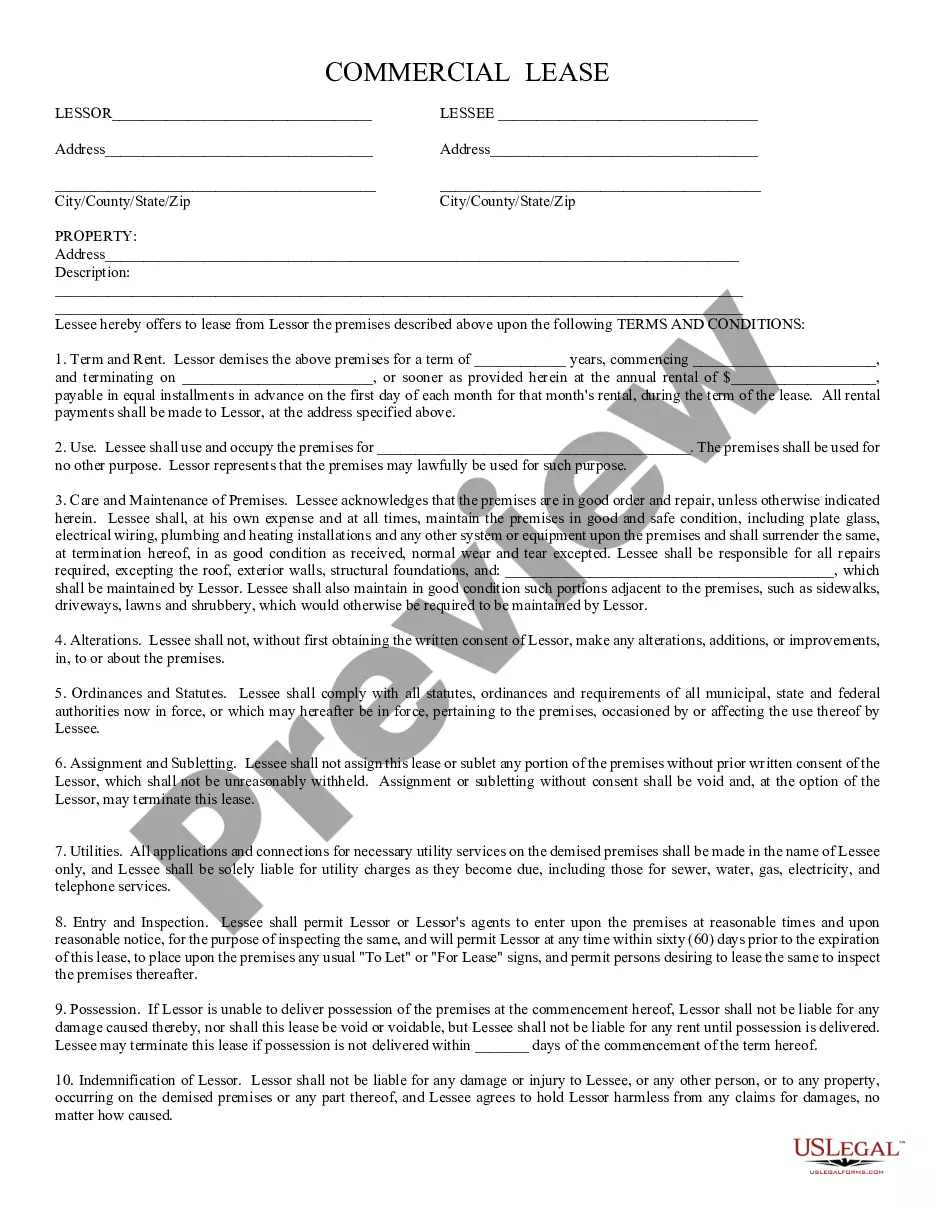

This form is a commercial lease for the rental of certain property described in the lease. The lessee acknowledges that the premises are in good order and repair, unless otherwise indicated in the lease. The lessee shall, at his own expense and at all times, maintain the premises in good and safe condition, including plate glass, electrical wiring, plumbing and heating installations and any other system or equipment upon the premises and shall surrender the same, at termination, in as good condition as received, normal wear and tear excepted.

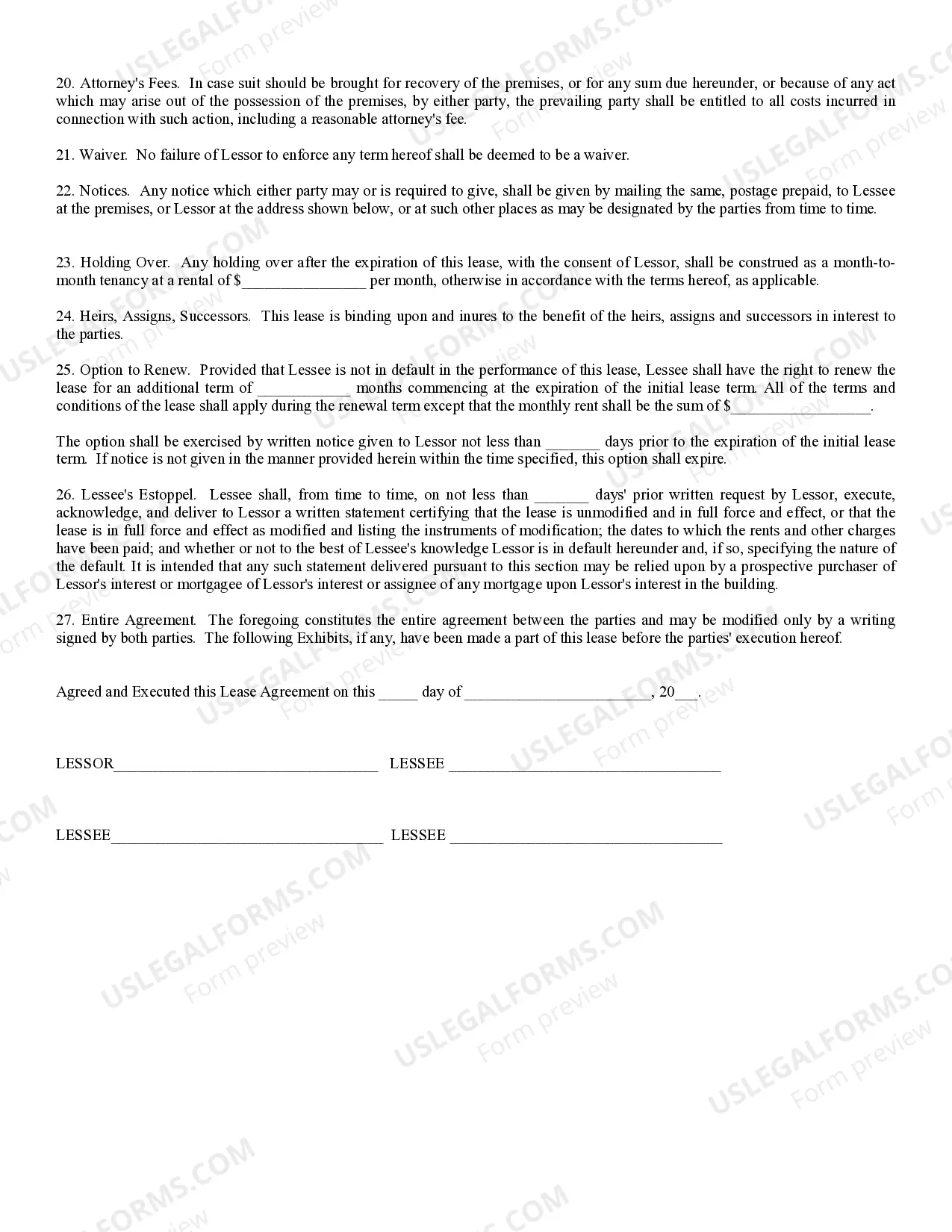

Lima Arizona Commercial Lease Part 1 is a legal contract that outlines the terms and conditions for leasing commercial properties in Lima, Arizona. This document serves as a legally binding agreement between the landlord (lessor) and the tenant (lessee). The Lima Arizona Commercial Lease Part 1 covers various aspects of the leasing agreement, including but not limited to: 1. Premises and Property Description: This section provides a detailed description of the commercial property being leased, including its location, size, boundaries, and any specific features or amenities available. 2. Lease Term: It defines the duration of the lease agreement, specifying the start and end dates. It may also include provisions for renewal options, termination clauses, and any notice periods required for early termination. 3. Rental Payment: This section outlines the details of rental payments, including the amount, due dates, and accepted payment methods. It may also mention any late payment fees, penalty charges, or rent escalation clauses. 4. Maintenance and Repairs: Here, the responsibilities for property maintenance and repairs are laid out, clearly specifying whether the landlord or tenant is responsible for certain tasks. It may also address any required insurance coverage for the leased property. 5. Use and Restrictions: This clause determines the permitted use of the property and any specific restrictions or limitations imposed by the landlord or local zoning regulations. It may outline the activities that are not allowed on the premises. 6. Improvements and Alterations: If the tenant is allowed to make improvements or alterations to the property, this section will address the process involved, necessary approvals, and who bears the cost. 7. Security Deposit: It explains the amount of security deposit required, its purpose, and the conditions under which the deposit will be returned to the tenant at the end of the lease term. 8. Utilities and Services: This section outlines which utilities and services the tenant is responsible for paying, such as water, electricity, heating, cooling, garbage disposal, or any other related expenses. 9. Default and Remedies: It provides details about the consequences of defaulting on any terms of the lease and the remedies available to the landlord or tenant, such as eviction or legal actions. 10. Governing Law: This clause specifies the jurisdiction or governing law under which any disputes arising from the lease agreement will be resolved. Different types of Lima Arizona Commercial Lease Part 1 may exist based on various factors such as property type, duration, and specific tenant requirements. For instance, there can be Lima Arizona Commercial Lease Part 1 agreements for retail spaces, office spaces, industrial buildings, warehouses, or multi-purpose commercial properties. Additionally, the terms and conditions may vary depending on whether the lease is for a short-term, long-term, or month-to-month basis.