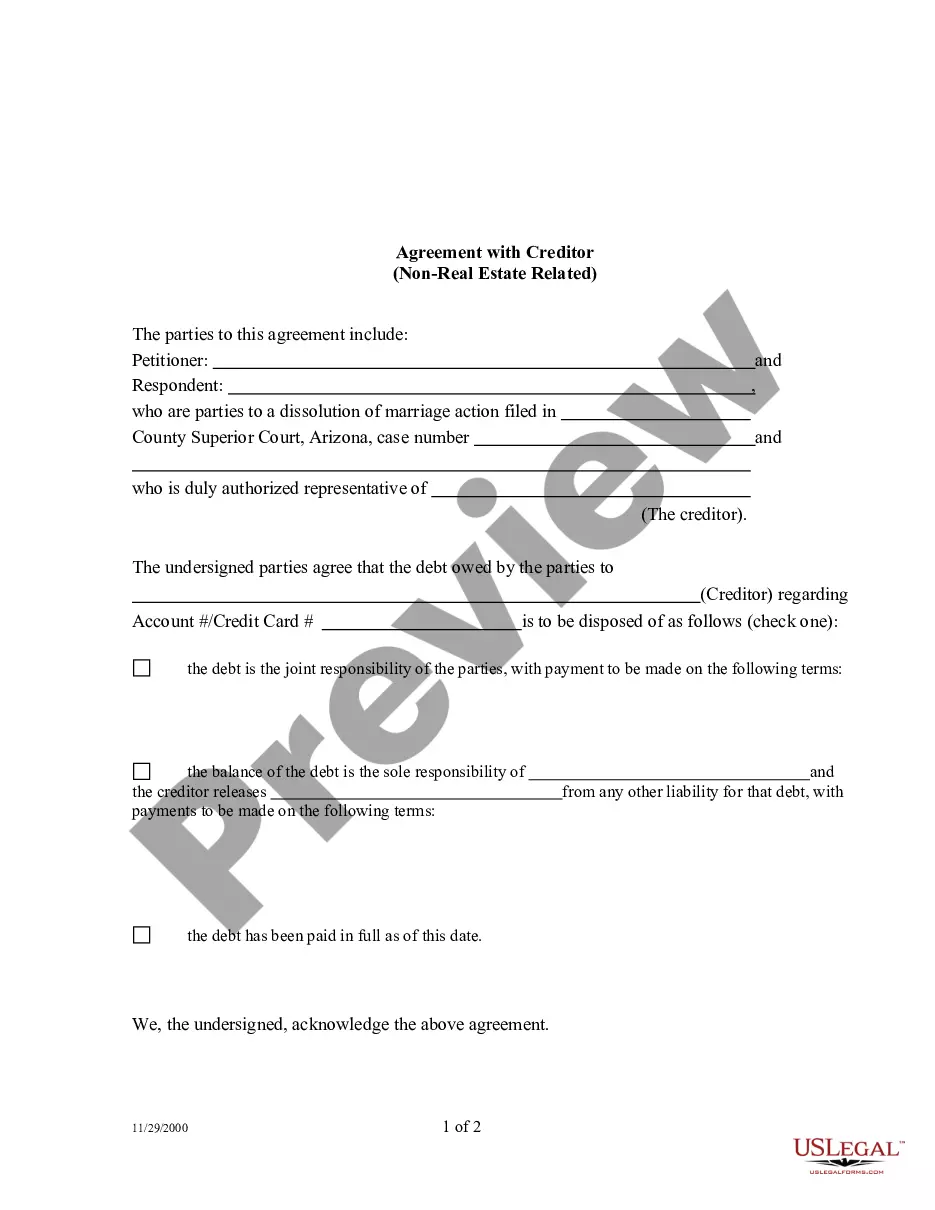

An Agreement with Creditor on Real Estate matters is a form used by both parties to a dissolution of marriage cause of action. It seeks to modify and/or reaffirm all non-real estate related debts.

Glendale Arizona Agreement with Creditor — Debt Not Related to Real Estate: In Glendale, Arizona, individuals or businesses facing debt-related challenges not related to real estate can enter into an agreement with a creditor to address and resolve their financial obligations. This type of agreement is designed to provide a negotiated settlement between the debtor and creditor, allowing both parties to reach a mutually beneficial resolution. Keywords: Glendale Arizona, Agreement with Creditor, Debt, Not Related to Real Estate, Negotiated settlement, Financial obligations, Debt resolution, Creditors, Debtor. Types of Glendale Arizona Agreement with Creditor — Debt Not Related to Real Estate: 1. Payment Plan Agreement: This type of agreement is commonly entered into when the debtor is unable to pay the full amount owed to the creditor immediately. A payment plan is established, outlining the specific terms, duration, and amounts to be paid at regular intervals until the debt is cleared. 2. Debt Settlement Agreement: In cases where the debtor is facing significant financial hardship and cannot repay the full debt amount, a debt settlement agreement may be reached. This involves negotiations to reduce the overall debt owed, typically in exchange for a lump sum payment or a structured payment plan. 3. Debt Consolidation Agreement: When a debtor has multiple debts with different creditors, a debt consolidation agreement can be pursued. This type of agreement involves combining all debts into a single loan or repayment plan, often with reduced interest rates and extended repayment terms. 4. Forbearance Agreement: A forbearance agreement is typically utilized when a debtor is experiencing temporary financial difficulties. The creditor agrees to temporarily suspend or reduce the debtor's monthly payments for a specified period, allowing the debtor time to improve their financial situation. 5. Debt Repayment Agreement: This agreement outlines the terms and conditions for repaying the debt in full, including the amount, interest rate, and repayment timeline. It provides a structure for both parties to ensure timely and complete debt repayment. 6. Wage Garnishment Agreement: In cases where a creditor has obtained a legal judgment against a debtor, a wage garnishment agreement can be negotiated. This involves an agreement where a portion of the debtor's wages is deducted directly from their paycheck and allocated towards satisfying the debt. By exploring these various types of Glendale Arizona agreements with creditors for debts not related to real estate, individuals and businesses can find suitable solutions to resolve their financial obligations and work towards a fresh start. Overall, Glendale Arizona offers a range of agreements for debt resolution, catering to unique financial circumstances and providing opportunities for debtors to regain financial stability and rebuild their creditworthiness.Glendale Arizona Agreement with Creditor — Debt Not Related to Real Estate: In Glendale, Arizona, individuals or businesses facing debt-related challenges not related to real estate can enter into an agreement with a creditor to address and resolve their financial obligations. This type of agreement is designed to provide a negotiated settlement between the debtor and creditor, allowing both parties to reach a mutually beneficial resolution. Keywords: Glendale Arizona, Agreement with Creditor, Debt, Not Related to Real Estate, Negotiated settlement, Financial obligations, Debt resolution, Creditors, Debtor. Types of Glendale Arizona Agreement with Creditor — Debt Not Related to Real Estate: 1. Payment Plan Agreement: This type of agreement is commonly entered into when the debtor is unable to pay the full amount owed to the creditor immediately. A payment plan is established, outlining the specific terms, duration, and amounts to be paid at regular intervals until the debt is cleared. 2. Debt Settlement Agreement: In cases where the debtor is facing significant financial hardship and cannot repay the full debt amount, a debt settlement agreement may be reached. This involves negotiations to reduce the overall debt owed, typically in exchange for a lump sum payment or a structured payment plan. 3. Debt Consolidation Agreement: When a debtor has multiple debts with different creditors, a debt consolidation agreement can be pursued. This type of agreement involves combining all debts into a single loan or repayment plan, often with reduced interest rates and extended repayment terms. 4. Forbearance Agreement: A forbearance agreement is typically utilized when a debtor is experiencing temporary financial difficulties. The creditor agrees to temporarily suspend or reduce the debtor's monthly payments for a specified period, allowing the debtor time to improve their financial situation. 5. Debt Repayment Agreement: This agreement outlines the terms and conditions for repaying the debt in full, including the amount, interest rate, and repayment timeline. It provides a structure for both parties to ensure timely and complete debt repayment. 6. Wage Garnishment Agreement: In cases where a creditor has obtained a legal judgment against a debtor, a wage garnishment agreement can be negotiated. This involves an agreement where a portion of the debtor's wages is deducted directly from their paycheck and allocated towards satisfying the debt. By exploring these various types of Glendale Arizona agreements with creditors for debts not related to real estate, individuals and businesses can find suitable solutions to resolve their financial obligations and work towards a fresh start. Overall, Glendale Arizona offers a range of agreements for debt resolution, catering to unique financial circumstances and providing opportunities for debtors to regain financial stability and rebuild their creditworthiness.