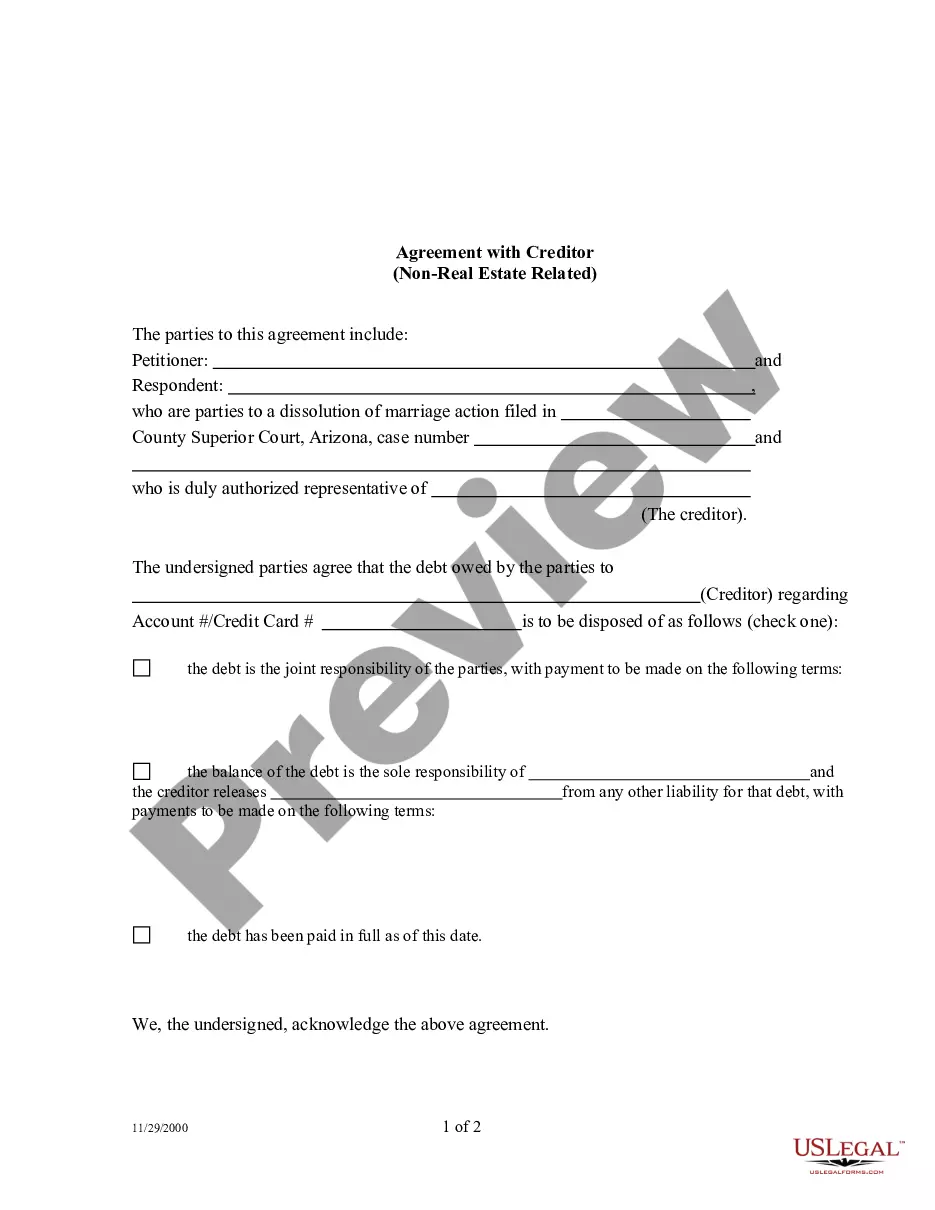

An Agreement with Creditor on Real Estate matters is a form used by both parties to a dissolution of marriage cause of action. It seeks to modify and/or reaffirm all non-real estate related debts.

Maricopa Arizona Agreement with Creditor — Debt Not Related to Real Estate Introduction: The Maricopa Arizona Agreement with Creditor — Debt Not Related to Real Estate is a legally binding document that outlines the terms and conditions under which an individual or business in Maricopa, Arizona, agrees to settle a debt with a creditor that is not related to real estate. This agreement ensures clarity and protection for both parties involved, fostering effective communication, and avoiding any misunderstandings or disputes. Types of Maricopa Arizona Agreement with Creditor — Debt Not Related to Real Estate: 1. Personal Loan Agreement: This agreement is entered into when an individual in Maricopa, Arizona, borrows money from a creditor for personal reasons, such as medical expenses, education, or personal investments. 2. Credit Card Debt Settlement Agreement: This agreement is established when an individual or business in Maricopa, Arizona, negotiates with a creditor to settle outstanding credit card debt. It includes terms related to the amount of the settlement, payment terms, and any potential adjustments or waivers of interest and fees. 3. Business Debt Agreement: This type of agreement applies to businesses in Maricopa, Arizona, that have acquired debt unrelated to real estate. It outlines the terms for repayment, including interest rates, installment plans, and any potential consequences for defaulting on the agreed terms. Key Elements of the Agreement: 1. Identification of Parties: The agreement should clearly identify the creditor and debtor involved, including their legal names and addresses. 2. Description of Debt: The agreement should provide a clear description of the debt owed, including the amount, dates, and any specifics related to the transaction. 3. Payment Terms: This section outlines how the debt will be repaid, specifying the agreed-upon installment amounts, due dates, and payment methods, such as direct bank transfers or checks. 4. Interest and Penalties: If applicable, the agreement should outline the agreed-upon interest rates, penalties for late payments, and potential consequences for defaulting on the agreed terms. 5. Dispute Resolution: In case of any disagreements or disputes, the agreement should include provisions for the resolution, such as mediation or arbitration. 6. Confidentiality: It is common for such agreements to include a confidentiality clause, ensuring that both parties keep details of the debt settlement confidential between themselves. 7. Termination: The agreement should include conditions under which either party can terminate the agreement, whether due to full repayment of the debt or other agreed-upon circumstances. Conclusion: The Maricopa Arizona Agreement with Creditor — Debt Not Related to Real Estate is crucial for individuals and businesses in Maricopa, Arizona, to settle various non-real estate debts. It ensures transparency, defines the responsibilities of both parties, and protects their interests. Whether it is a personal loan, credit card debt settlement, or a business debt agreement, this agreement provides a clear framework for timely debt repayment and minimizes the potential for future conflicts.Maricopa Arizona Agreement with Creditor — Debt Not Related to Real Estate Introduction: The Maricopa Arizona Agreement with Creditor — Debt Not Related to Real Estate is a legally binding document that outlines the terms and conditions under which an individual or business in Maricopa, Arizona, agrees to settle a debt with a creditor that is not related to real estate. This agreement ensures clarity and protection for both parties involved, fostering effective communication, and avoiding any misunderstandings or disputes. Types of Maricopa Arizona Agreement with Creditor — Debt Not Related to Real Estate: 1. Personal Loan Agreement: This agreement is entered into when an individual in Maricopa, Arizona, borrows money from a creditor for personal reasons, such as medical expenses, education, or personal investments. 2. Credit Card Debt Settlement Agreement: This agreement is established when an individual or business in Maricopa, Arizona, negotiates with a creditor to settle outstanding credit card debt. It includes terms related to the amount of the settlement, payment terms, and any potential adjustments or waivers of interest and fees. 3. Business Debt Agreement: This type of agreement applies to businesses in Maricopa, Arizona, that have acquired debt unrelated to real estate. It outlines the terms for repayment, including interest rates, installment plans, and any potential consequences for defaulting on the agreed terms. Key Elements of the Agreement: 1. Identification of Parties: The agreement should clearly identify the creditor and debtor involved, including their legal names and addresses. 2. Description of Debt: The agreement should provide a clear description of the debt owed, including the amount, dates, and any specifics related to the transaction. 3. Payment Terms: This section outlines how the debt will be repaid, specifying the agreed-upon installment amounts, due dates, and payment methods, such as direct bank transfers or checks. 4. Interest and Penalties: If applicable, the agreement should outline the agreed-upon interest rates, penalties for late payments, and potential consequences for defaulting on the agreed terms. 5. Dispute Resolution: In case of any disagreements or disputes, the agreement should include provisions for the resolution, such as mediation or arbitration. 6. Confidentiality: It is common for such agreements to include a confidentiality clause, ensuring that both parties keep details of the debt settlement confidential between themselves. 7. Termination: The agreement should include conditions under which either party can terminate the agreement, whether due to full repayment of the debt or other agreed-upon circumstances. Conclusion: The Maricopa Arizona Agreement with Creditor — Debt Not Related to Real Estate is crucial for individuals and businesses in Maricopa, Arizona, to settle various non-real estate debts. It ensures transparency, defines the responsibilities of both parties, and protects their interests. Whether it is a personal loan, credit card debt settlement, or a business debt agreement, this agreement provides a clear framework for timely debt repayment and minimizes the potential for future conflicts.