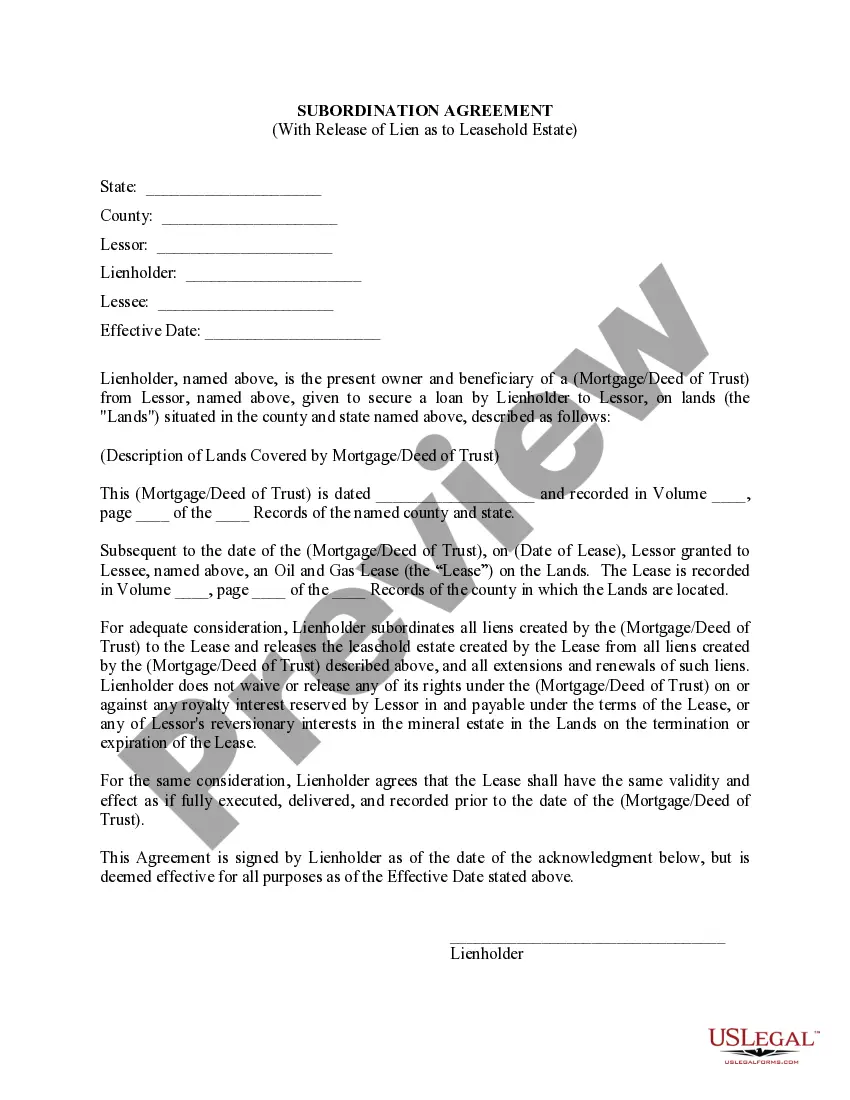

This Lease Subordination Agreement is a lienholder's lien that was created by a (Mortgage/Deed of Trust) and is subordinated to a mineral/oil/gas lease and lienholder releases, said Leasehold from all liens created by said (Mortgage/Deed of Trust), and all extensions and renewals of such liens. Lienholder retains all rights under the (Mortgage/Deed of Trust) against any royalty interest reserved by the lessor in and payable under the terms of the lease, or any of lessor's reversionary interests on the termination or expiration of the lease.

Subordination means an agreement to put a debt or claim which has priority in a lower position behind another debt, particularly a new loan. A property owner with a loan secured by the property who applies for a second mortgage to make additions or repairs usually must get a subordination of the original loan so the new loan has first priority. A declaration of homestead must always be subordinated to a loan.