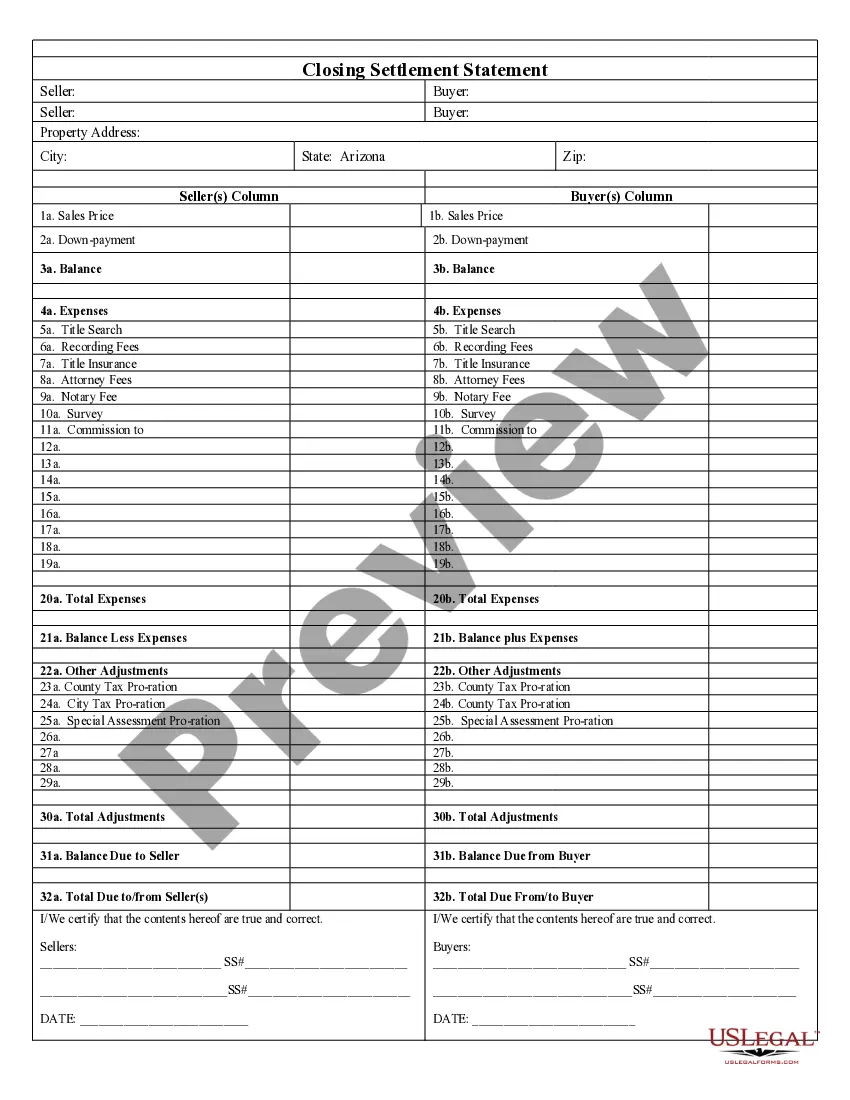

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Phoenix Arizona Closing Statement

Description

How to fill out Arizona Closing Statement?

Finding authorized templates relevant to your regional regulations can be challenging unless you utilize the US Legal Forms collection.

It's an online repository of over 85,000 legal documents catering to both personal and business needs as well as various real-life situations.

All the forms are appropriately categorized by their area of application and jurisdiction, making it straightforward to find the Phoenix Arizona Closing Statement in no time.

Maintain organized paperwork in compliance with legal standards is critically important. Take advantage of the US Legal Forms library to always have crucial document templates for any requirements readily available!

- Review the Preview mode and form description.

- Ensure you have selected the correct one that fulfills your requirements and aligns with your local jurisdiction standards.

- Search for another template if necessary.

- If you notice any discrepancies, use the Search tab above to find the accurate one. If it meets your needs, proceed to the next step.

- Purchase the document. Click on the Buy Now button and select your desired subscription plan. You must create an account to access the library’s resources.

Form popularity

FAQ

Contact the County Probate Court To find out if an estate is in probate, you can check with the county probate court. Probate proceedings are public, so there aren't any privacy laws that would prevent you from contacting the court for information.

When someone dies, their beneficiaries have up to two years to open probate. Once probate is opened, there aren't any time limits that will cause the case to expire.

Four Ways to Avoid Probate in Arizona Establish a Trust.Title Property with Rights of Survivorship.Make Accounts Payable on Death or Transfer of Death.Provisions for Small Estates.

According to Arizona law (ARS14-3108), the executor of an estate has two years from the date of death to file probate. This timeframe can be extended under certain circumstances, such as if the deceased left behind minor children.

Informal probates typically last between 6-8 months, depending on how quickly the Personal Representative completes their required duties. Formal and Supervised probates can last a year, or longer, depending on the complexity of the case.

In the state of Arizona, probate is only required if the decedent has any assets that did not transfer automatically upon their death. These assets tend to be titled individually in the decedent's name and will require a probate court to transfer the title of ownership to the intended beneficiary.

A typical flat fee for an informal probate would be between $1000 and $1500. If a probate is contested, or if you need a formal probate, the fees may well be substantially higher.

Informal probate requires that the deceased had a valid will at the time of death that has not been challenged and died less than 2 years before probate is opened. In an informal probate process, a personal representative is appointed by the court to administer the estate with minimal court supervision.

File the original Closing Statement: You can bring the Closing Statement to court or you can mail it. Also request that a copy of the Closing Statement be conformed (date-stamped) and mailed back to you.