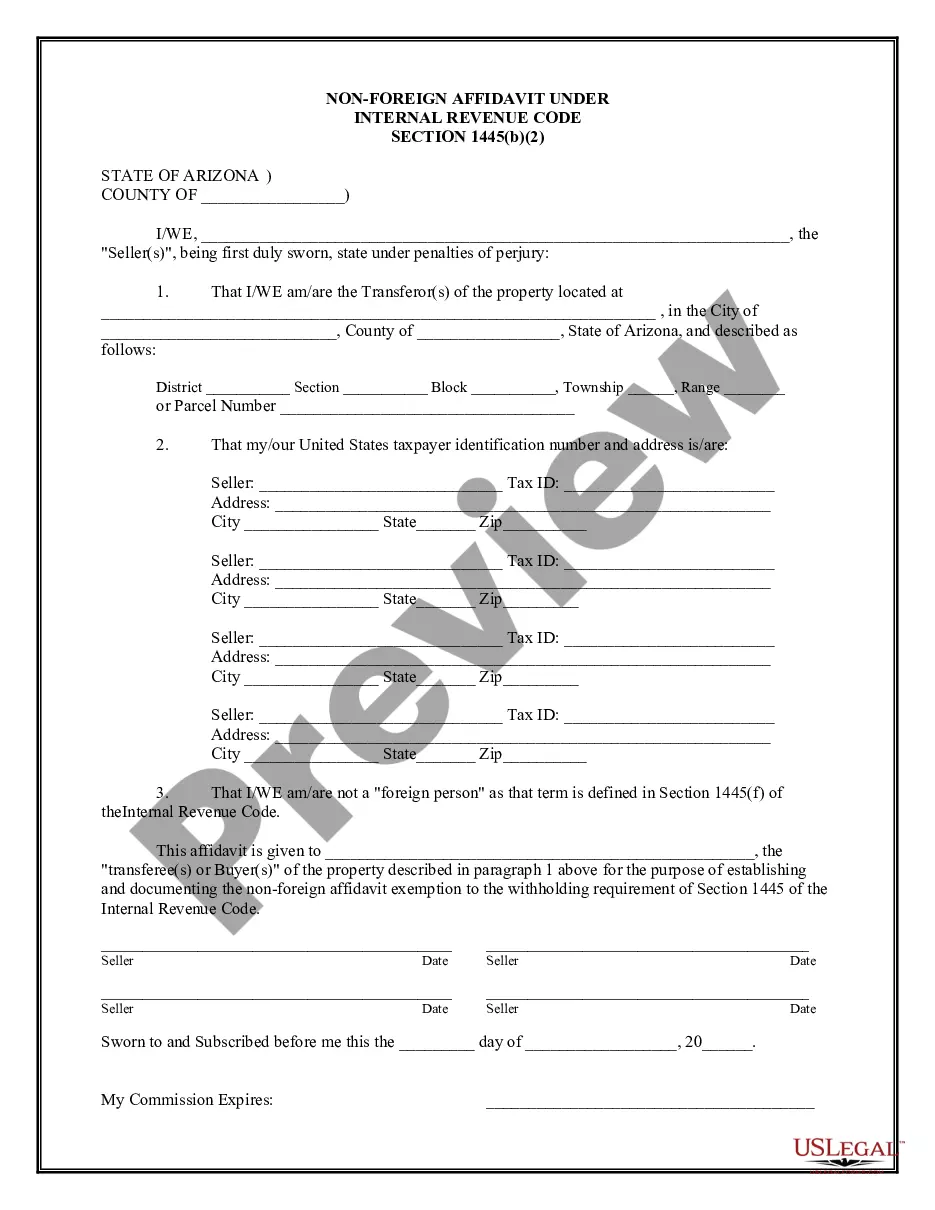

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Gilbert Arizona Non-Foreign Affidavit Under IRC 1445 is a legal document used to certify that the seller of real property in Gilbert, Arizona is not a foreign person as defined by the Internal Revenue Code (IRC) Section 1445. This affidavit is required by the IRS to ensure compliance with federal withholding tax requirements for the sale of real property by foreign individuals or entities. The Gilbert Arizona Non-Foreign Affidavit Under IRC 1445 serves as a declaration by the seller, affirming their non-foreign status. It includes important details such as the seller's name, address, and taxpayer identification number. The affidavit is typically prepared and signed by the seller or their authorized representative. It must be submitted to the closing agent or title company responsible for the real estate transaction. By completing and submitting this affidavit, the seller certifies that they are not a foreign person and therefore not subject to withholding tax requirements. This is crucial as the IRS requires a 15% withholding tax on the gross sales proceeds when a foreign person sells U.S. real property. This affidavit helps to ensure that the appropriate tax obligations are met and that the transaction stays in compliance. It's important to note that the Gilbert Arizona Non-Foreign Affidavit Under IRC 1445 is specific to real estate transactions in Gilbert, Arizona. Different jurisdictions may have similar affidavits tailored to their local laws. These affidavits aim to prevent tax evasion and ensure the appropriate withholding tax on real property transactions involving foreign sellers. The Gilbert Arizona Non-Foreign Affidavit Under IRC 1445 helps streamline the real estate closing process by providing a clear and concise declaration of the seller's non-foreign status. It minimizes the risk of potential tax liability issues and facilitates a smooth transfer of property ownership. In summary, the Gilbert Arizona Non-Foreign Affidavit Under IRC 1445 is a crucial legal document used in real estate transactions in Gilbert, Arizona to certify that the seller is not a foreign person as defined by the Internal Revenue Code Section 1445. By completing and submitting this affidavit, sellers affirm their non-foreign status and ensure compliance with federal withholding tax requirements.Gilbert Arizona Non-Foreign Affidavit Under IRC 1445 is a legal document used to certify that the seller of real property in Gilbert, Arizona is not a foreign person as defined by the Internal Revenue Code (IRC) Section 1445. This affidavit is required by the IRS to ensure compliance with federal withholding tax requirements for the sale of real property by foreign individuals or entities. The Gilbert Arizona Non-Foreign Affidavit Under IRC 1445 serves as a declaration by the seller, affirming their non-foreign status. It includes important details such as the seller's name, address, and taxpayer identification number. The affidavit is typically prepared and signed by the seller or their authorized representative. It must be submitted to the closing agent or title company responsible for the real estate transaction. By completing and submitting this affidavit, the seller certifies that they are not a foreign person and therefore not subject to withholding tax requirements. This is crucial as the IRS requires a 15% withholding tax on the gross sales proceeds when a foreign person sells U.S. real property. This affidavit helps to ensure that the appropriate tax obligations are met and that the transaction stays in compliance. It's important to note that the Gilbert Arizona Non-Foreign Affidavit Under IRC 1445 is specific to real estate transactions in Gilbert, Arizona. Different jurisdictions may have similar affidavits tailored to their local laws. These affidavits aim to prevent tax evasion and ensure the appropriate withholding tax on real property transactions involving foreign sellers. The Gilbert Arizona Non-Foreign Affidavit Under IRC 1445 helps streamline the real estate closing process by providing a clear and concise declaration of the seller's non-foreign status. It minimizes the risk of potential tax liability issues and facilitates a smooth transfer of property ownership. In summary, the Gilbert Arizona Non-Foreign Affidavit Under IRC 1445 is a crucial legal document used in real estate transactions in Gilbert, Arizona to certify that the seller is not a foreign person as defined by the Internal Revenue Code Section 1445. By completing and submitting this affidavit, sellers affirm their non-foreign status and ensure compliance with federal withholding tax requirements.