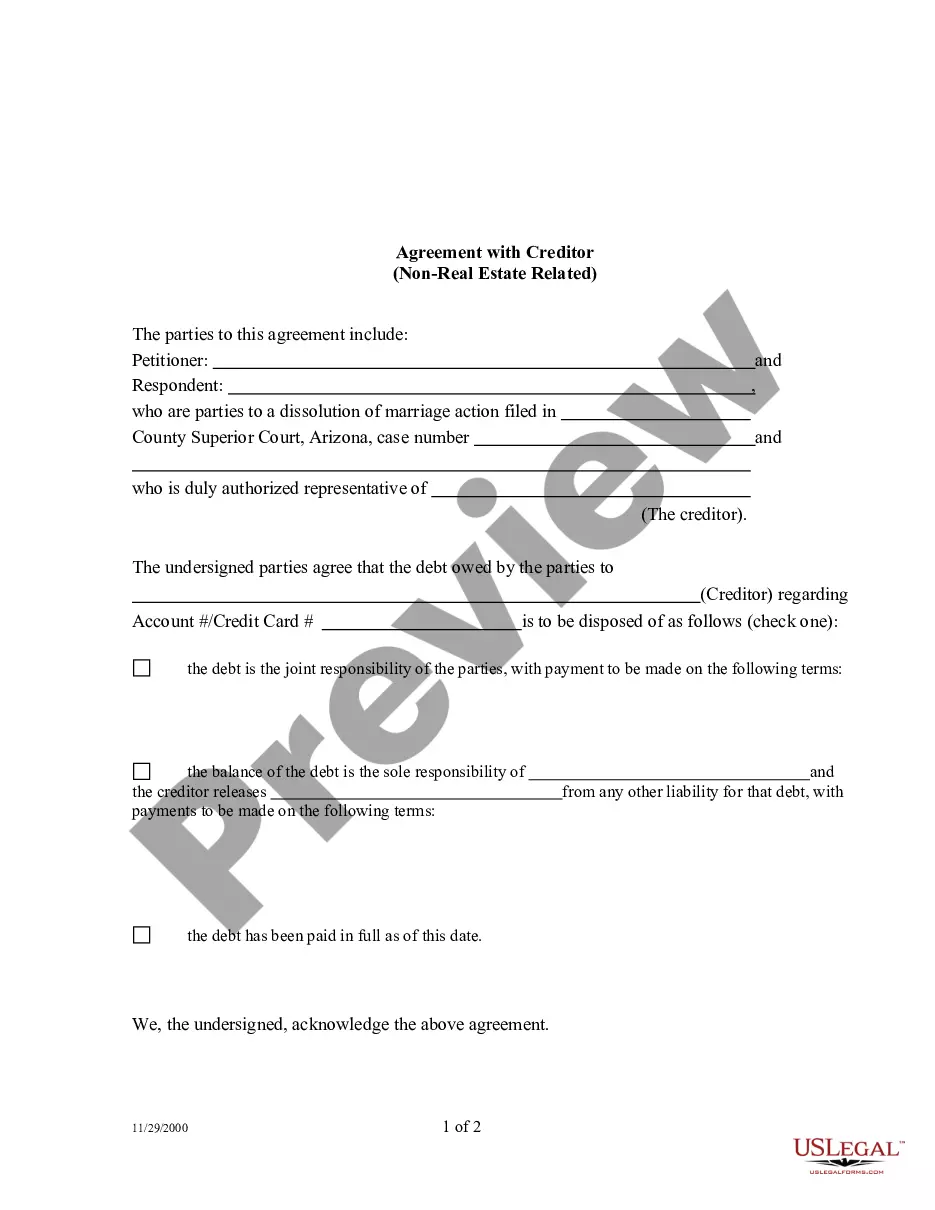

An Agreement with Creditor on Real Estate matters is a form used by both parties to a dissolution of marriage cause of action. It seeks to modify and/or reaffirm all non-real estate related debts.

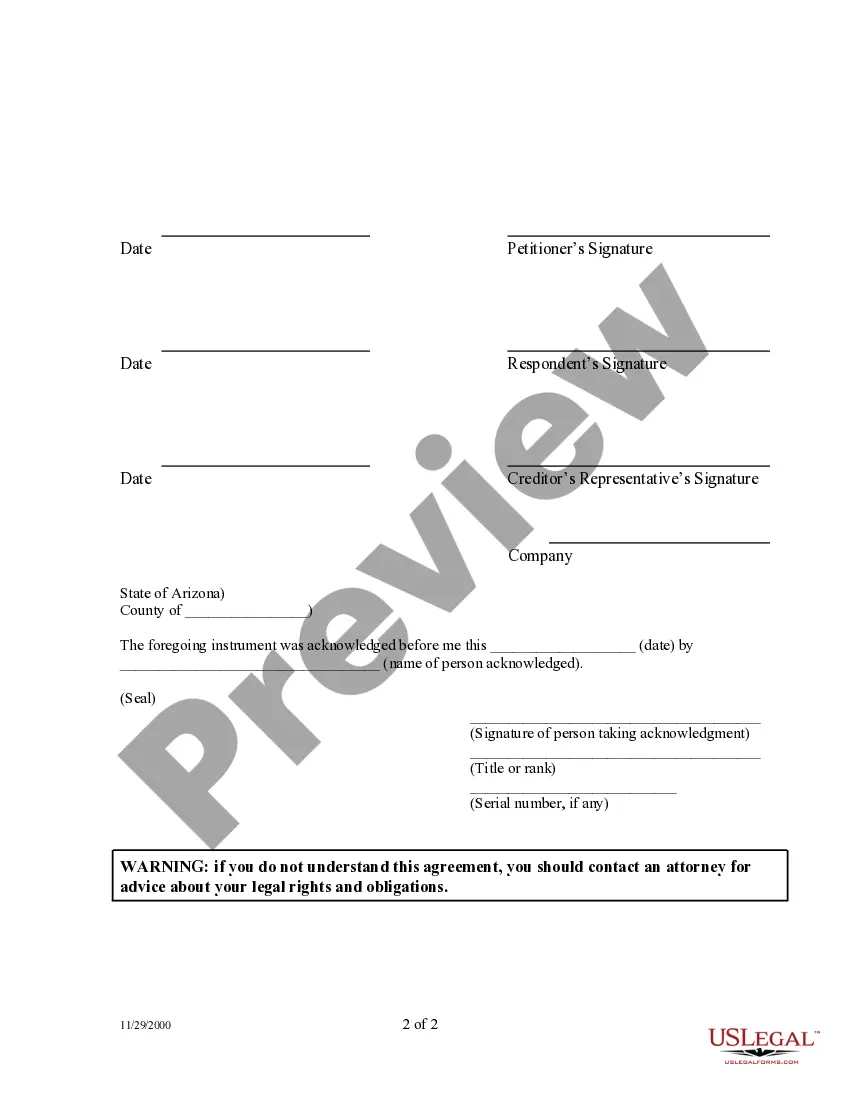

The Phoenix Arizona Agreement with Creditor — Debt Not Related to Real Estate refers to a legally binding contract that is designed to resolve outstanding debts owed by individuals or businesses in Phoenix, Arizona, specifically those that are not associated with real estate. This agreement is a crucial mechanism for debtors and creditors to come to a mutually beneficial arrangement and find a resolution to unpaid debts and financial obligations, without involving real estate assets. There are different types of Phoenix Arizona Agreement with Creditor — Debt Not Related to Real Estate, including: 1. Debt Settlement Agreement: This type of agreement typically involves the debtor negotiating with the creditor to settle the debt for a reduced amount. In many cases, a lump sum payment is negotiated, allowing the debtor to pay off the debt for less than the original amount owed. 2. Payment Plan Agreement: This agreement structure allows the debtor to create a repayment plan, usually in monthly installments, to gradually fulfill the debt owed. The debtor and creditor agree on specific terms such as the monthly payment amount, payment duration, and any additional fees or interest rates. 3. Debt Consolidation Agreement: This type of agreement is commonly used when an individual or business has multiple outstanding debts. It involves merging multiple debts into a single loan or payment plan, often with the goal of reducing interest rates or monthly payments. Regardless of the specific type of agreement, these contracts typically outline the details of the debt, including the amount owed, the identity of the creditor and debtor, and the agreed-upon terms for repayment. It is essential for the agreement to clearly state the consequences of non-payment, any interest rates or penalties that may apply, and any provisions for late payments or changes in circumstances. Furthermore, the Phoenix Arizona Agreement with Creditor — Debt Not Related to Real Estate should comply with applicable state laws, including regulations regarding fair debt collection practices, consumer protection, and contract law. This ensures that both parties are protected and that the agreement is enforceable in a court of law if necessary. Overall, the Phoenix Arizona Agreement with Creditor — Debt Not Related to Real Estate is a vital tool that allows debtors and creditors to establish clear terms for debt resolution. It provides a structured framework for negotiation, repayment plans, and overall debt management, fostering financial stability for both parties involved.The Phoenix Arizona Agreement with Creditor — Debt Not Related to Real Estate refers to a legally binding contract that is designed to resolve outstanding debts owed by individuals or businesses in Phoenix, Arizona, specifically those that are not associated with real estate. This agreement is a crucial mechanism for debtors and creditors to come to a mutually beneficial arrangement and find a resolution to unpaid debts and financial obligations, without involving real estate assets. There are different types of Phoenix Arizona Agreement with Creditor — Debt Not Related to Real Estate, including: 1. Debt Settlement Agreement: This type of agreement typically involves the debtor negotiating with the creditor to settle the debt for a reduced amount. In many cases, a lump sum payment is negotiated, allowing the debtor to pay off the debt for less than the original amount owed. 2. Payment Plan Agreement: This agreement structure allows the debtor to create a repayment plan, usually in monthly installments, to gradually fulfill the debt owed. The debtor and creditor agree on specific terms such as the monthly payment amount, payment duration, and any additional fees or interest rates. 3. Debt Consolidation Agreement: This type of agreement is commonly used when an individual or business has multiple outstanding debts. It involves merging multiple debts into a single loan or payment plan, often with the goal of reducing interest rates or monthly payments. Regardless of the specific type of agreement, these contracts typically outline the details of the debt, including the amount owed, the identity of the creditor and debtor, and the agreed-upon terms for repayment. It is essential for the agreement to clearly state the consequences of non-payment, any interest rates or penalties that may apply, and any provisions for late payments or changes in circumstances. Furthermore, the Phoenix Arizona Agreement with Creditor — Debt Not Related to Real Estate should comply with applicable state laws, including regulations regarding fair debt collection practices, consumer protection, and contract law. This ensures that both parties are protected and that the agreement is enforceable in a court of law if necessary. Overall, the Phoenix Arizona Agreement with Creditor — Debt Not Related to Real Estate is a vital tool that allows debtors and creditors to establish clear terms for debt resolution. It provides a structured framework for negotiation, repayment plans, and overall debt management, fostering financial stability for both parties involved.