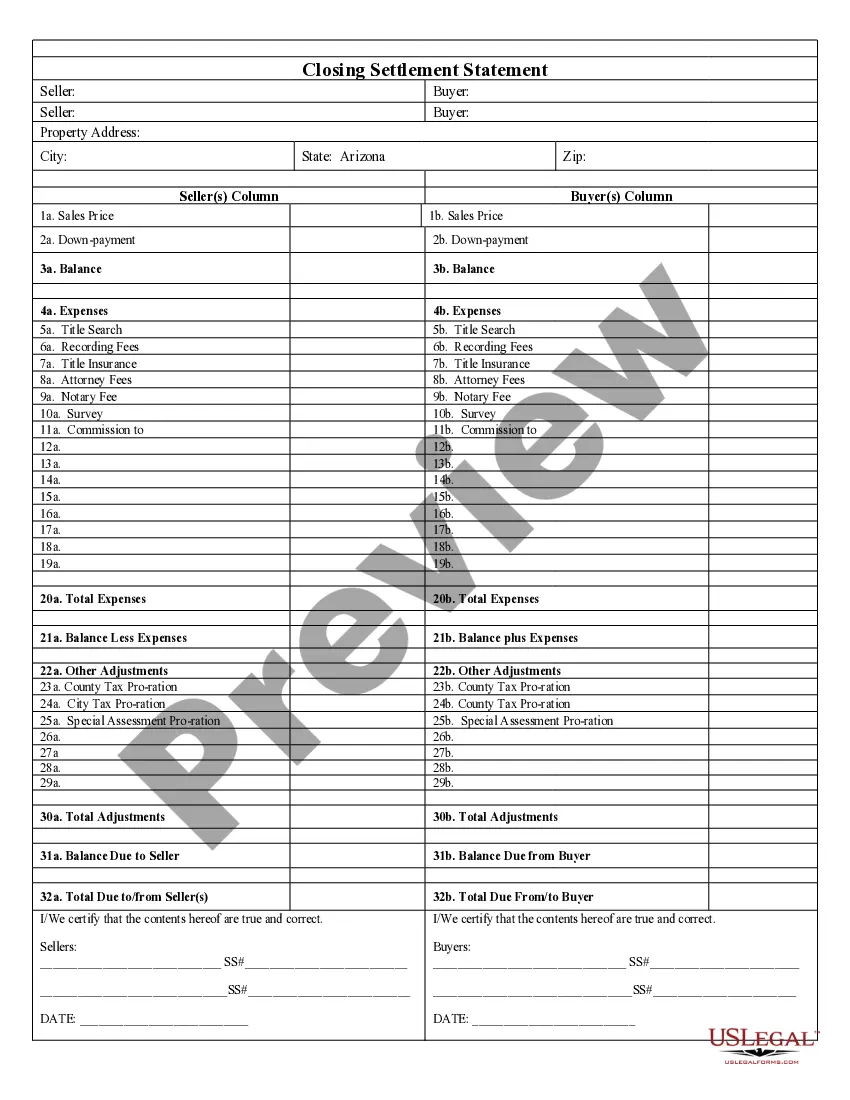

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

The Lima Arizona closing statement is a legal document that summarizes the final financial transactions and details involved in a real estate transaction. It is typically prepared by the title company or attorney representing the buyer and seller during the closing process. The closing statement clearly outlines all financial obligations and payments made by both parties, ensuring transparency and accuracy in the final settlement. Keywords: Lima Arizona, closing statement, legal document, financial transactions, real estate transaction, title company, attorney, buyer, seller, closing process, financial obligations, payments, transparency, accuracy, final settlement. There are typically two types of Lima Arizona closing statements: 1. Buyer's Closing Statement: This closing statement is prepared on behalf of the buyer by their attorney or title company. It itemizes all the costs associated with the purchase of the property, including the purchase price, loan fees, prorated property taxes, homeowners association fees, insurance premiums, and any other relevant expenses. The buyer's closing statement ensures that all financial obligations are listed accurately, providing a detailed breakdown of the buyer's expenses. 2. Seller's Closing Statement: This type of closing statement is prepared on behalf of the seller by their attorney or title company. It outlines all the financial aspects related to the sale, including the purchase price, proration of property taxes, outstanding mortgage payoffs, realtor commissions, and other closing costs. The seller's closing statement ensures that the proceeds from the sale are accurately calculated and disbursed to all parties involved, including the seller, any lenders, and third-party service providers. Overall, the Lima Arizona closing statement plays a crucial role in documenting and finalizing the financial aspects of a real estate transaction. It ensures transparency and fairness for both the buyer and seller, reducing the risk of disputes or misunderstandings.The Lima Arizona closing statement is a legal document that summarizes the final financial transactions and details involved in a real estate transaction. It is typically prepared by the title company or attorney representing the buyer and seller during the closing process. The closing statement clearly outlines all financial obligations and payments made by both parties, ensuring transparency and accuracy in the final settlement. Keywords: Lima Arizona, closing statement, legal document, financial transactions, real estate transaction, title company, attorney, buyer, seller, closing process, financial obligations, payments, transparency, accuracy, final settlement. There are typically two types of Lima Arizona closing statements: 1. Buyer's Closing Statement: This closing statement is prepared on behalf of the buyer by their attorney or title company. It itemizes all the costs associated with the purchase of the property, including the purchase price, loan fees, prorated property taxes, homeowners association fees, insurance premiums, and any other relevant expenses. The buyer's closing statement ensures that all financial obligations are listed accurately, providing a detailed breakdown of the buyer's expenses. 2. Seller's Closing Statement: This type of closing statement is prepared on behalf of the seller by their attorney or title company. It outlines all the financial aspects related to the sale, including the purchase price, proration of property taxes, outstanding mortgage payoffs, realtor commissions, and other closing costs. The seller's closing statement ensures that the proceeds from the sale are accurately calculated and disbursed to all parties involved, including the seller, any lenders, and third-party service providers. Overall, the Lima Arizona closing statement plays a crucial role in documenting and finalizing the financial aspects of a real estate transaction. It ensures transparency and fairness for both the buyer and seller, reducing the risk of disputes or misunderstandings.