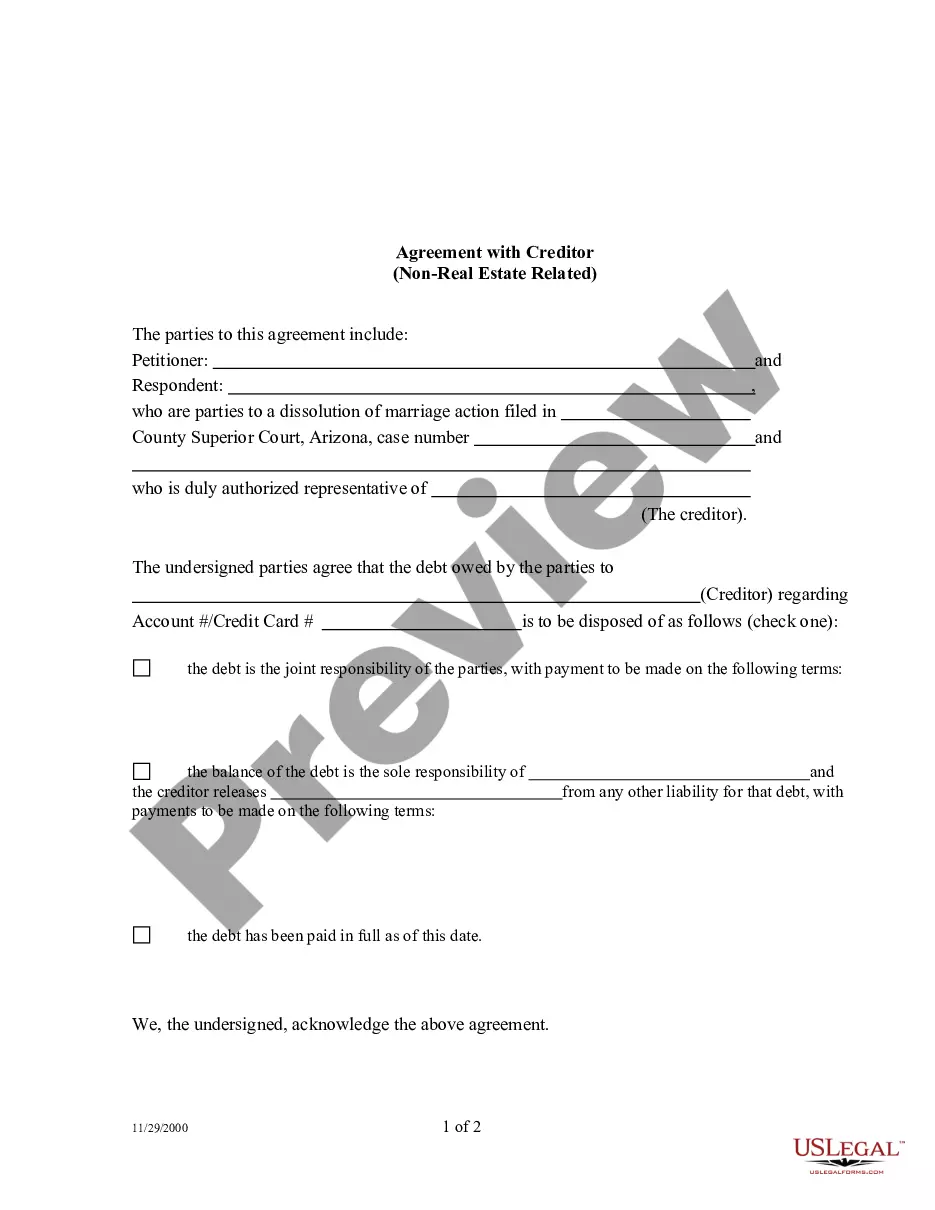

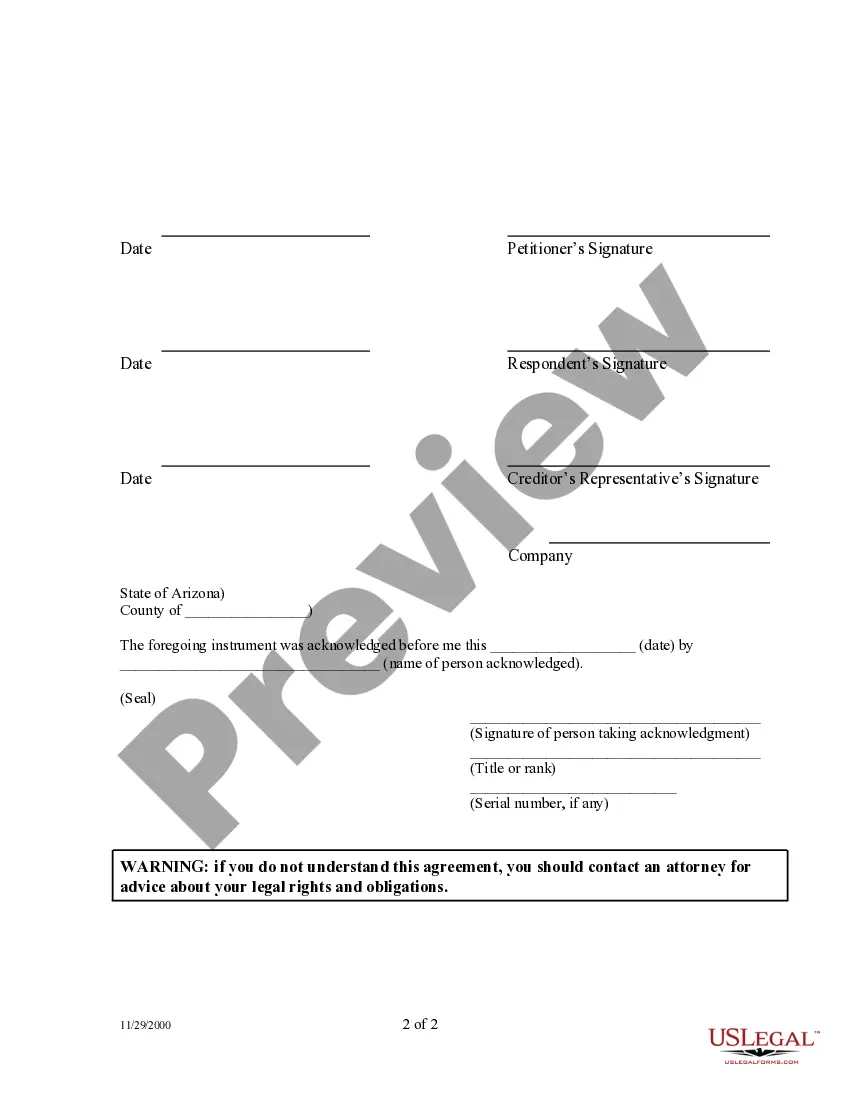

An Agreement with Creditor on Real Estate matters is a form used by both parties to a dissolution of marriage cause of action. It seeks to modify and/or reaffirm all non-real estate related debts.

Lima Arizona Agreement with Creditor — Debt Not Related to Real Estate is a legal document that outlines the terms and conditions agreed upon between a debtor and a creditor for non-real estate related debts. This agreement aims to formalize the agreement and provide a clear understanding of each party's obligations and responsibilities. The agreement typically includes the following key elements: 1. Parties involved: The agreement identifies the debtor and the creditor involved in the transaction. This could include individuals, businesses, or even government entities. 2. Debt details: The agreement outlines the specific details of the debt, such as the amount owed, the date the debt was incurred, and any applicable interest rates or penalties. 3. Payment terms: It specifies the agreed-upon terms for repayment, including the frequency of payments, the duration of the repayment period, and the preferred method of payment. 4. Settlement options: In some cases, the agreement may include provisions for debt settlement or negotiation, allowing the debtor to propose alternative payment arrangements or reduced settlement amounts. 5. Consequences of default: The agreement usually outlines the consequences of default, including potential legal actions, penalties, or additional fees that may be imposed in case of non-payment. 6. Confidentiality clause: To protect the privacy of both parties, the agreement may include a confidentiality clause, prohibiting the disclosure of any sensitive information related to the debt. Different types of Lima Arizona Agreement with Creditor — Debt Not Related to Real Estate may include: 1. Personal Loan Agreement: Used when an individual borrower borrows money from a creditor for personal expenses. 2. Credit Card Debt Agreement: Applied in cases where the debtor owes a certain amount on a credit card account. 3. Business Debt Agreement: Pertains to debts incurred by a business entity, excluding any real estate-related loans. 4. Government Debt Agreement: This type of agreement is formed between government entities and a creditor for any non-real estate related debt obligations. In conclusion, the Lima Arizona Agreement with Creditor — Debt Not Related to Real Estate serves as a legally binding contract that protects the rights of both the debtor and the creditor in cases where debt repayment is required. It ensures that both parties are aware of their responsibilities and provides a framework for resolving any potential disputes that may arise during the repayment process.