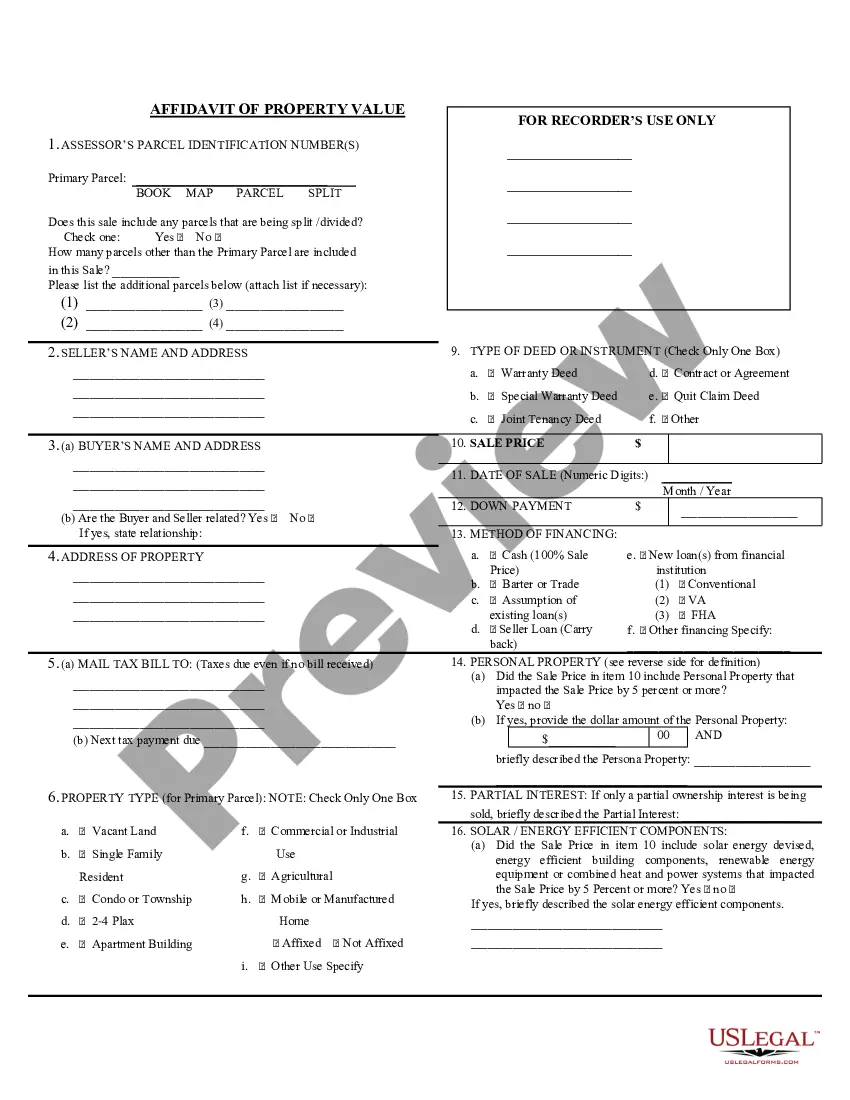

An Affidavit is a sworn, written statement of facts, signed by the 'affiant' (the person making the statement) before a notary public or other official witness. The affiant swears to the truth and accuracy of the statement contained in the affidavit. This document, an Affidavit of Property Value , is a model affidavit for recording the type of information stated. It must be signed before a notary, who must sign and stamp the document. Adapt the text to fit your facts. Available for download now in standard format(s). USLF control no. AZ-82162

Maricopa Arizona Affidavit of Property Value

Description

How to fill out Arizona Affidavit Of Property Value?

Utilize the US Legal Forms and gain instant access to any template you need.

Our effective platform with a vast array of documents enables you to locate and acquire nearly any document sample you require.

You can download, complete, and authorize the Maricopa Arizona Affidavit of Property Value in just a few minutes instead of spending hours online searching for a suitable template.

Using our catalog is an excellent approach to enhance the security of your record submission.

Access the page with the form you need. Ensure that it is the form you were looking for: confirm its title and description, and take advantage of the Preview option when it is accessible. Otherwise, use the Search field to find the correct one.

Initiate the saving process. Click Buy Now and choose your preferred pricing plan. Next, register for an account and pay for your order using a credit card or PayPal.

- Our expert attorneys frequently assess all the documents to ensure that the forms are applicable for a specific area and adhere to the latest laws and regulations.

- How can you obtain the Maricopa Arizona Affidavit of Property Value.

- If you possess a subscription, simply Log In to your account. The Download option will be activated on all the documents you review.

- Additionally, you can retrieve all previously saved records in the My documents section.

- If you haven’t created an account yet, follow the steps outlined below.

Form popularity

FAQ

Transferring property title to a family member in Arizona involves completing a deed, usually a quitclaim deed, which can be filed with the county recorder's office. After the deed is prepared, the Maricopa Arizona Affidavit of Property Value must also be completed to disclose the transfer information. This ensures that all legal aspects of the transfer are properly handled and recorded.

A notice of value in Maricopa County indicates the county assessor's estimated value of a property. This document plays a crucial role in determining property taxes for homeowners. Understanding this value can help you navigate the details associated with the Maricopa Arizona Affidavit of Property Value, ensuring you are well-informed during property transactions.

To get an Affidavit of affixture in Arizona, you must prepare and file the appropriate documentation with the county recorder, typically including proof of ownership and compliance with local regulations. This affidavit is vital for converting a manufactured home into real property. By using platforms like US Legal Forms, you can easily access the necessary forms and guides to simplify the process.

You can obtain a copy of your property deed in Arizona by visiting your county recorder's office or accessing their online database. It is a relatively simple process that ensures you have the most accurate property records. This step is particularly important when dealing with the Maricopa Arizona Affidavit of Property Value.

The Affidavit of Property Value in Maricopa County is a legal document used to declare the value of a property during a real estate transaction. This document is often essential for determining tax obligations and assessments. Properly completing this affidavit is crucial for smooth real estate processes in the county.

Yes, in Arizona, an affidavit typically must be notarized to be considered valid. This notarization process ensures that the document is legally binding and recognized by courts. Making sure your Maricopa Arizona Affidavit of Property Value includes notarization can help prevent potential disputes in property ownership.

To affix a manufactured home in Arizona, you must file an affidavit of affixture with your county recorder. This document verifies that the home is now considered real property. Ensuring all local zoning and construction regulations are met is vital, as this impacts your Maricopa Arizona Affidavit of Property Value.

An affidavit of affixture is a legal document that converts a manufactured home into real property. This process is essential in Arizona, particularly for the management of mobile and manufactured homes. The Maricopa Arizona Affidavit of Property Value plays a crucial role in this transition, ensuring property taxes and ownership are both clearly defined.

An Affidavit of succession to real property in Arizona transfers ownership of real estate to an heir after a property owner passes away. This affidavit is particularly useful in cases where the deceased did not leave a will, allowing heirs to claim their rightful ownership. It streamlines the transfer process, facilitating quicker access to the property for heirs. If you need templates or assistance, USLegalForms offers a reliable platform to guide you.

An Affidavit of affixture in Maricopa County is a legal document that certifies a mobile home or manufactured home is permanently affixed to real property. This affidavit enables the home to be treated as real property, which can simplify various legal processes. It is important for homeowners in Maricopa to have this document to ensure correct property records. Using services like USLegalForms can help you create the affidavit efficiently.