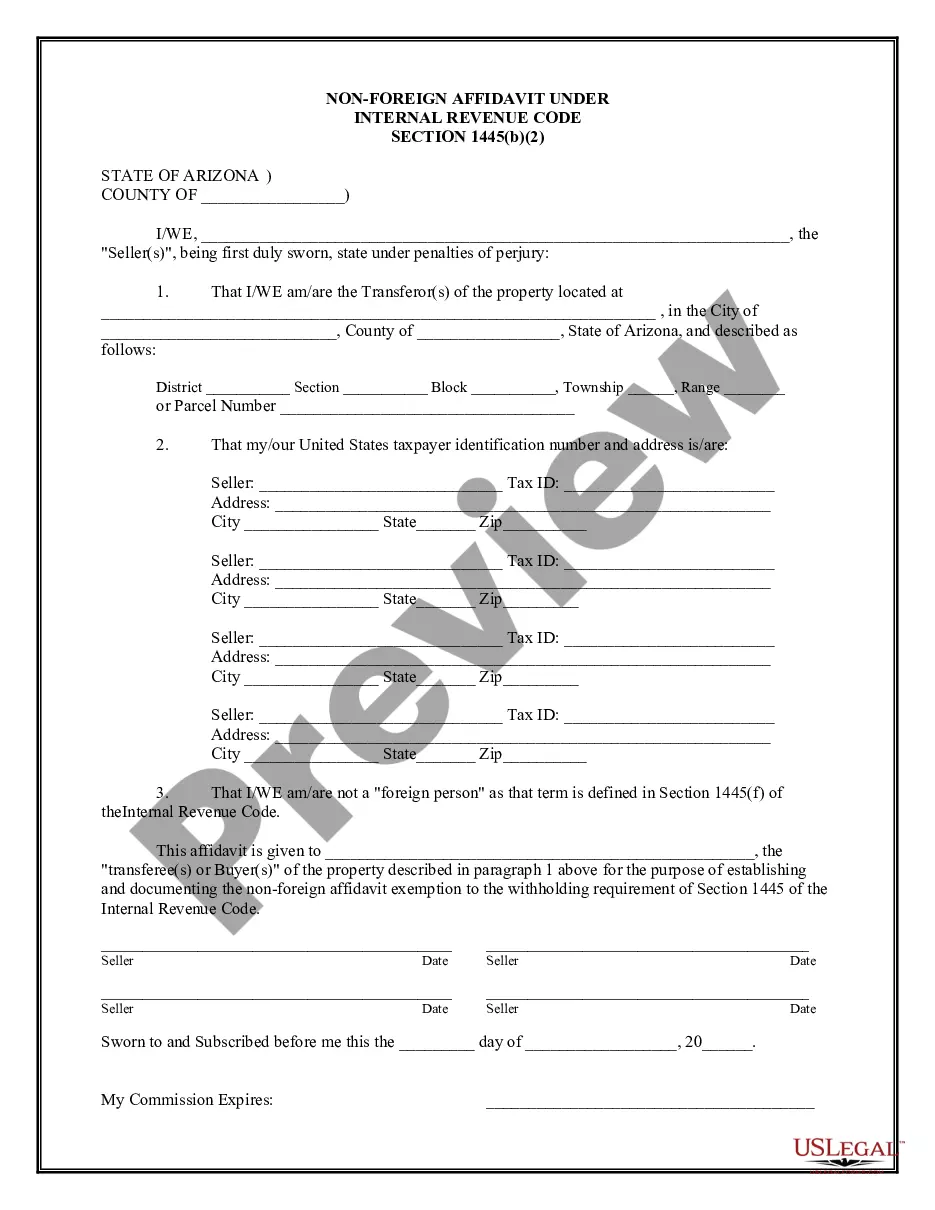

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Glendale, Arizona Non-Foreign Affidavit Under IRC 1445: Explained in Detail The Glendale, Arizona Non-Foreign Affidavit under IRC 1445 is a legal document used in real estate transactions to confirm that the seller of a property is not a foreign person, as defined by the Internal Revenue Code (IRC) Section 1445. This affidavit is required by the United States Internal Revenue Service (IRS) and helps to ensure the proper withholding of taxes on the sale of real property. In the context of Glendale, Arizona, several types of Non-Foreign Affidavits under IRC 1445 may be relevant, including: 1. Glendale Residential Non-Foreign Affidavit: This type of affidavit is used when an individual or a married couple is selling their residential property in Glendale, Arizona. It confirms that the seller(s) are not foreign persons, as defined by IRC 1445. 2. Glendale Commercial Non-Foreign Affidavit: If the property being sold in Glendale, Arizona is a commercial property, whether it's an office building, retail space, or industrial property, a Commercial Non-Foreign Affidavit is required. It asserts that the seller(s) are not foreign persons under IRC 1445. 3. Glendale Vacant Land Non-Foreign Affidavit: When a vacant land or undeveloped property is being sold in Glendale, Arizona, a Vacant Land Non-Foreign Affidavit may be necessary. It declares that the seller(s) are not foreign persons according to IRC 1445. These affidavits serve a crucial purpose by helping the IRS identify transactions subject to the Foreign Investment in Real Property Tax Act (FIR PTA). FIR PTA requires the buyer of real property from a foreign seller to withhold a certain percentage of the sale proceeds as tax, with the withheld amount remitted to the IRS. By submitting a Non-Foreign Affidavit, the seller certifies that FIR PTA withholding is not necessary. To complete a Glendale, Arizona Non-Foreign Affidavit under IRC 1445, the seller(s) must provide personal information such as name, address, Social Security Number (SSN), or Individual Taxpayer Identification Number (ITIN). The affidavit may also request details about the property being sold, including the address and legal description. Keep in mind that the requirements and specific details of the Glendale, Arizona Non-Foreign Affidavit under IRC 1445 may vary, so it's important to consult with an experienced real estate attorney or tax professional to ensure compliance with all applicable laws and regulations. In summary, the Glendale, Arizona Non-Foreign Affidavit under IRC 1445 is a crucial document in real estate transactions to confirm that the seller(s) are not foreign persons as defined by IRC 1445. Different types of affidavits may be needed based on the nature of the property being sold, including residential, commercial, and vacant land affidavits. Proper completion and submission of the affidavit help ensure compliance with tax withholding laws and smooth execution of real estate transactions.Glendale, Arizona Non-Foreign Affidavit Under IRC 1445: Explained in Detail The Glendale, Arizona Non-Foreign Affidavit under IRC 1445 is a legal document used in real estate transactions to confirm that the seller of a property is not a foreign person, as defined by the Internal Revenue Code (IRC) Section 1445. This affidavit is required by the United States Internal Revenue Service (IRS) and helps to ensure the proper withholding of taxes on the sale of real property. In the context of Glendale, Arizona, several types of Non-Foreign Affidavits under IRC 1445 may be relevant, including: 1. Glendale Residential Non-Foreign Affidavit: This type of affidavit is used when an individual or a married couple is selling their residential property in Glendale, Arizona. It confirms that the seller(s) are not foreign persons, as defined by IRC 1445. 2. Glendale Commercial Non-Foreign Affidavit: If the property being sold in Glendale, Arizona is a commercial property, whether it's an office building, retail space, or industrial property, a Commercial Non-Foreign Affidavit is required. It asserts that the seller(s) are not foreign persons under IRC 1445. 3. Glendale Vacant Land Non-Foreign Affidavit: When a vacant land or undeveloped property is being sold in Glendale, Arizona, a Vacant Land Non-Foreign Affidavit may be necessary. It declares that the seller(s) are not foreign persons according to IRC 1445. These affidavits serve a crucial purpose by helping the IRS identify transactions subject to the Foreign Investment in Real Property Tax Act (FIR PTA). FIR PTA requires the buyer of real property from a foreign seller to withhold a certain percentage of the sale proceeds as tax, with the withheld amount remitted to the IRS. By submitting a Non-Foreign Affidavit, the seller certifies that FIR PTA withholding is not necessary. To complete a Glendale, Arizona Non-Foreign Affidavit under IRC 1445, the seller(s) must provide personal information such as name, address, Social Security Number (SSN), or Individual Taxpayer Identification Number (ITIN). The affidavit may also request details about the property being sold, including the address and legal description. Keep in mind that the requirements and specific details of the Glendale, Arizona Non-Foreign Affidavit under IRC 1445 may vary, so it's important to consult with an experienced real estate attorney or tax professional to ensure compliance with all applicable laws and regulations. In summary, the Glendale, Arizona Non-Foreign Affidavit under IRC 1445 is a crucial document in real estate transactions to confirm that the seller(s) are not foreign persons as defined by IRC 1445. Different types of affidavits may be needed based on the nature of the property being sold, including residential, commercial, and vacant land affidavits. Proper completion and submission of the affidavit help ensure compliance with tax withholding laws and smooth execution of real estate transactions.