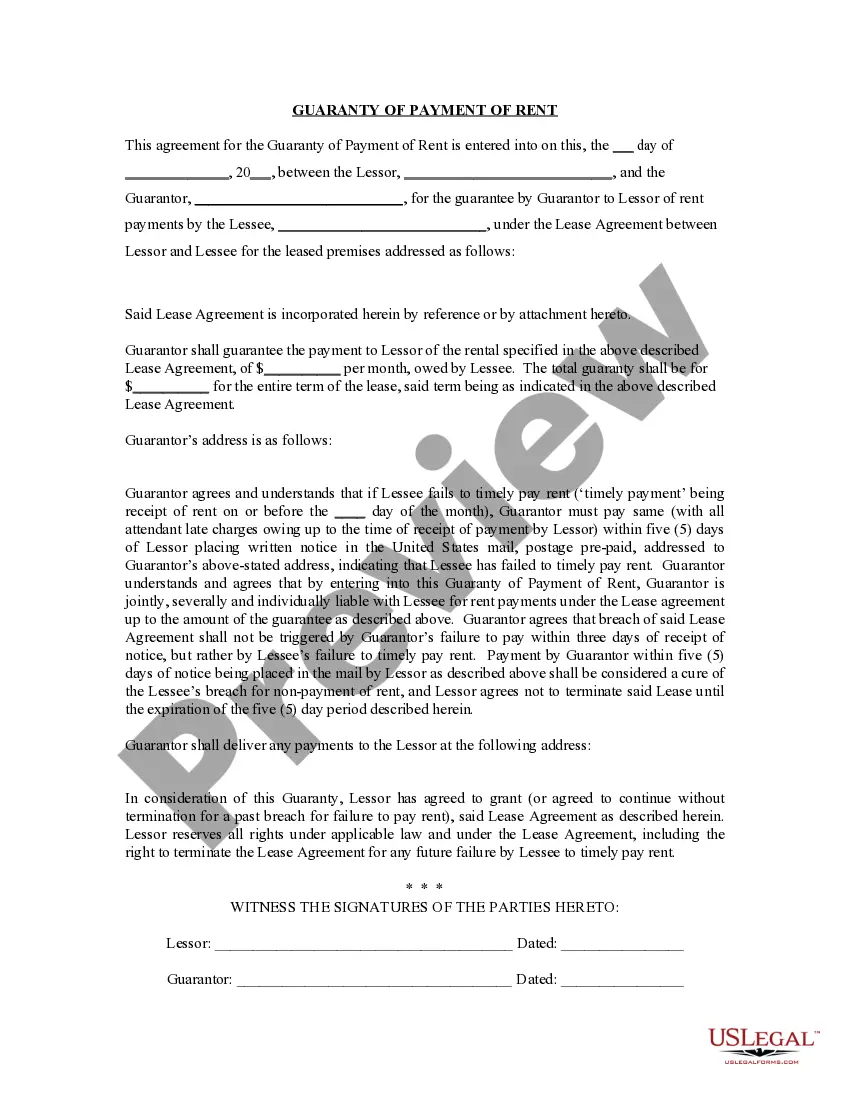

This Guaranty or Guarantee of Payment of Rent contract is an agreement between a guarantor for the tenant and the tenant's landlord. The guarantor agrees to pay the rent if the tenant is not able to pay. The guaranty contract sets out the details of this agreement, the trigger for the guarantor's payment, etc.

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

The Phoenix Arizona Guaranty or Guarantee of Payment of Rent is a legal document or agreement that offers assurance to a landlord or property owner that the rent will be paid in full and on time by a guarantor. This agreement serves as a protection for the landlord in case the tenant is unable to fulfill their rental payment obligations. The Guaranty or Guarantee of Payment of Rent in Phoenix, Arizona can be of different types, depending on the specific terms and conditions agreed upon by the parties involved. Some common types of guarantees include: 1. Corporate Guaranty: This type of guaranty is provided by a corporation or a business entity on behalf of the tenant. The corporation assumes the responsibility of ensuring that the rent will be paid even if the tenant defaults on their payment. 2. Individual Guaranty: In this scenario, an individual (usually a family member or friend of the tenant) takes on the responsibility of guaranteeing the payment of rent. This type of guaranty is commonly seen in cases where the tenant might have a limited credit history or financial standing. 3. Partial Guaranty: A partial guaranty of payment of rent is when the guarantor agrees to be responsible for only a portion of the rent amount. This type of guaranty can be used to mitigate the risk for the landlord, especially when the tenant's financial situation is uncertain. 4. Conditional Guaranty: A conditional guaranty is one where the guarantor's responsibility to cover the rent payments is dependent on specific events or circumstances. For example, the guarantor might only be liable if the tenant loses their job or faces a financial emergency. 5. Joint and Several guaranties: In this type of agreement, multiple guarantors collectively assume responsibility for the payment of rent. Each guarantor can be held individually liable for the entire amount of the rent in case of default by the tenant. It is important to note that these types of guaranty agreements may vary and can be customized based on the specific requirements and negotiations between the landlord and tenant. It is advisable for both parties to consult with legal professionals to ensure that the guaranty agreement is legally binding, enforceable, and adequately protects their interests.The Phoenix Arizona Guaranty or Guarantee of Payment of Rent is a legal document or agreement that offers assurance to a landlord or property owner that the rent will be paid in full and on time by a guarantor. This agreement serves as a protection for the landlord in case the tenant is unable to fulfill their rental payment obligations. The Guaranty or Guarantee of Payment of Rent in Phoenix, Arizona can be of different types, depending on the specific terms and conditions agreed upon by the parties involved. Some common types of guarantees include: 1. Corporate Guaranty: This type of guaranty is provided by a corporation or a business entity on behalf of the tenant. The corporation assumes the responsibility of ensuring that the rent will be paid even if the tenant defaults on their payment. 2. Individual Guaranty: In this scenario, an individual (usually a family member or friend of the tenant) takes on the responsibility of guaranteeing the payment of rent. This type of guaranty is commonly seen in cases where the tenant might have a limited credit history or financial standing. 3. Partial Guaranty: A partial guaranty of payment of rent is when the guarantor agrees to be responsible for only a portion of the rent amount. This type of guaranty can be used to mitigate the risk for the landlord, especially when the tenant's financial situation is uncertain. 4. Conditional Guaranty: A conditional guaranty is one where the guarantor's responsibility to cover the rent payments is dependent on specific events or circumstances. For example, the guarantor might only be liable if the tenant loses their job or faces a financial emergency. 5. Joint and Several guaranties: In this type of agreement, multiple guarantors collectively assume responsibility for the payment of rent. Each guarantor can be held individually liable for the entire amount of the rent in case of default by the tenant. It is important to note that these types of guaranty agreements may vary and can be customized based on the specific requirements and negotiations between the landlord and tenant. It is advisable for both parties to consult with legal professionals to ensure that the guaranty agreement is legally binding, enforceable, and adequately protects their interests.