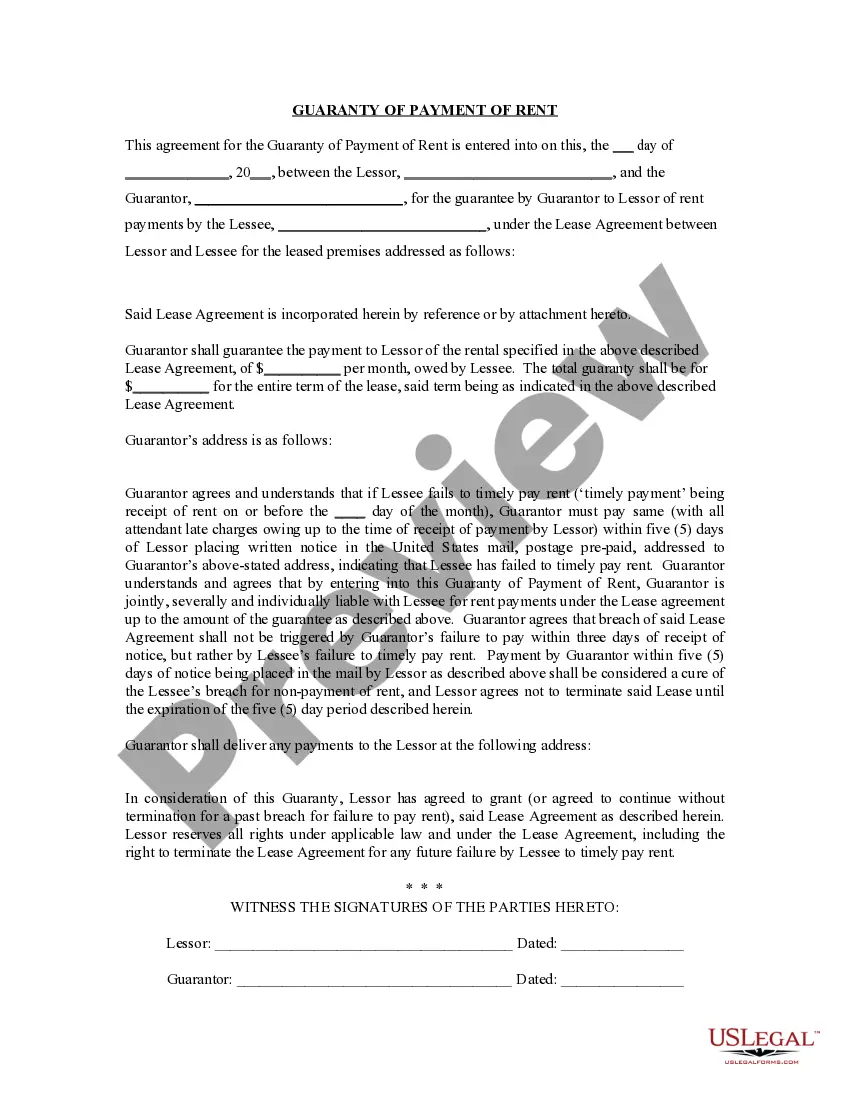

This Guaranty or Guarantee of Payment of Rent contract is an agreement between a guarantor for the tenant and the tenant's landlord. The guarantor agrees to pay the rent if the tenant is not able to pay. The guaranty contract sets out the details of this agreement, the trigger for the guarantor's payment, etc.

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Glendale Arizona Guaranty or Guarantee of Payment of Rent is a legal agreement between a landlord and a guarantor, providing assurance that the rent will be paid in the event of default by the tenant. This guarantee serves as a financial safeguard for landlords and ensures steady rental income. In Glendale, Arizona, there are primarily two types of Guaranty or Guarantee of Payment of Rent: 1. Individual Guaranty: This type involves a single individual who agrees to be responsible for paying the rent in case the tenant fails to do so. The guarantor's financial stability and creditworthiness are evaluated before entering into the agreement. This type of guaranty is commonly used for leases involving residential properties. 2. Corporate Guaranty: In some cases, commercial leases require a corporate guaranty where a business entity guarantees the payment of rent on behalf of the tenant. This type of guaranty is often applicable when a new or small business does not have a strong financial track record, and the landlord seeks additional reassurance. The Glendale Arizona Guaranty or Guarantee of Payment of Rent agreement typically includes the following elements: 1. Identification of Parties: The agreement defines the names and addresses of the landlord, tenant, and guarantor. 2. Lease Details: The lease terms and conditions including the rental amount, payment schedule, and lease period are clearly stated. 3. Guarantor's Obligations: The guarantee specifies that the guarantor will pay the rent promptly if the tenant defaults, and the guarantor's liability extends to all amounts owing under the lease. 4. Duration of Guaranty: The duration of the guaranty is explicitly mentioned, which may be for the entire lease term or for a specified period of time. 5. Release Clause: A release clause defines when the guarantor's obligations will be relieved, such as when the tenant meets specific criteria or fulfills certain obligations. 6. Notice Clause: The agreement outlines the notification process to inform the guarantor about defaults or arrears in rent payments. 7. Governing Law: The governing law of Glendale, Arizona, is typically mentioned to ensure compliance with local regulations. 8. Signatures: The agreement is signed by all parties involved, acknowledging their consent to the terms and conditions. In summary, Glendale Arizona Guaranty or Guarantee of Payment of Rent provides landlords with additional security in the rental process, protecting them from potential financial losses due to tenant defaults. Individual and corporate guaranties are the two main types of guarantees employed in this region, each serving specific purposes based on the nature of the lease.Glendale Arizona Guaranty or Guarantee of Payment of Rent is a legal agreement between a landlord and a guarantor, providing assurance that the rent will be paid in the event of default by the tenant. This guarantee serves as a financial safeguard for landlords and ensures steady rental income. In Glendale, Arizona, there are primarily two types of Guaranty or Guarantee of Payment of Rent: 1. Individual Guaranty: This type involves a single individual who agrees to be responsible for paying the rent in case the tenant fails to do so. The guarantor's financial stability and creditworthiness are evaluated before entering into the agreement. This type of guaranty is commonly used for leases involving residential properties. 2. Corporate Guaranty: In some cases, commercial leases require a corporate guaranty where a business entity guarantees the payment of rent on behalf of the tenant. This type of guaranty is often applicable when a new or small business does not have a strong financial track record, and the landlord seeks additional reassurance. The Glendale Arizona Guaranty or Guarantee of Payment of Rent agreement typically includes the following elements: 1. Identification of Parties: The agreement defines the names and addresses of the landlord, tenant, and guarantor. 2. Lease Details: The lease terms and conditions including the rental amount, payment schedule, and lease period are clearly stated. 3. Guarantor's Obligations: The guarantee specifies that the guarantor will pay the rent promptly if the tenant defaults, and the guarantor's liability extends to all amounts owing under the lease. 4. Duration of Guaranty: The duration of the guaranty is explicitly mentioned, which may be for the entire lease term or for a specified period of time. 5. Release Clause: A release clause defines when the guarantor's obligations will be relieved, such as when the tenant meets specific criteria or fulfills certain obligations. 6. Notice Clause: The agreement outlines the notification process to inform the guarantor about defaults or arrears in rent payments. 7. Governing Law: The governing law of Glendale, Arizona, is typically mentioned to ensure compliance with local regulations. 8. Signatures: The agreement is signed by all parties involved, acknowledging their consent to the terms and conditions. In summary, Glendale Arizona Guaranty or Guarantee of Payment of Rent provides landlords with additional security in the rental process, protecting them from potential financial losses due to tenant defaults. Individual and corporate guaranties are the two main types of guarantees employed in this region, each serving specific purposes based on the nature of the lease.