their debt obligations. Gilbert Arizona Agreement with Creditor — Debt Not Related to Real Estate is a legally binding contract that outlines the terms and conditions agreed upon by the debtor and the creditor to settle non-real estate-related debts. There are several types of agreements that can be established between creditors and debtors in Gilbert, Arizona: 1. Debt Settlement Agreement: This type of agreement allows debtors to negotiate with their creditors to settle their debts for a reduced amount. Debtors can propose a lump sum payment or an installment plan to settle the outstanding debt balance. Creditors may accept a settlement offer to avoid the risk of non-payment or prolonged legal proceedings. 2. Repayment Agreement: A repayment agreement enables debtors to establish a structured plan to repay their debts over a specific period. This type of arrangement is suitable for debtors who have steady incomes but require more time to repay their debts in manageable installments. 3. Debt Consolidation Agreement: Gilbert debtors facing multiple debts can opt for a debt consolidation agreement. This type of agreement combines all their debts into a single loan or repayment plan, often with a lower interest rate. This allows the debtor to streamline their payments and potentially reduce the total amount owed. 4. Forbearance Agreement: A forbearance agreement provides temporary relief to debtors experiencing financial hardship. This type of agreement allows the debtor to temporarily suspend or reduce their monthly payments or interest rates for a specified period. Once this period concludes, the debtor resumes regular payments. Regardless of the type of agreement, both the debtor and creditor must agree to the terms stated in the contract. It is essential to carefully review the terms and conditions, including the payment schedule, interest rates, penalties, and any additional fees. Failing to fulfill the agreed-upon terms can result in legal consequences or further financial strain. The Gilbert Arizona Agreement with Creditor — Debt Not Related to Real Estate is a useful tool for debtors seeking to resolve their financial burdens and regain control of their finances. It provides options for debtors to negotiate, settle, consolidate, or restructure their debts with their creditors based on their unique circumstances. Seeking professional advice from financial advisors or attorneys familiar with debt resolution can assist debtors in making informed decisions regarding these agreements.